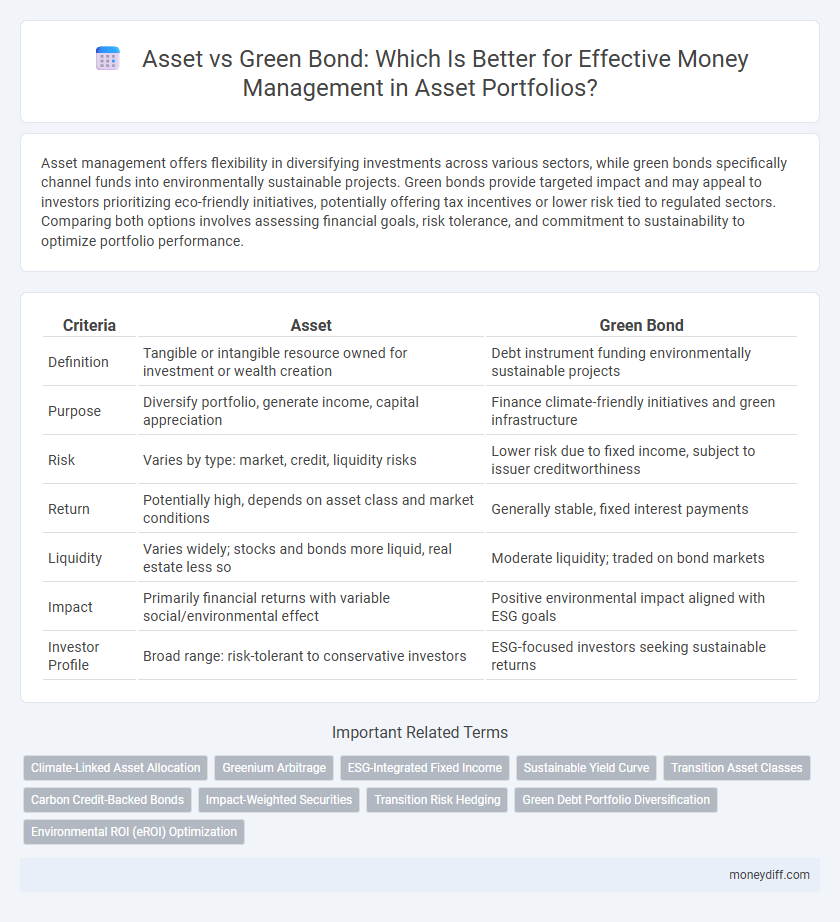

Asset management offers flexibility in diversifying investments across various sectors, while green bonds specifically channel funds into environmentally sustainable projects. Green bonds provide targeted impact and may appeal to investors prioritizing eco-friendly initiatives, potentially offering tax incentives or lower risk tied to regulated sectors. Comparing both options involves assessing financial goals, risk tolerance, and commitment to sustainability to optimize portfolio performance.

Table of Comparison

| Criteria | Asset | Green Bond |

|---|---|---|

| Definition | Tangible or intangible resource owned for investment or wealth creation | Debt instrument funding environmentally sustainable projects |

| Purpose | Diversify portfolio, generate income, capital appreciation | Finance climate-friendly initiatives and green infrastructure |

| Risk | Varies by type: market, credit, liquidity risks | Lower risk due to fixed income, subject to issuer creditworthiness |

| Return | Potentially high, depends on asset class and market conditions | Generally stable, fixed interest payments |

| Liquidity | Varies widely; stocks and bonds more liquid, real estate less so | Moderate liquidity; traded on bond markets |

| Impact | Primarily financial returns with variable social/environmental effect | Positive environmental impact aligned with ESG goals |

| Investor Profile | Broad range: risk-tolerant to conservative investors | ESG-focused investors seeking sustainable returns |

Understanding Assets and Green Bonds: Key Definitions

Assets represent resources with economic value owned by individuals or institutions, including physical items, financial investments, and intellectual property. Green bonds are fixed-income financial instruments specifically issued to fund projects that have positive environmental benefits, such as renewable energy or sustainable infrastructure. Understanding these definitions helps investors distinguish between general assets and targeted sustainable investments to optimize money management strategies.

Comparing Asset Investment and Green Bond Investment

Asset investment offers diverse opportunities across equities, real estate, and commodities, generally providing higher potential returns with variable risk levels, while green bond investment specifically targets environmentally sustainable projects, ensuring steady income with lower volatility. Green bonds attract investors prioritizing ESG criteria, offering tax benefits and alignment with global climate goals, whereas traditional asset investments offer flexibility and broader market exposure. Evaluating risk tolerance, return expectations, and sustainability goals is crucial when choosing between asset investment and green bond investment.

Risk Profiles: Asset Classes vs. Green Bonds

Asset classes encompass a broad spectrum of risk profiles, ranging from low-risk government bonds to high-risk equities, providing diversified investment opportunities tailored to varying risk appetites. Green bonds, specifically designed to fund environmentally-friendly projects, typically exhibit moderate risk levels influenced by the underlying project's sustainability and credit rating. Investors seeking environmentally responsible portfolios often balance green bonds with traditional asset classes to optimize risk-adjusted returns while advancing ESG goals.

Return Potential: Assessing Financial Performance

Asset investments often provide a more diversified return potential compared to green bonds, which are specifically tied to environmentally sustainable projects. While green bonds offer stable, lower-risk returns linked to fixed-income securities, traditional assets such as equities and real estate typically exhibit higher variability but greater upside in financial performance. Evaluating the expected yield, risk tolerance, and market conditions is essential for optimizing money management strategies between asset classes and green bonds.

Environmental Impact: Green Bonds vs. Traditional Assets

Green bonds specifically fund environmentally sustainable projects, offering investors a direct way to contribute to climate change mitigation and renewable energy initiatives. Traditional assets may provide financial returns but often lack targeted environmental impact, making green bonds a preferred choice for eco-conscious portfolios. Investing in green bonds aligns capital allocation with global sustainability goals, enhancing the environmental footprint of asset management strategies.

Portfolio Diversification: Role of Assets and Green Bonds

Assets provide a broad foundation for portfolio diversification by including various classes such as stocks, bonds, and real estate, which balance risk and return profiles. Green bonds specifically enhance diversification by targeting environmentally sustainable projects, offering exposure to the growing green economy without compromising financial stability. Integrating green bonds with traditional assets reduces overall portfolio volatility and aligns investment goals with environmental, social, and governance (ESG) criteria.

Liquidity Considerations: Assets Compared to Green Bonds

Assets generally offer higher liquidity compared to green bonds, enabling quicker conversion to cash without significant price impact. Green bonds, while providing targeted environmental investment opportunities, often have longer maturities and lower trading volumes, resulting in reduced liquidity. Investors prioritizing immediate access to funds may favor traditional assets over green bonds for more flexible money management.

Tax Advantages: Asset Investments vs. Green Bonds

Asset investments often provide tax advantages such as depreciation deductions, capital gains deferrals, and interest expense deductions, which can significantly reduce taxable income. Green bonds offer tax-exempt interest income in many jurisdictions, making them attractive for investors seeking tax-efficient fixed income options while supporting environmental projects. Comparing tax benefits requires assessing individual asset types, investor tax brackets, and jurisdiction-specific regulations to optimize overall money management strategies.

Suitability for Investors: Who Should Choose What?

Investors seeking steady income and long-term capital appreciation typically prefer assets such as stocks and bonds, which offer diversified risk and potential growth. Green bonds are ideal for socially conscious investors prioritizing environmental impact alongside financial returns, as they fund projects aligned with sustainability goals. Portfolio diversification strategies might combine traditional assets with green bonds to balance profitability with ethical investing.

Future Trends in Asset and Green Bond Money Management

Future trends in asset and green bond money management emphasize integrating environmental, social, and governance (ESG) criteria to drive sustainable investment portfolios. The growing demand for green bonds reflects increased investor interest in funding renewable energy, climate resilience projects, and carbon-neutral initiatives, influencing asset allocation strategies. Advances in AI and big data analytics enhance risk assessment and performance forecasting, enabling more precise alignment of assets with long-term sustainability goals.

Related Important Terms

Climate-Linked Asset Allocation

Climate-linked asset allocation strategically integrates green bonds into diversified portfolios to enhance environmental impact while managing financial risk. Unlike traditional assets, green bonds provide targeted funding for renewable energy and sustainable infrastructure, aligning investment returns with climate goals.

Greenium Arbitrage

Green bond investments often provide lower yields compared to traditional assets due to the "greenium," a premium investors accept for supporting sustainable projects. Exploiting greenium arbitrage involves strategically balancing portfolios by allocating funds between higher-yield traditional assets and lower-yield green bonds to maximize overall returns while promoting environmentally responsible investments.

ESG-Integrated Fixed Income

ESG-integrated fixed income strategies prioritize assets that align with environmental, social, and governance criteria, offering investors a balanced approach between risk management and sustainable impact. Unlike green bonds, which are specifically tied to funding environmental projects, ESG-integrated fixed income portfolios provide broader asset diversification while embedding sustainability metrics into traditional fixed income investments.

Sustainable Yield Curve

Asset allocation in sustainable finance prioritizes instruments like green bonds, which fund environmentally beneficial projects and contribute to a stable Sustainable Yield Curve by aligning returns with long-term ecological goals. Unlike traditional assets, green bonds integrate ESG criteria, enhancing risk-adjusted returns and supporting the transition to a low-carbon economy.

Transition Asset Classes

Transition asset classes bridge the gap between traditional assets and green bonds by supporting environmentally sustainable projects while still offering moderate risk and return profiles. These assets enable investors to finance the shift toward a low-carbon economy, balancing financial performance with environmental impact in money management strategies.

Carbon Credit-Backed Bonds

Carbon credit-backed bonds offer a unique asset class that combines environmental impact with financial returns by leveraging carbon offset projects to generate tradable credits. Compared to traditional green bonds, these bonds provide direct exposure to carbon markets, enhancing portfolio diversification and aligning investment strategies with global sustainability goals.

Impact-Weighted Securities

Impact-weighted securities prioritize measurable environmental and social outcomes, offering investors tangible benefits beyond financial returns compared to traditional assets. Green bonds specifically channel funds to eco-friendly projects, integrating sustainability metrics that enhance portfolio impact without compromising asset performance.

Transition Risk Hedging

Assets diversified across sectors offer traditional stability, while green bonds specifically target environmental projects, providing strategic hedging against transition risks associated with regulatory shifts in sustainability policies. Allocating capital to green bonds enhances portfolio resilience by aligning investments with low-carbon transition pathways and mitigating potential losses from fossil fuel asset stranding.

Green Debt Portfolio Diversification

Green bonds enhance asset portfolios by providing targeted exposure to environmentally sustainable projects, mitigating risks associated with traditional investments. Incorporating green debt instruments diversifies asset holdings, reducing volatility while aligning capital allocation with climate-conscious financial strategies.

Environmental ROI (eROI) Optimization

Investing in assets with high Environmental ROI (eROI) optimization leverages green bonds to channel capital specifically into sustainable projects yielding measurable ecological benefits. While traditional assets may offer financial returns, green bonds uniquely align money management strategies with environmental impact, maximizing eROI through targeted funding in renewable energy, conservation, and low-carbon infrastructure.

Asset vs Green Bond for money management. Infographic

moneydiff.com

moneydiff.com