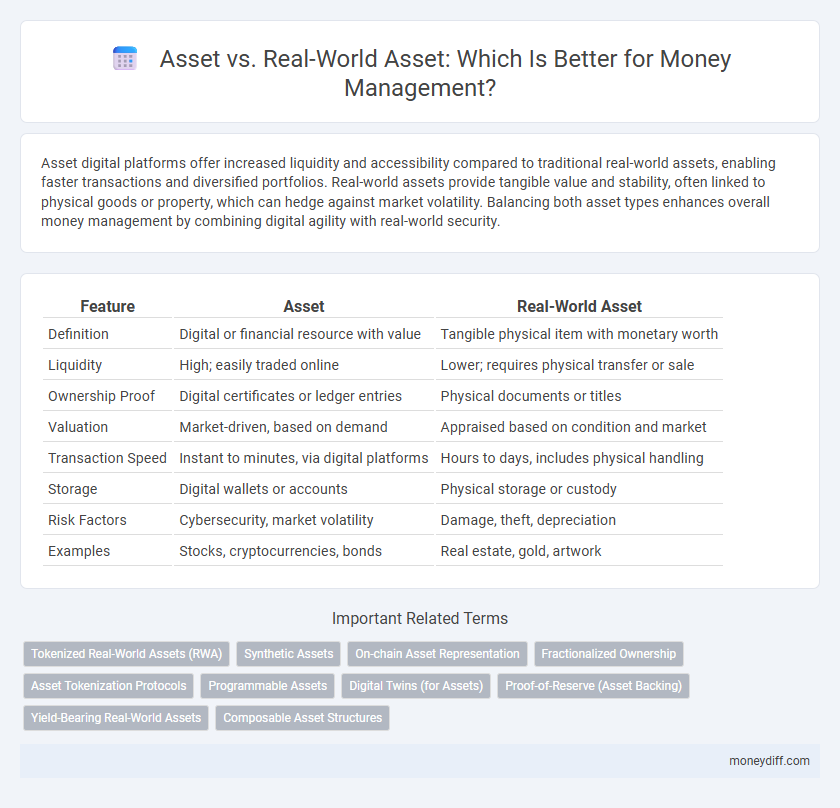

Asset digital platforms offer increased liquidity and accessibility compared to traditional real-world assets, enabling faster transactions and diversified portfolios. Real-world assets provide tangible value and stability, often linked to physical goods or property, which can hedge against market volatility. Balancing both asset types enhances overall money management by combining digital agility with real-world security.

Table of Comparison

| Feature | Asset | Real-World Asset |

|---|---|---|

| Definition | Digital or financial resource with value | Tangible physical item with monetary worth |

| Liquidity | High; easily traded online | Lower; requires physical transfer or sale |

| Ownership Proof | Digital certificates or ledger entries | Physical documents or titles |

| Valuation | Market-driven, based on demand | Appraised based on condition and market |

| Transaction Speed | Instant to minutes, via digital platforms | Hours to days, includes physical handling |

| Storage | Digital wallets or accounts | Physical storage or custody |

| Risk Factors | Cybersecurity, market volatility | Damage, theft, depreciation |

| Examples | Stocks, cryptocurrencies, bonds | Real estate, gold, artwork |

Understanding Assets in Money Management

Assets in money management encompass both financial instruments and real-world assets, each playing a crucial role in wealth accumulation and risk diversification. Real-world assets, such as real estate, commodities, and infrastructure, offer tangible value and inflation hedging, unlike purely financial assets like stocks or bonds that represent ownership or debt claims. Effective money management requires balancing these asset types to optimize portfolio stability, liquidity, and long-term growth potential.

What Are Real-World Assets (RWAs)?

Real-World Assets (RWAs) are tangible or physical assets such as real estate, commodities, or machinery that hold intrinsic value outside the digital realm. Unlike traditional financial assets, RWAs provide a direct link to the physical economy, offering greater stability and reducing volatility in money management. Integrating RWAs into portfolios diversifies risk and enhances asset-backed financing opportunities.

Key Differences: Asset vs Real-World Asset

Assets represent any resource with economic value owned by an individual or organization, including financial instruments, digital holdings, and physical properties. Real-world assets specifically refer to tangible items such as real estate, commodities, or machinery that have intrinsic value and a physical presence. The key difference lies in liquidity and valuation; traditional assets often offer greater liquidity and easier valuation, whereas real-world assets require specialized appraisal and may involve higher transaction costs.

Liquidity: Asset vs Real-World Asset

Digital assets offer higher liquidity compared to real-world assets due to their easy transferability and 24/7 market access. Real-world assets like real estate or machinery often experience slower transaction times and limited market availability, impacting liquidity. Efficient money management favors digital assets when rapid conversion to cash is critical.

Valuation Methods for Assets and RWAs

Valuation methods for traditional assets often rely on market-based approaches such as discounted cash flow (DCF) analysis and comparable company multiples, which assess future earnings potential and market conditions. Real-World Assets (RWAs) require hybrid valuation strategies incorporating physical appraisal, income generation potential, and risk factors unique to tangible assets like real estate, commodities, or infrastructure. Advanced models also integrate blockchain-based tokenization metrics to enhance transparency and liquidity assessment in RWA valuation for modern money management portfolios.

Risk Factors: Traditional Assets vs RWAs

Traditional assets such as stocks and bonds carry market volatility and liquidity risks, which can result in significant value fluctuations or inability to quickly convert into cash. Real-world assets (RWAs), including real estate and commodities, face risks related to physical depreciation, regulatory changes, and valuation difficulties due to illiquidity and lower market transparency. Effective money management requires assessing these distinct risk factors, balancing portfolio diversification, and incorporating asset-specific risk mitigation strategies.

Diversification Benefits: Comparing Asset Types

Diversification benefits between traditional financial assets and real-world assets lie in their distinct risk-return profiles and market behaviors. Real-world assets such as real estate, commodities, and infrastructure provide tangible value and act as inflation hedges, contrasting with the liquidity and volatility characteristics of stocks and bonds. Incorporating both asset types in a portfolio enhances risk mitigation by reducing correlation and improving overall stability during economic fluctuations.

Regulatory Considerations for Assets and RWAs

Regulatory considerations for traditional assets primarily involve compliance with financial reporting standards and taxation rules, ensuring transparency and investor protection. Real-world assets (RWAs), such as real estate or commodities tokenized on blockchain, face additional regulatory scrutiny related to asset custody, anti-money laundering (AML) protocols, and cross-jurisdictional legal frameworks. Navigating these regulations is critical for accurate valuation, legal compliance, and risk management in diversified money management portfolios.

Practical Applications in Money Management

Digital assets offer enhanced liquidity and ease of transfer compared to real-world assets, making them ideal for quick portfolio adjustments and automated trading strategies. Real-world assets provide tangible value and stability, serving as reliable collateral and long-term investment anchors in diversified portfolios. Integrating both asset types allows for balanced risk management and optimized capital allocation in practical money management.

Future Outlook: Asset and Real-World Asset Integration

The future of money management lies in the seamless integration of traditional assets with real-world assets, leveraging blockchain technology to enhance transparency and liquidity. Tokenization of physical assets such as real estate and commodities enables fractional ownership and streamlined transactions, revolutionizing asset management. This convergence supports more efficient capital allocation and unlocks new investment opportunities in both digital and physical economies.

Related Important Terms

Tokenized Real-World Assets (RWA)

Tokenized Real-World Assets (RWA) transform tangible assets like real estate, commodities, or invoices into digital tokens on blockchain platforms, enhancing liquidity and accessibility in money management. This innovation allows investors to diversify portfolios by seamlessly trading fractional ownership of traditionally illiquid assets with increased transparency and reduced transaction costs.

Synthetic Assets

Synthetic assets replicate the value of real-world assets by using blockchain technology and smart contracts, enabling fractional ownership and increased liquidity without the need for physical possession. These digital representations reduce barriers to entry and offer enhanced transparency in money management compared to traditional assets.

On-chain Asset Representation

On-chain asset representation enables digital ownership and transferability of real-world assets by tokenizing physical or financial instruments on a blockchain, enhancing transparency, liquidity, and security. This approach bridges traditional asset management with decentralized finance (DeFi), allowing seamless integration and programmable control over asset rights and transactions.

Fractionalized Ownership

Fractionalized ownership enables investors to acquire partial shares of both digital and real-world assets, increasing liquidity and accessibility in money management. Real-world assets, such as real estate or commodities, benefit from tokenization by allowing smaller investments and diversification, while traditional assets are often constrained by high entry barriers and illiquidity.

Asset Tokenization Protocols

Asset tokenization protocols digitize real-world assets, enabling fractional ownership, increased liquidity, and streamlined transactions within blockchain ecosystems. These protocols bridge traditional asset classes like real estate and commodities with decentralized finance, enhancing transparency and accessibility for money management.

Programmable Assets

Programmable assets leverage blockchain technology to enable automated transactions and smart contract execution, enhancing transparency and efficiency in money management compared to traditional real-world assets. These digital assets offer real-time liquidity, fractional ownership, and programmable rights, creating new opportunities for dynamic portfolio management and decentralized finance applications.

Digital Twins (for Assets)

Digital Twins for assets create precise virtual replicas that enhance monitoring, management, and valuation, bridging the gap between intangible digital assets and tangible real-world assets. This integration improves liquidity and risk assessment in money management by providing real-time data and predictive analytics on asset performance.

Proof-of-Reserve (Asset Backing)

Proof-of-Reserve protocols enhance transparency and trust by cryptographically verifying digital assets against real-world asset reserves, ensuring full collateralization in money management systems. This asset backing mechanism mitigates risks associated with illiquid or fractional reserves common in conventional financial models, strengthening the integrity of both digital and real-world asset portfolios.

Yield-Bearing Real-World Assets

Yield-bearing real-world assets such as rental properties, dividend stocks, and bonds generate consistent income streams and offer tangible value retention, contrasting with traditional digital or financial assets that may lack physical backing. Integrating yield-bearing real-world assets into money management strategies enhances portfolio diversification and risk mitigation while delivering steady cash flow.

Composable Asset Structures

Composable asset structures enable seamless integration of traditional financial instruments with tokenized real-world assets, enhancing liquidity and flexibility in money management. This hybrid approach leverages blockchain technology to create modular financial products, facilitating efficient asset allocation and risk diversification.

Asset vs Real-World Asset for money management. Infographic

moneydiff.com

moneydiff.com