Commodities offer broad market exposure with established trading volumes and lower entry barriers, making them accessible for alternative asset portfolios. Rare earth metals provide specialized investment opportunities driven by high demand in technology and green energy sectors, often delivering higher potential returns but with increased supply risk and geopolitical concerns. Diversifying between commodities and rare earth metals can balance risk and capitalize on the evolving global resource landscape.

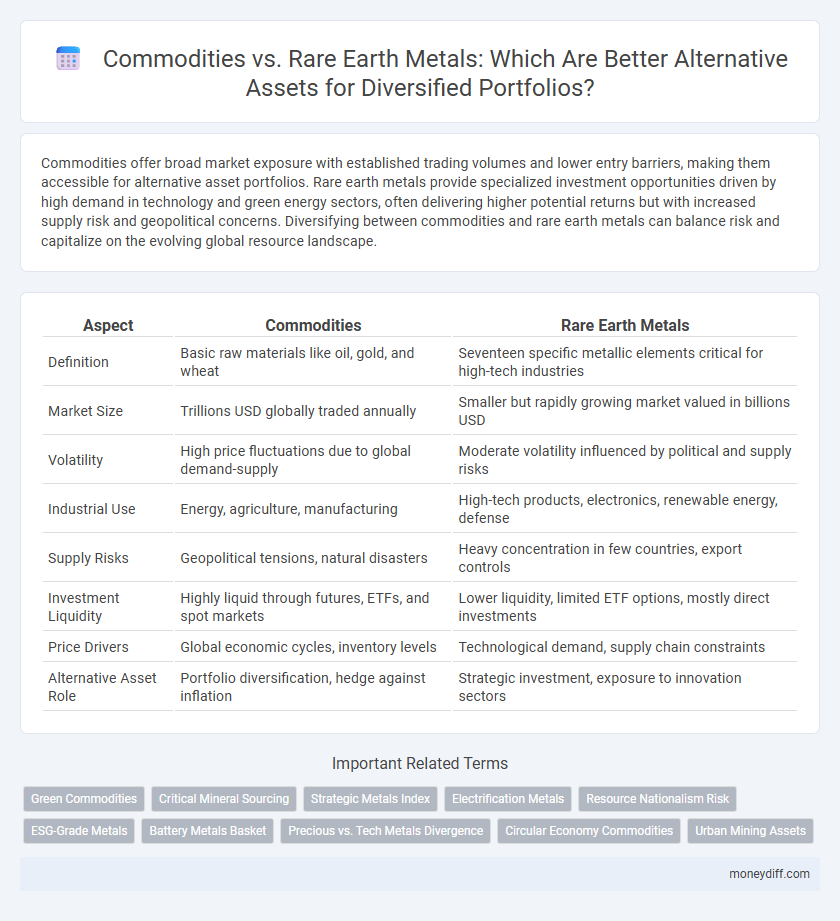

Table of Comparison

| Aspect | Commodities | Rare Earth Metals |

|---|---|---|

| Definition | Basic raw materials like oil, gold, and wheat | Seventeen specific metallic elements critical for high-tech industries |

| Market Size | Trillions USD globally traded annually | Smaller but rapidly growing market valued in billions USD |

| Volatility | High price fluctuations due to global demand-supply | Moderate volatility influenced by political and supply risks |

| Industrial Use | Energy, agriculture, manufacturing | High-tech products, electronics, renewable energy, defense |

| Supply Risks | Geopolitical tensions, natural disasters | Heavy concentration in few countries, export controls |

| Investment Liquidity | Highly liquid through futures, ETFs, and spot markets | Lower liquidity, limited ETF options, mostly direct investments |

| Price Drivers | Global economic cycles, inventory levels | Technological demand, supply chain constraints |

| Alternative Asset Role | Portfolio diversification, hedge against inflation | Strategic investment, exposure to innovation sectors |

Understanding Commodities and Rare Earth Metals as Alternative Assets

Commodities, including agricultural products, energy resources, and metals, offer diversification and inflation hedging within alternative investment portfolios. Rare earth metals, critical for advanced technologies and clean energy, present unique investment opportunities due to their supply constraints and geopolitical significance. Understanding the distinct market dynamics, demand drivers, and risk factors of commodities versus rare earth metals is essential for optimizing alternative asset allocation strategies.

Market Dynamics: Commodities vs Rare Earth Metals

Commodities exhibit high market liquidity and global demand driven by traditional sectors like energy, agriculture, and industrial metals, resulting in relatively stable price cycles influenced by supply-demand fundamentals and geopolitical factors. Rare earth metals command niche markets with supply concentrated in specific regions, exposing them to significant geopolitical risks, export restrictions, and strategic stockpiling, which induce greater price volatility and speculative trading. Investors differentiate these alternative assets by evaluating commodities for broad economic exposure and rare earth metals for their critical role in technology and clean energy supply chains.

Investment Returns: Historical Performance Comparison

Commodities like oil, gold, and agricultural products have demonstrated moderate historical returns with high volatility influenced by global economic cycles and geopolitical events. Rare earth metals, essential for advanced technologies and clean energy, have shown stronger growth potential due to increasing demand and limited supply, resulting in higher returns over recent decades. Investment in rare earth metals often yields superior long-term performance compared to traditional commodities, driven by market dynamics and strategic industrial importance.

Portfolio Diversification Benefits

Commodities like gold, oil, and agricultural products provide broad market exposure and hedge against inflation, enhancing portfolio stability. Rare earth metals, critical for technology and renewable energy sectors, offer unique growth potential and lower correlation with traditional assets. Combining both in alternative asset portfolios maximizes diversification benefits by balancing volatility and capturing sector-specific opportunities.

Risk Factors in Commodities and Rare Earth Metals Investing

Investing in commodities involves significant risks such as price volatility driven by supply-demand imbalances, geopolitical tensions, and currency fluctuations. Rare earth metals present unique risk factors including geopolitical concentration in production, export restrictions, and environmental regulations affecting mining and processing. Both asset classes require careful assessment of market dynamics, regulatory frameworks, and global economic trends to mitigate investment risks effectively.

Liquidity and Accessibility of Each Asset Class

Commodities like oil, gold, and agricultural products offer higher liquidity due to active global markets and standardized contracts, facilitating easier entry and exit. Rare earth metals, essential for technology and renewable energy, tend to have lower liquidity and accessibility because of limited trading platforms and geopolitical supply constraints. Investors seeking alternative assets must weigh commodities' market depth and ease of transaction against the niche, often less liquid nature of rare earth metals.

Global Demand Drivers: Industry Uses and Trends

Commodities such as oil, gold, and agricultural products experience global demand driven by established industrial sectors including energy, manufacturing, and food production. Rare earth metals command increasing attention due to their critical role in high-tech industries, renewable energy technologies, and electric vehicle batteries, reflecting a shift towards sustainable and digital economies. The accelerating adoption of clean energy technologies and advanced electronics significantly amplifies demand for rare earth metals compared to traditional commodities.

Environmental and Regulatory Impact

Commodities such as oil and agricultural products often face fluctuating environmental regulations due to their high carbon emissions and land use concerns, impacting investment risk profiles. In contrast, rare earth metals attract stricter regulatory scrutiny because of their critical role in clean energy technologies and the environmental costs of mining and refining, leading to increased compliance costs for asset managers. The shift towards sustainable investing amplifies the importance of assessing environmental impact and regulatory frameworks when evaluating commodities versus rare earth metals as alternative assets.

Future Outlook: Growth Potential and Emerging Opportunities

Commodities like oil and agricultural products exhibit steady demand with moderate growth potential driven by global consumption and industrial use. Rare earth metals demonstrate higher growth prospects due to their critical role in advanced technologies such as electric vehicles, renewable energy, and electronics, driving increased investment interest. Emerging opportunities in rare earth metals include securing supply chains and developing sustainable mining practices to meet escalating demand in high-tech industries.

Strategies for Allocating Commodities and Rare Earth Metals in a Portfolio

Allocating commodities and rare earth metals in a portfolio requires diversification to balance risk and enhance returns, with commodities like oil, gold, and agricultural products offering liquidity and inflation hedging. Rare earth metals, including neodymium, dysprosium, and cerium, provide strategic exposure due to their critical role in technology and renewable energy sectors, potentially delivering superior long-term growth. Optimal portfolio strategies combine physical holdings, futures contracts, and exchange-traded funds (ETFs) to capitalize on market volatility and supply-demand dynamics unique to both asset classes.

Related Important Terms

Green Commodities

Green commodities, such as lithium, cobalt, and nickel, play a critical role in the transition to renewable energy by supporting battery production and clean technologies, while rare earth metals like neodymium and dysprosium are essential for manufacturing high-efficiency magnets used in wind turbines and electric vehicles. Investing in these alternative assets offers exposure to essential materials driving decarbonization, combining growth potential with strategic importance in the global green economy.

Critical Mineral Sourcing

Critical mineral sourcing for alternative assets increasingly emphasizes rare earth metals due to their essential role in advanced technologies and renewable energy systems, offering higher strategic value compared to traditional commodities like oil or gold. Unlike bulk commodities, rare earth metals present unique supply chain challenges, including geopolitical risks and limited extraction sites, making secure sourcing and sustainable mining practices crucial for long-term asset resilience.

Strategic Metals Index

Commodities such as oil and agricultural products provide liquidity and broad market exposure, whereas rare earth metals within the Strategic Metals Index offer targeted investment in critical materials essential for technology and clean energy sectors. The Strategic Metals Index tracks rare earth elements like neodymium and dysprosium, highlighting their growing importance in electric vehicles and renewable energy infrastructure as alternative assets.

Electrification Metals

Electrification metals such as lithium, cobalt, and nickel play a critical role in the transition to renewable energy and electric vehicles, making rare earth metals increasingly valuable as alternative assets compared to traditional commodities like oil or gold. The growing demand for battery components and electric infrastructure drives higher valuation and investment interest in rare earth metals, highlighting their strategic importance in the global shift toward electrification.

Resource Nationalism Risk

Commodities and rare earth metals serve as alternative assets with distinct exposure to resource nationalism risk, where governments may impose export restrictions or increased taxes to secure domestic supply. Rare earth metals face higher risk due to their critical role in advanced technologies and concentrated geographic production, intensifying governmental control and geopolitical tensions compared to more diversified commodity markets.

ESG-Grade Metals

ESG-grade metals in commodities and rare earth metals offer distinct investment opportunities, with commodities like copper and aluminum emphasizing sustainable sourcing and low environmental impact, while rare earth metals, essential for clean energy technologies, face greater scrutiny over mining practices and supply chain transparency. Investors prioritize rare earth metals rich in ESG attributes due to their critical role in electric vehicles, wind turbines, and advanced electronics, aligning alternative asset portfolios with environmental, social, and governance criteria.

Battery Metals Basket

Battery metals basket primarily includes lithium, cobalt, and nickel, essential for electric vehicle batteries and renewable energy storage, offering higher growth potential compared to broader commodities like oil or gold. Rare earth metals, while critical for high-tech applications, face supply constraints and geopolitical risks, making battery metals a more attractive alternative asset class within the clean energy transition.

Precious vs. Tech Metals Divergence

Precious metals like gold and silver have long been valued for their stability and hedge against inflation, while rare earth metals such as neodymium and dysprosium are crucial for high-tech applications in electronics and renewable energy technologies. The divergence between these asset classes highlights a shift from traditional store-of-value commodities toward strategic materials driving technological innovation and supply chain security.

Circular Economy Commodities

Circular economy commodities emphasize sustainable resource management by focusing on the reuse and recycling of materials like aluminum, copper, and plastics, reducing dependence on finite resources. Rare earth metals, critical for advanced technologies, pose recycling challenges but represent a strategic asset in alternative investments due to their high demand and limited supply.

Urban Mining Assets

Urban mining assets primarily involve the recovery of rare earth metals from electronic waste, offering a sustainable alternative to traditional commodity extraction such as gold or oil. Rare earth metals obtained through urban mining possess high demand in technology and renewable energy industries, making them strategically valuable alternative assets compared to more volatile commodity markets.

Commodities vs Rare Earth Metals for alternative assets Infographic

moneydiff.com

moneydiff.com