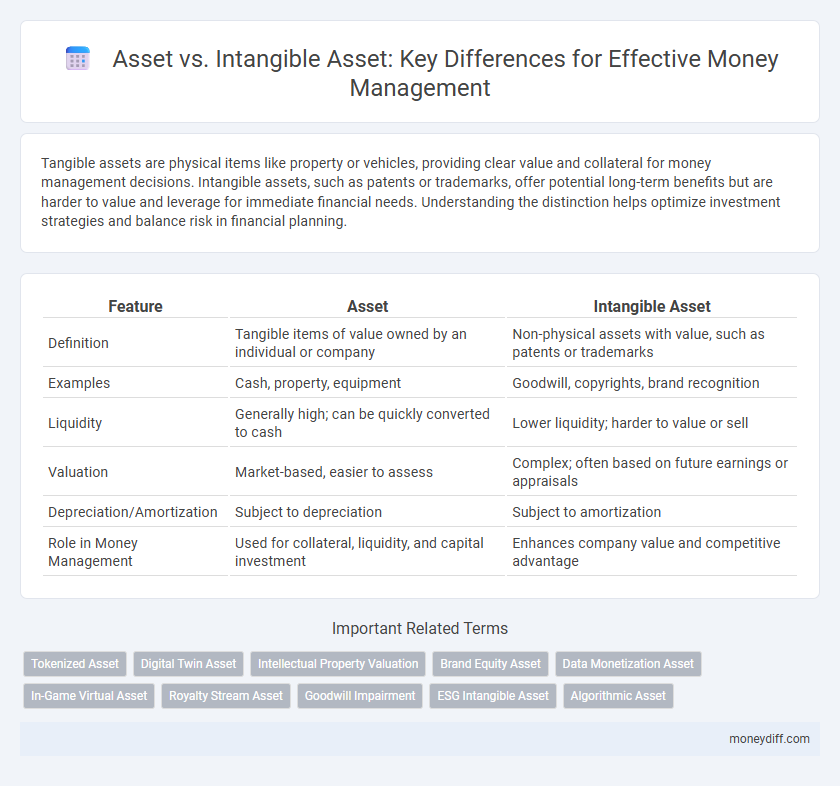

Tangible assets are physical items like property or vehicles, providing clear value and collateral for money management decisions. Intangible assets, such as patents or trademarks, offer potential long-term benefits but are harder to value and leverage for immediate financial needs. Understanding the distinction helps optimize investment strategies and balance risk in financial planning.

Table of Comparison

| Feature | Asset | Intangible Asset |

|---|---|---|

| Definition | Tangible items of value owned by an individual or company | Non-physical assets with value, such as patents or trademarks |

| Examples | Cash, property, equipment | Goodwill, copyrights, brand recognition |

| Liquidity | Generally high; can be quickly converted to cash | Lower liquidity; harder to value or sell |

| Valuation | Market-based, easier to assess | Complex; often based on future earnings or appraisals |

| Depreciation/Amortization | Subject to depreciation | Subject to amortization |

| Role in Money Management | Used for collateral, liquidity, and capital investment | Enhances company value and competitive advantage |

Understanding Assets: Tangible vs. Intangible

Assets in money management are categorized into tangible and intangible types, where tangible assets include physical items like real estate, equipment, and inventory that hold intrinsic value. Intangible assets consist of non-physical resources such as patents, trademarks, copyrights, and goodwill, which represent potential economic benefits without physical substance. Effective asset management requires distinguishing between these types to optimize financial planning, risk assessment, and investment strategies.

The Role of Tangible Assets in Wealth Building

Tangible assets, such as real estate, machinery, and cash, play a critical role in wealth building by providing collateral, liquidity, and physical value that can be leveraged for loans or investments. Unlike intangible assets, tangible assets offer stability and ease of valuation, making them essential for risk management and securing financial growth. Effective money management strategies balance tangible assets with intangible ones to maximize portfolio diversity and long-term wealth accumulation.

Defining Intangible Assets in Modern Finance

Intangible assets in modern finance encompass non-physical resources such as patents, trademarks, copyrights, and goodwill that generate economic value without a tangible presence. Unlike physical or financial assets, intangible assets require specialized valuation methods reflecting their contribution to a firm's competitive advantage and long-term profitability. Proper identification and management of intangible assets are crucial in comprehensive money management strategies to optimize investment decisions and enhance enterprise value.

Key Differences Between Assets and Intangible Assets

Assets represent tangible resources such as cash, property, and equipment that hold monetary value and can be used for financial management or investment purposes. Intangible assets, including patents, trademarks, and goodwill, lack physical form but provide long-term value through intellectual property and brand recognition. The key difference lies in tangibility and liquidity: tangible assets are generally easier to evaluate and convert to cash, whereas intangible assets require specialized valuation methods and contribute to competitive advantage.

Valuation Methods for Assets and Intangible Assets

Valuation methods for tangible assets primarily include cost, market, and income approaches, focusing on physical depreciation and market comparables. Intangible asset valuation employs methods such as relief-from-royalty, excess earnings, and discounted cash flow analyses, emphasizing future economic benefits and intellectual property rights. Accurate valuation of both asset types is crucial for effective money management, investment decisions, and financial reporting.

Impact of Asset Types on Financial Statements

Tangible assets such as machinery and real estate appear on the balance sheet as physical resources with measurable value, directly affecting depreciation and asset turnover ratios. Intangible assets like patents and trademarks contribute to the financial statements through amortization, influencing net income and equity valuation differently. Proper categorization of assets ensures accurate representation of a company's financial health and informs strategic money management decisions.

Managing Tangible Assets for Financial Stability

Managing tangible assets, such as real estate, equipment, and inventory, is crucial for achieving financial stability because these physical assets provide measurable value and can be leveraged for loans or investment opportunities. Unlike intangible assets, tangible assets offer liquidity options and collateral security, enhancing risk management in money management strategies. Regular valuation and maintenance of tangible assets ensure they retain their worth, contributing to a solid financial foundation.

Leveraging Intangible Assets for Competitive Advantage

Leveraging intangible assets such as intellectual property, brand reputation, and customer relationships plays a crucial role in enhancing financial performance and sustaining competitive advantage. Unlike tangible assets, intangible assets often generate long-term value through innovation, market differentiation, and customer loyalty. Efficient money management strategies prioritize investing in and protecting these assets to maximize returns and drive business growth.

Risks and Rewards: Comparing Asset Classes

Tangible assets such as real estate and equipment offer physical security and potential for depreciation tax benefits, but carry risks like market volatility and maintenance costs. Intangible assets, including patents and trademarks, provide unique competitive advantages and scalable revenue streams yet face valuation challenges and legal risks. Effective money management requires balancing these asset classes to optimize returns while mitigating exposure to liquidity constraints and regulatory uncertainties.

Strategic Asset Allocation for Optimal Money Management

Tangible assets like real estate and equipment provide physical value and liquidity in strategic asset allocation, while intangible assets such as patents or trademarks contribute long-term growth potential and risk diversification. Effective money management balances these asset types to optimize portfolio returns and mitigate volatility. Incorporating both tangible and intangible assets enhances the resilience and adaptability of investment strategies in changing market conditions.

Related Important Terms

Tokenized Asset

Tokenized assets represent ownership rights through blockchain technology, bridging traditional tangible assets with intangible digital securities for enhanced liquidity and transparency in money management. Unlike conventional intangible assets such as patents or trademarks, tokenized assets enable fractional ownership and real-time transactions, transforming asset management by increasing accessibility and efficiency.

Digital Twin Asset

Digital Twin Assets represent a cutting-edge category of intangible assets that simulate real-world physical assets through digital replicas, enhancing predictive maintenance and financial forecasting in money management. Unlike traditional assets, Digital Twin Assets offer dynamic insights and real-time data analytics that optimize asset utilization and improve investment decision-making processes.

Intellectual Property Valuation

Intangible assets, such as intellectual property (IP), require specialized valuation methods distinct from physical assets to accurately assess their contribution to financial strength and investment potential. Effective money management involves leveraging IP valuation techniques like income, market, and cost approaches to optimize asset allocation and maximize returns.

Brand Equity Asset

Brand equity, a key intangible asset, significantly enhances a company's financial value by leveraging customer loyalty and perception, which directly impacts revenue streams and market positioning. Unlike tangible assets, brand equity cannot be physically measured but plays a crucial role in money management through its influence on valuation, investment decisions, and long-term profitability.

Data Monetization Asset

Data monetization assets, classified as intangible assets, hold significant value by transforming raw data into revenue-generating opportunities, unlike traditional tangible assets such as property or equipment. Effective money management strategies prioritize leveraging these intangible data monetization assets to maximize financial returns and optimize long-term business growth.

In-Game Virtual Asset

In-game virtual assets are categorized as intangible assets because they lack physical substance but hold significant monetary value within digital economies, impacting player investment and money management strategies. Unlike traditional tangible assets, these virtual assets require specialized accounting and valuation methods to accurately reflect their role in financial planning and asset portfolios.

Royalty Stream Asset

Royalty stream assets, classified as intangible assets, generate consistent cash flow through rights to future revenue rather than physical ownership, making them valuable for diversified money management strategies. Distinguishing between tangible assets and intangible royalty streams allows investors to optimize portfolio liquidity and risk exposure by leveraging predictable income from intellectual property rights.

Goodwill Impairment

Goodwill impairment directly impacts intangible assets by reducing their reported value on the balance sheet, affecting overall asset valuation and financial ratios used in money management. Monitoring goodwill impairment is essential for accurate asset assessment, ensuring that investors and managers make informed decisions based on realistic asset recoverability.

ESG Intangible Asset

ESG intangible assets, such as brand reputation and stakeholder trust, play a critical role in sustainable money management by enhancing long-term value beyond physical or financial assets. Integrating ESG factors into asset management strategies improves risk mitigation and drives responsible investment decisions that align with environmental, social, and governance criteria.

Algorithmic Asset

Algorithmic assets leverage data-driven models and machine learning algorithms to optimize investment portfolios and enhance money management strategies, offering real-time adaptability unlike traditional intangible assets such as patents or trademarks. These algorithmic assets provide quantifiable performance metrics and predictive analytics, transforming intangible value into actionable financial insights.

Asset vs Intangible Asset for money management. Infographic

moneydiff.com

moneydiff.com