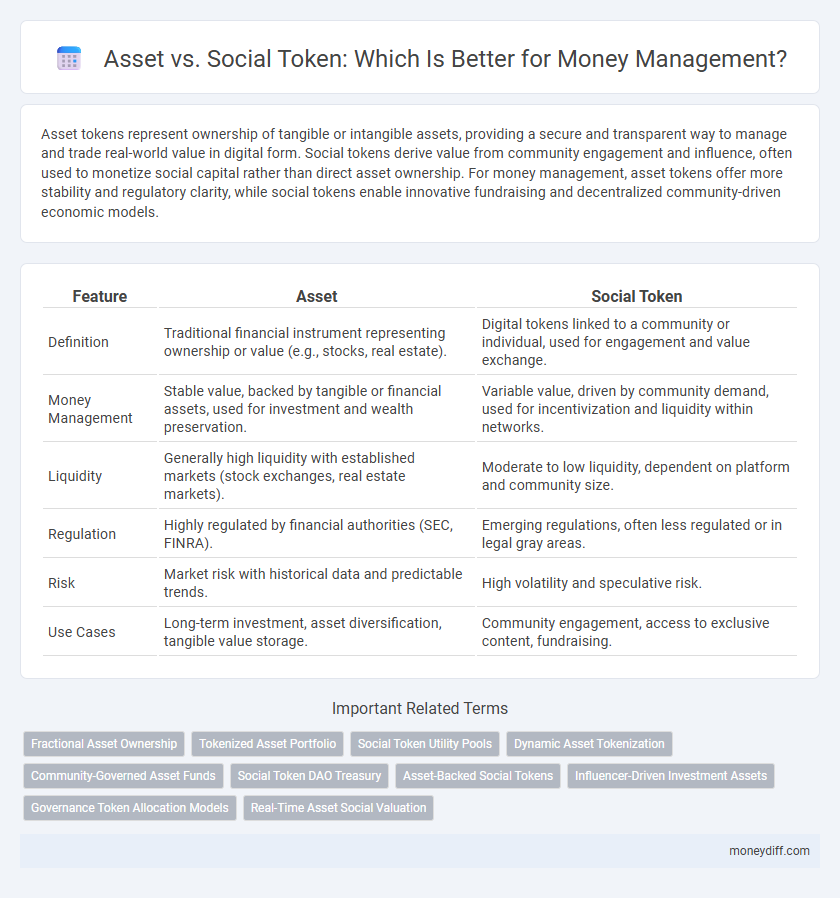

Asset tokens represent ownership of tangible or intangible assets, providing a secure and transparent way to manage and trade real-world value in digital form. Social tokens derive value from community engagement and influence, often used to monetize social capital rather than direct asset ownership. For money management, asset tokens offer more stability and regulatory clarity, while social tokens enable innovative fundraising and decentralized community-driven economic models.

Table of Comparison

| Feature | Asset | Social Token |

|---|---|---|

| Definition | Traditional financial instrument representing ownership or value (e.g., stocks, real estate). | Digital tokens linked to a community or individual, used for engagement and value exchange. |

| Money Management | Stable value, backed by tangible or financial assets, used for investment and wealth preservation. | Variable value, driven by community demand, used for incentivization and liquidity within networks. |

| Liquidity | Generally high liquidity with established markets (stock exchanges, real estate markets). | Moderate to low liquidity, dependent on platform and community size. |

| Regulation | Highly regulated by financial authorities (SEC, FINRA). | Emerging regulations, often less regulated or in legal gray areas. |

| Risk | Market risk with historical data and predictable trends. | High volatility and speculative risk. |

| Use Cases | Long-term investment, asset diversification, tangible value storage. | Community engagement, access to exclusive content, fundraising. |

Defining Assets and Social Tokens

Assets represent tangible or intangible resources with economic value owned by an individual or organization, such as properties, stocks, or intellectual property. Social tokens are blockchain-based digital assets tied to an individual, group, or community, designed to incentivize engagement and provide utility within social networks. While assets focus on inherent value and ownership, social tokens emphasize social capital and influence within digital ecosystems.

Key Differences Between Assets and Social Tokens

Assets represent tangible or intangible resources owned by individuals or entities, typically holding intrinsic value and serving as store of wealth or investment instruments. Social tokens are blockchain-based digital assets tied to a person, community, or brand, primarily designed to create social value and engagement rather than traditional financial returns. The key differences lie in their purpose: assets focus on financial value and ownership rights, while social tokens emphasize community participation, influence, and non-traditional economic models.

Use Cases for Assets in Money Management

Assets serve as tangible or intangible resources that hold intrinsic value, facilitating wealth preservation and risk diversification in money management strategies. Unlike social tokens, which primarily drive community engagement and digital interactions, assets such as real estate, stocks, and commodities provide steady income streams, capital appreciation, and collateral for loans. Effective asset allocation enables investors to optimize portfolio growth, manage liquidity needs, and safeguard against market volatility.

Social Tokens: Emerging Trends in Wealth

Social tokens represent a transformative shift in wealth management by enabling fractional ownership, enhanced liquidity, and direct community engagement compared to traditional assets. These blockchain-based tokens facilitate personalized financial ecosystems where holders gain access to exclusive experiences, governance rights, or revenue shares, fostering deeper value creation beyond mere asset appreciation. Emerging trends highlight social tokens' potential to democratize wealth, incentivize participation, and reshape digital economies with transparent, secure, and programmable financial instruments.

Risk Assessment: Assets vs Social Tokens

Risk assessment for assets involves evaluating tangible and financial instruments with established market values and regulatory oversight, providing clearer insights into volatility and liquidity. Social tokens carry higher risk due to their speculative nature, dependence on community engagement, and often limited regulatory frameworks, making their valuation more uncertain. Effective money management requires balancing the stability of traditional assets against the potentially high but unpredictable returns of social tokens.

Liquidity and Accessibility Comparison

Assets provide greater liquidity through tangible or tradable value, allowing easier conversion to cash or other forms of wealth. Social tokens, often tied to digital communities, offer accessibility benefits by enabling fractional ownership and streamlined transactions via blockchain technology. While traditional assets depend on market conditions for liquidity, social tokens leverage decentralized platforms to enhance access and fluidity in money management.

Potential Returns: Traditional Assets vs Social Tokens

Traditional assets like stocks and bonds offer historically stable and often predictable returns driven by market fundamentals and regulatory oversight. Social tokens, emerging from digital communities and blockchain ecosystems, present higher volatility but potential for exponential gains tied to community growth and creator influence. Investors seeking balanced portfolios may weigh the consistent dividend returns of traditional assets against the speculative, high-reward opportunities found in social tokens.

Security and Regulation Considerations

Security in asset management focuses on tangible collateral and regulatory compliance under established financial laws, ensuring transparency and risk mitigation through audited records and asset-backed guarantees. Social tokens, while innovative, present unique security challenges due to potential regulatory ambiguities, heightened risk of fraud, and the need for decentralized enforcement mechanisms. Regulatory frameworks for social tokens remain evolving, requiring careful legal scrutiny to address compliance gaps, anti-money laundering (AML), and investor protection standards.

Integrating Assets and Social Tokens in Portfolios

Integrating assets and social tokens in portfolios enhances diversification by combining traditional asset classes like stocks and real estate with blockchain-based digital tokens representing social influence and community value. Social tokens provide liquidity and fractional ownership, enabling new ways to monetize personal brands and community engagement alongside conventional investments. This hybrid approach leverages asset-backed stability and social token innovation, optimizing portfolio risk-adjusted returns and expanding access to emerging decentralized financial ecosystems.

Future Outlook: Evolution of Money Management

Assets are increasingly integrated with social tokens to revolutionize money management by enabling fractional ownership and enhanced liquidity on digital platforms. The future outlook highlights the growth of decentralized finance (DeFi) ecosystems where assets tokenized as social tokens facilitate seamless peer-to-peer transactions and real-time value tracking. Advanced blockchain protocols are set to drive transparency, security, and programmable asset functionalities, transforming traditional financial landscapes.

Related Important Terms

Fractional Asset Ownership

Fractional asset ownership enables investors to buy and hold portions of high-value assets, increasing liquidity and accessibility compared to traditional full ownership models. Social tokens, while useful for community engagement and rewards, lack the intrinsic value and legal recognition tied to fractionalized real assets, making them less suitable for money management strategies focused on asset-backed investments.

Tokenized Asset Portfolio

A tokenized asset portfolio leverages blockchain technology to represent real-world assets as digital tokens, enabling fractional ownership and enhanced liquidity. Compared to social tokens, which primarily function as community engagement tools, asset-backed tokens provide tangible value and stability for diversified money management strategies.

Social Token Utility Pools

Social Token Utility Pools enable community-driven asset management by allowing holders to participate in allocating funds toward projects, increasing transparency and engagement. Unlike traditional assets, social tokens integrate financial incentives with social governance, fostering decentralized control and real-time value creation.

Dynamic Asset Tokenization

Dynamic asset tokenization enhances money management by converting real-world assets into tradable digital tokens, offering increased liquidity and fractional ownership. Unlike social tokens, which represent individual or community value, dynamic asset tokens provide measurable financial backing and asset-linked stability for investors.

Community-Governed Asset Funds

Community-governed asset funds leverage decentralized decision-making to manage pooled resources, ensuring transparent asset allocation and collective ownership, unlike social tokens which primarily represent digital identity or membership without direct asset control. These funds enhance money management by enabling stakeholders to vote on investments, promoting accountability and fostering sustainable growth within the community ecosystem.

Social Token DAO Treasury

Social Token DAO Treasury offers innovative money management by leveraging blockchain-based social tokens to enable transparent, programmable asset control within decentralized communities. Unlike traditional assets, social tokens facilitate dynamic governance and fractional ownership, optimizing liquidity and value distribution in DAO ecosystems.

Asset-Backed Social Tokens

Asset-backed social tokens represent a hybrid financial instrument combining traditional asset ownership with blockchain-based digital currencies, enhancing transparency and liquidity in money management. These tokens tie real-world assets such as real estate, commodities, or equity to blockchain tokens, enabling fractional ownership and streamlined transactions while mitigating volatility common in conventional social tokens.

Influencer-Driven Investment Assets

Influencer-driven investment assets leverage social tokens to create personalized financial ecosystems that reflect the influencer's brand value and audience engagement, offering more dynamic and community-oriented money management compared to traditional asset structures. Social tokens enable fractional ownership and direct interaction between influencers and investors, transforming asset management into a participatory and transparent process.

Governance Token Allocation Models

Governance token allocation models are critical in distinguishing asset-based frameworks from social tokens by defining control and decision-making power in decentralized finance systems. Asset tokens typically allocate governance based on ownership stakes, while social tokens emphasize community engagement and contribution metrics to influence governance rights.

Real-Time Asset Social Valuation

Real-time asset social valuation leverages blockchain technology to provide transparent, instantaneous tracking of asset worth through social tokens, enabling better liquidity and community-driven value assessment. Unlike traditional assets, social tokens integrate user engagement and market sentiment, offering dynamic money management tools that reflect collective asset perception in real time.

Asset vs Social Token for money management. Infographic

moneydiff.com

moneydiff.com