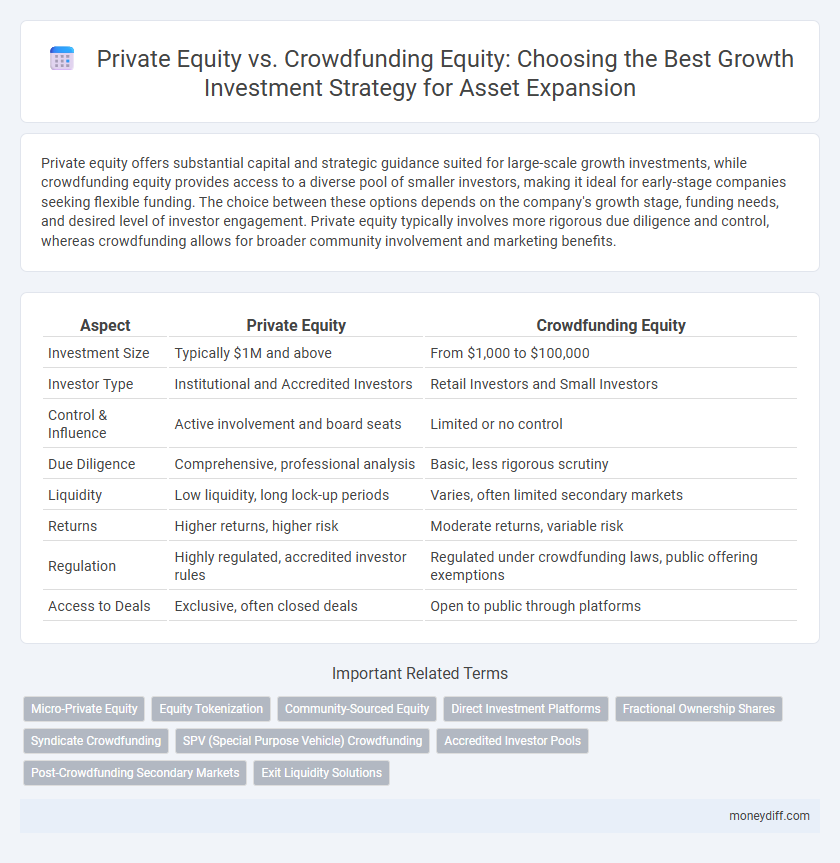

Private equity offers substantial capital and strategic guidance suited for large-scale growth investments, while crowdfunding equity provides access to a diverse pool of smaller investors, making it ideal for early-stage companies seeking flexible funding. The choice between these options depends on the company's growth stage, funding needs, and desired level of investor engagement. Private equity typically involves more rigorous due diligence and control, whereas crowdfunding allows for broader community involvement and marketing benefits.

Table of Comparison

| Aspect | Private Equity | Crowdfunding Equity |

|---|---|---|

| Investment Size | Typically $1M and above | From $1,000 to $100,000 |

| Investor Type | Institutional and Accredited Investors | Retail Investors and Small Investors |

| Control & Influence | Active involvement and board seats | Limited or no control |

| Due Diligence | Comprehensive, professional analysis | Basic, less rigorous scrutiny |

| Liquidity | Low liquidity, long lock-up periods | Varies, often limited secondary markets |

| Returns | Higher returns, higher risk | Moderate returns, variable risk |

| Regulation | Highly regulated, accredited investor rules | Regulated under crowdfunding laws, public offering exemptions |

| Access to Deals | Exclusive, often closed deals | Open to public through platforms |

Overview of Private Equity and Crowdfunding Equity

Private equity involves pooled capital from accredited investors to acquire significant ownership in established companies, offering active management and strategic guidance for growth. Crowdfunding equity enables numerous smaller investors to purchase shares through online platforms, providing accessible funding primarily for startups or early-stage businesses. Both methods aim to support business expansion but differ in investor profile, regulatory requirements, and control levels.

Key Differences in Investment Structure

Private equity investments typically involve significant capital commitments from accredited investors pooling funds into a managed fund, granting investors limited partnership interests and centralized decision-making by professional managers. Crowdfunding equity offers smaller, individual stakes directly in startups or projects via online platforms, enabling broad participation and often less regulatory complexity. The key difference lies in private equity's concentrated, high-value investments with greater control and active management, versus crowdfunding's open-access, lower ticket size contributions with limited investor influence.

Accessibility and Investor Requirements

Private equity typically requires high minimum investments and stringent accreditation criteria, limiting accessibility to wealthy or institutional investors. Crowdfunding equity platforms lower entry barriers by allowing smaller capital contributions from a broader pool of retail investors. This democratization of investment opportunities provides greater accessibility while often involving fewer regulatory hurdles compared to private equity funds.

Due Diligence and Transparency Standards

Private equity investments typically undergo rigorous due diligence processes, including detailed financial analysis, background checks, and operational assessments, ensuring higher transparency standards for growth capital deployment. Crowdfunding equity offers broader accessibility but often involves limited due diligence, which can increase risk and reduce the depth of financial disclosure available to investors. The contrast in transparency and due diligence frameworks significantly impacts investor confidence and risk management in growth-stage asset allocation.

Risk Factors in Private Equity vs Crowdfunding

Private equity investments typically involve higher financial thresholds and longer lock-in periods, increasing exposure to liquidity risk compared to crowdfunding, which offers lower entry barriers but higher market volatility. Risk factors in private equity include leverage-induced solvency risk and dependence on management expertise, while crowdfunding faces challenges from less rigorous due diligence and potential project failure rates. Diversification possibilities differ significantly, with private equity portfolios often more concentrated, elevating firm-specific risk relative to broader but less controlled crowdfunding investments.

Potential Returns and Exit Strategies

Private equity investments typically offer higher potential returns through active management and strategic growth initiatives, targeting returns of 20% or more annually, while crowdfunding equity often provides more modest returns averaging 8-12% due to diversified, smaller-scale investments. Exit strategies in private equity commonly involve leveraged buyouts, strategic sales, or IPOs within a 5-7 year horizon, enabling significant capital appreciation. Crowdfunding equity exit options are generally limited to secondary market sales or buybacks, often resulting in longer holding periods and less liquidity.

Control and Influence Over Portfolio Companies

Private equity investors typically gain significant control and influence over portfolio companies through board seats and strategic decision-making, enabling active management and value creation. In contrast, crowdfunding equity investors usually have limited control, often restricted to voting on major issues without day-to-day operational involvement. This disparity affects the level of oversight and ability to drive growth initiatives within the invested businesses.

Regulatory Landscape and Compliance

Private equity investments operate under stringent regulatory frameworks such as the Investment Company Act of 1940 and SEC oversight, ensuring rigorous compliance and investor protection requirements. Crowdfunding equity platforms are governed by regulations like the JOBS Act, allowing broader public participation but imposing limits on fundraising amounts and investor eligibility to mitigate risk. Navigating these distinct compliance landscapes is crucial for growth investments, influencing capital access, reporting obligations, and legal accountability.

Costs, Fees, and Minimum Investment Thresholds

Private equity typically involves higher minimum investment thresholds, often starting at $1 million, accompanied by management fees around 2% and performance fees near 20%, impacting overall cost efficiency for growth investments. Crowdfunding equity platforms usually require significantly lower minimums, sometimes as low as $1,000, with comparatively lower fees but increased risk due to less rigorous due diligence. Evaluating fee structures and capital requirements is crucial for optimizing returns and aligning investment strategies with risk tolerance and growth objectives.

Suitability for Various Growth Investment Goals

Private equity offers substantial capital infusion and strategic guidance ideal for established companies targeting rapid expansion or market consolidation. Crowdfunding equity provides access to diverse investor bases suited for early-stage ventures or niche projects seeking moderate growth with community engagement. Each funding method aligns differently with growth objectives, risk tolerance, and investor involvement preferences.

Related Important Terms

Micro-Private Equity

Micro-Private Equity offers targeted growth investments by providing substantial capital and strategic guidance to smaller companies, unlike crowdfunding equity which pools smaller investments from many individuals often resulting in diluted ownership and limited involvement. For asset growth, Micro-Private Equity delivers higher value through active management and long-term commitment, optimizing returns in niche markets where crowdfunding equity may fall short.

Equity Tokenization

Private Equity offers substantial capital with strategic management input but lacks liquidity and accessibility for smaller investors, whereas Crowdfunding Equity democratizes investment opportunities through blockchain-based equity tokenization that enhances transparency, fractional ownership, and secondary market trading. Equity tokenization transforms traditional growth investments by enabling faster capital inflows, reducing transaction costs, and providing real-time asset liquidity, thereby attracting a broader investor base and accelerating portfolio expansion.

Community-Sourced Equity

Community-sourced equity in crowdfunding democratizes growth investments by enabling a diverse pool of individual investors to fund startups and small businesses, often fostering stronger brand loyalty and local economic impact. Unlike traditional private equity, which involves high-net-worth investors and institutional funds with stringent entry requirements, crowdfunding equity offers accessible, transparent investment opportunities and aligns investor interests directly with business success.

Direct Investment Platforms

Private equity offers substantial capital infusion from professional investors, enabling high-growth potential through hands-on management and strategic guidance, while crowdfunding equity via direct investment platforms democratizes access by pooling smaller investments from a diverse crowd, facilitating startup and SME funding with increased liquidity options. Direct investment platforms enhance transparency and investor control, bridging the gap between traditional private equity's exclusivity and crowdfunding's broad investor base, ideal for targeted growth capital deployment.

Fractional Ownership Shares

Private equity typically involves larger investment sums and exclusive access to fractional ownership shares, providing greater control and long-term growth potential compared to crowdfunding equity, which offers smaller entry points and broader investor participation. Fractional ownership shares in private equity allow investors to diversify within a high-net-worth portfolio, while crowdfunding equity enables access to emerging companies with lower financial barriers.

Syndicate Crowdfunding

Syndicate crowdfunding empowers investors to pool resources and partner with lead investors who conduct due diligence and manage deals, offering greater access to diversified growth opportunities compared to traditional private equity funds that require substantial capital commitments and longer lock-in periods. This model provides startups and growth-stage companies with more flexible funding solutions and quicker capital access while enabling investors to benefit from collective expertise and reduced individual risk exposure.

SPV (Special Purpose Vehicle) Crowdfunding

Private Equity typically involves large, institutional investors pooling capital in a centralized vehicle, whereas SPV Crowdfunding structures allow multiple retail investors to collectively invest through a single Special Purpose Vehicle, enhancing access to growth opportunities with streamlined management. SPV Crowdfunding optimizes risk distribution and regulatory compliance while enabling smaller investors to participate in equity growth rounds that are traditionally dominated by private equity firms.

Accredited Investor Pools

Private equity offers accredited investors access to larger, professionally managed growth investments with higher minimum capital thresholds, leveraging established networks and due diligence processes for optimized returns. Crowdfunding equity enables a broader pool of accredited investors to participate in early-stage growth opportunities with lower entry points, fostering diversification but often involving higher risk and less regulatory oversight.

Post-Crowdfunding Secondary Markets

Post-crowdfunding secondary markets provide liquidity options that traditional private equity lacks, enabling investors to trade equity stakes more efficiently after initial funding rounds. These markets enhance capital accessibility for growth-stage companies by facilitating faster valuation adjustments and investor exits compared to the typically longer lock-in periods of private equity investments.

Exit Liquidity Solutions

Private equity offers structured exit liquidity solutions through predetermined buyouts, secondary sales, or IPOs, providing investors with defined exit timelines and return expectations. Crowdfunding equity typically presents less predictable exit opportunities, relying on platform buybacks or company acquisitions, which may result in longer liquidity horizons and varied exit outcomes.

Private Equity vs Crowdfunding Equity for growth investments Infographic

moneydiff.com

moneydiff.com