Asset pets offer tangible ownership and long-term value stability, whereas digital collectibles primarily rely on market trends and platform popularity. Asset pets provide utility and emotional connection, enhancing their intrinsic worth beyond mere digital scarcity. Choosing asset pets for value storage ensures a more reliable investment compared to the volatility of digital collectibles.

Table of Comparison

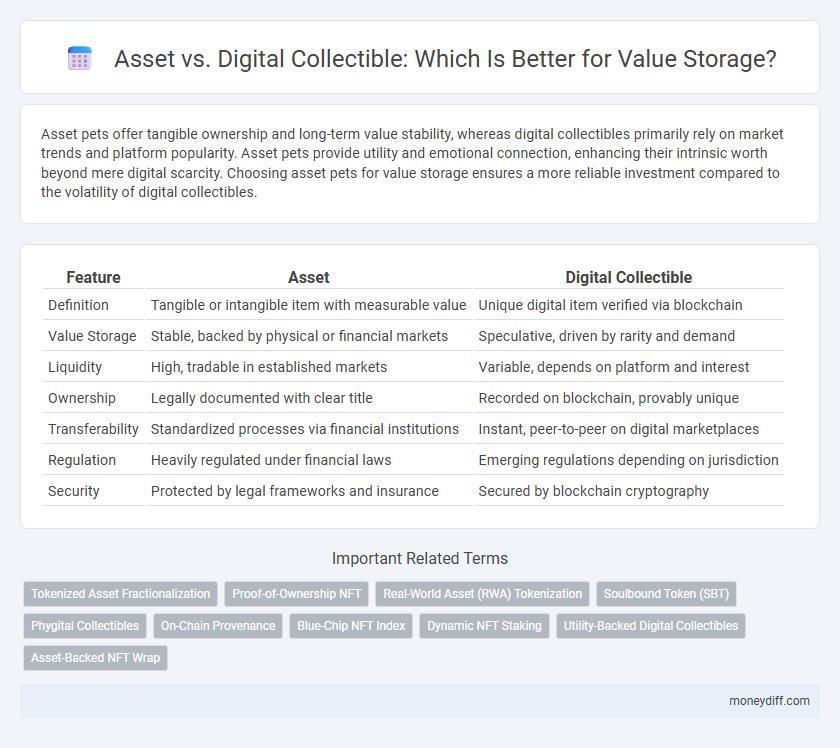

| Feature | Asset | Digital Collectible |

|---|---|---|

| Definition | Tangible or intangible item with measurable value | Unique digital item verified via blockchain |

| Value Storage | Stable, backed by physical or financial markets | Speculative, driven by rarity and demand |

| Liquidity | High, tradable in established markets | Variable, depends on platform and interest |

| Ownership | Legally documented with clear title | Recorded on blockchain, provably unique |

| Transferability | Standardized processes via financial institutions | Instant, peer-to-peer on digital marketplaces |

| Regulation | Heavily regulated under financial laws | Emerging regulations depending on jurisdiction |

| Security | Protected by legal frameworks and insurance | Secured by blockchain cryptography |

Understanding Traditional Assets: Definition and Types

Traditional assets encompass physical or financial resources such as real estate, stocks, bonds, and commodities that hold measurable economic value and can generate returns or income. These assets are characterized by their tangible or legally recognized ownership, established market mechanisms, and regulatory frameworks ensuring liquidity and value stability. Understanding the definition and types of traditional assets is crucial for comparing their value storage capabilities against emerging digital collectibles like NFTs and cryptocurrencies.

What Are Digital Collectibles? Key Characteristics

Digital collectibles are unique, blockchain-based assets that represent ownership of exclusive digital items such as art, music, or virtual goods. Their value stems from scarcity, provenance, and the ability to verify authenticity via smart contracts, distinguishing them from traditional assets used for value storage like stocks or real estate. Key characteristics include immutability, transferability, and programmability, enabling secure peer-to-peer trading and verifiable scarcity.

Asset vs Digital Collectible: Fundamental Differences

Assets represent tangible or intangible items with intrinsic value, such as real estate, stocks, or commodities, offering stability and long-term value preservation. Digital collectibles, often unique tokens like NFTs, derive value from scarcity and demand within digital ecosystems but lack intrinsic utility outside those platforms. The fundamental difference lies in assets' inherent economic worth compared to digital collectibles' reliance on market perception and technological frameworks for value storage.

Value Stability: Comparing Assets and Digital Collectibles

Assets like real estate and precious metals offer value stability through intrinsic worth and long-term demand, making them reliable stores of value. Digital collectibles, while potentially lucrative, exhibit higher volatility due to market speculation and lack of inherent asset backing. Investors seeking consistent value preservation typically favor traditional assets over digital collectibles for reduced risk and predictable returns.

Liquidity: Which Is Easier to Buy and Sell?

Assets generally offer higher liquidity compared to digital collectibles due to established markets and regulatory frameworks. Traditional assets such as stocks, bonds, and real estate can be quickly bought or sold through brokers and exchanges with standardized pricing. Digital collectibles, including NFTs, often face limited buyers and illiquid markets, making transactions slower and pricing more volatile.

Security and Ownership: Navigating Risks

Assets offer inherent security through legal frameworks and regulatory protections, ensuring clear ownership and reducing the risk of fraud. Digital collectibles rely on blockchain technology for ownership verification, but vulnerabilities such as hacking and smart contract exploits pose significant risks. Evaluating the security infrastructure and understanding custodial responsibilities are crucial when choosing between physical assets and digital collectibles for value storage.

Accessibility: Who Can Invest?

Assets such as real estate, stocks, and bonds typically require higher capital and regulatory compliance, limiting investment to accredited or financially qualified individuals. Digital collectibles, including NFTs, offer broader accessibility by enabling fractional ownership and lower entry costs, allowing a wider range of investors to participate. This democratization of investment opportunities enhances liquidity and diversifies portfolios across various socioeconomic groups.

Long-Term Value Growth: Historical Performance Insights

Assets have demonstrated consistent long-term value growth through historical performance data, often supported by tangible factors such as market demand, scarcity, and utility. Digital collectibles, while offering innovative ownership models and potential for rapid appreciation, exhibit higher volatility and less predictable value trajectories. Investors seeking stability typically favor traditional assets due to established market trends and proven resilience over extended periods.

Regulatory Landscape: Legal Considerations

Assets and digital collectibles differ significantly in their regulatory treatment, impacting their suitability for value storage. Traditional assets often fall under well-established financial regulations, providing clearer legal protections and compliance frameworks. Digital collectibles, classified as non-fungible tokens (NFTs), face evolving regulatory scrutiny related to securities laws, intellectual property rights, and consumer protection, creating uncertainty in their long-term legal classification and value stability.

Choosing the Right Value Storage: Asset or Digital Collectible?

Assets like real estate, stocks, and precious metals offer tangible value and long-term stability, making them reliable choices for value storage. Digital collectibles, such as NFTs, provide unique, blockchain-verified ownership with potential for high appreciation but often come with higher volatility and market uncertainty. Evaluating risk tolerance, liquidity needs, and investment goals is crucial when choosing between traditional assets and digital collectibles for storing value.

Related Important Terms

Tokenized Asset Fractionalization

Tokenized asset fractionalization enables the division of high-value physical or financial assets into smaller, tradable digital shares, enhancing liquidity and accessibility compared to traditional assets. Unlike digital collectibles, which primarily hold intrinsic or entertainment value, tokenized assets provide quantifiable ownership stakes that represent real-world value and income potential.

Proof-of-Ownership NFT

Proof-of-Ownership NFTs offer a secure, verifiable method for storing value compared to traditional assets by leveraging blockchain technology to ensure transparency and immutability. Unlike physical assets, digital collectibles with embedded proof-of-ownership provide enhanced liquidity and programmability, transforming how value is stored and transferred.

Real-World Asset (RWA) Tokenization

Real-World Asset (RWA) tokenization bridges tangible assets like real estate, commodities, or art with blockchain technology, offering enhanced transparency, liquidity, and fractional ownership compared to traditional digital collectibles. Unlike purely digital collectibles, RWAs provide intrinsic value derived from physical counterparts, making them a more stable and secure option for long-term value storage.

Soulbound Token (SBT)

Soulbound Tokens (SBTs) represent a paradigm shift in value storage by offering non-transferable digital assets that anchor individual identity and reputation on the blockchain, unlike traditional digital collectibles which are primarily designed for trade and speculation. SBTs enhance asset security and authenticity, making them ideal for preserving long-term value tied to personal credentials, achievements, and rights within decentralized ecosystems.

Phygital Collectibles

Phygital collectibles combine physical assets with digital elements, offering a unique value storage method that bridges tangible ownership and blockchain-backed authenticity. This hybrid approach enhances asset liquidity, verifiable provenance, and long-term value retention compared to traditional digital collectibles or standalone physical assets.

On-Chain Provenance

On-chain provenance ensures the authenticity and immutability of digital collectibles, making them a secure option for value storage compared to traditional assets with less transparent ownership records. This blockchain-backed verification enhances trust and liquidity by providing a permanent, auditable history of each digital collectible.

Blue-Chip NFT Index

Blue-Chip NFT Index represents a curated portfolio of high-value digital collectibles recognized for their market stability and long-term appreciation potential. Unlike traditional assets, these digital collectibles offer fractional ownership, enhanced liquidity, and verifiable provenance through blockchain technology, positioning them as innovative value storage alternatives.

Dynamic NFT Staking

Dynamic NFT staking enhances asset value storage by enabling real-time metadata updates and interactive ownership features that traditional digital collectibles lack. This dynamic interaction increases long-term value retention and user engagement by integrating utility and adaptability within the NFT ecosystem.

Utility-Backed Digital Collectibles

Utility-backed digital collectibles provide tangible value through embedded functions such as access rights, redeemable rewards, or exclusive services, distinguishing them from traditional assets that rely solely on market-driven appreciation. These collectibles combine blockchain verification with practical use cases, enhancing their stability and appeal as long-term value storage solutions.

Asset-Backed NFT Wrap

Asset-backed NFT wraps enhance value storage by embedding real-world assets like gold, real estate, or stocks into blockchain tokens, ensuring tangible collateral and reducing volatility compared to purely digital collectibles. This hybrid model leverages the security and transparency of NFTs while maintaining intrinsic asset value, creating a more stable investment vehicle for users.

Asset vs Digital Collectible for value storage. Infographic

moneydiff.com

moneydiff.com