Mutual funds offer broad asset diversification by pooling investments across various sectors and securities, reducing risk through professional management. Thematic ETFs concentrate on specific investment themes or trends, providing targeted exposure while maintaining diversification within that theme. Both options enhance portfolio diversification, with mutual funds offering wider market coverage and thematic ETFs delivering focused investment opportunities.

Table of Comparison

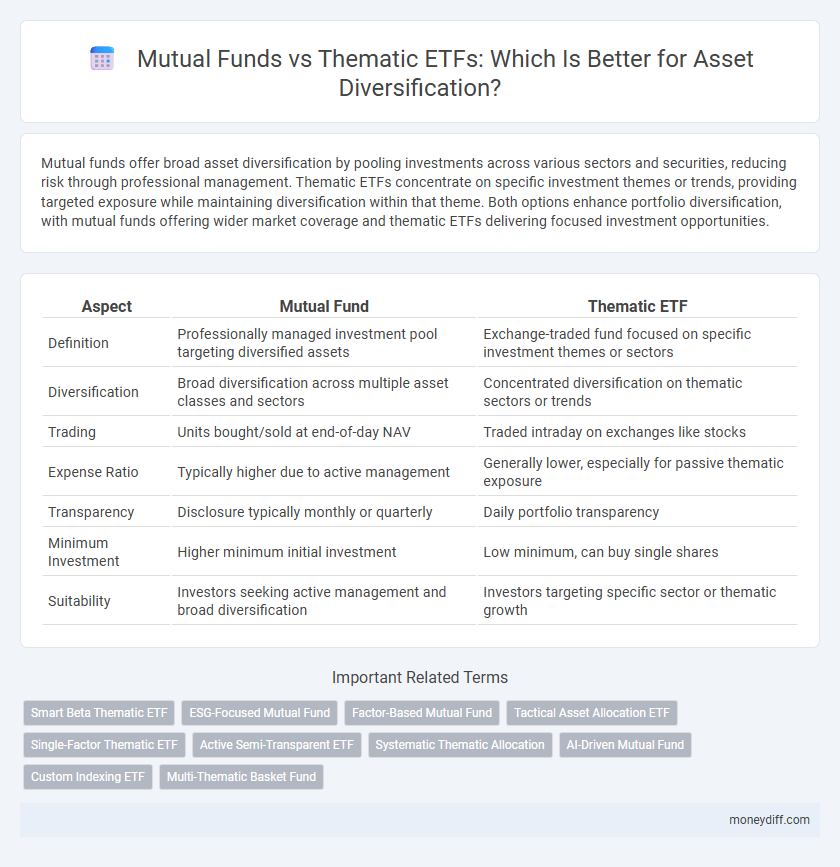

| Aspect | Mutual Fund | Thematic ETF |

|---|---|---|

| Definition | Professionally managed investment pool targeting diversified assets | Exchange-traded fund focused on specific investment themes or sectors |

| Diversification | Broad diversification across multiple asset classes and sectors | Concentrated diversification on thematic sectors or trends |

| Trading | Units bought/sold at end-of-day NAV | Traded intraday on exchanges like stocks |

| Expense Ratio | Typically higher due to active management | Generally lower, especially for passive thematic exposure |

| Transparency | Disclosure typically monthly or quarterly | Daily portfolio transparency |

| Minimum Investment | Higher minimum initial investment | Low minimum, can buy single shares |

| Suitability | Investors seeking active management and broad diversification | Investors targeting specific sector or thematic growth |

Understanding Mutual Funds and Thematic ETFs

Mutual funds pool investors' money to invest in a diversified portfolio managed by professionals, offering broad asset diversification and risk reduction. Thematic ETFs focus on specific sectors or trends, providing targeted exposure and higher growth potential but with increased volatility. Understanding these differences helps investors balance risk and return when diversifying their asset allocations.

Key Differences Between Mutual Funds and Thematic ETFs

Mutual funds pool investor capital to invest across diversified securities managed by professional fund managers, offering broad market exposure and typically lower volatility. Thematic ETFs target specific sectors, trends, or themes like technology or clean energy, allowing investors to capture niche market opportunities with higher concentration risk. Liquidity also differs as ETFs trade on stock exchanges throughout the day, whereas mutual funds are priced once daily at net asset value (NAV).

Asset Diversification: The Core Concept

Mutual funds offer broad asset diversification by pooling investments across multiple sectors and securities, reducing risk through wide exposure. Thematic ETFs concentrate on specific trends or sectors, providing targeted diversification aligned with particular investment themes. Combining both allows investors to balance broad market exposure with focused opportunities, enhancing portfolio resilience against market volatility.

How Mutual Funds Achieve Diversification

Mutual funds achieve diversification by pooling resources from multiple investors to invest across a wide range of securities, including stocks, bonds, and other assets, which spreads risk and minimizes exposure to any single investment. Fund managers actively select a diversified portfolio aligned with the fund's investment objectives, balancing sectors, geographic locations, and asset classes to optimize risk-adjusted returns. This broad approach contrasts with thematic ETFs that concentrate on specific sectors or trends, offering targeted exposure rather than extensive diversification.

Thematic ETFs: Sector-Specific Diversification

Thematic ETFs offer targeted exposure to specific sectors or themes, enabling investors to capitalize on emerging trends and industry growth within distinct asset classes. Unlike mutual funds, Thematic ETFs provide greater transparency and liquidity, with real-time trading options that enhance portfolio flexibility for diversification. Sector-specific diversification through Thematic ETFs mitigates risk by concentrating assets in high-potential industries such as technology, healthcare, or clean energy, aligning investments with market innovations and evolving economic drivers.

Risk Factors: Mutual Funds vs Thematic ETFs

Mutual funds offer diversified portfolios managed by professionals, which can mitigate specific risks but may be exposed to broader market fluctuations. Thematic ETFs concentrate on sectors or trends, increasing exposure to sector-specific risks and volatility tied to thematic performance. Understanding the risk profile is crucial for aligning asset diversification strategies with investment goals and risk tolerance.

Performance Comparison: Historical Trends

Historical performance trends indicate that mutual funds often provide steady returns with diversified asset allocation, while thematic ETFs show higher volatility due to concentration in specific sectors or themes. Data from the past decade reveals that thematic ETFs can outperform mutual funds during sector surges but underperform during market corrections. Mutual funds maintain resilience through broader market exposure, whereas thematic ETFs cater to investors seeking targeted growth opportunities.

Cost and Fee Structure Analysis

Mutual funds typically charge higher expense ratios and potential sales loads, whereas thematic ETFs generally offer lower fees and no load costs, making them more cost-effective for diversification. Expense ratios for mutual funds can range from 0.5% to 2%, while thematic ETFs often maintain fees below 0.5%, enhancing long-term portfolio growth. Evaluating transaction costs and tax efficiency is crucial, as ETFs usually provide greater flexibility and lower capital gains distributions compared to mutual funds.

Suitability for Different Investor Profiles

Mutual funds offer diversified exposure through actively managed portfolios, making them suitable for investors seeking professional management and moderate risk tolerance. Thematic ETFs provide targeted investment in specific sectors or trends, ideal for investors with a higher risk appetite aiming for focused growth opportunities. Matching the choice to an investor's financial goals, risk profile, and investment horizon enhances portfolio diversification and potential returns.

Choosing the Right Option for Your Portfolio

Mutual funds offer diversified exposure managed by professionals, ideal for investors seeking a balanced portfolio with moderate risk, while thematic ETFs concentrate on specific sectors or trends, providing targeted growth opportunities suited for those aiming to capitalize on niche markets. Analyzing factors such as expense ratios, liquidity, and tax efficiency can help determine the best fit for portfolio goals and risk tolerance. Strategic selection between mutual funds and thematic ETFs enhances asset diversification by aligning investment choices with long-term financial objectives and market outlook.

Related Important Terms

Smart Beta Thematic ETF

Smart Beta Thematic ETFs leverage factor-based strategies to optimize asset diversification by targeting specific investment themes with enhanced risk-adjusted returns, contrasting with traditional mutual funds that often follow broader market indices. These ETFs provide dynamic exposure to evolving trends and sectors, offering more precise portfolio customization and potential alpha generation in diversified asset allocation.

ESG-Focused Mutual Fund

ESG-focused mutual funds prioritize investments in companies with strong environmental, social, and governance practices, offering diversified exposure across sectors and geographies, which enhances asset diversification compared to thematic ETFs that concentrate on specific themes or industries. Mutual funds benefit from professional management and regulatory oversight, providing a balanced risk-return profile aligned with sustainable investing goals.

Factor-Based Mutual Fund

Factor-Based Mutual Funds strategically diversify assets by targeting specific investment factors such as value, momentum, and quality, offering a nuanced risk-return profile compared to broad-market approaches. Unlike Thematic ETFs that concentrate on specific sectors or trends, Factor-Based Mutual Funds provide diversification across multiple economic drivers, enhancing portfolio resilience.

Tactical Asset Allocation ETF

Mutual funds offer broad asset diversification through active management, while thematic ETFs provide targeted exposure to specific sectors or trends, ideal for tactical asset allocation strategies. Tactical Asset Allocation ETFs enable investors to dynamically adjust portfolio weights, optimizing risk-return profiles by capturing thematic growth opportunities.

Single-Factor Thematic ETF

Mutual funds offer broad diversification through actively managed portfolios, while single-factor thematic ETFs target specific investment themes or factors, providing focused exposure within sectors such as technology or clean energy. Single-factor thematic ETFs enhance asset diversification by capturing concentrated growth opportunities aligned with market trends, often with lower expense ratios and greater transparency compared to traditional mutual funds.

Active Semi-Transparent ETF

Active semi-transparent ETFs offer a unique blend of mutual fund-like active management with enhanced transparency, enabling investors to track underlying holdings more efficiently compared to traditional mutual funds. Thematic ETFs provide focused exposure to specific sectors or trends, making them ideal for targeted asset diversification within a portfolio, while active semi-transparent ETFs balance diversification with dynamic asset allocation.

Systematic Thematic Allocation

Mutual funds offer diversified exposure across various sectors with professional management, while thematic ETFs provide targeted investment aligned with specific trends or themes, enhancing portfolio precision through Systematic Thematic Allocation strategies. Incorporating thematic ETFs within a mutual fund framework can optimize asset diversification by balancing broad market coverage with focused thematic growth opportunities.

AI-Driven Mutual Fund

AI-driven mutual funds leverage advanced machine learning algorithms to dynamically allocate assets across sectors, offering diversified exposure with the potential for higher risk-adjusted returns compared to thematic ETFs, which concentrate on specific trends like artificial intelligence. Mutual funds provide professional management and broader asset diversification, making them a more resilient choice for long-term portfolio stability amid evolving market conditions.

Custom Indexing ETF

Mutual funds offer broad diversification by pooling assets across various sectors, while thematic ETFs concentrate investments on specific trends or industries, providing targeted exposure. Custom indexing ETFs enhance asset diversification by allowing investors to create personalized index portfolios that align with unique risk tolerance and investment goals, combining thematic focus with tailored asset allocation.

Multi-Thematic Basket Fund

Multi-Thematic Basket Funds combine various thematic ETFs within a single portfolio, offering diversified exposure across multiple growth sectors while mitigating risk compared to investing in individual thematic ETFs or traditional mutual funds. This approach enhances asset diversification by leveraging sector-specific trends alongside broader market dynamics, optimizing returns through a balanced, strategically weighted asset allocation.

Mutual Fund vs Thematic ETF for asset diversification Infographic

moneydiff.com

moneydiff.com