Fixed deposits provide stable, predictable returns with low risk, making them ideal for conservative asset allocation. Laddered notes offer diversification and the potential for higher yields by staggering maturity dates, which can enhance liquidity management and reduce interest rate risk. Choosing between these options depends on an investor's risk tolerance, income needs, and market outlook.

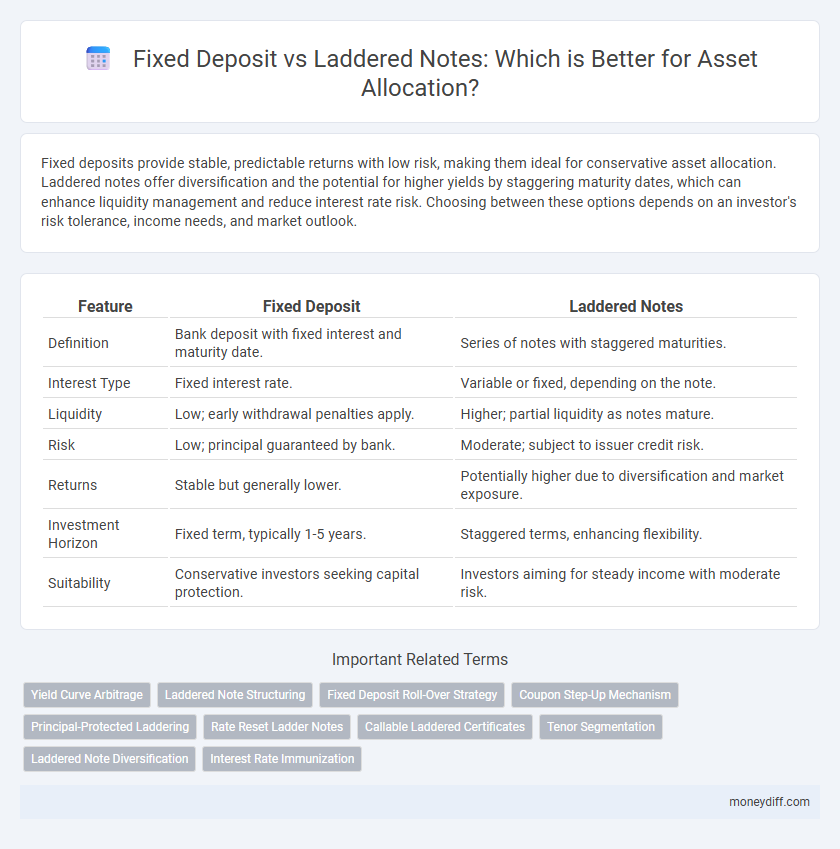

Table of Comparison

| Feature | Fixed Deposit | Laddered Notes |

|---|---|---|

| Definition | Bank deposit with fixed interest and maturity date. | Series of notes with staggered maturities. |

| Interest Type | Fixed interest rate. | Variable or fixed, depending on the note. |

| Liquidity | Low; early withdrawal penalties apply. | Higher; partial liquidity as notes mature. |

| Risk | Low; principal guaranteed by bank. | Moderate; subject to issuer credit risk. |

| Returns | Stable but generally lower. | Potentially higher due to diversification and market exposure. |

| Investment Horizon | Fixed term, typically 1-5 years. | Staggered terms, enhancing flexibility. |

| Suitability | Conservative investors seeking capital protection. | Investors aiming for steady income with moderate risk. |

Introduction to Fixed Deposit and Laddered Notes

Fixed Deposits offer a secure, fixed interest rate over a predetermined term, making them a popular choice for conservative asset allocation. Laddered Notes diversify investment maturity dates by staggering fixed-income securities, reducing interest rate risk and enhancing liquidity. Both instruments serve to balance stability and return in a diversified asset portfolio.

Key Features of Fixed Deposits

Fixed deposits offer a fixed interest rate with guaranteed principal protection, making them a low-risk asset for conservative investors. They provide predictable returns over a specified tenure, typically ranging from 7 days to 10 years, with interest paid monthly, quarterly, or at maturity. Fixed deposits also offer liquidity options through premature withdrawal, albeit often with a penalty, ensuring flexible access to funds when needed.

Understanding Laddered Notes

Laddered notes diversify fixed income investments by staggering maturities, reducing interest rate risk compared to traditional fixed deposits. This strategy enhances liquidity and potential returns through periodic reinvestment at varying interest rates, optimizing asset allocation. Investors benefit from predictable cash flows and improved risk management in volatile markets.

Risk and Return Comparison

Fixed deposits offer a predictable return with low risk, making them a stable choice for conservative asset allocation, but their fixed interest rates may limit potential gains in a rising rate environment. Laddered notes diversify interest rate risk by staggering maturities, enhancing liquidity and providing opportunities for higher yields across different market conditions. Comparing risk and return, fixed deposits emphasize capital preservation while laddered notes balance moderate risk with the potential for improved returns through strategic maturity structuring.

Liquidity and Accessibility

Fixed deposits provide fixed interest rates with predictable returns but often come with penalties for early withdrawal, limiting liquidity and accessibility. Laddered notes enhance liquidity by staggering maturity dates, allowing investors to access portions of their assets at regular intervals without forfeiting returns on the entire investment. This structure improves cash flow management and flexibility in asset allocation.

Interest Rate Sensitivity

Fixed deposits offer a fixed interest rate, making them less sensitive to rising interest rates but vulnerable to opportunity cost during rate hikes. Laddered notes spread maturities across multiple dates, providing better interest rate risk management and enhanced liquidity by adjusting to market rate fluctuations. This staggered approach helps optimize yield while mitigating the impact of interest rate volatility on overall asset allocation.

Impact on Portfolio Diversification

Fixed Deposits offer stable returns with low risk, concentrating assets in a single instrument, which may limit portfolio diversification. Laddered Notes involve staggered maturities across multiple fixed-income securities, enhancing diversification by spreading risk and liquidity over time. This strategy reduces interest rate risk and improves portfolio resilience against market fluctuations.

Tax Implications and Considerations

Fixed deposits offer predictable interest income taxed as per individual income tax slabs, often leading to higher tax liabilities for high-income earners. Laddered notes provide structured payouts that may include principal protection features, potentially attracting different tax treatments such as capital gains tax depending on holding periods and product specifics. Investors should evaluate tax efficiency based on their income bracket and investment horizon to optimize after-tax returns in asset allocation.

Suitability for Different Investor Profiles

Fixed Deposits are ideal for conservative investors seeking capital preservation and predictable returns through fixed interest rates and maturity terms. Laddered Notes suit moderate-risk investors aiming to balance liquidity and yield by staggering maturities across different fixed-income securities. Both instruments optimize asset allocation by aligning with an individual's risk tolerance, investment horizon, and income requirements.

Choosing the Right Option for Asset Allocation

Fixed deposits offer capital guarantee with fixed returns, making them suitable for conservative asset allocation seeking stability and predictable income. Laddered notes, by staggering maturity dates and potentially higher yields, provide diversification and liquidity flexibility in asset allocation strategies. Balancing fixed deposits and laddered notes depends on risk tolerance, desired cash flow timing, and return optimization within the portfolio.

Related Important Terms

Yield Curve Arbitrage

Fixed Deposit offers stable returns with fixed interest rates, but Laddered Notes exploit Yield Curve Arbitrage by staggering maturities to capture higher yields across different bond segments. This strategy enhances asset allocation efficiency by balancing liquidity and maximizing interest income through term structure variations.

Laddered Note Structuring

Laddered notes strategically diversify maturity dates to optimize liquidity and manage interest rate risk within an asset portfolio. This structured approach enhances yield potential compared to fixed deposits by capturing varying rate environments and minimizing reinvestment timing risks.

Fixed Deposit Roll-Over Strategy

Fixed Deposit roll-over strategy enhances asset allocation by systematically reinvesting matured deposits at prevailing interest rates, optimizing liquidity and yield stability. Compared to laddered notes, this approach offers predictable returns and reduced interest rate risk, crucial for conservative portfolios prioritizing capital preservation.

Coupon Step-Up Mechanism

Fixed deposits offer predictable interest rates with steady returns, while laddered notes incorporate a coupon step-up mechanism, increasing yields over time to better hedge against interest rate volatility. This step-up feature enhances asset allocation flexibility by aligning cash flows with changing market conditions and optimizing portfolio income.

Principal-Protected Laddering

Principal-protected laddered notes enhance asset allocation by offering scheduled maturities with full principal security, outperforming traditional fixed deposits in liquidity and yield potential. This strategy balances risk and reward by diversifying investment periods while safeguarding capital through structured note features.

Rate Reset Ladder Notes

Rate Reset Ladder Notes offer dynamic interest rate adjustments that align with market fluctuations, enhancing yield potential compared to fixed-rate deposits. Incorporating these securities into asset allocation diversifies income streams and mitigates interest rate risk by systematically staggering maturities.

Callable Laddered Certificates

Fixed Deposits offer guaranteed returns with fixed interest rates and principal protection over a set term, making them a low-risk asset allocation choice. Callable Laddered Certificates provide flexible cash flow management through staggered maturity dates and the issuer's call option, enabling investors to optimize yield while managing interest rate risk in their portfolio.

Tenor Segmentation

Fixed deposits offer fixed tenor periods with predetermined interest rates, providing predictable returns but limited flexibility in tenor segmentation. Laddered notes allocate investments across staggered maturities, enhancing liquidity management and optimizing asset allocation by balancing risk and return through diversified tenor profiles.

Laddered Note Diversification

Laddered notes offer enhanced diversification by spreading investment maturities across different dates, reducing interest rate risk and improving liquidity compared to traditional fixed deposits. This strategy allows asset allocation to balance steady income streams with flexibility, optimizing portfolio stability and yield in varying market conditions.

Interest Rate Immunization

Fixed deposits provide stable, fixed returns ideal for interest rate immunization by locking in yields, while laddered notes offer diversified maturity dates to mitigate interest rate risk through staggered reinvestment opportunities. Choosing laddered notes enhances portfolio flexibility and income stream stability amid fluctuating interest rates, balancing yield optimization with risk management.

Fixed Deposit vs Laddered Notes for asset allocation Infographic

moneydiff.com

moneydiff.com