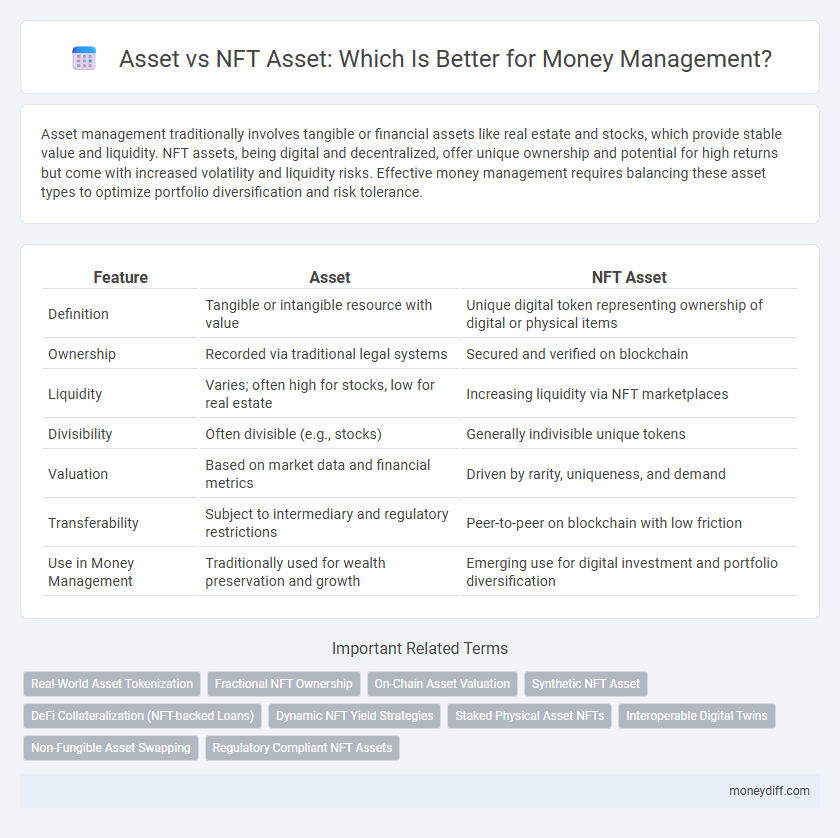

Asset management traditionally involves tangible or financial assets like real estate and stocks, which provide stable value and liquidity. NFT assets, being digital and decentralized, offer unique ownership and potential for high returns but come with increased volatility and liquidity risks. Effective money management requires balancing these asset types to optimize portfolio diversification and risk tolerance.

Table of Comparison

| Feature | Asset | NFT Asset |

|---|---|---|

| Definition | Tangible or intangible resource with value | Unique digital token representing ownership of digital or physical items |

| Ownership | Recorded via traditional legal systems | Secured and verified on blockchain |

| Liquidity | Varies; often high for stocks, low for real estate | Increasing liquidity via NFT marketplaces |

| Divisibility | Often divisible (e.g., stocks) | Generally indivisible unique tokens |

| Valuation | Based on market data and financial metrics | Driven by rarity, uniqueness, and demand |

| Transferability | Subject to intermediary and regulatory restrictions | Peer-to-peer on blockchain with low friction |

| Use in Money Management | Traditionally used for wealth preservation and growth | Emerging use for digital investment and portfolio diversification |

Understanding Traditional Assets in Money Management

Traditional assets such as stocks, bonds, and real estate represent tangible or financial instruments with established market values and regulatory frameworks, making them fundamental in money management strategies. These assets provide liquidity, income generation, and risk diversification, supported by decades of market performance data and legal protections. Understanding the characteristics and valuation methods of traditional assets enables better portfolio allocation and long-term financial planning compared to the emerging and volatile nature of NFT assets.

What Are NFT Assets?

NFT assets are digital representations of ownership recorded on a blockchain, providing unique, verifiable proof of authenticity for virtual items or collectibles. Unlike traditional assets, NFT assets enable decentralized and transparent transactions, allowing users to manage digital property with increased security and liquidity. These assets can include digital art, music, virtual real estate, and other forms of intellectual property, offering new opportunities for investment and asset diversification in money management.

Differences Between Physical Assets and NFT Assets

Physical assets represent tangible items such as real estate, gold, or collectibles, providing intrinsic value and stability in money management through physical ownership and potential for appreciation. NFT (Non-Fungible Token) assets are digital representations of unique items secured by blockchain technology, offering verifiable authenticity, liquidity, and ease of transfer across digital platforms. Unlike physical assets, NFTs lack physical presence but enable innovative investment opportunities through fractional ownership, smart contracts, and decentralized marketplaces.

Evaluating Risk: Assets vs NFT Assets

Evaluating risk between traditional assets and NFT assets requires analyzing volatility, liquidity, and market maturity; traditional assets like stocks and bonds typically offer more stability and established valuation models, while NFT assets often exhibit higher price fluctuations and limited regulation. NFT assets can pose risks related to market manipulation, intellectual property disputes, and technological vulnerabilities, which are less prevalent in conventional assets. Effective money management involves diversifying portfolios by balancing the predictable returns of traditional assets against the speculative opportunities and unique ownership features inherent in NFTs.

Liquidity Comparison: Assets vs NFT Assets

Traditional assets such as stocks, bonds, and real estate generally offer higher liquidity due to established marketplaces and regulatory frameworks that facilitate quick buying and selling. NFT assets, while innovative and unique, often face lower liquidity because of a narrower buyer pool and less standardized valuation methods, making quick conversion to cash more challenging. Investors should weigh the ease of access to cash when managing portfolios, as liquidity directly affects the ability to respond to market changes or financial needs.

Security Considerations for Asset and NFT Asset Management

Traditional asset management relies on established regulatory frameworks and custodial safeguards to protect investor funds, ensuring legal recourse and insured security measures. NFT asset management requires robust blockchain protocols, smart contract audits, and decentralized security strategies to prevent hacking, fraud, and unauthorized access since ownership is tied to digital wallets and immutable ledgers. Understanding the security nuances between physical assets and digital NFT assets is critical for mitigating risks in diversified investment portfolios.

Valuation Methods: Conventional Assets vs NFT Assets

Valuation methods for conventional assets typically rely on standardized financial metrics such as discounted cash flow (DCF), market comparables, and book value to establish intrinsic and market value. NFT asset valuation, however, hinges on unique factors including provenance, rarity, utility, and market demand, often using blockchain analytics and sales history as critical indicators. While conventional assets benefit from regulatory frameworks and historical pricing data, NFT asset valuation remains more speculative and volatile due to the emerging and rapidly evolving digital marketplace.

Diversification Strategies with Assets and NFT Assets

In money management, diversification strategies benefit from combining traditional assets, such as stocks and bonds, with NFT assets, which provide exposure to digital collectibles and unique cryptographic tokens. NFT assets introduce non-correlated value streams that can enhance portfolio resilience against market volatility. Effective diversification balances liquid traditional assets with emerging NFT investments to optimize risk-adjusted returns.

Regulatory Landscape: Assets vs NFT Assets

Traditional assets such as stocks and bonds operate within well-established regulatory frameworks governed by entities like the SEC and FINRA, ensuring investor protection and compliance. NFT assets, however, face evolving regulatory scrutiny due to their unique digital nature, with authorities like the SEC exploring whether NFTs qualify as securities or digital commodities under existing laws. Understanding these regulatory distinctions is crucial for money management strategies to mitigate legal risks and ensure proper asset classification.

Future Trends in Asset and NFT Asset Management

Future trends in asset management emphasize the integration of blockchain technology, with NFT assets enabling fractional ownership and enhanced liquidity. Traditional asset portfolios are increasingly incorporating NFTs to diversify holdings and capitalize on digital scarcity. Advanced AI-driven analytics optimize the management of both tangible assets and NFT portfolios for improved performance and risk assessment.

Related Important Terms

Real-World Asset Tokenization

Real-World Asset Tokenization transforms traditional assets into digital tokens, offering enhanced liquidity, transparency, and fractional ownership compared to conventional NFTs. This shift enables more efficient money management by bridging physical assets like real estate and commodities with blockchain technologies, facilitating easier access and diversified investment portfolios.

Fractional NFT Ownership

Fractional NFT ownership enables investors to hold partial shares of high-value digital assets, enhancing liquidity and diversification compared to traditional asset holdings. This innovative approach to asset management leverages blockchain technology to facilitate secure, transparent transactions and unlocks access to previously exclusive investment opportunities.

On-Chain Asset Valuation

On-chain asset valuation utilizes blockchain data to provide transparent, real-time assessment of digital assets, offering greater liquidity and traceability compared to traditional assets. NFTs, as unique on-chain assets, enable precise provenance tracking and encourage decentralized finance applications, revolutionizing money management strategies.

Synthetic NFT Asset

Synthetic NFT assets combine traditional asset features with blockchain technology, enabling fractional ownership, enhanced liquidity, and programmable financial instruments for money management. Unlike conventional assets, they leverage smart contracts to automate transactions and embed customizable terms, optimizing portfolio diversification and risk control.

DeFi Collateralization (NFT-backed Loans)

Traditional assets provide stable collateral for DeFi loans but lack the unique ownership and programmability features of NFT assets, which enable more flexible and personalized financial products. NFT-backed loans in DeFi platforms leverage the distinctiveness and verifiable scarcity of digital collectibles to unlock new liquidity pools while introducing complex valuation challenges.

Dynamic NFT Yield Strategies

Dynamic NFT yield strategies enhance traditional asset management by leveraging programmable, real-time financial mechanisms unique to NFT assets, enabling more flexible and diversified revenue streams. Unlike static assets, these strategies optimize returns through automated adjustments based on market conditions, unlocking novel liquidity and investment opportunities within decentralized finance ecosystems.

Staked Physical Asset NFTs

Staked Physical Asset NFTs represent a revolutionary approach to money management by combining the liquidity and transparency of NFTs with the intrinsic value of tangible assets, enabling investors to earn passive income while retaining ownership rights. This hybrid asset class enhances portfolio diversification and mitigates traditional market volatility by leveraging blockchain technology to securely tokenize and stake physical assets.

Interoperable Digital Twins

Interoperable digital twins enhance asset management by providing dynamic, real-time representations of physical and NFT assets, enabling seamless integration across diverse financial platforms. This interoperability facilitates accurate valuation, liquidity, and transferability in both traditional and digital asset ecosystems, optimizing money management strategies.

Non-Fungible Asset Swapping

Non-fungible asset swapping enables the exchange of unique digital assets like NFTs without intermediation, enhancing liquidity in money management by allowing direct peer-to-peer transactions. Unlike traditional assets, which are typically interchangeable and valued uniformly, NFT assets carry distinct metadata and provenance, necessitating specialized handling and valuation frameworks in financial portfolios.

Regulatory Compliant NFT Assets

Regulatory compliant NFT assets represent a digital evolution of traditional assets, incorporating blockchain technology to enable transparent, secure ownership and transfer while adhering to financial regulations like KYC and AML standards. These NFT assets offer enhanced liquidity and fractional ownership opportunities, positioning them as innovative tools for modern money management within compliant frameworks.

Asset vs NFT Asset for money management. Infographic

moneydiff.com

moneydiff.com