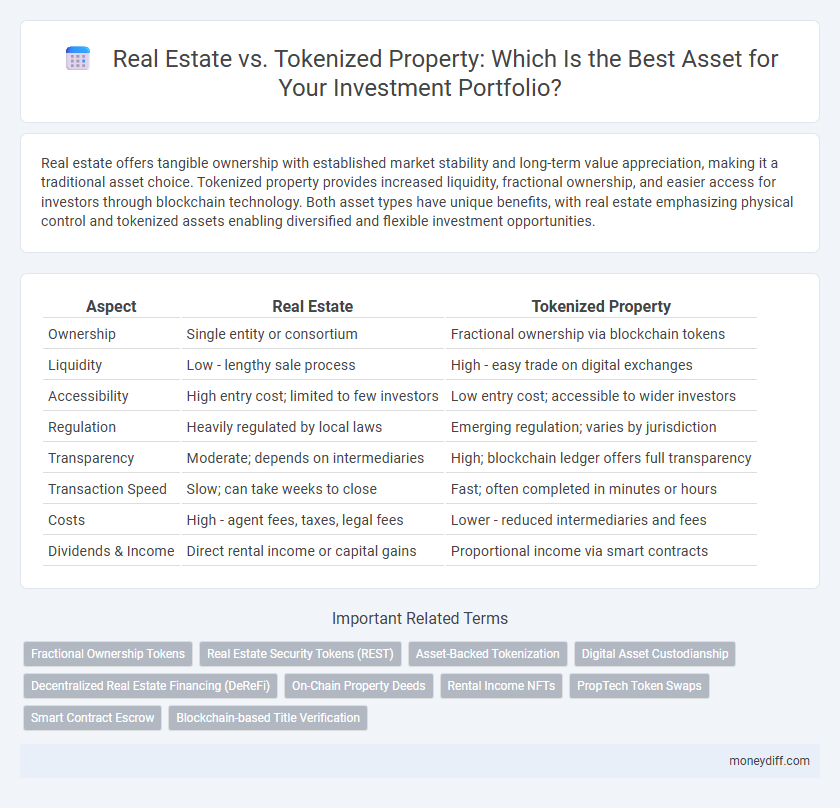

Real estate offers tangible ownership with established market stability and long-term value appreciation, making it a traditional asset choice. Tokenized property provides increased liquidity, fractional ownership, and easier access for investors through blockchain technology. Both asset types have unique benefits, with real estate emphasizing physical control and tokenized assets enabling diversified and flexible investment opportunities.

Table of Comparison

| Aspect | Real Estate | Tokenized Property |

|---|---|---|

| Ownership | Single entity or consortium | Fractional ownership via blockchain tokens |

| Liquidity | Low - lengthy sale process | High - easy trade on digital exchanges |

| Accessibility | High entry cost; limited to few investors | Low entry cost; accessible to wider investors |

| Regulation | Heavily regulated by local laws | Emerging regulation; varies by jurisdiction |

| Transparency | Moderate; depends on intermediaries | High; blockchain ledger offers full transparency |

| Transaction Speed | Slow; can take weeks to close | Fast; often completed in minutes or hours |

| Costs | High - agent fees, taxes, legal fees | Lower - reduced intermediaries and fees |

| Dividends & Income | Direct rental income or capital gains | Proportional income via smart contracts |

Introduction to Real Estate and Tokenized Property

Real estate traditionally involves the ownership of physical properties such as residential, commercial, or industrial buildings, offering tangible asset value and long-term appreciation potential. Tokenized property represents real estate ownership through blockchain-based digital tokens, enabling fractional ownership, increased liquidity, and easier transferability of assets. This innovative approach leverages smart contracts to streamline transactions, reduce costs, and enhance access for a broader range of investors.

Key Differences Between Traditional Real Estate and Tokenized Assets

Traditional real estate involves physical property ownership with high transaction costs and limited liquidity, often requiring significant capital and lengthy processes. Tokenized assets represent real estate ownership through blockchain technology, enabling fractional ownership, enhanced liquidity, and faster, more transparent transactions. Regulatory compliance and market accessibility also differ, with tokenization democratizing investment opportunities compared to conventional real estate markets.

Advantages of Investing in Physical Real Estate

Investing in physical real estate offers tangible asset ownership with intrinsic value and long-term appreciation potential, providing stability in volatile markets. Physical properties generate consistent rental income and allow investors to leverage tax benefits such as depreciation and mortgage interest deductions. The direct control over property management and improvements enhances asset value and reduces investment risk compared to digital or tokenized real estate platforms.

Benefits of Tokenized Property Investment

Tokenized property investment offers enhanced liquidity compared to traditional real estate by enabling fractional ownership and faster transactions through blockchain technology. Investors gain increased transparency and security with immutable digital records and smart contracts that automate compliance and reduce intermediaries. This digital transformation broadens access to real estate markets, lowering entry barriers and allowing global participation in property investments.

Liquidity Comparison: Real Estate vs Tokenized Property

Real estate assets typically exhibit low liquidity due to lengthy transaction processes and high entry costs, often taking weeks or months to sell. Tokenized property leverages blockchain technology to enable fractional ownership and faster, 24/7 trading on digital platforms, significantly enhancing liquidity. This digitized asset class allows investors to convert property stakes into liquid tokens, reducing barriers and enabling near-instant market access compared to traditional real estate transactions.

Accessibility and Minimum Investment Thresholds

Real estate traditionally requires significant capital due to high minimum investment thresholds, making it less accessible for individual investors. Tokenized property lowers entry barriers by allowing fractional ownership through blockchain technology, enabling investments with smaller amounts. This increased accessibility democratizes asset participation and expands investment opportunities to a broader audience.

Regulatory and Legal Considerations

Real estate investments are governed by well-established regulatory frameworks, including zoning laws, ownership rights, and property taxes, while tokenized property operates under emerging blockchain laws and securities regulations that vary by jurisdiction. Traditional real estate transactions require extensive due diligence, title verification, and compliance with local real estate laws, whereas tokenized assets demand adherence to digital asset regulations and Anti-Money Laundering (AML) protocols. Legal clarity for tokenized properties continues to evolve, posing challenges for investors regarding jurisdiction, smart contract enforceability, and ownership verification compared to conventional real estate compliance.

Risk Factors and Security Issues

Real estate investments traditionally face risks such as market volatility, illiquidity, and regulatory changes, while tokenized property introduces concerns around cybersecurity vulnerabilities, smart contract failures, and unclear legal frameworks. Tokenized assets offer enhanced transparency and fractional ownership, yet the reliance on blockchain technology increases exposure to hacking and fraud risks. Evaluating security measures and regulatory compliance is critical when comparing physical property assets to their digital tokenized counterparts.

Returns and Profit Potential Analysis

Real estate traditionally offers steady rental income and long-term appreciation, making it a reliable asset class for consistent returns. Tokenized property provides enhanced liquidity and fractional ownership, allowing investors to access profit potential in smaller increments and diversify portfolios more efficiently. Studies indicate tokenized assets can achieve higher short-term gains due to market volatility, while physical real estate remains favored for stable, long-term wealth accumulation.

Which Asset Class Suits Your Money Management Goals?

Real estate offers tangible ownership with long-term appreciation potential and income through rental yields, making it ideal for conservative investors seeking stability. Tokenized property provides fractional ownership, enhanced liquidity, and easier access to diverse portfolios, fitting those who prefer flexibility and digital asset diversification. Assessing your risk tolerance, investment horizon, and liquidity needs helps determine whether traditional real estate or tokenized assets align better with your money management goals.

Related Important Terms

Fractional Ownership Tokens

Fractional ownership tokens enable investors to buy and trade shares of real estate assets with increased liquidity and lower entry barriers compared to traditional property investments. These blockchain-based tokens provide transparent asset management, reduced transaction costs, and enhanced market accessibility in the real estate sector.

Real Estate Security Tokens (REST)

Real Estate Security Tokens (REST) represent a revolutionary evolution in asset ownership, enabling fractionalized investment with enhanced liquidity and transparency compared to traditional real estate. By leveraging blockchain technology, REST facilitates secure, compliant transactions and broadens access to diverse property portfolios without the complexities of conventional real estate management.

Asset-Backed Tokenization

Asset-backed tokenization transforms real estate ownership by converting physical properties into digital tokens on a blockchain, enhancing liquidity and fractional investment opportunities. Unlike traditional real estate transactions, tokenized property enables faster asset transfers, increased transparency, and global access to diverse investment portfolios.

Digital Asset Custodianship

Real estate traditionally relies on physical asset custody involving deeds, legal documentation, and escrow services, whereas tokenized property utilizes blockchain-based digital asset custodianship to ensure secure, transparent ownership and transfer through smart contracts. Digital asset custodianship offers enhanced security protocols, real-time transaction verification, and reduced intermediary costs, revolutionizing asset management in the property sector.

Decentralized Real Estate Financing (DeReFi)

Decentralized Real Estate Financing (DeReFi) transforms traditional asset ownership by enabling fractional investment in tokenized property, increasing liquidity and accessibility compared to conventional real estate. This blockchain-driven approach reduces intermediaries, enhances transparency, and offers real-time asset management, revolutionizing asset portfolio diversification and financing models.

On-Chain Property Deeds

On-chain property deeds provide tamper-proof ownership records secured by blockchain technology, enhancing transparency and reducing fraud risks compared to traditional real estate deeds. Tokenized property enables fractional ownership and seamless transferability, unlocking liquidity and new investment opportunities within asset markets.

Rental Income NFTs

Rental income NFTs represent a disruptive evolution in real estate asset management by enabling fractional ownership and real-time revenue distribution through blockchain technology. Unlike traditional real estate, tokenized properties offer enhanced liquidity, transparency, and low entry barriers, redefining how investors access and profit from rental income streams.

PropTech Token Swaps

Tokenized properties leverage blockchain technology to enable fractional ownership, increased liquidity, and faster transactions compared to traditional real estate deals. PropTech token swaps facilitate seamless asset exchanges by reducing intermediaries and enhancing transparency in property investments.

Smart Contract Escrow

Smart contract escrow in tokenized property enables automated, secure transactions by holding funds until all predefined conditions are met, reducing reliance on traditional intermediaries common in real estate deals. This blockchain-based mechanism enhances transparency and efficiency, streamlining asset transfers and minimizing risks associated with manual escrow processes.

Blockchain-based Title Verification

Blockchain-based title verification enhances tokenized property by providing immutable, transparent records that significantly reduce title fraud and streamline ownership transfers. Unlike traditional real estate, tokenized assets leverage decentralized ledgers to ensure real-time verification and secure, verifiable proof of ownership.

Real Estate vs Tokenized Property for asset. Infographic

moneydiff.com

moneydiff.com