Asset management involves traditional financial instruments like stocks, bonds, and real estate, offering stability and established regulatory frameworks. DeFi assets operate on blockchain technology, providing decentralized control, increased transparency, and enhanced liquidity options. Combining both approaches can optimize money management by balancing security with innovation and accessibility.

Table of Comparison

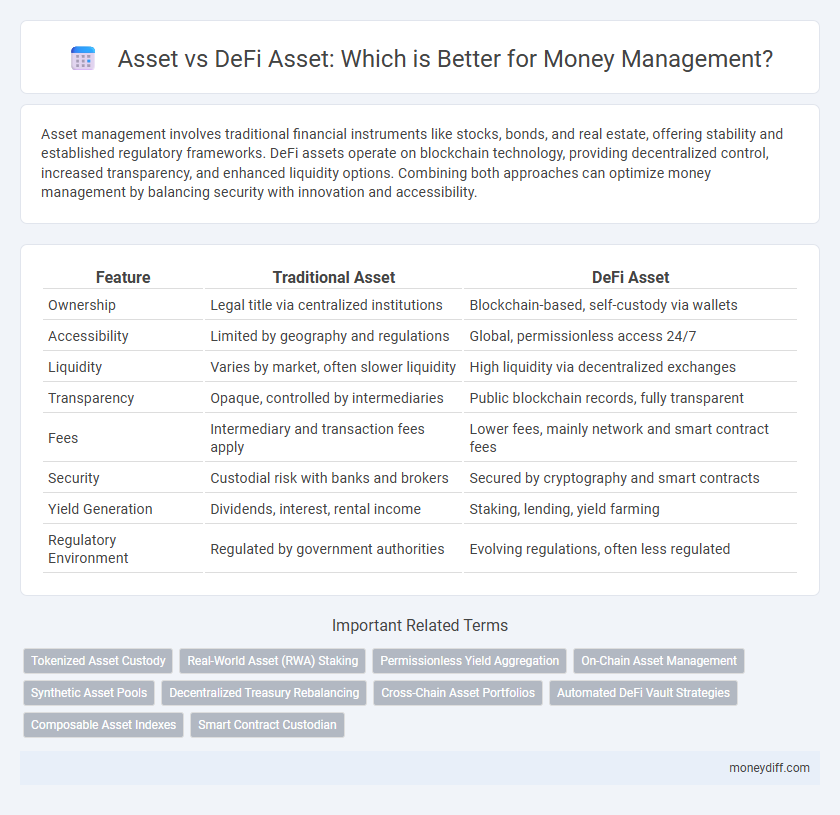

| Feature | Traditional Asset | DeFi Asset |

|---|---|---|

| Ownership | Legal title via centralized institutions | Blockchain-based, self-custody via wallets |

| Accessibility | Limited by geography and regulations | Global, permissionless access 24/7 |

| Liquidity | Varies by market, often slower liquidity | High liquidity via decentralized exchanges |

| Transparency | Opaque, controlled by intermediaries | Public blockchain records, fully transparent |

| Fees | Intermediary and transaction fees apply | Lower fees, mainly network and smart contract fees |

| Security | Custodial risk with banks and brokers | Secured by cryptography and smart contracts |

| Yield Generation | Dividends, interest, rental income | Staking, lending, yield farming |

| Regulatory Environment | Regulated by government authorities | Evolving regulations, often less regulated |

Introduction to Traditional Assets and DeFi Assets

Traditional assets include physical holdings like real estate, stocks, bonds, and cash, characterized by centralized ownership and regulated markets. DeFi assets exist on blockchain platforms, enabling decentralized financial activities such as lending, borrowing, and trading through smart contracts without intermediaries. Comparing traditional assets with DeFi assets highlights differences in liquidity, transparency, security, and accessibility in modern money management.

Key Differences Between Traditional Assets and DeFi Assets

Traditional assets, such as stocks and bonds, are centralized, regulated, and often require intermediaries for transactions, ensuring legal protection and stability. DeFi assets operate on decentralized blockchain networks, providing direct peer-to-peer access, enhanced liquidity, and programmable features with smart contracts that automate processes. The key differences lie in transparency, accessibility, and risk profiles, where DeFi assets offer increased control but carry higher volatility and regulatory uncertainty compared to traditional assets.

Risk Profiles: Asset vs DeFi Asset

Traditional assets like stocks, bonds, and real estate typically exhibit established risk profiles influenced by market volatility, regulatory oversight, and liquidity constraints. DeFi assets, including tokens and cryptocurrencies on decentralized platforms, present higher risk due to price volatility, smart contract vulnerabilities, and lack of regulatory protection. Investors managing money must assess risk tolerance carefully, as DeFi assets offer potential high returns but increased susceptibility to hacking and market manipulation compared to conventional assets.

Accessibility and Inclusion in Money Management

Traditional assets often require intermediaries and significant capital, limiting accessibility for many individuals in money management. DeFi assets leverage blockchain technology to provide decentralized, permissionless access, enabling broader inclusion regardless of geographical or financial barriers. This democratization fosters equal opportunities for wealth growth and financial participation.

Liquidity Comparison: Asset vs DeFi Asset

Traditional assets typically offer lower liquidity due to dependence on intermediaries and longer settlement times, often requiring days to convert into cash. In contrast, DeFi assets leverage blockchain technology and decentralized exchanges, enabling near-instantaneous transactions and 24/7 market access, significantly improving liquidity. This enhanced liquidity in DeFi assets facilitates more efficient money management by allowing rapid portfolio adjustments and reduced slippage during asset transfers.

Transparency and Security Considerations

Traditional assets offer established regulatory oversight and proven security frameworks, ensuring investor confidence through transparent reporting and custodial protections. DeFi assets leverage blockchain technology to provide enhanced transparency via immutable ledgers and real-time transaction visibility, but they also face unique security challenges such as smart contract vulnerabilities and the absence of centralized control. Effective money management requires balancing these factors by assessing the transparency of asset provenance and the robustness of security protocols within each system.

Cost Efficiency in Managing Assets

Traditional assets typically incur higher management fees, custody costs, and intermediary expenses compared to DeFi assets, which leverage blockchain technology to reduce or eliminate these costs through smart contracts. DeFi assets enable direct ownership and automated transactions, minimizing the need for third-party involvement and enhancing cost efficiency in asset management. Lower transaction fees and faster settlement times in DeFi contribute to more effective and economical money management strategies.

Regulatory Landscape: Traditional Assets vs DeFi

Traditional assets operate under established regulatory frameworks enforced by agencies such as the SEC and FINRA, ensuring investor protection through compliance with laws like the Securities Act. DeFi assets, by contrast, function on decentralized blockchain networks with limited regulatory oversight, creating challenges in legal clarity, anti-money laundering enforcement, and investor safeguards. This evolving regulatory landscape impacts risk management and legal responsibilities, influencing how money management strategies are developed for conventional versus decentralized assets.

Yield Generation and Growth Potential

Traditional assets provide stable yield generation through dividends and interest, appealing to risk-averse investors seeking predictable income streams. DeFi assets offer higher growth potential via decentralized lending, staking, and yield farming, though they involve increased volatility and regulatory uncertainty. Combining both asset classes can optimize portfolio diversification by balancing steady returns with amplified growth opportunities.

Choosing the Right Asset for Your Money Management Strategy

Selecting the right asset for your money management strategy requires careful evaluation of traditional assets versus DeFi assets, considering factors like liquidity, volatility, and regulatory environment. Traditional assets such as stocks, bonds, and real estate offer established market stability and regulatory protections, while DeFi assets provide decentralized control, transparency, and potentially higher yields through protocols like liquidity pools and staking. Balancing risk tolerance and return expectations helps determine whether conventional investments or innovative decentralized finance solutions better align with your financial goals.

Related Important Terms

Tokenized Asset Custody

Tokenized asset custody enhances money management by providing secure, transparent, and efficient holding of digital representations of physical assets, bridging traditional financial systems with decentralized finance (DeFi) platforms. Unlike conventional assets, DeFi assets leverage blockchain technology for real-time verification and increased liquidity, transforming asset management through smart contracts and reduced intermediaries.

Real-World Asset (RWA) Staking

Real-World Asset (RWA) staking integrates tangible financial instruments into DeFi ecosystems, enabling users to earn yields by locking assets like real estate, commodities, or invoices on blockchain platforms. This fusion of traditional assets with decentralized finance optimizes liquidity and risk management, offering enhanced transparency and diversified revenue streams compared to conventional asset management.

Permissionless Yield Aggregation

Permissionless yield aggregation in DeFi assets enables users to maximize returns by automatically reallocating funds across multiple decentralized protocols without intermediaries, enhancing liquidity and minimizing risks. Traditional assets lack this level of automation and transparency, making DeFi asset management more efficient for dynamic portfolio optimization.

On-Chain Asset Management

On-chain asset management leverages blockchain technology to provide transparent, secure, and automated control over digital assets, contrasting traditional asset management that relies on centralized institutions. DeFi assets enable decentralized finance protocols to facilitate peer-to-peer transactions, liquidity pools, and yield farming, empowering users with direct ownership and programmable money management without intermediaries.

Synthetic Asset Pools

Synthetic asset pools in DeFi enable users to gain exposure to a wide range of financial assets without owning the underlying asset, offering enhanced liquidity and customizable risk profiles compared to traditional assets. These pools leverage blockchain technology to provide transparent, efficient money management solutions by tokenizing derivatives and facilitating seamless trading and collateralization.

Decentralized Treasury Rebalancing

Decentralized Treasury Rebalancing leverages DeFi assets to optimize liquidity and yield strategies, contrasting traditional asset management by enabling automated, transparent, and permissionless portfolio adjustments. This approach enhances efficiency and risk diversification through programmable protocols, minimizing reliance on centralized intermediaries in managing asset allocations.

Cross-Chain Asset Portfolios

Cross-chain asset portfolios enable seamless management of both traditional assets and DeFi assets by facilitating secure transfers and diversified holdings across multiple blockchain networks. Leveraging cross-chain interoperability enhances portfolio liquidity and risk management, optimizing returns in decentralized finance ecosystems.

Automated DeFi Vault Strategies

Automated DeFi vault strategies enable efficient money management by leveraging smart contracts to optimize asset allocation and yield generation without manual intervention. Unlike traditional assets, DeFi assets benefit from real-time protocol adjustments and decentralized governance, enhancing liquidity and reducing counterparty risks.

Composable Asset Indexes

Composable Asset Indexes in traditional asset management enable diversified portfolio construction by aggregating multiple underlying assets into a single, manageable entity, optimizing risk and return profiles. In contrast, DeFi Asset indexes leverage blockchain technology to create transparent, programmable, and easily tradable baskets of digital assets, enhancing liquidity and enabling dynamic rebalancing through smart contracts.

Smart Contract Custodian

Smart contract custodians enhance asset management by automating trustless control and reducing counterparty risks inherent in traditional assets, enabling transparent and efficient DeFi asset handling. Unlike conventional assets held by intermediaries, DeFi assets governed through smart contracts provide programmable, secure, and decentralized custody solutions that streamline financial operations and asset transfers.

Asset vs DeFi Asset for money management. Infographic

moneydiff.com

moneydiff.com