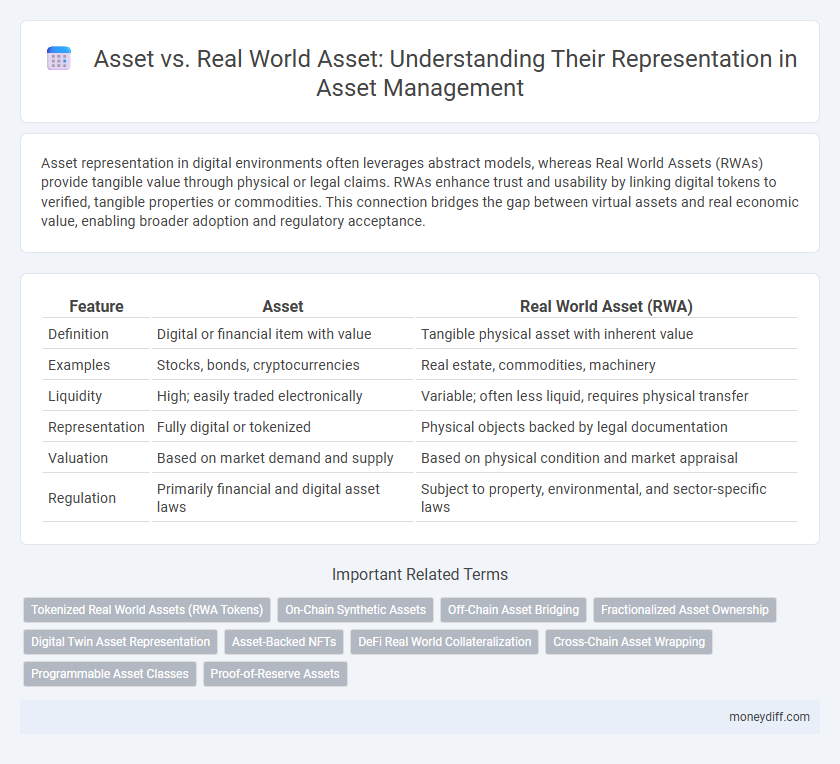

Asset representation in digital environments often leverages abstract models, whereas Real World Assets (RWAs) provide tangible value through physical or legal claims. RWAs enhance trust and usability by linking digital tokens to verified, tangible properties or commodities. This connection bridges the gap between virtual assets and real economic value, enabling broader adoption and regulatory acceptance.

Table of Comparison

| Feature | Asset | Real World Asset (RWA) |

|---|---|---|

| Definition | Digital or financial item with value | Tangible physical asset with inherent value |

| Examples | Stocks, bonds, cryptocurrencies | Real estate, commodities, machinery |

| Liquidity | High; easily traded electronically | Variable; often less liquid, requires physical transfer |

| Representation | Fully digital or tokenized | Physical objects backed by legal documentation |

| Valuation | Based on market demand and supply | Based on physical condition and market appraisal |

| Regulation | Primarily financial and digital asset laws | Subject to property, environmental, and sector-specific laws |

Introduction to Asset and Real World Asset

An asset is a resource with economic value that an individual, corporation, or government owns or controls with the expectation of future benefit. Real World Assets (RWAs) refer to tangible or physical assets such as real estate, commodities, or equipment, which can be tokenized or represented digitally on blockchain platforms. Representing RWAs digitally enhances liquidity, transparency, and accessibility by bridging physical ownership with decentralized financial ecosystems.

Defining Traditional Assets

Traditional assets refer to tangible or intangible resources such as stocks, bonds, real estate, or cash equivalents that hold intrinsic value and are easily traded or liquidated within established financial markets. Real World Assets (RWAs), by contrast, represent physical, tangible items like machinery, commodities, or real estate properties that provide direct economic utility and are often tokenized for digital representation. Understanding the distinction clarifies how traditional financial instruments differ from RWAs in terms of liquidity, valuation, and digital adaptability.

What Are Real World Assets (RWAs)?

Real World Assets (RWAs) represent tangible or physical assets such as real estate, commodities, and infrastructure that are tokenized on blockchain platforms for digital representation. Unlike traditional digital assets, RWAs provide investors with exposure to physical market value and generate real-world economic activity through decentralized finance protocols. This hybrid approach enhances liquidity, transparency, and accessibility by bridging the gap between blockchain technology and the tangible asset market.

Key Differences Between Traditional Assets and RWAs

Traditional assets represent ownership or value in financial instruments such as stocks, bonds, or cash, typically recorded and traded within centralized systems. Real World Assets (RWAs) refer to tangible, physical items like real estate, commodities, or equipment tokenized on blockchain platforms to enhance liquidity and transparency. Key differences include RWAs' linkage to physical entities and their authentication via decentralized ledgers, contrasting with intangible traditional assets reliant on intermediaries.

Representation of Assets in Digital Finance

Digital finance leverages tokenization to represent assets by converting Real World Assets (RWAs) such as real estate, commodities, or equities into digital tokens on blockchain platforms. This representation enhances liquidity, transparency, and fractional ownership, enabling seamless transfer and efficient access to traditionally illiquid assets. The precise mapping of RWAs to digital tokens requires robust legal frameworks and accurate valuation methodologies to maintain asset integrity and trust.

Benefits of Tokenizing Real World Assets

Tokenizing real world assets enhances liquidity by enabling fractional ownership and 24/7 trading on digital platforms. It reduces transaction costs and settlement times through blockchain technology, providing greater transparency and security. This digital representation unlocks global access for investors, democratizing market participation beyond traditional barriers.

Regulatory Considerations for RWAs

Regulatory considerations for Real World Assets (RWAs) focus on compliance with securities laws, anti-money laundering (AML) regulations, and proper asset registration to ensure legal ownership and transferability. Unlike digital-only assets, RWAs require detailed verification of asset provenance and adherence to jurisdiction-specific rules governing tangible property. These regulatory frameworks aim to mitigate risks associated with fraud, market manipulation, and investor protection in blockchain-based asset representation.

Risks and Challenges in Representing Assets

Representing digital assets versus real-world assets presents significant risks, including valuation discrepancies and legal uncertainties tied to asset ownership and transfer. Real-world asset representation often faces challenges related to jurisdictional regulations, physical verification, and liquidity constraints. Ensuring accurate digital representation requires robust tokenization standards, secure custody solutions, and transparent regulatory compliance to mitigate fraud and counterparty risks.

Investment Opportunities: Asset vs RWA

Investment opportunities in traditional assets often involve financial instruments such as stocks, bonds, or mutual funds, which represent claims or ownership but lack direct ties to tangible objects. Real World Assets (RWA) represent physical or tangible items like real estate, commodities, or infrastructure, offering investors exposure to concrete value and potential inflation hedging. The tokenization of RWAs enables fractional ownership, increased liquidity, and broader market access compared to conventional asset classes.

Future Trends in Asset Representation

Future trends in asset representation emphasize the integration of Real World Assets (RWAs) with blockchain technology to enhance transparency, liquidity, and accessibility. Tokenization of physical assets such as real estate, commodities, and intellectual property enables fractional ownership and efficient market participation. Advances in decentralized finance (DeFi) platforms and regulatory frameworks are expected to drive broader adoption and innovation in representing tangible assets digitally.

Related Important Terms

Tokenized Real World Assets (RWA Tokens)

Tokenized Real World Assets (RWA Tokens) represent tangible assets such as real estate, commodities, or art through blockchain technology, enabling fractional ownership, enhanced liquidity, and transparent transactions. Unlike traditional digital assets, RWA Tokens bridge the gap between physical assets and digital finance, unlocking new investment opportunities and reducing entry barriers.

On-Chain Synthetic Assets

On-chain synthetic assets replicate the value of real-world assets like stocks, commodities, and currencies through blockchain technology, enabling seamless fractional ownership and programmable trading without physical custody. These synthetic assets leverage smart contracts to provide enhanced liquidity, transparency, and accessibility compared to traditional asset representation methods.

Off-Chain Asset Bridging

Off-chain asset bridging enables the seamless transfer of real-world assets, such as property or commodities, into digital representations on blockchain networks, enhancing liquidity and accessibility while maintaining regulatory compliance. This process ensures that digital assets accurately reflect underlying off-chain value and ownership, bridging the gap between traditional financial systems and decentralized platforms.

Fractionalized Asset Ownership

Fractionalized asset ownership enables multiple investors to hold partial shares of high-value assets, enhancing liquidity and accessibility compared to traditional asset models. Real-world assets, when tokenized, bridge physical ownership with digital representation, allowing seamless transfer, verification, and division of ownership rights on blockchain platforms.

Digital Twin Asset Representation

Digital Twin Asset Representation offers a dynamic, data-driven model that mirrors a Real World Asset's physical properties, operational status, and lifecycle in real time, enhancing monitoring and decision-making processes. Unlike traditional static Asset records, Digital Twins integrate IoT sensors and AI analytics to provide continuous insights and predictive maintenance for complex machinery and infrastructure.

Asset-Backed NFTs

Asset-Backed NFTs represent ownership through digital tokens linked to tangible or intangible assets, providing verifiable proof of value and provenance on blockchain networks. Unlike real world assets, which exist physically, these NFTs enable fractional ownership, enhanced liquidity, and streamlined transferability of assets such as real estate, art, or commodities within decentralized marketplaces.

DeFi Real World Collateralization

Real World Assets (RWA) in DeFi provide tangible collateral like real estate, invoices, or commodities to enhance loan security, reducing reliance on purely digital assets and improving liquidity. Tokenizing these assets bridges traditional finance with decentralized protocols, enabling greater capital efficiency and risk diversification in lending platforms.

Cross-Chain Asset Wrapping

Cross-chain asset wrapping enables the representation of real-world assets on multiple blockchain networks, enhancing liquidity and interoperability across ecosystems. By tokenizing physical assets into blockchain-native wrapped tokens, users can seamlessly transfer and utilize asset value beyond the limitations of a single chain.

Programmable Asset Classes

Programmable asset classes enable digitized representation of real-world assets, allowing automated management and transfer through smart contracts on blockchain networks. These tokenized assets enhance liquidity, transparency, and compliance by encoding ownership rights and transaction rules directly into the programmable framework.

Proof-of-Reserve Assets

Proof-of-Reserve assets provide verifiable on-chain evidence that digital tokens are backed by real-world assets, ensuring transparency and trust in asset representation. Unlike purely digital assets, Real World Assets integrate tangible collateral such as commodities or fiat, bridging the gap between blockchain records and physical ownership.

Asset vs Real World Asset for representation. Infographic

moneydiff.com

moneydiff.com