Green bonds specifically finance projects with environmental benefits, making them ideal for asset portfolios targeting sustainability and climate resilience. Bond investments generally offer steady income and lower risk, but green bonds add the advantage of aligning financial returns with environmental impact goals. Choosing green bonds enhances asset value through growing market demand for responsible investing and regulatory incentives.

Table of Comparison

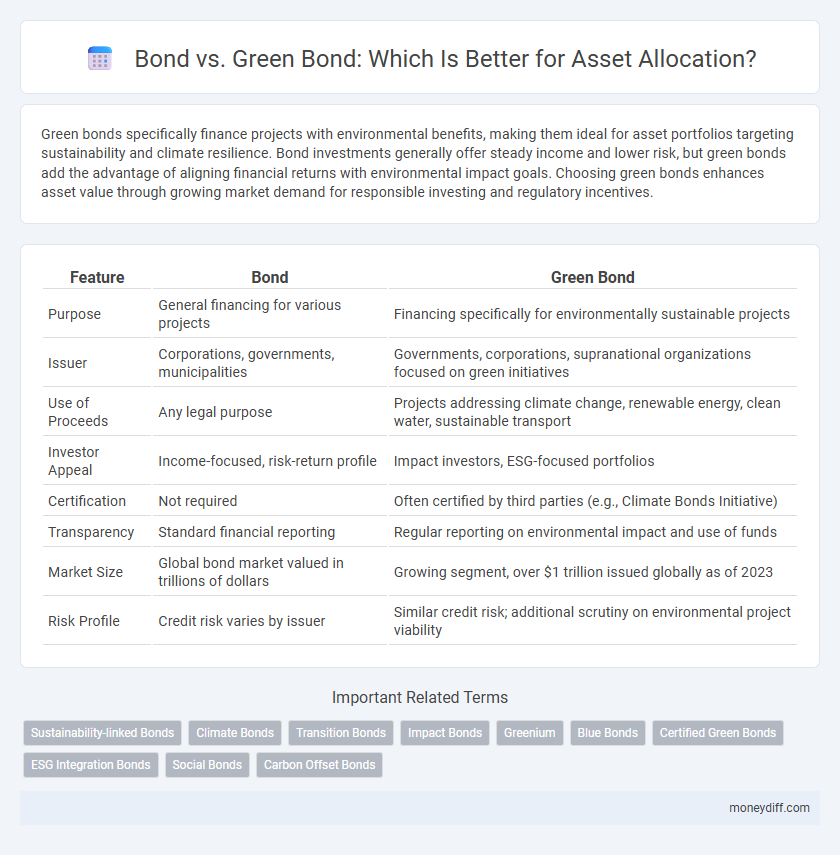

| Feature | Bond | Green Bond |

|---|---|---|

| Purpose | General financing for various projects | Financing specifically for environmentally sustainable projects |

| Issuer | Corporations, governments, municipalities | Governments, corporations, supranational organizations focused on green initiatives |

| Use of Proceeds | Any legal purpose | Projects addressing climate change, renewable energy, clean water, sustainable transport |

| Investor Appeal | Income-focused, risk-return profile | Impact investors, ESG-focused portfolios |

| Certification | Not required | Often certified by third parties (e.g., Climate Bonds Initiative) |

| Transparency | Standard financial reporting | Regular reporting on environmental impact and use of funds |

| Market Size | Global bond market valued in trillions of dollars | Growing segment, over $1 trillion issued globally as of 2023 |

| Risk Profile | Credit risk varies by issuer | Similar credit risk; additional scrutiny on environmental project viability |

Understanding Traditional Bonds vs Green Bonds

Traditional bonds provide fixed income by lending money to corporations or governments with no specific environmental criteria, while green bonds are debt securities specifically earmarked for funding projects with positive environmental impacts, such as renewable energy or clean transportation. Investors in green bonds benefit from supporting sustainability initiatives and often report enhanced portfolio diversification due to the growing demand in ESG investing. Understanding the key differences in purpose, impact, and market growth is essential for asset allocation aligned with responsible investment goals.

Key Features of Bonds in Asset Management

Bonds serve as fixed-income assets providing predictable returns and risk diversification within investment portfolios, while green bonds specifically fund environmentally sustainable projects, attracting socially responsible investors seeking impact alongside financial gain. Key features include maturity dates, coupon rates, and credit ratings, which influence yield and risk assessment in asset management strategies. Green bonds differentiate themselves by offering transparency on project use and adherence to environmental standards, appealing to asset managers targeting ESG (Environmental, Social, and Governance) criteria.

Green Bonds: Purpose and Environmental Impact

Green Bonds are debt instruments specifically designed to finance projects with positive environmental benefits, such as renewable energy, clean transportation, and sustainable water management. These assets attract investors seeking to support climate change mitigation and promote sustainable development while potentially earning competitive returns. The purpose-driven nature of Green Bonds enhances portfolio diversification by integrating environmental impact with financial performance.

Risk and Return: Bonds vs Green Bonds

Traditional bonds often carry predictable risk and stable returns based on established credit ratings and market conditions, appealing to investors seeking consistent income. Green bonds, while generally aligned with the financial risk profile of conventional bonds, incorporate environmental project risks and may offer comparable or slightly varied returns due to increasing investor demand for sustainable assets. Both asset types require analysis of interest rate risk, credit risk, and liquidity, but green bonds add an extra layer of impact assessment related to environmental outcomes, influencing long-term return expectations.

Regulatory Frameworks Governing Bonds and Green Bonds

Regulatory frameworks for traditional bonds primarily focus on financial disclosures, issuer creditworthiness, and market stability, governed by entities such as the SEC in the United States and ESMA in Europe. Green bonds are subject to additional environmental criteria and verification standards, often following guidelines like the Green Bond Principles (GBP) or regulations imposed by the EU Sustainable Finance Disclosure Regulation (SFDR). Compliance with these enhanced frameworks ensures transparency in the allocation of proceeds to environmentally sustainable projects, thereby increasing investor confidence and market integrity in the green bond segment.

Portfolio Diversification with Bonds and Green Bonds

Including both traditional bonds and green bonds in an asset portfolio enhances diversification by balancing risk and sustainability criteria. Green bonds target projects with environmental benefits, attracting investors seeking both financial returns and positive ecological impact, which complements the steady income from conventional bonds. This mix reduces exposure to market volatility while aligning with growing demand for responsible investment options.

Market Performance: Comparing Bonds and Green Bonds

Green bonds have demonstrated growing market demand driven by increasing investor interest in sustainable assets, often experiencing competitive yields compared to traditional bonds. While conventional bonds provide steady returns tied to the issuer's creditworthiness, green bonds attract a premium due to their environmental impact and certification standards. Market performance analysis reveals that green bonds can offer diversification benefits and resilience during volatility, aligning financial returns with ESG (Environmental, Social, Governance) goals.

Sustainability Criteria in Green Bond Selection

Green bonds prioritize sustainability criteria by funding projects with measurable environmental benefits such as renewable energy, pollution reduction, and climate resilience, distinguishing them from traditional bonds that primarily focus on financial returns. The selection process for green bonds involves rigorous assessment against standards like the Green Bond Principles, ensuring transparency, impact reporting, and alignment with global sustainability goals like the UN Sustainable Development Goals (SDGs). Investors demanding accountability use these criteria to evaluate the environmental performance of assets, making green bonds a strategic tool for sustainable asset allocation.

Tax Benefits and Incentives for Green Bonds

Green bonds offer unique tax benefits and incentives that traditional bonds typically lack, including tax exemptions on interest income and eligibility for government subsidies. These fiscal advantages are designed to promote environmentally sustainable projects, enhancing the asset's appeal to socially conscious investors. Incorporating green bonds into a portfolio can improve tax efficiency while supporting climate-focused initiatives, providing both financial and ecological value.

Strategic Asset Allocation: When to Choose Green Bonds Over Traditional Bonds

Strategic asset allocation favors green bonds over traditional bonds when aligning portfolios with Environmental, Social, and Governance (ESG) criteria and targeting sustainability goals. Green bonds offer exposure to projects that mitigate climate risks and promote renewable energy, enhancing portfolio resilience against regulatory shifts and reputational risks. Allocating assets to green bonds can also tap into growing investor demand for responsible investments, potentially improving long-term risk-adjusted returns.

Related Important Terms

Sustainability-linked Bonds

Sustainability-linked bonds (SLBs) differ from traditional bonds and green bonds by tying financial terms directly to the issuer's achievement of specific environmental, social, and governance (ESG) performance targets, thus promoting accountability and long-term value creation. Unlike green bonds that fund predefined green projects, SLBs provide issuers with flexibility while incentivizing measurable improvements in sustainability performance linked to asset management strategies.

Climate Bonds

Climate Bonds offer investors a sustainable asset option by funding projects that reduce carbon emissions and support environmental resilience, distinguishing them from traditional bonds primarily focused on financial returns. These green bonds adhere to rigorous certification standards set by the Climate Bonds Initiative, enhancing transparency and fostering investor confidence in climate-aligned asset portfolios.

Transition Bonds

Transition bonds facilitate investment in companies shifting toward sustainable practices by funding projects that reduce carbon emissions while supporting existing asset portfolios. Unlike traditional bonds, transition bonds specifically target assets involved in environmental improvements, ensuring alignment with climate transition goals and enhancing long-term asset value.

Impact Bonds

Impact bonds, a subset of green bonds, specifically finance projects delivering measurable social or environmental benefits alongside financial returns, enhancing portfolio diversification and sustainability impact. Traditional bonds primarily focus on financial yield without targeted outcomes, whereas impact bonds integrate asset management with positive environmental and social performance metrics.

Greenium

Green bonds often command a premium, known as the greenium, reflecting investor demand for sustainable assets and their willingness to accept lower yields compared to traditional bonds. This greenium can enhance asset valuation by signaling commitment to environmental criteria and attracting capital aligned with ESG investment strategies.

Blue Bonds

Blue bonds, a subset of green bonds, specifically fund marine and ocean conservation projects, offering investors targeted impact in sustainable asset portfolios. Compared to traditional bonds, blue bonds provide both financial returns and measurable environmental benefits, addressing climate resilience in coastal and aquatic ecosystems.

Certified Green Bonds

Certified Green Bonds allocate capital specifically to environmentally sustainable projects, offering asset holders verified impact and risk mitigation in climate-conscious portfolios. Traditional Bonds provide broader investment opportunities but lack the targeted environmental credentials and third-party certification essential for green asset allocation strategies.

ESG Integration Bonds

Green bonds are a subset of bonds specifically designed to fund projects with positive environmental impacts, aligning closely with ESG integration by prioritizing sustainability criteria in asset allocation. Traditional bonds may incorporate ESG factors, but green bonds provide a more targeted approach, ensuring capital directly supports climate-friendly and socially responsible initiatives.

Social Bonds

Social bonds focus on financing projects that generate positive social outcomes, such as affordable housing and community development, differentiating them from traditional bonds that primarily prioritize financial returns. Compared to green bonds, which target environmental initiatives, social bonds specifically address social impact metrics, making them essential for investors seeking to support social equity through asset allocation.

Carbon Offset Bonds

Carbon Offset Bonds represent a specialized category within Green Bonds designed to finance projects specifically aimed at reducing or offsetting carbon emissions, thereby enhancing an asset portfolio's environmental impact. Compared to traditional Bonds, these Green Bonds provide measurable environmental benefits by funding renewable energy, reforestation, and carbon capture initiatives, aligning investment strategies with global sustainability goals.

Bond vs Green Bond for asset. Infographic

moneydiff.com

moneydiff.com