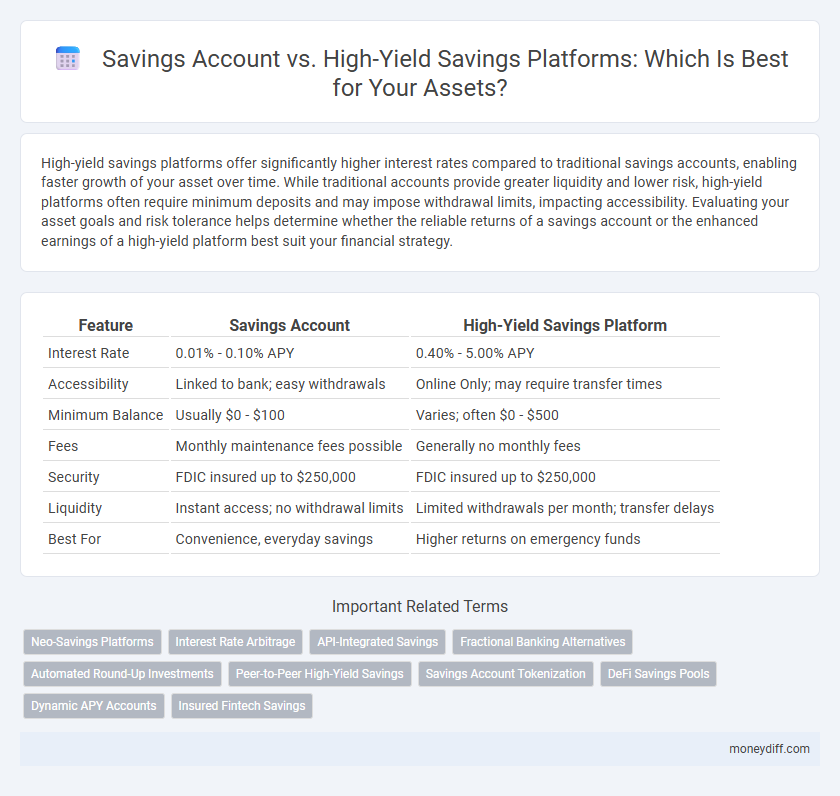

High-yield savings platforms offer significantly higher interest rates compared to traditional savings accounts, enabling faster growth of your asset over time. While traditional accounts provide greater liquidity and lower risk, high-yield platforms often require minimum deposits and may impose withdrawal limits, impacting accessibility. Evaluating your asset goals and risk tolerance helps determine whether the reliable returns of a savings account or the enhanced earnings of a high-yield platform best suit your financial strategy.

Table of Comparison

| Feature | Savings Account | High-Yield Savings Platform |

|---|---|---|

| Interest Rate | 0.01% - 0.10% APY | 0.40% - 5.00% APY |

| Accessibility | Linked to bank; easy withdrawals | Online Only; may require transfer times |

| Minimum Balance | Usually $0 - $100 | Varies; often $0 - $500 |

| Fees | Monthly maintenance fees possible | Generally no monthly fees |

| Security | FDIC insured up to $250,000 | FDIC insured up to $250,000 |

| Liquidity | Instant access; no withdrawal limits | Limited withdrawals per month; transfer delays |

| Best For | Convenience, everyday savings | Higher returns on emergency funds |

Introduction to Savings Accounts and High-Yield Savings Platforms

Savings accounts offer a secure and accessible way to store cash with modest interest rates typically ranging from 0.01% to 0.10%, provided by traditional banks and credit unions. High-yield savings platforms, often offered by online banks or fintech companies, deliver significantly higher annual percentage yields (APYs), sometimes exceeding 4%, enabling faster asset growth while maintaining liquidity and FDIC insurance. Choosing between these options depends on prioritizing either convenience and branch access with standard savings accounts or maximizing returns through competitive interest rates on high-yield savings platforms.

Understanding the Basics: What Are Savings Accounts?

Savings accounts are secure deposit accounts offered by banks that provide interest on the balance while maintaining high liquidity and easy access to funds. They serve as a foundational asset for individuals seeking a low-risk way to save money, with interest rates typically lower than high-yield savings platforms. Understanding the basic mechanics of traditional savings accounts helps in comparing their benefits against more specialized high-yield options that offer increased returns but may have different access or minimum balance requirements.

High-Yield Savings Platforms Explained

High-Yield Savings Platforms offer significantly higher interest rates compared to traditional savings accounts, enabling faster asset growth through compounding returns. These platforms often operate online, reducing overhead costs and passing savings to users in the form of elevated annual percentage yields (APYs). Investors seeking efficient asset accumulation benefit from enhanced liquidity and lower fees typical of high-yield savings options.

Interest Rates Comparison: Traditional vs High-Yield

High-yield savings platforms typically offer interest rates ranging from 3.5% to 5%, significantly outperforming traditional savings accounts that average around 0.01% to 0.10%. This disparity in interest rates can substantially accelerate asset growth over time, especially with compounding. Investors prioritizing asset maximization should consider high-yield accounts to leverage these superior returns.

Accessibility and Convenience: Where Can You Access Your Funds?

Savings accounts typically offer easy access to funds through physical branches, ATMs, and online banking, providing immediate liquidity for asset management. High-yield savings platforms, often online-only, may limit access to funds with withdrawal restrictions or longer processing times but compensate with higher interest rates, optimizing asset growth. Choosing between the two depends on prioritizing liquidity and convenience versus maximizing asset yield with potential access limitations.

Security and Insurance: Protecting Your Assets

High-yield savings platforms often provide competitive interest rates while maintaining FDIC insurance, ensuring deposits are protected up to $250,000 per account holder, similar to traditional savings accounts. The security protocols of both savings account types include encryption and fraud monitoring, but high-yield platforms may also offer added features like multi-factor authentication. Investors should verify that their chosen high-yield savings platform is FDIC-insured to safeguard their assets against institutional failure.

Fees and Minimum Balance Requirements

High-yield savings platforms often offer significantly higher interest rates compared to traditional savings accounts, which can accelerate asset growth over time. Fees tend to be lower or nonexistent on high-yield platforms, while traditional savings accounts may charge monthly maintenance fees that erode returns. Minimum balance requirements on high-yield accounts are usually minimal or waived, enabling more flexible asset allocation without penalty.

Integration with Other Asset Management Tools

Savings accounts often offer basic integration features with conventional asset management tools, providing seamless synchronization for tracking cash balances and transactions. High-yield savings platforms tend to support advanced integration capabilities, including API access and compatibility with automated portfolio management software, enhancing real-time asset allocation and performance analysis. Effective integration with other asset management tools ensures comprehensive financial oversight and optimized asset growth strategies across diverse investment vehicles.

Risks and Limitations of Each Option

Savings accounts offer low-risk asset protection with federal insurance coverage up to $250,000 through the FDIC, but their low interest rates limit growth potential. High-yield savings platforms provide substantially higher returns, often 2-4 times the national average, but may lack federal insurance and pose risks like platform insolvency or withdrawal restrictions. Evaluating asset safety against yield expectations is critical when choosing between traditional savings accounts and high-yield savings options.

Choosing the Best Savings Vehicle for Your Asset Strategy

Selecting the optimal savings vehicle for asset growth involves comparing traditional savings accounts with high-yield savings platforms, which typically offer significantly higher interest rates, often exceeding 3% APY compared to the average 0.05% APY in standard accounts. High-yield savings platforms often feature FDIC insurance, low or no fees, and digital access, enhancing both security and convenience for asset management. Evaluating factors like liquidity, interest compounding frequency, and platform reputation ensures the chosen savings vehicle aligns with your asset strategy and financial goals.

Related Important Terms

Neo-Savings Platforms

Neo-savings platforms offer significantly higher interest rates compared to traditional savings accounts, leveraging advanced technology and lower overhead costs to maximize returns on assets. These digital-first platforms provide enhanced user experiences and seamless access to high-yield savings opportunities, making them an increasingly popular choice for asset growth.

Interest Rate Arbitrage

High-yield savings platforms consistently offer interest rates up to 5 times higher than traditional savings accounts, enabling greater interest rate arbitrage and maximizing asset growth. Leveraging these platforms allows investors to capitalize on optimal returns while maintaining liquidity and minimizing risk associated with lower-yield assets.

API-Integrated Savings

API-integrated savings platforms offer enhanced asset growth opportunities by enabling seamless automation of deposits and withdrawals, outperforming traditional savings accounts with higher interest rates and real-time financial data access. These platforms leverage APIs to provide personalized interest optimization, immediate asset tracking, and integration with other financial tools, maximizing the efficiency and returns of savings assets.

Fractional Banking Alternatives

High-yield savings platforms leverage fractional banking principles to offer significantly higher interest rates compared to traditional savings accounts, optimizing asset growth potential while maintaining liquidity. These platforms typically utilize pooled deposits and advanced risk management, allowing asset holders to earn superior returns without sacrificing accessibility.

Automated Round-Up Investments

Automated round-up investments linked to savings accounts provide a seamless way to grow assets by rounding up daily purchases and investing the difference, optimizing small change accumulation without active management. High-yield savings platforms with round-up features offer superior interest rates combined with automated micro-investments, maximizing asset growth potential through both compounding interest and consistent incremental investment contributions.

Peer-to-Peer High-Yield Savings

Peer-to-peer high-yield savings platforms offer significantly higher interest rates compared to traditional savings accounts by directly connecting savers with borrowers, enhancing asset growth potential through competitive returns. These platforms often provide flexible terms and diversified lending portfolios, reducing risk while maximizing the yield on savings assets.

Savings Account Tokenization

Savings account tokenization enhances asset liquidity by converting traditional savings accounts into digital tokens, enabling seamless trading and fractional ownership on blockchain platforms. High-yield savings platforms offer higher returns but lack the asset-backed security and regulatory transparency provided by tokenized savings accounts, making tokenization a more secure and innovative approach for asset diversification.

DeFi Savings Pools

DeFi savings pools offer higher yield rates compared to traditional savings accounts by leveraging decentralized finance protocols and liquidity mining incentives. These platforms provide asset holders with optimized interest accrual through automated smart contracts, reducing intermediaries and enhancing capital efficiency.

Dynamic APY Accounts

High-yield savings platforms offer dynamic APY accounts that adjust interest rates based on market conditions, providing potentially greater returns compared to traditional fixed-rate savings accounts. These flexible APYs enhance asset growth by capitalizing on fluctuating rates, making them ideal for savers seeking optimized yield on liquid assets.

Insured Fintech Savings

Insured fintech savings platforms offer competitive interest rates on savings accounts, combining federal deposit insurance with advanced digital access and seamless management tools. These platforms enhance asset growth potential without compromising security, making them a superior alternative to traditional savings accounts for maximizing returns on insured deposits.

Savings Account vs High-Yield Savings Platforms for asset. Infographic

moneydiff.com

moneydiff.com