Physical art offers tangible ownership and a direct emotional connection, making it ideal for collectors who value uniqueness and provenance. Fractional art investment allows multiple investors to own shares of high-value pieces, enhancing liquidity and diversification without the need for large capital outlay. Both options present opportunities for asset growth, but physical art demands more maintenance and storage, while fractional investments depend on digital platforms and market liquidity.

Table of Comparison

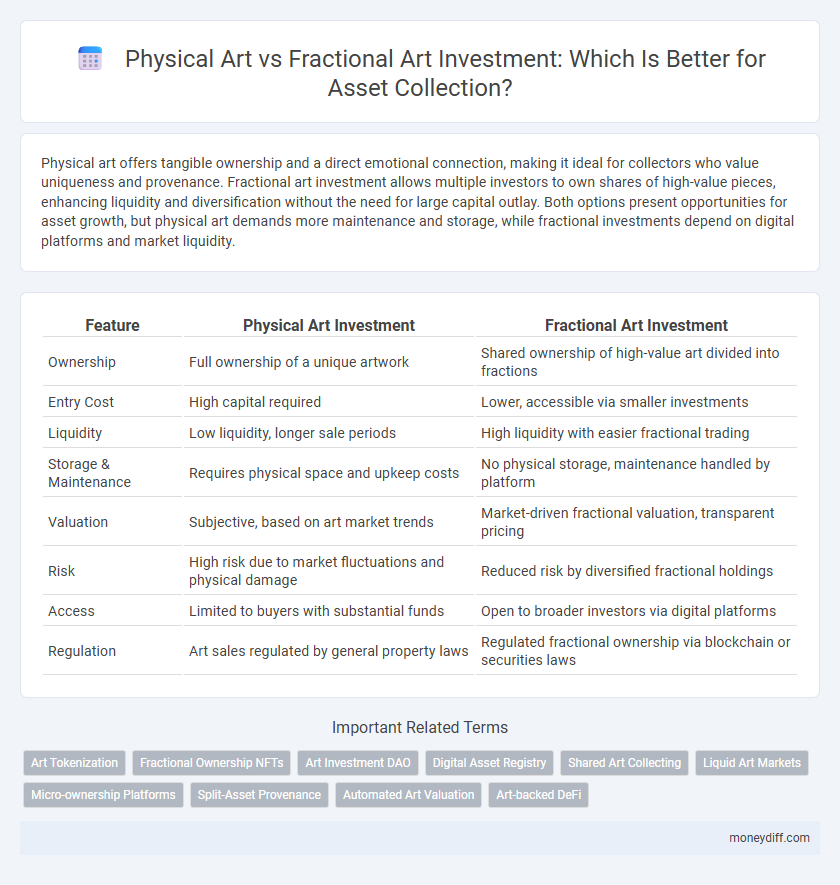

| Feature | Physical Art Investment | Fractional Art Investment |

|---|---|---|

| Ownership | Full ownership of a unique artwork | Shared ownership of high-value art divided into fractions |

| Entry Cost | High capital required | Lower, accessible via smaller investments |

| Liquidity | Low liquidity, longer sale periods | High liquidity with easier fractional trading |

| Storage & Maintenance | Requires physical space and upkeep costs | No physical storage, maintenance handled by platform |

| Valuation | Subjective, based on art market trends | Market-driven fractional valuation, transparent pricing |

| Risk | High risk due to market fluctuations and physical damage | Reduced risk by diversified fractional holdings |

| Access | Limited to buyers with substantial funds | Open to broader investors via digital platforms |

| Regulation | Art sales regulated by general property laws | Regulated fractional ownership via blockchain or securities laws |

Understanding Physical Art Investment

Physical art investment entails acquiring tangible artworks, offering collectors direct ownership and the potential for value appreciation based on artist reputation, rarity, and condition. This form of asset collection provides benefits such as portfolio diversification, cultural prestige, and possible tax advantages, though it requires expertise to authenticate and manage artworks effectively. Investors must consider factors like market liquidity, storage costs, and provenance to maximize returns and mitigate risks inherent in physical art ownership.

What is Fractional Art Investment?

Fractional art investment allows multiple investors to own shares of high-value physical artworks, enabling access to prestigious assets with lower capital requirements. This approach leverages blockchain technology for transparent ownership records and facilitates liquidity through secondary markets. Fractional ownership diversifies risk while providing exposure to the appreciating value of physical art collections.

Key Differences Between Physical and Fractional Art Assets

Physical art assets offer direct ownership, tangible value, and exclusive possession of unique pieces, often requiring significant upfront capital and secure storage. Fractional art investment divides ownership into shares, enabling diversified portfolios with lower entry costs and increased liquidity through secondary markets. The key differences revolve around control, liquidity, and accessibility, impacting risk exposure and investment strategies.

Accessibility: Who Can Invest?

Physical art investment typically requires substantial capital, making it accessible primarily to high-net-worth individuals and collectors with significant upfront funds. Fractional art investment lowers the barrier to entry by allowing multiple investors to purchase shares in expensive artworks, broadening access to individuals with varying investment amounts. This democratization of art ownership enables a wider audience to diversify their asset portfolio with fractional interests in high-value physical art pieces.

Liquidity Concerns in Art Investments

Physical art investments often face liquidity concerns due to the time-consuming process of finding buyers and negotiating sales, which can delay cash flow. Fractional art investment platforms enhance liquidity by enabling investors to trade shares of expensive artworks on secondary markets, offering quicker access to funds. This shift significantly improves asset turnover rates compared to traditional physical art holdings.

Storage and Maintenance of Physical Art

Physical art requires secure, climate-controlled storage to prevent damage from humidity, temperature fluctuations, and light exposure, making maintenance costly and labor-intensive. Preservation often involves professional conservation services and regular inspections to maintain the artwork's value and condition. In contrast, fractional art investment eliminates these storage and upkeep burdens by digitizing ownership shares in high-value pieces.

Risk Management in Fractional Art Platforms

Fractional art investment provides diversified exposure by allowing ownership of high-value artworks at reduced costs, mitigating the risk associated with single-asset concentration. Physical art investment demands substantial capital and carries liquidity risks, while fractional platforms offer enhanced liquidity through secondary markets and transparent blockchain-based records that improve provenance and reduce fraud. Effective risk management in fractional art relies on platform credibility, regulatory compliance, and secure digital infrastructure to protect investor interests.

Market Trends: Physical vs Fractional Art

The market for physical art remains strong, driven by wealthy collectors valuing exclusivity and tangibility, with auction houses reporting record sales in traditional masterpieces. Fractional art investment is rapidly gaining traction, offering increased liquidity and accessibility through blockchain technology, attracting younger, tech-savvy investors seeking diversified portfolios. Data indicates fractional platforms have seen exponential growth in transaction volume, signaling a shift toward democratized ownership in the art market.

Portfolio Diversification with Art Assets

Physical art offers tangible value and unique aesthetic appeal, making it a classic asset for portfolio diversification with low correlation to traditional markets. Fractional art investment enables access to high-value artworks through shared ownership, enhancing liquidity and lowering entry barriers for diversified art asset portfolios. Combining both physical and fractional art investments optimizes risk management and broadens exposure within art asset classes.

Maximizing Returns: Which Art Investment is Right for You?

Physical art offers tangible ownership with potential long-term appreciation influenced by artist reputation and market trends, making it ideal for collectors seeking direct asset control. Fractional art investment provides diversified exposure to high-value pieces through shared ownership, reducing individual risk while enabling access to otherwise inaccessible artworks. Evaluating your risk tolerance, liquidity needs, and investment horizon is crucial for maximizing returns in either physical or fractional art assets.

Related Important Terms

Art Tokenization

Art tokenization transforms physical art into digital fractional shares, enabling investors to diversify portfolios with lower capital requirements while maintaining asset provenance on blockchain. This method enhances liquidity and accessibility compared to traditional physical art investment, which involves high entry costs and limited market flexibility.

Fractional Ownership NFTs

Fractional ownership NFTs revolutionize art investment by allowing collectors to acquire verified shares of high-value physical artworks, increasing liquidity and accessibility compared to full physical art purchases. This digital asset model facilitates diversified portfolios, enabling fractional investors to benefit from potential appreciation without the complexities of storage and insurance associated with traditional art ownership.

Art Investment DAO

Physical art investment offers tangible ownership and potential long-term value appreciation but requires significant capital and secure storage. Fractional art investment through Art Investment DAOs enables diversified access to high-value pieces by tokenizing assets, providing liquidity and democratizing entry into exclusive art markets.

Digital Asset Registry

Physical art offers tangible ownership and unique aesthetic value in asset collection, whereas fractional art investment leverages a Digital Asset Registry to enable divisible, transparent, and secure ownership through blockchain technology. The Digital Asset Registry enhances liquidity and accessibility, allowing investors to hold verifiable shares of high-value artworks with reduced entry barriers.

Shared Art Collecting

Physical art offers tangible ownership and aesthetic value but requires significant capital and storage resources, whereas fractional art investment enables shared ownership of high-value pieces through digital platforms, increasing accessibility and diversification in asset collection. Shared art collecting leverages blockchain technology to securely divide and trade art shares, enhancing liquidity while preserving the cultural and financial appeal of prestigious artworks.

Liquid Art Markets

Physical art offers tangible asset ownership with intrinsic value but faces limited liquidity and high transaction costs in art markets. Fractional art investment enables diversified ownership and enhanced liquidity through digital platforms, allowing investors to trade shares in artworks efficiently within liquid art markets.

Micro-ownership Platforms

Micro-ownership platforms revolutionize asset collection by enabling fractional art investment, allowing individuals to own a share of high-value physical art pieces with lower capital commitment. This democratized investment approach provides liquidity and accessibility, contrasting traditional physical art acquisition which requires significant upfront capital and poses challenges in asset liquidity.

Split-Asset Provenance

Physical art investment provides tangible ownership and direct control, ensuring clear provenance through documented history and expert authentication; fractional art investment offers accessibility to high-value assets with provenance verified via blockchain technology to maintain transparent, immutable ownership records. Choosing between these asset types depends on investor priorities for physical possession versus liquidity and diversification within art asset portfolios.

Automated Art Valuation

Automated art valuation leverages AI algorithms to provide real-time, data-driven appraisals for both physical and fractional art investments, enhancing accuracy and liquidity in asset collection. This technology analyzes market trends, provenance, and condition metrics, enabling investors to make informed decisions and optimize portfolio diversification.

Art-backed DeFi

Art-backed DeFi platforms enable fractional art investment by tokenizing physical artworks, providing greater liquidity and accessibility compared to traditional physical art asset collection. This innovative approach democratizes ownership, allowing investors to diversify portfolios through smaller shares while leveraging blockchain transparency and security.

Physical Art vs Fractional Art Investment for asset collection Infographic

moneydiff.com

moneydiff.com