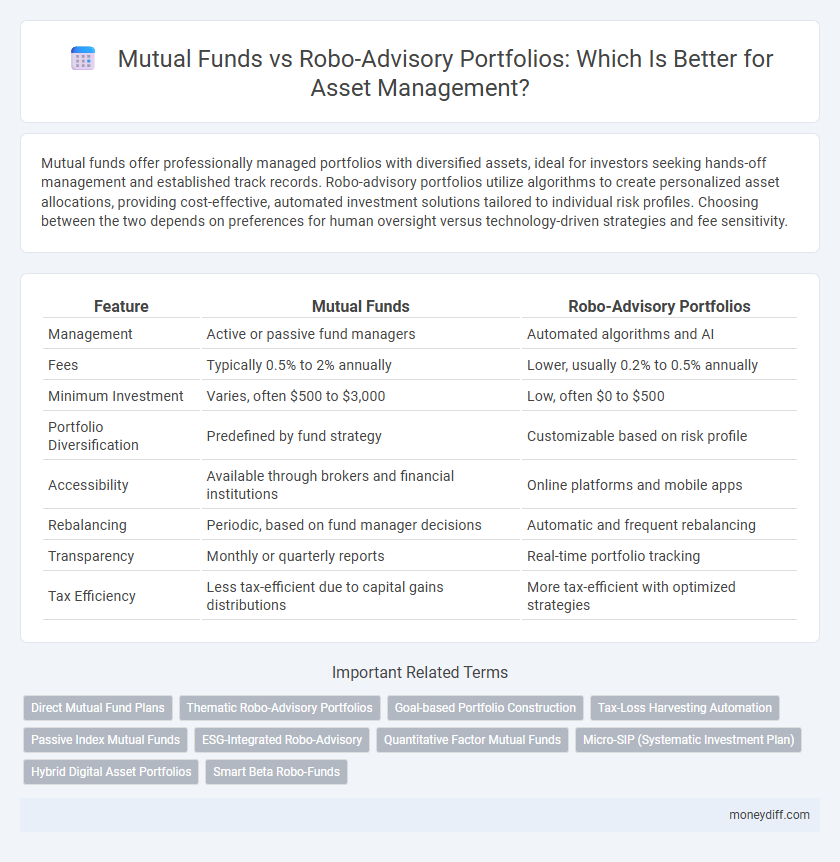

Mutual funds offer professionally managed portfolios with diversified assets, ideal for investors seeking hands-off management and established track records. Robo-advisory portfolios utilize algorithms to create personalized asset allocations, providing cost-effective, automated investment solutions tailored to individual risk profiles. Choosing between the two depends on preferences for human oversight versus technology-driven strategies and fee sensitivity.

Table of Comparison

| Feature | Mutual Funds | Robo-Advisory Portfolios |

|---|---|---|

| Management | Active or passive fund managers | Automated algorithms and AI |

| Fees | Typically 0.5% to 2% annually | Lower, usually 0.2% to 0.5% annually |

| Minimum Investment | Varies, often $500 to $3,000 | Low, often $0 to $500 |

| Portfolio Diversification | Predefined by fund strategy | Customizable based on risk profile |

| Accessibility | Available through brokers and financial institutions | Online platforms and mobile apps |

| Rebalancing | Periodic, based on fund manager decisions | Automatic and frequent rebalancing |

| Transparency | Monthly or quarterly reports | Real-time portfolio tracking |

| Tax Efficiency | Less tax-efficient due to capital gains distributions | More tax-efficient with optimized strategies |

Introduction to Mutual Funds and Robo-Advisory Portfolios

Mutual funds pool capital from multiple investors to invest in diversified portfolios managed by professional fund managers, offering accessibility and a range of asset classes such as equities, bonds, and money markets. Robo-advisory portfolios utilize algorithm-driven platforms to create and manage personalized investment portfolios based on individual risk tolerance, financial goals, and asset allocation strategies with minimal human intervention. Both investment vehicles aim to optimize asset growth while catering to different levels of investor engagement and management fee structures.

Core Differences: Mutual Funds vs Robo-Advisory Portfolios

Mutual funds pool investments from multiple investors to purchase a diversified portfolio managed by professional fund managers, offering active or passive management with predetermined fund objectives. Robo-advisory portfolios utilize algorithm-driven technology to automatically allocate and rebalance assets based on individual risk profiles and financial goals, emphasizing low-cost, automated investment management. The core difference lies in mutual funds' human-managed collective investment approach versus robo-advisors' personalized, technology-driven asset allocation and continuous portfolio adjustments.

Risk Management Strategies in Mutual Funds and Robo-Advisors

Mutual funds employ professional portfolio managers who actively adjust asset allocations and diversify holdings to mitigate market risks and protect investor capital. Robo-advisory portfolios utilize algorithm-driven models to implement risk management through automated rebalancing and tax-loss harvesting based on investor risk profiles. Both approaches prioritize dynamic risk assessment but differ in human oversight and technology integration for optimizing asset growth.

Costs and Fees: Comparing Investment Expenses

Mutual funds typically charge expense ratios ranging from 0.5% to 1.5%, reflecting management fees, administrative costs, and distribution charges, which can erode long-term returns. Robo-advisory portfolios generally offer lower fees, often between 0.25% and 0.50%, due to automated management and lower operational expenses. Investors should assess total cost structures, including fund expense ratios and platform fees, to optimize net investment performance.

Performance Track Record: Historical Returns Analysis

Mutual funds typically offer a more extensive performance track record with historical returns spanning several decades, enabling investors to analyze long-term trends and risk-adjusted returns. Robo-advisory portfolios leverage algorithm-driven strategies that adapt in real-time to market changes but often lack the extensive historical data available for traditional mutual funds. Evaluating mutual funds' past performance alongside robo-advisors' dynamic rebalancing can provide a comprehensive understanding of potential asset growth and volatility management.

Diversification Benefits in Mutual Funds and Robo-Portfolios

Mutual funds offer broad diversification by pooling assets from numerous investors to invest in a wide range of securities, reducing individual risk exposure. Robo-advisory portfolios also provide diversified asset allocations through algorithm-driven strategies tailored to investor risk profiles, often including ETFs and bonds for balanced growth. Both options enhance diversification benefits, but mutual funds typically deliver instant diversification at scale, while robo-advisors continuously rebalance portfolios to maintain optimal asset allocation.

Accessibility and Ease of Use for Investors

Mutual funds offer broad accessibility through traditional platforms and require minimal initial investment, making them suitable for a wide range of investors. Robo-advisory portfolios enhance ease of use by employing algorithm-driven strategies with intuitive digital interfaces, providing personalized asset management with low fees. Investors benefit from mutual funds' well-established presence, while robo-advisors deliver streamlined, automated portfolio adjustments for enhanced convenience and real-time access.

Customization and Personalization of Asset Allocation

Mutual funds offer asset allocation based on predefined strategies managed by professionals, limiting customization to investor-selected fund options. Robo-advisory portfolios provide personalized asset allocation through algorithms tailored to individual risk tolerance, goals, and time horizons, enabling dynamic rebalancing. This automated customization enhances precision and responsiveness compared to traditional mutual fund allocation methods.

Tax Efficiency: Mutual Funds vs Robo-Advisory Accounts

Mutual funds often experience higher capital gains distributions due to active management and frequent trading, resulting in greater tax liabilities for investors. Robo-advisory portfolios utilize tax-loss harvesting strategies and low turnover to enhance tax efficiency and reduce taxable income. Investors seeking optimized asset growth should consider robo-advisors for their ability to minimize tax impact through automated, tax-efficient portfolio management.

Which Option Suits Your Financial Goals?

Mutual funds provide diversified asset management managed by professional fund managers, ideal for investors seeking hands-off involvement and consistent market exposure. Robo-advisory portfolios use algorithms to tailor asset allocation dynamically, offering personalized investment strategies with lower fees, making them suitable for tech-savvy investors prioritizing cost efficiency and automation. Selecting between mutual funds and robo-advisors depends on your financial goals, risk tolerance, and preference for active versus automated management in achieving optimal asset growth.

Related Important Terms

Direct Mutual Fund Plans

Direct Mutual Fund Plans offer cost-effective investment options with lower expense ratios compared to robo-advisory portfolios, maximizing returns by eliminating intermediary fees. These plans provide investors with the flexibility to choose funds aligned with their risk tolerance and financial goals, enhancing portfolio personalization and asset growth potential.

Thematic Robo-Advisory Portfolios

Thematic robo-advisory portfolios leverage algorithm-driven strategies to create diversified asset allocations focused on specific sectors or trends, enabling targeted exposure that traditional mutual funds may lack due to broader investment mandates. These portfolios offer cost-effective, dynamic rebalancing aligned with evolving market themes, enhancing potential returns and risk management compared to conventional mutual fund investments.

Goal-based Portfolio Construction

Mutual funds offer professionally managed, diversified portfolios tailored to specific investment goals, while robo-advisory platforms use algorithm-driven goal-based portfolio construction that automatically adjusts asset allocation based on individual risk tolerance and target outcomes. Robo-advisors provide continuous portfolio rebalancing and tax-loss harvesting, enhancing personalized asset management compared to the more static structure of traditional mutual funds.

Tax-Loss Harvesting Automation

Mutual funds typically distribute capital gains that can trigger tax liabilities, whereas robo-advisory portfolios offer automated tax-loss harvesting to minimize taxable events and optimize after-tax returns. This automation systematically sells losing investments to offset gains, enhancing overall tax efficiency within asset management strategies.

Passive Index Mutual Funds

Passive index mutual funds provide cost-effective, diversified exposure by tracking market indices, making them a preferred choice for long-term asset growth compared to robo-advisory portfolios that often incorporate algorithm-driven active management and personalized asset allocation strategies. Investors seeking simplicity and lower fees benefit from passive mutual funds, while those prioritizing tailored portfolio adjustments may lean towards the adaptive, technology-based approach of robo-advisors.

ESG-Integrated Robo-Advisory

ESG-integrated robo-advisory portfolios leverage algorithm-driven asset allocation models prioritizing environmental, social, and governance criteria, offering automated, personalized investment strategies with enhanced transparency and scalability compared to traditional mutual funds. These digital platforms optimize ESG impact by continuously analyzing real-time data, enabling dynamic adjustments that align with evolving sustainability goals and risk profiles.

Quantitative Factor Mutual Funds

Quantitative factor mutual funds leverage advanced algorithms and data-driven models to identify asset patterns and optimize portfolio allocations, offering a systematic approach to asset management compared to robo-advisory portfolios that primarily use rule-based automation. These funds employ factors such as value, momentum, and volatility to enhance risk-adjusted returns while robo-advisory platforms focus on automation, cost-efficiency, and client risk profiles without the nuanced factor exposure of quantitative funds.

Micro-SIP (Systematic Investment Plan)

Micro-SIP investment in mutual funds offers personalized portfolio management with human expertise, while robo-advisory portfolios utilize algorithm-driven strategies to optimize asset allocation with minimal fees. Comparing these options reveals that micro-SIP plans provide flexibility in selecting diverse mutual fund schemes, whereas robo-advisors ensure disciplined, automated investment aligned with risk preferences and financial goals.

Hybrid Digital Asset Portfolios

Hybrid digital asset portfolios combine mutual funds' diversified, professionally managed approach with robo-advisory portfolios' algorithm-driven, low-cost execution to optimize asset allocation. This integration leverages automated rebalancing and data analytics to enhance risk-adjusted returns while maintaining flexibility across equities, bonds, and alternative assets.

Smart Beta Robo-Funds

Smart Beta Robo-Funds combine algorithm-driven portfolio management with factor-based investing strategies, optimizing asset allocation by emphasizing specific factors such as value, momentum, or volatility to enhance returns and reduce risk compared to traditional mutual funds. These robo-advisory portfolios leverage data analytics and automation to dynamically rebalance assets, offering cost-effective, transparent, and adaptive investment solutions that outperform conventional fund management in capturing market inefficiencies.

Mutual Funds vs Robo-Advisory Portfolios for asset. Infographic

moneydiff.com

moneydiff.com