Traditional REITs generate asset income through physical property investments managed by centralized entities, often involving higher fees and slower transaction processes. Blockchain-based REITs offer increased transparency, faster settlements, and fractional ownership opportunities by leveraging smart contracts on decentralized platforms. This innovation enhances liquidity, reduces costs, and democratizes access to real estate investment income.

Table of Comparison

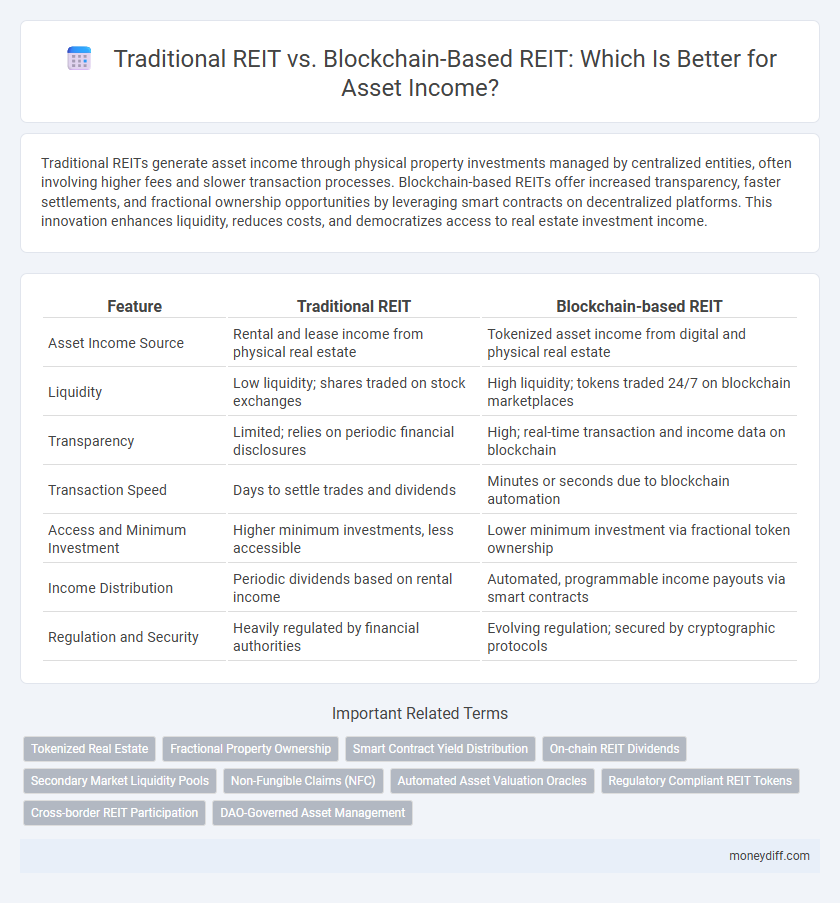

| Feature | Traditional REIT | Blockchain-based REIT |

|---|---|---|

| Asset Income Source | Rental and lease income from physical real estate | Tokenized asset income from digital and physical real estate |

| Liquidity | Low liquidity; shares traded on stock exchanges | High liquidity; tokens traded 24/7 on blockchain marketplaces |

| Transparency | Limited; relies on periodic financial disclosures | High; real-time transaction and income data on blockchain |

| Transaction Speed | Days to settle trades and dividends | Minutes or seconds due to blockchain automation |

| Access and Minimum Investment | Higher minimum investments, less accessible | Lower minimum investment via fractional token ownership |

| Income Distribution | Periodic dividends based on rental income | Automated, programmable income payouts via smart contracts |

| Regulation and Security | Heavily regulated by financial authorities | Evolving regulation; secured by cryptographic protocols |

Introduction: Understanding Traditional vs. Blockchain-Based REITs

Traditional REITs generate asset income through physical property ownership, leveraging rental payments and property appreciation to provide steady dividends. Blockchain-based REITs utilize decentralized ledger technology, enabling fractional ownership, enhanced transparency, and faster transactions for investors. This shift introduces greater liquidity and accessibility, reshaping how asset income is generated and distributed in real estate investment trusts.

Fundamental Structure of Traditional REITs

Traditional REITs operate through centralized ownership of real estate assets, generating income primarily from rental payments and property appreciation. Their fundamental structure involves pooling investor capital to acquire, manage, and profit from physical properties, subject to regulatory oversight and tax obligations. This model ensures steady income streams through lease agreements but often lacks liquidity and transparent transaction processes compared to emerging blockchain-based alternatives.

Core Features of Blockchain-Based REITs

Blockchain-based REITs offer enhanced transparency and security through decentralized ledger technology, enabling real-time tracking of asset ownership and transactions. Smart contracts automate dividend distributions and reduce administrative costs, improving efficiency compared to traditional REITs. These core features provide investors with greater liquidity and accessibility while maintaining regulatory compliance and oversight.

Accessibility and Investment Minimums

Traditional REITs often require higher minimum investments and limit accessibility to accredited investors or those with significant capital, restricting broader participation. Blockchain-based REITs leverage tokenization to lower entry barriers, enabling fractional ownership with minimal investment amounts and opening access to a global investor base. This democratization enhances liquidity and inclusivity, making asset income opportunities more attainable for retail investors.

Transparency and Reporting Standards

Traditional REITs rely on established accounting principles and regulatory frameworks, providing investors with audited financial statements and standardized reporting that ensure transparency in asset income distribution. Blockchain-based REITs leverage decentralized ledger technology to offer real-time transaction visibility and immutable records, enhancing transparency and reducing discrepancies in reporting standards. The integration of smart contracts in blockchain REITs automates income disbursement, ensuring timely and verifiable payments, which contrasts with the slower, periodic reporting typical of traditional REITs.

Liquidity and Secondary Market Options

Traditional REITs offer limited liquidity since shares are often traded on established stock exchanges with set trading hours and regulatory constraints, leading to slower transactions. Blockchain-based REITs provide enhanced liquidity through tokenized assets that can be traded 24/7 on decentralized exchanges, enabling faster and more flexible access to secondary markets. The decentralized nature of blockchain also reduces intermediaries, lowering transaction costs and expanding global investor participation.

Regulatory Compliance and Security

Traditional REITs operate within established regulatory frameworks, ensuring investor protection through stringent oversight by agencies like the SEC and adherence to compliance standards such as the Investment Company Act of 1940. Blockchain-based REITs leverage decentralized ledger technology to enhance transparency and security, reducing fraud risks via immutable transaction records while often navigating evolving regulatory landscapes that challenge compliance consistency. Both structures offer asset income streams, but traditional REITs provide proven legal safeguards, whereas blockchain REITs emphasize innovative security protocols amid regulatory uncertainties.

Income Distribution and Yield Management

Traditional REITs distribute income through regulated quarterly dividends, providing predictable cash flows for investors, while blockchain-based REITs leverage smart contracts for automated, real-time income distribution, enhancing transparency and efficiency. Yield management in traditional REITs relies on periodic asset appraisals and market analysis, whereas blockchain-based REITs utilize continuous data feeds and decentralized finance protocols to optimize yield dynamically. The integration of blockchain technology reduces administrative costs and intermediaries, potentially increasing net income yield for asset holders compared to conventional REIT structures.

Risks and Drawbacks Comparison

Traditional REITs face risks such as market volatility, regulatory constraints, and management inefficiencies that can impact asset income stability. Blockchain-based REITs offer increased transparency and liquidity but expose investors to cybersecurity threats, regulatory uncertainty, and technological adoption barriers. Evaluating these risks is essential for optimizing asset income strategies in both traditional and blockchain real estate investment models.

Future Trends: Evolution of Asset Income Platforms

Blockchain-based REITs are transforming asset income platforms through enhanced transparency, faster transaction settlements, and fractional ownership, making real estate investment more accessible and efficient compared to traditional REITs. Future trends indicate increased integration of smart contracts and decentralized finance (DeFi) protocols, driving innovation in asset management and income distribution. These advancements position blockchain-based REITs as a disruptive force in evolving asset income ecosystems, optimizing liquidity and investor engagement.

Related Important Terms

Tokenized Real Estate

Traditional REITs generate asset income through pooled real estate investments managed by centralized entities, offering limited liquidity and accessibility. Blockchain-based REITs leverage tokenized real estate to enable fractional ownership, enhanced transparency, and real-time trading, increasing market efficiency and investor inclusivity.

Fractional Property Ownership

Traditional REITs offer asset income through pooled real estate investments but often require significant minimum capital and lack liquidity, whereas blockchain-based REITs enable fractional property ownership with lower entry barriers and enhanced transparency via smart contracts. This fractionalization increases accessibility for smaller investors while providing real-time trading opportunities on decentralized platforms, revolutionizing asset income generation in real estate markets.

Smart Contract Yield Distribution

Traditional REITs distribute income through centralized management relying on periodic manual processes, whereas blockchain-based REITs leverage smart contract yield distribution to automate and transparently execute real-time income payments directly to investors. Smart contracts ensure immutable, instantaneous allocation of rental yields and dividends, enhancing efficiency, reducing administrative costs, and increasing investor trust in asset income flows.

On-chain REIT Dividends

Traditional REITs generate asset income through property rentals and capital appreciation, distributing dividends based on periodic financial performance reports. Blockchain-based REITs enable on-chain dividend payouts with real-time transparency, lower transaction costs, and fractional ownership, enhancing liquidity and investor accessibility.

Secondary Market Liquidity Pools

Traditional REITs offer limited secondary market liquidity due to regulatory constraints and centralized management, restricting asset income flexibility. Blockchain-based REITs leverage decentralized liquidity pools on digital exchanges, enhancing real-time asset liquidity and enabling continuous income generation through tokenized shares.

Non-Fungible Claims (NFC)

Traditional REITs generate asset income through equity ownership in real estate, while blockchain-based REITs utilize Non-Fungible Claims (NFC) for digitized, transparent ownership and streamlined income distribution. NFCs enable fractionalized, secure, and verifiable asset income streams, enhancing liquidity and investor access compared to conventional REIT structures.

Automated Asset Valuation Oracles

Traditional REITs rely on periodic manual appraisals for asset income valuation, leading to delays and potential inaccuracies. Blockchain-based REITs utilize automated asset valuation oracles that provide real-time, transparent, and immutable data feeds, enhancing accuracy and efficiency in income distribution.

Regulatory Compliant REIT Tokens

Traditional REITs offer regulated asset income through established compliance frameworks, ensuring investor protections and predictable dividends from real estate holdings. Blockchain-based REITs leverage tokenization for enhanced liquidity and fractional ownership while adhering to regulatory compliant REIT token standards, enabling transparent and secure asset income streams.

Cross-border REIT Participation

Traditional REITs often face regulatory hurdles and currency exchange limitations that restrict cross-border investment, while blockchain-based REITs enable seamless global participation through tokenization, reducing barriers and enhancing liquidity. The decentralized ledger technology allows fractional ownership and real-time transactions, increasing accessibility and diversification for international investors seeking asset income.

DAO-Governed Asset Management

Traditional REITs rely on centralized management structures that can limit transparency and slow decision-making, whereas blockchain-based REITs leverage DAO-governed asset management to enable decentralized, transparent, and efficient income distribution. DAO governance ensures real-time stakeholder participation in asset management, enhancing liquidity and aligning asset income with investor interests through smart contracts.

Traditional REIT vs Blockchain-based REIT for asset income Infographic

moneydiff.com

moneydiff.com