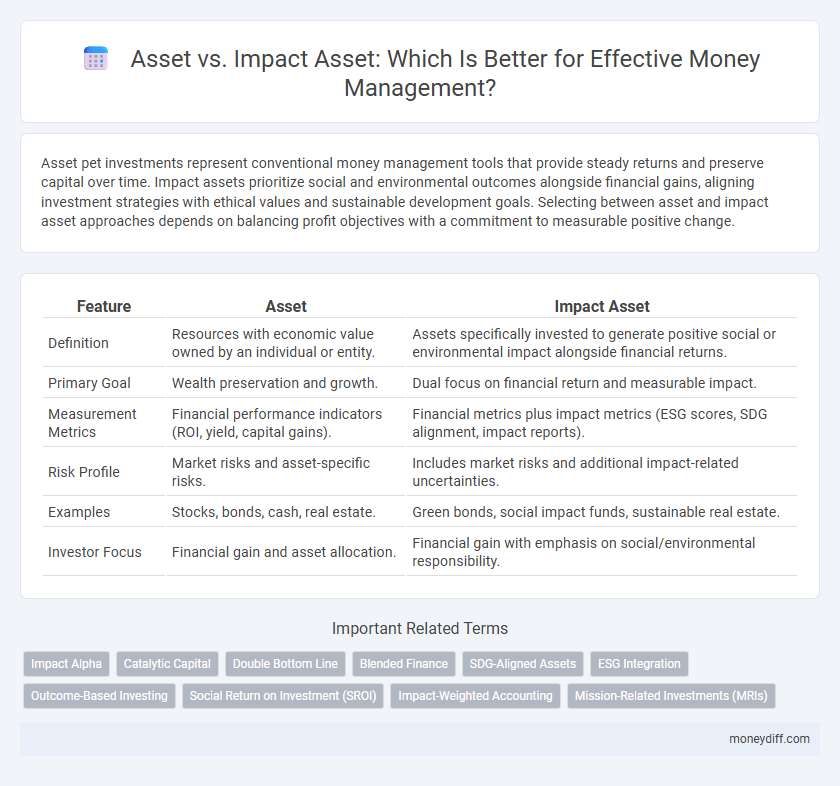

Asset pet investments represent conventional money management tools that provide steady returns and preserve capital over time. Impact assets prioritize social and environmental outcomes alongside financial gains, aligning investment strategies with ethical values and sustainable development goals. Selecting between asset and impact asset approaches depends on balancing profit objectives with a commitment to measurable positive change.

Table of Comparison

| Feature | Asset | Impact Asset |

|---|---|---|

| Definition | Resources with economic value owned by an individual or entity. | Assets specifically invested to generate positive social or environmental impact alongside financial returns. |

| Primary Goal | Wealth preservation and growth. | Dual focus on financial return and measurable impact. |

| Measurement Metrics | Financial performance indicators (ROI, yield, capital gains). | Financial metrics plus impact metrics (ESG scores, SDG alignment, impact reports). |

| Risk Profile | Market risks and asset-specific risks. | Includes market risks and additional impact-related uncertainties. |

| Examples | Stocks, bonds, cash, real estate. | Green bonds, social impact funds, sustainable real estate. |

| Investor Focus | Financial gain and asset allocation. | Financial gain with emphasis on social/environmental responsibility. |

Understanding Traditional Assets in Money Management

Traditional assets in money management typically include cash, stocks, bonds, and real estate, which provide stability and predictable returns. These assets are primarily valued for their ability to preserve capital and generate income, focusing on financial gain rather than social or environmental outcomes. Understanding the fundamental characteristics of traditional assets is essential for building a diversified portfolio that balances risk and return.

Defining Impact Assets: A New Era in Finance

Impact assets represent a new paradigm in money management by prioritizing measurable social and environmental outcomes alongside financial returns. Unlike traditional assets, impact assets integrate sustainability metrics into investment strategies, driving positive change while generating profit. This shift reflects growing investor demand for accountability in capital allocation to address global challenges.

Core Differences Between Assets and Impact Assets

Assets primarily generate financial returns through ownership of valuable resources, while impact assets combine financial performance with measurable social or environmental benefits. Traditional assets focus on wealth accumulation and risk management, whereas impact assets prioritize sustainability and positive societal outcomes alongside profits. The core difference lies in the intentional integration of impact objectives with financial goals in impact assets, reshaping investment strategies for responsible money management.

Measuring Financial Returns: Assets vs. Impact Assets

Measuring financial returns for traditional assets typically involves evaluating risk-adjusted yield and market appreciation, focusing purely on monetary gains. Impact assets, however, require dual assessment metrics that combine financial performance with social or environmental outcomes, incorporating impact measurement frameworks like IRIS+ or GIIRS ratings. This integrated approach enables investors to quantify both profit and purpose, aligning capital deployment with broader sustainability goals.

Non-Financial Outcomes: The Role of Impact Assets

Impact assets prioritize non-financial outcomes such as environmental sustainability, social equity, and community development, integrating these goals into investment strategies. Unlike traditional assets that focus solely on financial returns, impact assets deliberately target measurable positive social and environmental effects alongside monetary gains. This dual focus enhances long-term value creation by aligning investment portfolios with broader societal benefits.

Risk Assessment in Traditional and Impact Assets

Risk assessment in traditional assets primarily focuses on financial metrics such as volatility, market liquidity, and credit risk, aiming to maximize returns while minimizing potential losses. Impact assets incorporate these traditional risk factors but also evaluate social and environmental risks, requiring multifaceted analysis tools to quantify non-financial outcomes alongside financial performance. Integrating impact assessment frameworks enhances decision-making by aligning portfolio risks with sustainable development goals and stakeholder values.

Diversification Strategies: Blending Assets and Impact Assets

Diversification strategies in money management benefit from blending traditional assets, such as stocks and bonds, with impact assets that generate financial returns alongside positive social or environmental effects. Integrating impact assets into a portfolio enhances resilience by reducing correlation with conventional markets while aligning investments with ethical goals and sustainable development objectives. This balanced approach optimizes asset allocation, mitigates risk, and supports long-term value creation through diversified exposure to both financial performance and measurable impact.

Aligning Investment Goals with Asset Types

Aligning investment goals with asset types ensures optimal portfolio performance and risk management. Traditional assets like stocks and bonds offer predictable returns, while impact assets target social or environmental outcomes alongside financial gains. Selecting the right balance between asset and impact asset depends on the investor's priorities for financial growth and mission-driven impact.

Case Studies: Success Stories with Impact Assets

Impact assets demonstrate measurable social and environmental benefits alongside financial returns, distinguishing them from traditional assets focused solely on profit. Case studies reveal that investors in impact assets, such as green bonds and social enterprise equity, have achieved sustainable growth while driving positive change in communities. These success stories highlight how integrating impact metrics into portfolios enhances both risk mitigation and long-term value creation.

Building a Future-Proof Portfolio: Choosing Between Asset and Impact Asset

Choosing between traditional assets and impact assets is crucial for building a future-proof portfolio that balances financial returns with social and environmental goals. Impact assets, such as green bonds and social impact funds, offer measurable benefits in sustainability while traditional assets focus primarily on financial growth and risk management. Integrating impact assets into a diversified portfolio enhances resilience against market volatility and aligns investments with long-term global trends like climate change and social equity.

Related Important Terms

Impact Alpha

Impact assets prioritize generating measurable positive social and environmental outcomes alongside financial returns, leveraging impact alpha to outperform traditional asset classes by capturing unique value drivers linked to sustainability and societal progress. This strategic focus on impact alpha differentiates impact assets from conventional assets, aligning investment performance with broader stakeholder benefits and driving long-term risk-adjusted returns.

Catalytic Capital

Catalytic capital invests in high-impact assets designed to generate social and environmental returns alongside financial gains, differentiating them from traditional assets that primarily focus on monetary value. This form of capital plays a crucial role in unlocking additional private sector investment by absorbing higher risks and catalyzing sustainable development projects that mainstream investors typically avoid.

Double Bottom Line

Impact assets generate both financial returns and measurable social or environmental benefits, aligning with the double bottom line framework that evaluates success through profit and positive societal impact. Traditional assets prioritize financial performance alone, whereas impact assets integrate sustainability metrics, appealing to investors seeking purposeful wealth management.

Blended Finance

Impact assets in blended finance combine financial returns with measurable social or environmental benefits, whereas traditional assets primarily focus on financial gain. Allocating capital to impact assets enhances money management strategies by leveraging blended finance instruments to mitigate risks and attract diverse investors aligned with sustainable development goals.

SDG-Aligned Assets

SDG-aligned assets prioritize investments that generate measurable social and environmental benefits in line with the United Nations Sustainable Development Goals, while traditional assets primarily focus on financial returns. Impact assets integrate rigorous impact measurement frameworks, ensuring capital actively contributes to sustainable development outcomes beyond just preserving or growing financial value.

ESG Integration

Asset management that incorporates ESG (Environmental, Social, and Governance) criteria prioritizes impact assets to generate measurable social and environmental outcomes alongside financial returns. Traditional assets focus primarily on financial performance, while impact assets leverage ESG integration to align investments with sustainability goals and responsible investment principles.

Outcome-Based Investing

Impact assets prioritize measurable social and environmental outcomes alongside financial returns, differentiating them from traditional assets that focus solely on financial performance. Outcome-based investing leverages impact assets to align capital with specific societal goals, driving both positive impact and sustainable profitability.

Social Return on Investment (SROI)

Impact assets prioritize generating measurable Social Return on Investment (SROI) by directing capital towards projects with positive social and environmental outcomes, unlike traditional assets that focus mainly on financial returns. SROI metrics quantify the social impact relative to the invested capital, enabling investors to evaluate both financial performance and societal benefits of impact asset portfolios.

Impact-Weighted Accounting

Impact assets integrate environmental, social, and governance (ESG) factors into traditional asset valuation, enabling money management strategies that prioritize sustainable outcomes alongside financial returns. Impact-Weighted Accounting enhances this approach by quantifying the social and environmental impacts of assets, providing a comprehensive framework for investors to assess true value beyond monetary metrics.

Mission-Related Investments (MRIs)

Mission-Related Investments (MRIs) strategically allocate assets to generate both financial returns and measurable social or environmental impact, distinguishing them from traditional assets solely focused on financial performance. Impact assets within MRIs integrate rigorous impact metrics and ESG criteria, aligning investment goals with the organization's mission to foster sustainable development and long-term value creation.

Asset vs Impact Asset for money management. Infographic

moneydiff.com

moneydiff.com