Traditional real estate offers tangible property with established market demand and physical utility, making it a reliable asset for long-term investment and income generation. In contrast, metaverse land provides a digital asset with potential for high growth through virtual experiences, social interactions, and blockchain-based ownership, appealing to tech-savvy investors. Both asset types present unique risks and rewards, with traditional real estate offering stability and metaverse land promising innovation-driven value.

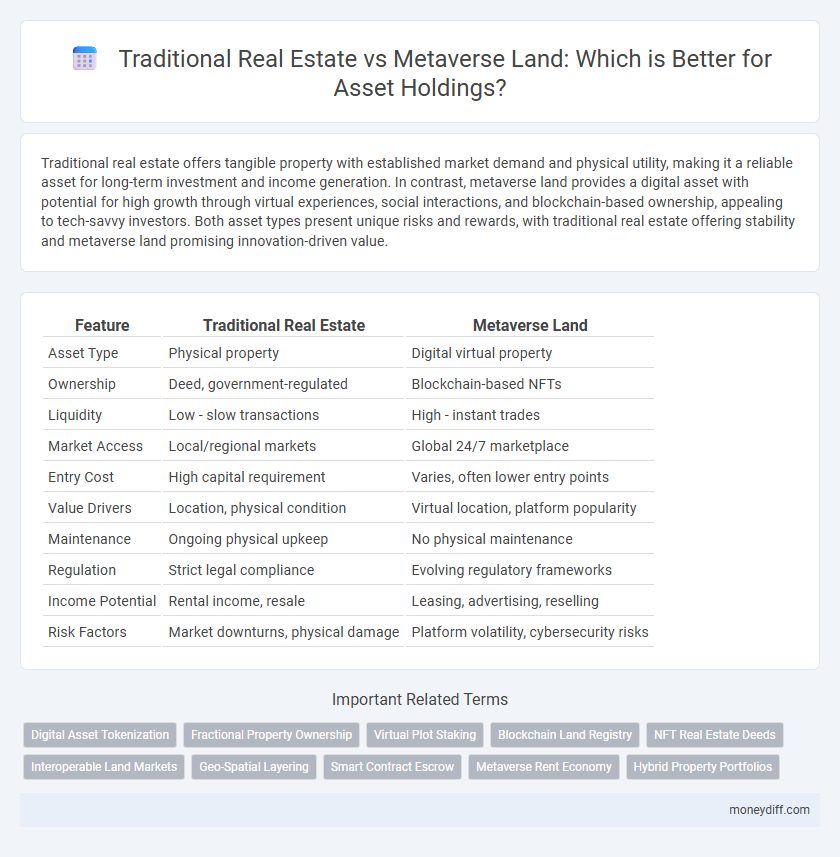

Table of Comparison

| Feature | Traditional Real Estate | Metaverse Land |

|---|---|---|

| Asset Type | Physical property | Digital virtual property |

| Ownership | Deed, government-regulated | Blockchain-based NFTs |

| Liquidity | Low - slow transactions | High - instant trades |

| Market Access | Local/regional markets | Global 24/7 marketplace |

| Entry Cost | High capital requirement | Varies, often lower entry points |

| Value Drivers | Location, physical condition | Virtual location, platform popularity |

| Maintenance | Ongoing physical upkeep | No physical maintenance |

| Regulation | Strict legal compliance | Evolving regulatory frameworks |

| Income Potential | Rental income, resale | Leasing, advertising, reselling |

| Risk Factors | Market downturns, physical damage | Platform volatility, cybersecurity risks |

Overview: Comparing Traditional Real Estate and Metaverse Land as Assets

Traditional real estate offers tangible assets with physical location, established market values, and potential for rental income, providing long-term stability and liquidity in established financial systems. Metaverse land, as a digital asset within virtual environments, presents high volatility, speculative growth opportunities, and innovative monetization through NFTs and blockchain technology. Evaluating risk tolerance, market maturity, and liquidity is crucial when comparing these distinct asset classes for portfolio diversification.

Asset Acquisition: Buying Physical Property vs Virtual Land

Acquiring traditional real estate involves purchasing tangible properties with established market values, legal frameworks, and physical usage rights, providing stability and predictable asset appreciation. In contrast, acquiring metaverse land entails buying virtual parcels within blockchain-based platforms, offering customizable environments, digital scarcity through NFTs, and potential speculative gains driven by user base growth and platform adoption. Legal ownership of physical real estate is governed by government-regulated titles, whereas metaverse land ownership relies on smart contracts and decentralized ledger technology ensuring transparent but evolving digital property rights.

Valuation Methods: Real Estate Appraisal vs Metaverse Land Pricing

Traditional real estate valuation relies on appraisal methods including comparable sales, income approaches, and replacement costs rooted in physical and economic factors. Metaverse land pricing, however, is predominantly influenced by digital scarcity, user engagement metrics, and platform-specific demand dynamics, making its market more speculative and volatile. This contrast highlights how asset valuation in physical versus virtual realms depends on fundamentally different data sets and market behaviors.

Liquidity and Market Accessibility

Traditional real estate offers limited liquidity due to lengthy transaction processes and regulatory constraints, often requiring significant time to convert assets into cash. Metaverse land provides enhanced liquidity and market accessibility through decentralized platforms and digital marketplaces, enabling faster, borderless transactions with lower entry barriers. These digital assets benefit from 24/7 trading availability and global participation, expanding investment opportunities beyond conventional real estate limits.

Legal Frameworks and Ownership Rights

Traditional real estate ownership is governed by well-established legal frameworks including property deeds, zoning laws, and government registries that ensure clear title and enforceable rights. In contrast, metaverse land is based on blockchain technology with ownership rights recorded via non-fungible tokens (NFTs), which provide transparency and security but face evolving regulatory scrutiny. Legal protections for metaverse assets remain limited and vary across jurisdictions, raising concerns about dispute resolution, intellectual property, and long-term enforceability.

Income Generation: Rental Yields and Digital Monetization

Traditional real estate offers reliable rental yields through leasing physical properties, providing steady income streams backed by tangible assets. Metaverse land generates digital monetization opportunities via virtual events, advertising, and NFT integrations, enabling new forms of passive income in dynamic online ecosystems. Investors diversify income sources by balancing stable cash flow from real estate rentals with innovative revenue models from metaverse land holdings.

Portfolio Diversification and Risk Management

Traditional real estate offers tangible assets with historical stability and predictable cash flow, serving as a cornerstone for portfolio diversification by balancing risk with physical property values. Metaverse land, as a digital asset, introduces high volatility but significant growth potential, enabling investors to hedge against traditional market downturns and capitalize on emerging virtual economies. Combining both asset types can optimize risk management by blending established real estate security with innovative digital asset opportunities.

Maintenance, Costs, and Upkeep

Traditional real estate requires ongoing maintenance costs such as repairs, property management fees, insurance, and taxes, which can be substantial and unpredictable. In contrast, metaverse land incurs minimal upkeep expenses, often limited to platform subscription fees or occasional digital content updates, making it a cost-efficient alternative. Investors should consider that virtual properties eliminate physical depreciation and environmental risks, reducing long-term overhead.

Long-term Value and Appreciation Trends

Traditional real estate offers tangible, historically stable asset appreciation driven by location, physical infrastructure, and economic growth, with property values often increasing steadily over decades. Metaverse land presents a novel digital asset class where value appreciation depends on platform popularity, virtual utility, and user engagement, showing rapid but highly volatile growth potential. Long-term value in traditional real estate is supported by legal ownership and physical scarcity, whereas metaverse land's appreciation relies on technological innovation and market adoption within decentralized virtual ecosystems.

Regulatory Concerns and Future Outlook

Traditional real estate transactions are heavily regulated by local, state, and federal laws, ensuring legal ownership, zoning compliance, and property rights protections; in contrast, metaverse land operates within decentralized digital platforms where regulatory frameworks remain nascent and largely undefined, creating uncertainties in legal recognition and asset security. Regulatory bodies are beginning to explore frameworks for digital assets, including metaverse properties, but issues such as jurisdiction, intellectual property, and taxation pose significant challenges that affect investor confidence and market stability. The future outlook for asset holdings in metaverse land hinges on the development of comprehensive regulations and technological advancements, potentially offering increased liquidity and accessibility compared to traditional real estate, which continues to be constrained by physical and regulatory limitations.

Related Important Terms

Digital Asset Tokenization

Traditional real estate asset holdings involve physical property subject to location constraints and limited liquidity, whereas metaverse land represents digital assets tokenized on blockchain platforms, enabling fractional ownership, increased accessibility, and seamless transferability. Digital asset tokenization transforms real estate ownership by converting physical and virtual properties into tradeable digital tokens, enhancing transparency, reducing transaction costs, and expanding investment opportunities across global markets.

Fractional Property Ownership

Fractional property ownership in traditional real estate allows investors to share equity in physical assets, offering tangible value and potential rental income, whereas metaverse land provides digital fractional ownership with benefits such as liquidity, low entry barriers, and blockchain-verified transparency. Both asset types diversify portfolios, but metaverse land introduces novel opportunities for virtual development and monetization in decentralized digital ecosystems.

Virtual Plot Staking

Traditional real estate assets offer tangible property ownership with established market liquidity and long-term appreciation, while metaverse land introduces virtual plot staking as an innovative way to earn passive income by locking digital assets in a decentralized environment. Virtual plot staking enables asset holders to generate yields, participate in governance, and enhance their virtual land value through blockchain-based incentive mechanisms.

Blockchain Land Registry

Traditional real estate offers tangible, legally recognized property secured by government-backed land registries, whereas metaverse land relies on blockchain land registries that provide decentralized, transparent, and immutable records of virtual asset ownership. Blockchain land registries enhance security and reduce fraud risk by recording metaverse land titles on decentralized ledgers, enabling seamless transferability and global accessibility without intermediaries.

NFT Real Estate Deeds

NFT real estate deeds represent a revolutionary shift in asset holdings by digitizing property ownership on the blockchain, offering enhanced transparency, security, and ease of transfer compared to traditional real estate. Unlike conventional assets tied to physical locations, metaverse land NFTs provide unique, programmable virtual properties that enable new forms of investment, monetization, and interaction within digital ecosystems.

Interoperable Land Markets

Traditional real estate assets offer physical land with localized market regulations and limited liquidity, while metaverse land leverages blockchain technology to enable interoperable land markets across multiple virtual platforms, enhancing asset portability and real-time trading. This interoperability fosters decentralized ownership, seamless asset transfer, and expanded investment opportunities beyond geographical constraints.

Geo-Spatial Layering

Traditional real estate assets rely on physical geo-spatial layering defined by legal land parcels and zoning regulations, providing tangible ownership and location-based value. In contrast, metaverse land assets utilize digital geo-spatial layering within virtual environments, allowing dynamic customization and programmable interactions that transcend physical limitations.

Smart Contract Escrow

Smart contract escrow in metaverse land transactions automates payment release based on predefined conditions, reducing risks and increasing transparency compared to traditional real estate escrow services reliant on intermediaries. This blockchain-based mechanism enhances asset security and expedites ownership transfer in digital property holdings.

Metaverse Rent Economy

Metaverse land generates dynamic revenue streams through virtual rent economies, enabling asset holders to monetize digital properties by leasing spaces for events, advertising, and commerce within diverse online platforms. Unlike traditional real estate, metaverse assets offer scalable income potential with lower entry barriers and increased liquidity in the digital economy.

Hybrid Property Portfolios

Hybrid property portfolios combining traditional real estate and metaverse land diversify asset holdings by blending tangible physical properties with digital virtual assets, offering unique opportunities for growth and risk management. Integrating blockchain technology enhances transparency and liquidity, while leveraging immersive virtual spaces enables innovative use cases such as virtual commerce and social interactions, optimizing overall portfolio performance.

Traditional Real Estate vs Metaverse Land for asset holdings. Infographic

moneydiff.com

moneydiff.com