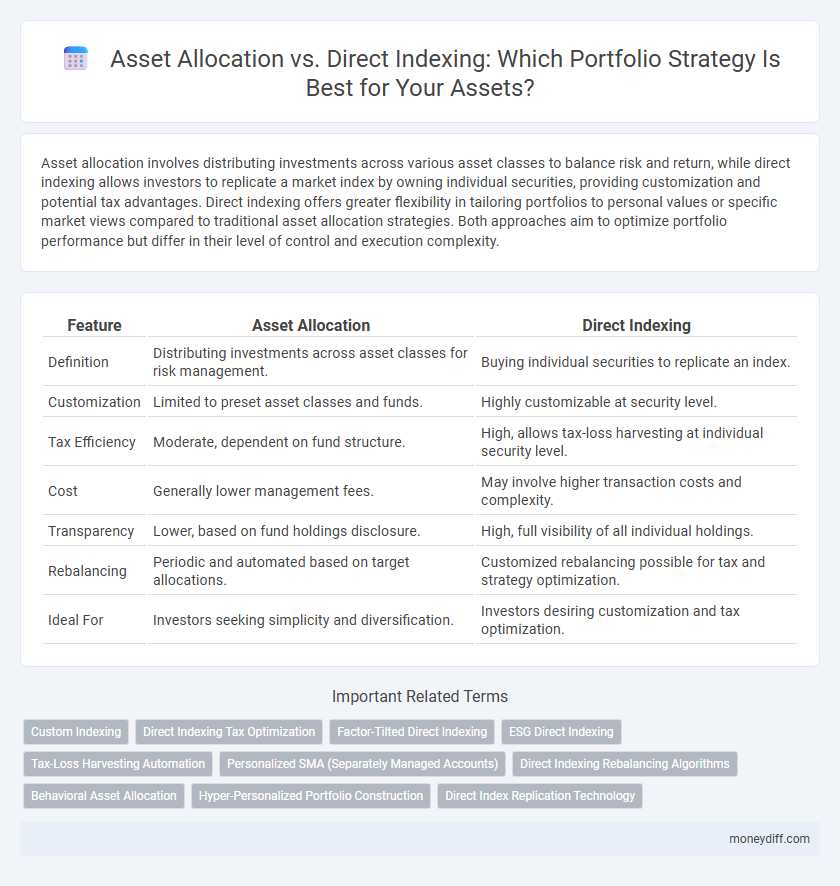

Asset allocation involves distributing investments across various asset classes to balance risk and return, while direct indexing allows investors to replicate a market index by owning individual securities, providing customization and potential tax advantages. Direct indexing offers greater flexibility in tailoring portfolios to personal values or specific market views compared to traditional asset allocation strategies. Both approaches aim to optimize portfolio performance but differ in their level of control and execution complexity.

Table of Comparison

| Feature | Asset Allocation | Direct Indexing |

|---|---|---|

| Definition | Distributing investments across asset classes for risk management. | Buying individual securities to replicate an index. |

| Customization | Limited to preset asset classes and funds. | Highly customizable at security level. |

| Tax Efficiency | Moderate, dependent on fund structure. | High, allows tax-loss harvesting at individual security level. |

| Cost | Generally lower management fees. | May involve higher transaction costs and complexity. |

| Transparency | Lower, based on fund holdings disclosure. | High, full visibility of all individual holdings. |

| Rebalancing | Periodic and automated based on target allocations. | Customized rebalancing possible for tax and strategy optimization. |

| Ideal For | Investors seeking simplicity and diversification. | Investors desiring customization and tax optimization. |

Understanding Asset Allocation: Foundations and Principles

Asset allocation involves distributing investment capital across various asset classes such as equities, bonds, and real estate to optimize risk and return based on individual risk tolerance and investment goals. It relies on diversification principles, aiming to reduce portfolio volatility and enhance long-term growth through strategic exposure to different market sectors. Understanding the foundational role of asset allocation provides a stable framework that informs decisions when considering alternative strategies like direct indexing.

What is Direct Indexing? A Modern Investment Approach

Direct indexing is a modern investment approach that allows investors to own individual securities within an index, rather than purchasing a traditional index fund. This strategy enables personalized portfolio customization, tax-loss harvesting, and improved tax efficiency compared to conventional asset allocation methods. By directly tracking an index's components, investors gain greater control over asset selection and diversification aligned with specific financial goals.

Comparing Risk Management: Asset Allocation vs Direct Indexing

Asset allocation spreads investments across diversified asset classes to minimize risk through broad market exposure and systematic rebalancing, reducing volatility and potential losses. Direct indexing enables precise customization of portfolios by replicating index performance with individual securities, allowing targeted tax-loss harvesting and enhanced risk control at the security level. Risk management in asset allocation relies on macro-level diversification, while direct indexing offers micro-level, personalized risk adjustment aligned with investor preferences and tax efficiency.

Portfolio Diversification: Which Strategy Performs Better?

Asset allocation emphasizes broad diversification across asset classes to manage risk and enhance long-term returns, while direct indexing allows for customized portfolios that replicate indices with personalized tax and ESG considerations. Studies show direct indexing can achieve finer diversification by holding individual securities, reducing tracking error and potentially improving after-tax performance compared to traditional asset allocation. However, asset allocation offers simplicity and lower costs, making its performance dependent on investor goals and the level of portfolio customization desired.

Customization Options: Tailoring Asset Allocation and Direct Indexing

Asset allocation offers broad customization through varying asset classes and risk levels, enabling investors to balance diversification with targeted exposure. Direct indexing allows for granular personalization by selecting individual securities aligned with specific criteria such as ESG factors, tax considerations, or unique financial goals. This level of customization supports tailored portfolio strategies that optimize both performance and individual investor preferences.

Tax Efficiency: Evaluating Direct Indexing and Asset Allocation

Direct indexing offers enhanced tax efficiency by allowing investors to realize specific capital losses and customize tax-loss harvesting opportunities at the individual security level. In contrast, traditional asset allocation often relies on pooled investments like mutual funds or ETFs, which limit the ability to manage tax implications precisely. Evaluating tax efficiency between these strategies reveals that direct indexing can provide more tailored tax management, potentially improving after-tax portfolio returns.

Costs and Fees: Direct Indexing vs Traditional Asset Allocation

Direct indexing typically incurs higher costs due to customized portfolio construction and increased trading activity, while traditional asset allocation benefits from lower management fees and economies of scale in mutual funds or ETFs. Tax efficiency in direct indexing can offset some expenses by enabling personalized tax-loss harvesting, which is less feasible in traditional asset allocation. Investors must weigh the trade-off between potentially higher direct indexing fees and the broad diversification and simplicity of traditional asset allocation strategies.

Rebalancing Strategies: Maintaining Portfolio Alignment

Rebalancing strategies in asset allocation involve periodic adjustments to maintain target weights, ensuring risk levels align with investment goals. Direct indexing enables more granular rebalancing by allowing customization of individual securities within an index, improving tax efficiency and personalization. Consistent rebalancing in both approaches sustains portfolio alignment, mitigates drift, and optimizes long-term performance.

Technology’s Role in Modern Portfolio Strategies

Technology enhances asset allocation and direct indexing by enabling precise, data-driven portfolio customization and real-time risk management. Advanced algorithms and AI-powered platforms facilitate dynamic rebalancing and tax-loss harvesting, improving investment efficiency and adherence to individual goals. Integration of big data analytics in portfolio strategies supports faster decision-making and personalized asset exposure, driving optimized returns in volatile markets.

Choosing the Right Approach: Factors to Consider for Investors

Investors should evaluate risk tolerance, tax efficiency, and customization needs when choosing between asset allocation and direct indexing for portfolio strategy. Asset allocation offers broad diversification and simplified management, while direct indexing provides personalized tax-loss harvesting and precise exposure to individual securities. Consider portfolio size, investment goals, and cost structure to determine the optimal approach for enhanced portfolio performance and risk management.

Related Important Terms

Custom Indexing

Custom Indexing in asset allocation allows investors to create personalized portfolios that mirror the market index while enabling tax efficiency and tailored risk exposure. This strategy offers greater control over individual securities compared to traditional asset allocation, optimizing returns through customized diversification and direct ownership.

Direct Indexing Tax Optimization

Direct indexing allows investors to customize their portfolios by directly owning individual securities, enabling precise tax-loss harvesting and improved tax efficiency compared to traditional asset allocation strategies that typically rely on pooled funds. This tax optimization can significantly enhance after-tax returns by strategically realizing losses and offsetting gains within the portfolio.

Factor-Tilted Direct Indexing

Factor-tilted direct indexing allows investors to customize portfolios by targeting specific risk factors such as value, momentum, or low volatility, enhancing return potential while maintaining tax efficiency compared to traditional asset allocation strategies. This approach provides greater control over portfolio exposures and can lead to improved diversification and performance aligned with individual investment goals.

ESG Direct Indexing

ESG direct indexing enhances traditional asset allocation by enabling personalized, tax-efficient portfolios that replicate ESG benchmarks through individual securities ownership, offering greater alignment with specific environmental, social, and governance values. This approach leverages advanced data analytics and technology to optimize portfolio customization, reduce tracking error, and improve sustainable investment outcomes compared to conventional mutual fund or ETF-based ESG strategies.

Tax-Loss Harvesting Automation

Tax-loss harvesting automation in asset allocation strategies can enhance portfolio tax efficiency by systematically identifying and selling securities at a loss to offset gains, optimizing after-tax returns. Direct indexing further amplifies this benefit by allowing individualized customization and more precise tax-loss harvesting across specific securities within an index, leading to potentially greater tax savings compared to traditional asset allocation models.

Personalized SMA (Separately Managed Accounts)

Personalized SMA (Separately Managed Accounts) offer enhanced customization in asset allocation by allowing investors to tailor portfolios based on specific tax preferences, risk tolerance, and investment goals, unlike traditional direct indexing which replicates an index broadly. This strategy leverages precise security selection and real-time adjustments to optimize tax efficiency and enhance portfolio diversification, making it a preferred approach for sophisticated asset allocation.

Direct Indexing Rebalancing Algorithms

Direct indexing rebalancing algorithms utilize advanced optimization techniques and tax-loss harvesting strategies to adjust individual securities within a portfolio, enhancing customization and tax efficiency compared to traditional asset allocation models. These algorithms systematically monitor market fluctuations and investor-specific criteria, enabling precise, dynamic portfolio adjustments that align with targeted risk and return profiles.

Behavioral Asset Allocation

Behavioral Asset Allocation integrates psychological factors and investor biases to optimize portfolio diversification, contrasting with Direct Indexing, which allows customized security selection to track an index more precisely. This approach enhances risk management by aligning investment decisions with individual behavior patterns, improving long-term portfolio performance.

Hyper-Personalized Portfolio Construction

Hyper-personalized portfolio construction leverages direct indexing to customize asset allocation by selecting individual securities that align precisely with an investor's unique risk tolerance, values, and financial goals. This strategy contrasts with traditional asset allocation by enhancing tax efficiency and enabling granular control over portfolio composition, optimizing returns through tailored exposure to desired market segments.

Direct Index Replication Technology

Direct Index Replication Technology enables precise asset allocation by replicating the performance of an index through direct ownership of individual securities, enhancing tax efficiency and customization compared to traditional asset allocation methods. This technology leverages advanced algorithms to optimize portfolio exposure while minimizing tracking error, offering a strategic advantage in portfolio diversification and risk management.

Asset Allocation vs Direct Indexing for portfolio strategy. Infographic

moneydiff.com

moneydiff.com