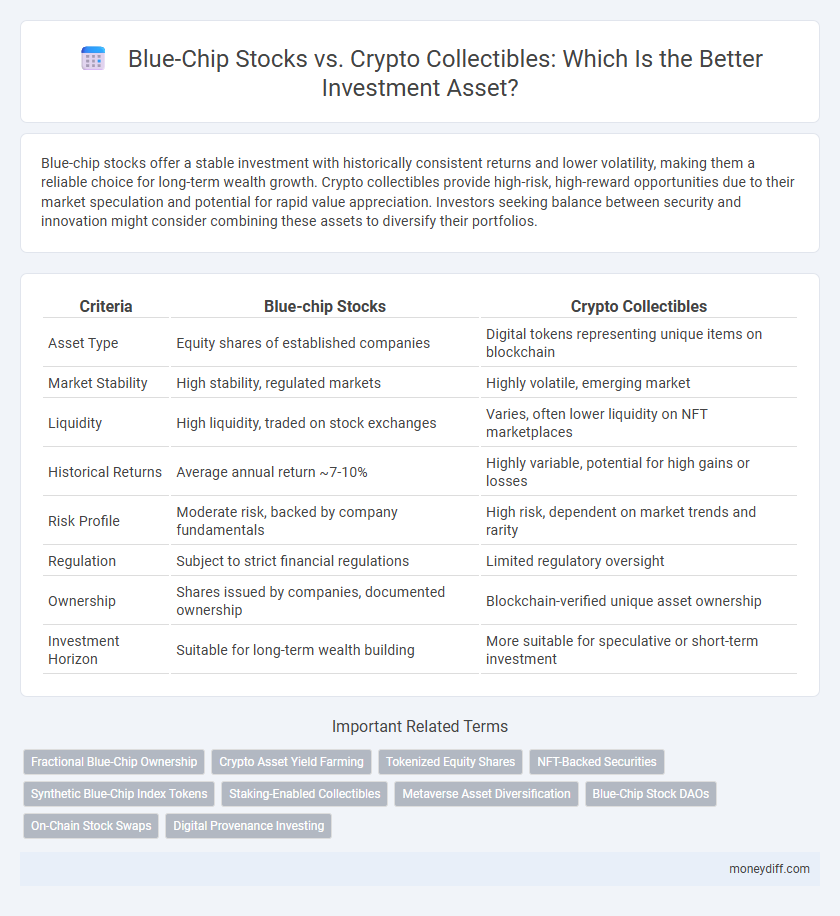

Blue-chip stocks offer a stable investment with historically consistent returns and lower volatility, making them a reliable choice for long-term wealth growth. Crypto collectibles provide high-risk, high-reward opportunities due to their market speculation and potential for rapid value appreciation. Investors seeking balance between security and innovation might consider combining these assets to diversify their portfolios.

Table of Comparison

| Criteria | Blue-chip Stocks | Crypto Collectibles |

|---|---|---|

| Asset Type | Equity shares of established companies | Digital tokens representing unique items on blockchain |

| Market Stability | High stability, regulated markets | Highly volatile, emerging market |

| Liquidity | High liquidity, traded on stock exchanges | Varies, often lower liquidity on NFT marketplaces |

| Historical Returns | Average annual return ~7-10% | Highly variable, potential for high gains or losses |

| Risk Profile | Moderate risk, backed by company fundamentals | High risk, dependent on market trends and rarity |

| Regulation | Subject to strict financial regulations | Limited regulatory oversight |

| Ownership | Shares issued by companies, documented ownership | Blockchain-verified unique asset ownership |

| Investment Horizon | Suitable for long-term wealth building | More suitable for speculative or short-term investment |

Introduction to Blue-chip Stocks and Crypto Collectibles

Blue-chip stocks represent shares of well-established companies with a history of stable earnings, strong market capitalization, and reliable dividend payments, making them a cornerstone for conservative investment portfolios. Crypto collectibles, also known as non-fungible tokens (NFTs), are unique digital assets secured by blockchain technology, offering potential high returns through digital scarcity and cultural relevance. Investors evaluate blue-chip stocks for long-term stability, while crypto collectibles attract those seeking innovation and high growth in emerging digital markets.

Historical Performance: Blue-chip Stocks vs Crypto Collectibles

Blue-chip stocks have demonstrated consistent historical performance with steady dividends and long-term capital appreciation, reflecting the financial stability of established corporations. In contrast, crypto collectibles exhibit high volatility and speculative price swings, driven largely by market sentiment and scarcity rather than traditional financial metrics. Investors seeking reliable returns often favor blue-chip stocks, while crypto collectibles attract those willing to endure risk for potentially exponential gains.

Risk Profile of Blue-chip Stocks and Crypto Collectibles

Blue-chip stocks offer a lower risk profile due to established market presence, stable earnings, and regulatory oversight, making them suitable for conservative investors seeking steady returns. Crypto collectibles exhibit high volatility and lack historical valuation benchmarks, leading to substantial price fluctuations and increased investment risk. Diversifying portfolios with blue-chip stocks can mitigate exposure to the unpredictable market swings commonly associated with digital collectibles.

Liquidity and Accessibility of Each Asset Class

Blue-chip stocks offer high liquidity through established stock exchanges, enabling investors to buy and sell shares quickly with minimal price volatility. Crypto collectibles, while increasing in popularity, often face lower liquidity due to limited marketplaces and less standardized trading mechanisms. Accessibility to blue-chip stocks benefits from regulatory frameworks and brokerage platforms, whereas crypto collectibles require digital wallets and familiarity with blockchain technology, potentially limiting mass adoption.

Market Volatility: Comparing Blue-chip Stocks and Crypto Collectibles

Blue-chip stocks offer lower market volatility due to established company stability and historical performance, providing more predictable returns for investors. Crypto collectibles exhibit significantly higher volatility driven by speculative trading, market sentiment, and limited liquidity. Understanding these volatility differences aids investors in balancing risk exposure between traditional assets and emerging digital investments.

Ownership and Security Considerations

Blue-chip stocks offer investors regulated ownership with transparent shareholder rights and established legal protections, ensuring secure and verifiable asset holding. Crypto collectibles leverage blockchain technology for decentralized digital ownership, providing immutable proof of authenticity but with higher susceptibility to cybersecurity risks and regulatory uncertainties. Investors must weigh the traditional security and stability of blue-chip stocks against the innovative but volatile nature of crypto asset ownership.

Income Generation: Dividends vs Potential Appreciation

Blue-chip stocks provide reliable income generation through regular dividend payments, making them attractive for investors seeking steady cash flow. Crypto collectibles offer potential appreciation with high volatility, but rarely produce dividends or passive income. Investors focused on stable income may prefer blue-chip stocks, while those targeting capital gains may consider crypto collectibles despite their uncertain income prospects.

Regulatory Environment and Investor Protection

Blue-chip stocks benefit from a well-established regulatory framework governed by entities such as the U.S. Securities and Exchange Commission (SEC), ensuring investor protection through transparency, mandatory disclosures, and fraud prevention measures. Crypto collectibles, or non-fungible tokens (NFTs), operate in a less mature regulatory environment with varying global standards, often lacking comprehensive investor safeguards and exposing holders to greater market volatility and potential fraud. Investors prioritizing regulatory oversight and legal recourse generally find blue-chip stocks offer a safer asset class compared to the nascent and rapidly evolving crypto collectibles market.

Diversification Strategies with Blue-chip Stocks and Crypto Collectibles

Diversification strategies involving blue-chip stocks and crypto collectibles balance stability and high-growth potential within investment portfolios. Blue-chip stocks offer consistent dividends and reliable market performance, providing a foundation of financial security, while crypto collectibles introduce exposure to emerging digital asset markets with unique appreciation prospects. Combining these assets reduces portfolio volatility by leveraging traditional market resilience alongside innovative, high-risk opportunities.

Choosing the Right Asset for Your Investment Goals

Blue-chip stocks offer stability and long-term growth potential due to their established market presence and consistent dividends, making them ideal for conservative investors focused on steady returns. Crypto collectibles, such as NFTs, provide high-risk, high-reward opportunities with significant volatility and potential for rapid appreciation, appealing to investors seeking speculative gains. Evaluating your risk tolerance, investment horizon, and liquidity needs is essential to selecting the asset class that aligns with your financial objectives.

Related Important Terms

Fractional Blue-Chip Ownership

Fractional blue-chip ownership enables investors to acquire shares of high-value, established companies like Apple or Microsoft without the need for large capital outlays, enhancing portfolio diversification and stability. Unlike volatile crypto collectibles, blue-chip fractions offer predictable dividends and long-term appreciation, aligning with conservative investment strategies.

Crypto Asset Yield Farming

Crypto asset yield farming offers higher potential returns compared to blue-chip stocks by leveraging decentralized finance protocols to earn passive income through staking and liquidity provision. However, yield farming carries increased risks such as smart contract vulnerabilities and market volatility, contrasting the relative stability and long-term growth associated with blue-chip equity investments.

Tokenized Equity Shares

Tokenized equity shares represent a fusion of traditional blue-chip stocks and blockchain innovation, offering fractional ownership and enhanced liquidity compared to conventional shares. Unlike volatile crypto collectibles, tokenized stocks provide investors with regulatory-backed dividends and voting rights, making them a more stable and transparent asset class within digital investment portfolios.

NFT-Backed Securities

NFT-backed securities combine the stability of blue-chip stocks with the innovation of crypto collectibles by offering digital ownership authenticated on blockchain, providing investors with unique asset diversification. These securities leverage the liquidity and regulatory frameworks of traditional markets while capturing the high-growth potential and exclusivity of NFTs, making them an emerging class of investment assets.

Synthetic Blue-Chip Index Tokens

Synthetic Blue-Chip Index Tokens combine the stability of traditional blue-chip stocks with the innovative exposure of crypto collectibles, offering diversified investment assets on blockchain platforms. These tokens synthesize market capitalization and liquidity metrics, enabling investors to gain fractionalized ownership in top-performing blue-chip portfolios while benefiting from crypto asset security and transparency.

Staking-Enabled Collectibles

Staking-enabled crypto collectibles offer investors the potential for passive income through token staking rewards, providing an innovative alternative to traditional blue-chip stocks known for their dividend payouts and long-term stability. While blue-chip stocks provide established market value and lower volatility, staking-enabled collectibles present dynamic asset appreciation opportunities driven by blockchain technology and decentralized finance mechanisms.

Metaverse Asset Diversification

Blue-chip stocks offer stable, long-term growth with established market value, making them a cornerstone for traditional asset diversification in the metaverse economy. Crypto collectibles provide unique, tokenized ownership and high volatility, enabling investors to capitalize on emerging digital trends and niche markets within virtual environments.

Blue-Chip Stock DAOs

Blue-chip stock DAOs combine the stability of blue-chip equities with decentralized governance, offering investors transparent, community-driven asset management in traditional markets. These DAOs enable fractional ownership and liquidity in high-value stocks, contrasting with the volatility and speculative nature of crypto collectibles.

On-Chain Stock Swaps

On-chain stock swaps enable instant, secure exchange of blue-chip stocks with crypto collectibles using blockchain technology, enhancing liquidity and transparency. These swaps reduce intermediaries, lower transaction costs, and provide investors with diversified asset portfolios through programmable smart contracts.

Digital Provenance Investing

Blue-chip stocks offer well-established asset stability with transparent financial histories, while crypto collectibles leverage blockchain technology to provide immutable digital provenance and unique ownership verification. Investors prioritizing digital provenance should consider crypto collectibles for their enhanced traceability and scarcity benefits compared to traditional blue-chip equity investments.

Blue-chip Stocks vs Crypto Collectibles for investment assets. Infographic

moneydiff.com

moneydiff.com