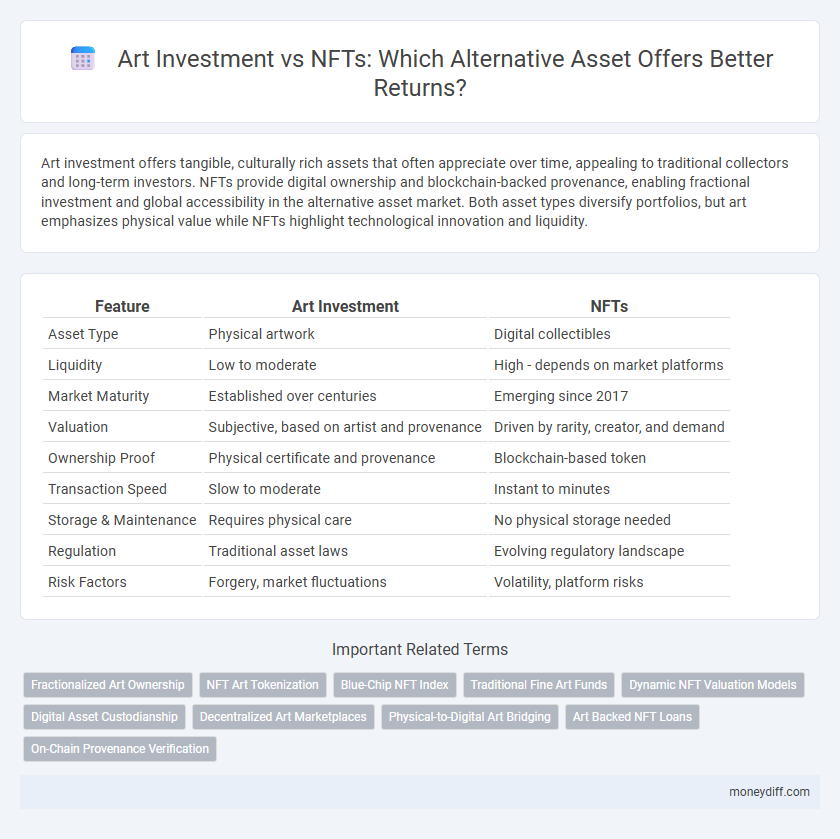

Art investment offers tangible, culturally rich assets that often appreciate over time, appealing to traditional collectors and long-term investors. NFTs provide digital ownership and blockchain-backed provenance, enabling fractional investment and global accessibility in the alternative asset market. Both asset types diversify portfolios, but art emphasizes physical value while NFTs highlight technological innovation and liquidity.

Table of Comparison

| Feature | Art Investment | NFTs |

|---|---|---|

| Asset Type | Physical artwork | Digital collectibles |

| Liquidity | Low to moderate | High - depends on market platforms |

| Market Maturity | Established over centuries | Emerging since 2017 |

| Valuation | Subjective, based on artist and provenance | Driven by rarity, creator, and demand |

| Ownership Proof | Physical certificate and provenance | Blockchain-based token |

| Transaction Speed | Slow to moderate | Instant to minutes |

| Storage & Maintenance | Requires physical care | No physical storage needed |

| Regulation | Traditional asset laws | Evolving regulatory landscape |

| Risk Factors | Forgery, market fluctuations | Volatility, platform risks |

Introduction to Art Investment and NFTs as Alternative Assets

Art investment offers a tangible asset with historical appreciation and cultural significance, often preserved through physical ownership of paintings or sculptures. NFTs represent a digital alternative asset, leveraging blockchain technology to provide verifiable ownership of unique digital artworks and collectibles. Both art and NFTs diversify investment portfolios, but NFTs introduce liquidity and accessibility that traditional art markets may lack.

Market Overview: Traditional Art vs. Digital NFTs

The traditional art market consistently demonstrates long-term value appreciation, driven by physical scarcity and established auction house networks, with global sales exceeding $65 billion in 2023. Conversely, the NFT market, valued at around $20 billion in 2023, offers fractional ownership and instant liquidity but remains highly volatile and speculative. Investors seeking alternative assets must weigh the proven stability of traditional art against the innovative, yet uncertain, potential of digital NFTs.

Value Appreciation: Historical Performance and Volatility

Art investment has demonstrated steady value appreciation over decades, with blue-chip artworks often increasing in worth due to rarity and demand, while NFTs exhibit rapid, highly volatile price movements fueled by speculative interest and market trends. Traditional art markets benefit from established appraisal systems and provenance verification, contributing to more predictable appreciation patterns compared to the nascent, fluctuating NFT space. Historical performance data underlines art's role as a stable alternative asset, whereas NFTs' value appreciation remains uncertain and subject to pronounced market swings.

Accessibility: Barriers to Entry for Art and NFTs

Traditional art investment often requires substantial upfront capital, expert knowledge, and access to galleries or auctions, creating significant barriers for average investors. NFTs lower entry barriers by enabling fractional ownership and direct purchases through decentralized platforms, making alternative assets more accessible to a broader audience. However, the volatility and technical understanding needed for NFTs can still pose challenges for new investors exploring digital art markets.

Liquidity: Selling and Trading Traditional Art vs. NFTs

Traditional art offers limited liquidity due to lengthy auction processes and reliance on private sales, often requiring weeks or months to finalize transactions. NFTs provide enhanced liquidity through blockchain technology, enabling instant buying, selling, and trading on digital marketplaces 24/7. The decentralized nature of NFTs reduces intermediaries, facilitating faster ownership transfers compared to conventional art markets.

Authenticity and Ownership Verification

Art investments provide verifiable authenticity through provenance records and expert certifications, ensuring clear ownership history in traditional markets. NFTs leverage blockchain technology to offer decentralized, tamper-proof ownership verification, enabling transparent proof of authenticity and transferability. While art relies on physical documentation and expert validation, NFTs deliver automated digital verification that reduces fraud risks and enhances asset liquidity.

Legal and Regulatory Considerations

Art investment faces established legal frameworks governing provenance, ownership rights, and authenticity verification, ensuring investor protection through recognized art market regulations. NFTs operate under emerging and evolving regulatory landscapes addressing digital ownership rights, intellectual property, and anti-money laundering compliance, with varied legal interpretations across jurisdictions. Both asset classes require thorough due diligence on contractual terms, regulatory compliance, and jurisdiction-specific legal risks to mitigate potential financial and reputational liabilities.

Risks and Security Concerns in Art and NFT Investments

Art investment carries risks such as market volatility, forgery, and liquidity challenges, with physical artworks being susceptible to theft or deterioration. NFTs present security concerns including smart contract vulnerabilities, digital theft, and platform dependency, while their regulatory framework remains uncertain. Both asset classes require thorough due diligence and secure storage solutions to mitigate potential losses.

Diversification: Portfolio Integration of Art and NFTs

Art investment offers tangible assets with historical value and potential appreciation, while NFTs provide digital ownership and liquidity in emerging markets. Combining traditional art and NFTs in a portfolio enhances diversification by balancing physical and digital asset classes with varying risk profiles and market dynamics. This integration allows investors to optimize returns through exposure to both established art markets and innovative blockchain-based assets.

Future Trends: Emerging Opportunities in Art and NFT Markets

Art investment continues to evolve with NFTs creating novel opportunities by enabling digital ownership and provenance verification on blockchain platforms. Future trends indicate increasing integration of augmented reality and AI to enhance the valuation and trading of both traditional artworks and NFTs. Market growth is driven by greater accessibility, fractional ownership models, and expanding interest from institutional investors in these alternative asset classes.

Related Important Terms

Fractionalized Art Ownership

Fractionalized art ownership enables investors to purchase shares in high-value artworks, providing liquidity and diversification unmatched by traditional art investment or NFTs. Unlike volatile NFT markets, fractionalized art combines tangible asset value with blockchain-based transparency, appealing to investors seeking alternative asset classes with reduced entry barriers.

NFT Art Tokenization

NFT art tokenization revolutionizes alternative asset investment by transforming physical and digital art into blockchain-backed tokens, enhancing liquidity and provenance transparency. Unlike traditional art investment, NFT art tokens enable fractional ownership, instant trading on decentralized platforms, and global access to a diverse art market, driving a shift in asset management strategies.

Blue-Chip NFT Index

Blue-Chip NFT Index offers a diversified portfolio of high-value digital assets that have demonstrated strong market performance and liquidity, providing an innovative alternative to traditional art investments. Investors seeking exposure to the evolving digital art market can benefit from blue-chip NFTs' potential for appreciation alongside their established credibility and cultural significance.

Traditional Fine Art Funds

Traditional fine art funds offer investors a stable alternative asset by pooling capital to acquire, manage, and sell high-quality artworks, benefiting from proven historical appreciation and expert curation. Unlike volatile NFTs, these funds leverage established art market infrastructure and tangible assets, providing diversified risk and potential long-term value growth.

Dynamic NFT Valuation Models

Dynamic NFT valuation models leverage real-time market data, user interaction metrics, and blockchain provenance to provide more accurate and adaptive asset pricing compared to traditional art investment methods. These models enhance liquidity and transparency in alternative assets by continuously updating NFT values based on demand fluctuations, rarity, and digital engagement.

Digital Asset Custodianship

Art investment traditionally relies on physical asset security and provenance verification, whereas NFTs demand robust digital asset custodianship solutions to ensure secure storage, transfer, and authentication on blockchain networks. Trusted digital asset custodians employ advanced encryption and multi-party key management to mitigate risks like hacking and theft, positioning NFTs as a viable alternative asset class alongside traditional fine art investments.

Decentralized Art Marketplaces

Decentralized art marketplaces leverage blockchain technology to offer transparent, secure, and fractional ownership of digital and physical art assets, making them a compelling alternative to traditional art investment. Unlike NFTs, which represent unique digital tokens, decentralized platforms enable broader access and liquidity by facilitating peer-to-peer transactions and avoiding centralized intermediaries.

Physical-to-Digital Art Bridging

Art investment increasingly leverages the physical-to-digital bridge, where traditional artworks are tokenized as NFTs, enabling provenance verification and fractional ownership. This fusion enhances liquidity and accessibility, positioning NFTs as a transformative vehicle for diversifying alternative asset portfolios beyond conventional art markets.

Art Backed NFT Loans

Art backed NFT loans combine the tangible value of traditional art investment with blockchain transparency, offering investors liquidity without selling the physical asset. This emerging financial instrument leverages the unique provenance and market potential of NFTs while maintaining the intrinsic worth of high-value art.

On-Chain Provenance Verification

Art investment benefits from traditional provenance documentation, but NFTs revolutionize alternative assets with on-chain provenance verification, offering transparent, immutable records of authenticity and ownership. This blockchain-backed traceability enhances trust, reduces fraud risks, and provides real-time access to an asset's entire transaction history, making NFTs a superior choice for secure art-related asset verification.

Art Investment vs NFTs for alternative assets. Infographic

moneydiff.com

moneydiff.com