Stocks represent full ownership of a company's shares, requiring investors to buy whole units, which can be costly for high-priced assets. Fractional shares allow investors to purchase a portion of a stock, making asset investment more accessible and diversified with smaller amounts of capital. This flexibility enhances portfolio management by enabling precise allocation and reducing the barriers to entry for valuable assets.

Table of Comparison

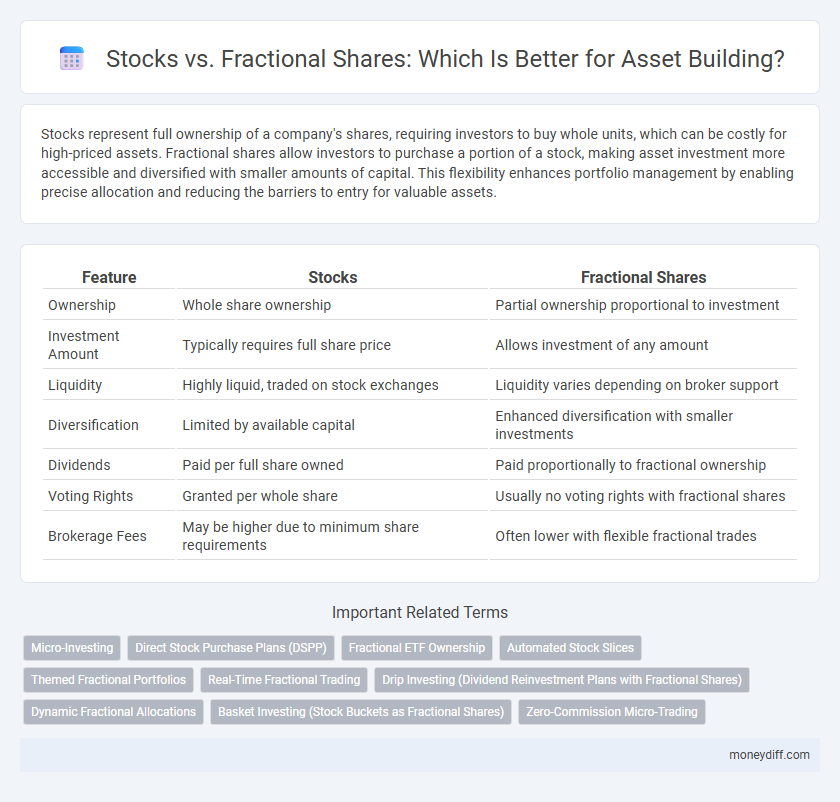

| Feature | Stocks | Fractional Shares |

|---|---|---|

| Ownership | Whole share ownership | Partial ownership proportional to investment |

| Investment Amount | Typically requires full share price | Allows investment of any amount |

| Liquidity | Highly liquid, traded on stock exchanges | Liquidity varies depending on broker support |

| Diversification | Limited by available capital | Enhanced diversification with smaller investments |

| Dividends | Paid per full share owned | Paid proportionally to fractional ownership |

| Voting Rights | Granted per whole share | Usually no voting rights with fractional shares |

| Brokerage Fees | May be higher due to minimum share requirements | Often lower with flexible fractional trades |

Understanding Stocks and Fractional Shares

Stocks represent full ownership units in a company, granting shareholders voting rights and dividends proportional to their holdings. Fractional shares allow investors to purchase portions of a stock, enabling access to high-priced assets without committing to a full share. This flexibility enhances portfolio diversification and lowers the barrier to entry for individual investors.

Key Differences Between Stocks and Fractional Shares

Stocks represent whole ownership units in a company, typically purchased and traded in full shares on stock exchanges. Fractional shares allow investors to own a portion of a stock, providing greater accessibility and flexibility by enabling investments with smaller capital. The key differences are that stocks require full share purchases, have standard voting rights, and typically incur standard brokerage fees, whereas fractional shares allow partial investments, may have limited or no voting rights, and often come with different fee structures.

Accessibility: Fractional Shares vs Whole Stocks

Fractional shares enhance accessibility to the stock market by allowing investors to purchase portions of high-priced stocks, lowering the entry barrier compared to whole stocks that require buying at least one full share. This flexibility enables diversification of portfolios with limited capital, making investments in expensive assets like Amazon or Google more attainable. Whole stocks, while straightforward, often necessitate larger initial investments, restricting market participation for smaller investors.

Cost Efficiency in Purchasing Stocks vs Fractional Shares

Investing in fractional shares provides cost efficiency by allowing the purchase of high-priced stocks with smaller capital, eliminating the need for full-share transactions. Traditional stock purchases require buying whole shares, which can be prohibitively expensive and limit diversification opportunities. Fractional shares enable more precise budget allocation and improved portfolio diversification, making them a cost-effective option for investors with limited funds.

Diversification Opportunities: Whole Stocks vs Fractional Shares

Whole stocks require purchasing entire shares, often limiting diversification due to higher individual share prices, especially for high-value companies like Amazon or Google. Fractional shares enable investors to allocate smaller amounts across multiple companies, enhancing diversification by spreading risk across a broader portfolio. This accessibility to fractional investing allows for tailored asset distribution, optimizing portfolio balance and reducing dependency on single-stock performance.

Liquidity Comparison: Stocks and Fractional Shares

Stocks offer higher liquidity due to their ability to be bought and sold in whole units on major exchanges with immediate execution. Fractional shares, while allowing investment flexibility by enabling partial ownership, may experience delayed liquidity since they often require transactions through brokerage platforms with varying settlement times. Understanding the liquidity differences between whole stocks and fractional shares helps investors optimize asset allocation and access to capital.

Dividend Payments: Stocks vs Fractional Shares

Stocks provide dividend payments based on whole share ownership, often resulting in larger payouts per share compared to fractional shares. Fractional shares enable investors to receive proportional dividends relative to the exact fraction owned, increasing accessibility for smaller investments. Dividend reinvestment plans (DRIPs) commonly support fractional shares, allowing consistent compounding of earnings over time.

Risks and Rewards of Stocks vs Fractional Shares

Stocks offer full ownership of shares, providing voting rights and potential dividends, but require higher capital and carry the risk of losing the entire investment if the company underperforms. Fractional shares enable investors to purchase a portion of a stock at a lower cost, allowing diversification with smaller amounts, though they may lack voting privileges and have limited liquidity. Both options involve market risk, but fractional shares reduce entry barriers while stocks offer full shareholder benefits and potential for greater returns.

Tax Implications for Stocks and Fractional Shares

Stocks typically generate taxable events such as dividends and capital gains when sold, with the tax rates varying based on holding period and income level. Fractional shares are treated identically to whole shares for tax purposes, with investors responsible for reporting proportional dividends and capital gains. The IRS requires accurate cost basis tracking for fractional shares to ensure proper tax reporting and compliance.

Choosing the Right Option for Your Asset Portfolio

Selecting between stocks and fractional shares depends on your investment goals, budget, and diversification needs. Whole stocks offer full ownership and voting rights in a company, ideal for long-term investors seeking substantial influence. Fractional shares enable portfolio diversification with limited capital, allowing access to high-priced stocks without the need to buy a full share.

Related Important Terms

Micro-Investing

Stocks represent full ownership units in a company, requiring investors to purchase whole shares that may be costly, while fractional shares allow ownership of a portion of a stock, enabling micro-investing with lower capital and diversified portfolios. Micro-investing platforms leverage fractional shares to democratize access to stock markets, making it easier for individuals to build long-term wealth through small, incremental investments.

Direct Stock Purchase Plans (DSPP)

Direct Stock Purchase Plans (DSPPs) enable investors to buy whole stocks or fractional shares directly from companies, often with lower fees and no need for a broker. Fractional shares through DSPPs allow greater portfolio diversification by enabling investment in high-priced stocks with minimal capital.

Fractional ETF Ownership

Fractional shares allow investors to own a precise portion of high-value ETFs, enabling diversified portfolios with minimal capital. This method improves accessibility to premium assets by lowering entry barriers compared to purchasing full shares of stocks or ETFs.

Automated Stock Slices

Automated stock slices enable investors to purchase fractional shares, allowing precise allocation of funds into high-value stocks otherwise unaffordable with whole shares. This technology enhances portfolio diversification by facilitating access to a broader range of assets, maximizing investment potential even with limited capital.

Themed Fractional Portfolios

Themed fractional portfolios offer diversified exposure within specific sectors or investment themes by allowing investors to buy portions of multiple stocks, optimizing asset allocation without the high capital requirement of full shares. This strategy enhances liquidity and risk management compared to traditional stock investments, making it accessible for portfolio diversification and targeted asset growth.

Real-Time Fractional Trading

Real-time fractional trading enables investors to buy partial shares of high-priced stocks, increasing accessibility and portfolio diversification without requiring full share purchases. This method maximizes liquidity and flexibility compared to traditional stock trading, allowing precise investment amounts aligned with market movements.

Drip Investing (Dividend Reinvestment Plans with Fractional Shares)

Dividend Reinvestment Plans (DRIPs) utilize fractional shares to automatically reinvest dividends, increasing asset accumulation without requiring the purchase of full stock units. This approach maximizes investment growth by compounding returns and enhancing portfolio diversification with minimal capital outlay.

Dynamic Fractional Allocations

Dynamic fractional allocations enhance investment flexibility by enabling precise distribution of assets across multiple stocks, reducing capital requirements while maintaining diversification. Unlike whole stocks, fractional shares allow investors to target specific portfolio weights dynamically, optimizing asset allocation in response to market fluctuations.

Basket Investing (Stock Buckets as Fractional Shares)

Basket investing through stock buckets enables investors to diversify their asset portfolio efficiently by purchasing fractional shares of multiple stocks within a single transaction, reducing the barrier to entry and minimizing risk exposure. Fractional shares allow precise allocation of capital across various sectors, enhancing portfolio balance compared to traditional whole-share stock investments.

Zero-Commission Micro-Trading

Zero-commission micro-trading platforms allow investors to purchase fractional shares, enabling diversified portfolios with minimal capital by dividing individual stocks into smaller, affordable units. This approach eliminates barriers associated with full stock purchases, democratizing asset ownership and increasing market accessibility.

Stocks vs Fractional Shares for asset. Infographic

moneydiff.com

moneydiff.com