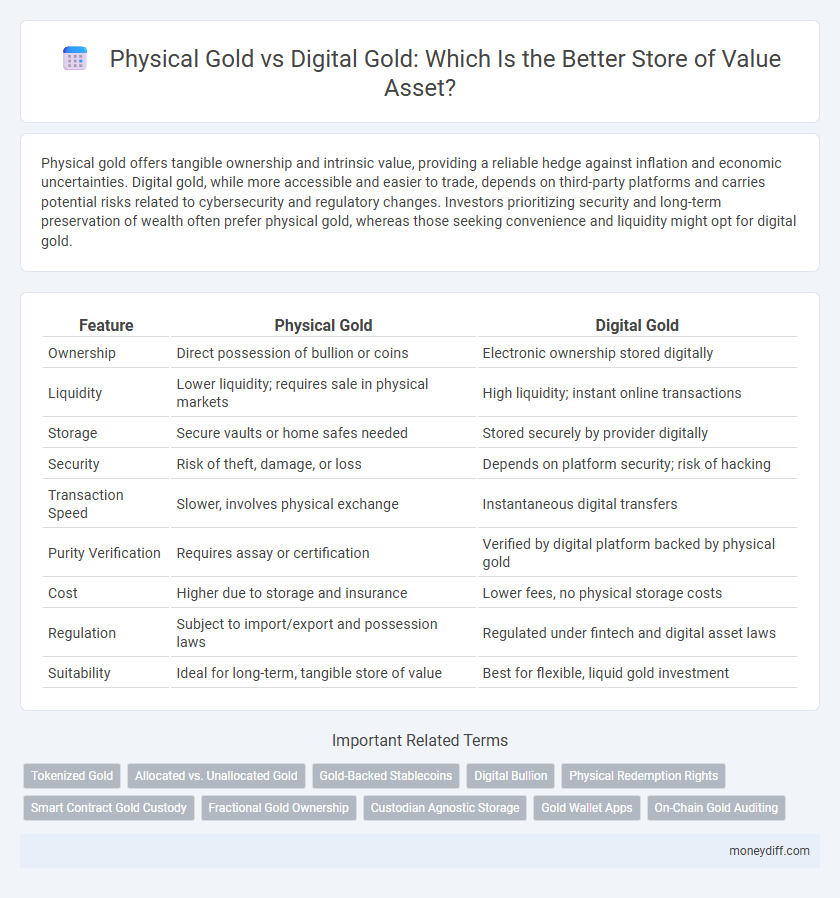

Physical gold offers tangible ownership and intrinsic value, providing a reliable hedge against inflation and economic uncertainties. Digital gold, while more accessible and easier to trade, depends on third-party platforms and carries potential risks related to cybersecurity and regulatory changes. Investors prioritizing security and long-term preservation of wealth often prefer physical gold, whereas those seeking convenience and liquidity might opt for digital gold.

Table of Comparison

| Feature | Physical Gold | Digital Gold |

|---|---|---|

| Ownership | Direct possession of bullion or coins | Electronic ownership stored digitally |

| Liquidity | Lower liquidity; requires sale in physical markets | High liquidity; instant online transactions |

| Storage | Secure vaults or home safes needed | Stored securely by provider digitally |

| Security | Risk of theft, damage, or loss | Depends on platform security; risk of hacking |

| Transaction Speed | Slower, involves physical exchange | Instantaneous digital transfers |

| Purity Verification | Requires assay or certification | Verified by digital platform backed by physical gold |

| Cost | Higher due to storage and insurance | Lower fees, no physical storage costs |

| Regulation | Subject to import/export and possession laws | Regulated under fintech and digital asset laws |

| Suitability | Ideal for long-term, tangible store of value | Best for flexible, liquid gold investment |

Introduction to Physical and Digital Gold as Store of Value

Physical gold has been a trusted store of value for centuries due to its tangible nature, intrinsic worth, and global acceptance. Digital gold represents ownership of physical gold through electronic certificates, offering ease of access, liquidity, and reduced storage costs. Both forms serve as effective hedges against inflation and economic uncertainty, with physical gold appealing to those valuing direct possession while digital gold suits investors seeking convenience and security in transactions.

Key Differences Between Physical Gold and Digital Gold

Physical gold offers tangible ownership, allowing investors to hold and store coins or bars securely, whereas digital gold represents ownership recorded electronically without physical possession. Physical gold typically incurs storage, insurance, and transportation costs, while digital gold minimizes these expenses through online platforms and instant liquidity. Security risks differ as physical gold faces theft and damage threats, whereas digital gold relies on cybersecurity measures and platform credibility.

Security and Safety Considerations

Physical gold offers tangible security through direct ownership and offline storage, minimizing exposure to cyber threats or digital fraud. Digital gold provides convenience and liquidity but relies heavily on secure platforms and encryption protocols to protect against hacking and unauthorized access. Investors should weigh the risks of theft and loss in physical possession against potential cybersecurity vulnerabilities in digital storage solutions.

Liquidity and Ease of Transactions

Physical gold offers limited liquidity due to the need for physical verification and secure storage, often resulting in slower transaction times and higher costs. Digital gold provides enhanced liquidity with instant, low-cost transactions facilitated by online platforms, allowing seamless buying, selling, and transfer. The ease of transactions in digital gold surpasses physical gold, making it a more efficient store of value in fast-paced markets.

Accessibility and Ownership Verification

Physical gold requires secure storage and can be difficult to access or verify ownership quickly, often involving trusted third parties or certificates. Digital gold offers instant accessibility through online platforms and uses blockchain technology for transparent, tamper-proof ownership verification. This enhances liquidity and ease of transfer while maintaining a reliable store of value.

Storage and Maintenance Costs Comparison

Physical gold requires secure storage solutions such as safes or bank vaults, which incur significant maintenance and insurance costs over time. Digital gold eliminates physical storage expenses by representing ownership electronically, often backed by insured custodians, reducing the overall cost burden. Investors considering long-term asset preservation should weigh the tangible security of physical gold against the cost-efficiency and convenience of digital gold storage.

Regulatory and Legal Implications

Physical gold remains subject to established regulations including import duties, storage compliance, and ownership verification under property laws, ensuring tangible asset security but requiring stringent legal adherence. Digital gold operates under evolving regulatory frameworks that address anti-money laundering (AML) and know-your-customer (KYC) compliance, with jurisdiction-specific licensing requirements for platforms offering digital gold tokens. Legal implications highlight risks and opportunities: physical gold offers clear ownership rights while digital gold depends on smart contract security and regulatory clarity to validate ownership claims and prevent fraud.

Historical Performance and Price Stability

Physical gold has demonstrated consistent historical performance as a reliable store of value, maintaining purchasing power through economic cycles and geopolitical uncertainties. Its price stability is underpinned by tangible scarcity and intrinsic value, which have preserved wealth over centuries. Digital gold, while offering convenience and fractional ownership, often exhibits higher price volatility influenced by technological risks and market speculation, making it less stable compared to traditional physical gold holdings.

Environmental Impact and Sustainability

Physical gold mining consumes significant energy and generates substantial carbon emissions, raising environmental concerns. Digital gold, typically backed by physical reserves or blockchain tokens, offers a lower environmental footprint by minimizing the need for continuous mining activities. Sustainable investment strategies increasingly favor digital gold for its reduced ecological impact and efficient resource utilization.

Choosing the Right Gold Investment for Your Portfolio

Physical gold offers tangible security and direct ownership, making it a reliable hedge against inflation and currency fluctuations. Digital gold provides liquidity, ease of transaction, and lower storage costs, appealing to investors seeking convenience and quick access. Balancing physical and digital gold in a portfolio optimizes risk management and aligns with both long-term wealth preservation and agile investment strategies.

Related Important Terms

Tokenized Gold

Tokenized gold provides a secure, transparent, and easily tradable alternative to physical gold by leveraging blockchain technology to verify ownership and ensure liquidity. Unlike physical gold, digital gold tokens reduce storage costs and counterparty risks while enabling fractional ownership and instant transfers globally.

Allocated vs. Unallocated Gold

Allocated gold provides investors direct ownership of specific physical gold bars or coins stored securely, ensuring true asset backing and protection against counterparty risk. Unallocated gold represents a claim on a pool of gold without direct ownership, exposing holders to potential default risk but offering greater liquidity and lower storage costs.

Gold-Backed Stablecoins

Gold-backed stablecoins combine the intrinsic value of physical gold with the liquidity and accessibility of digital assets, offering a secure store of value that is resistant to volatility typical of other cryptocurrencies. These tokens are backed by verified reserves of physical gold, ensuring transparency and trust while enabling seamless global transactions and fractional ownership.

Digital Bullion

Digital Bullion offers a secure and easily transferable store of value compared to physical gold, with blockchain technology ensuring transparency and authenticity. Unlike physical gold, Digital Bullion eliminates the risks of theft and storage costs, making it a more efficient asset for modern investors seeking liquidity and quick access.

Physical Redemption Rights

Physical gold offers undeniable security through tangible ownership and physical redemption rights, ensuring investors can directly convert their assets into physical bars or coins. Digital gold provides liquidity and ease of transaction but often lacks guaranteed physical redemption, limiting its effectiveness as a true store of value.

Smart Contract Gold Custody

Physical gold requires secure storage and insurance, leading to high maintenance costs, while digital gold backed by smart contract gold custody ensures transparent, efficient, and automated ownership verification on blockchain platforms. Smart contracts minimize counterparty risks and enable instant transferability, enhancing liquidity and reducing the complexities of traditional gold custody.

Fractional Gold Ownership

Physical gold offers tangible security and direct possession, making it a traditional store of value, while digital gold enables fractional ownership, allowing investors to buy smaller, more affordable portions of gold without the need for physical storage. Fractional gold ownership through digital platforms increases liquidity and accessibility, facilitating diversified investment and easier trading compared to holding whole physical gold units.

Custodian Agnostic Storage

Physical gold requires secure, insured vaults and incurs higher custody fees, while digital gold offers custodian-agnostic storage on blockchain platforms, enabling decentralized ownership and easier transferability. Digital gold leverages cryptographic security and smart contracts to reduce reliance on central custodians, enhancing liquidity and accessibility without compromising asset-backed value.

Gold Wallet Apps

Gold Wallet Apps enable instant access to both physical and digital gold assets, combining the tangible security of physical gold with the liquidity and convenience of digital gold ownership. These platforms enhance portfolio diversification by offering real-time asset tracking, secure storage solutions, and seamless transaction capabilities for investors prioritizing gold as a long-term store of value.

On-Chain Gold Auditing

On-chain gold auditing provides transparent, tamper-proof verification of digital gold holdings, ensuring verifiable asset-backed security unmatched by physical gold storage. This blockchain-enabled audit trail enhances trust and liquidity for investors seeking a reliable store of value in digital gold.

Physical Gold vs Digital Gold for store of value. Infographic

moneydiff.com

moneydiff.com