Art ownership offers a tangible sense of pride and direct control over a unique piece, while fractional art ownership enables investors to diversify their portfolio by holding shares in high-value artworks. Fractional ownership lowers the entry barrier, making prestigious art accessible without the burden of full acquisition and maintenance costs. Both approaches provide different opportunities for asset growth and market exposure depending on investor goals.

Table of Comparison

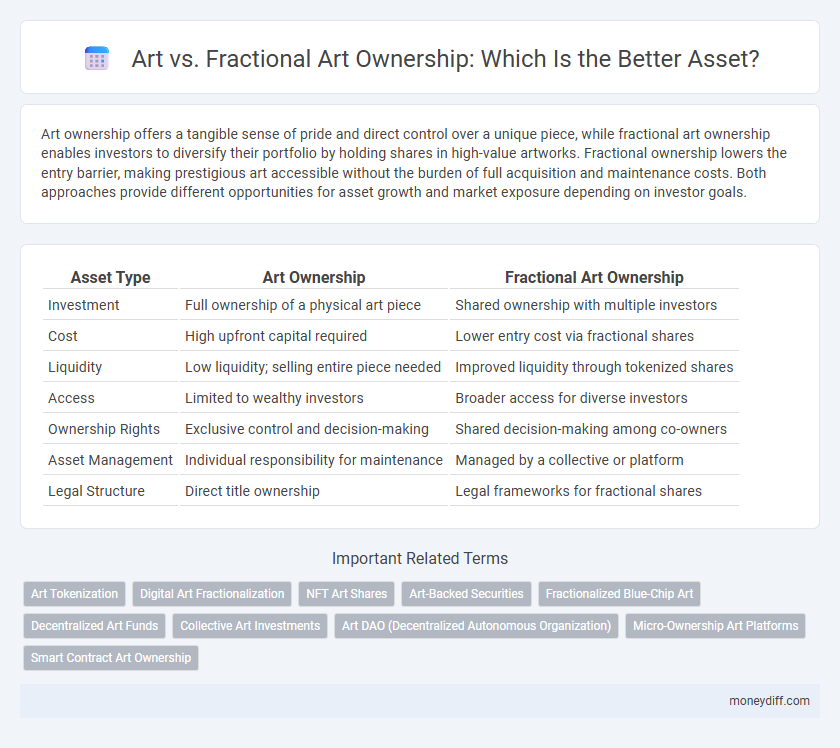

| Asset Type | Art Ownership | Fractional Art Ownership |

|---|---|---|

| Investment | Full ownership of a physical art piece | Shared ownership with multiple investors |

| Cost | High upfront capital required | Lower entry cost via fractional shares |

| Liquidity | Low liquidity; selling entire piece needed | Improved liquidity through tokenized shares |

| Access | Limited to wealthy investors | Broader access for diverse investors |

| Ownership Rights | Exclusive control and decision-making | Shared decision-making among co-owners |

| Asset Management | Individual responsibility for maintenance | Managed by a collective or platform |

| Legal Structure | Direct title ownership | Legal frameworks for fractional shares |

Understanding Traditional Art Investment

Traditional art investment involves purchasing entire artworks, providing full ownership, control, and potential appreciation tied to the artist's reputation and market trends. High entry costs, limited liquidity, and the need for expert knowledge characterize this asset class, making it suitable for investors with substantial capital and long-term horizons. Investors must consider provenance, authenticity, and storage expenses to effectively manage risks associated with traditional art ownership.

What Is Fractional Art Ownership?

Fractional art ownership allows multiple investors to buy shares in a single artwork, making high-value art assets more accessible and liquid. This model leverages blockchain technology or traditional agreements to allocate ownership percentages, enabling partial control and potential profit from the art's appreciation. Compared to owning an entire piece, fractional ownership reduces entry costs and diversifies investment portfolios within the art market.

Comparing Asset Liquidity: Art vs Fractional Shares

Art as a physical asset often experiences lower liquidity due to high transaction costs, limited buyer pools, and lengthy selling processes. Fractional art ownership, enabled by blockchain and digital platforms, significantly enhances liquidity by allowing investors to buy and sell smaller shares quickly and with lower capital barriers. This fractional approach democratizes access, increases market efficiency, and offers a more liquid alternative compared to owning traditional, whole artworks.

Diversification Opportunities in Art Investments

Art investments offer distinct diversification opportunities through fractional art ownership, allowing investors to acquire partial shares in high-value artworks that might be otherwise inaccessible. This fractional approach mitigates risk by spreading investment across multiple pieces rather than concentrating capital in a single artwork. Direct art ownership, while potentially lucrative, often requires significant capital and limits diversification within an asset class known for its unique value and market volatility.

Accessibility: Fractional Art vs Traditional Acquisition

Fractional art ownership significantly lowers entry barriers by allowing investors to purchase shares of high-value artworks, making prestigious art accessible without the need for full capital investment typical in traditional acquisition. This model enhances liquidity and diversification, enabling broader participation from a wider demographic compared to the exclusive, often prohibitive costs of acquiring entire pieces. Traditional acquisition remains limited by high upfront costs, legal complexities, and storage responsibilities, which fractional ownership platforms mitigate through streamlined digital interfaces and shared stewardship.

Legal and Ownership Structures

Art ownership involves full legal title transfer, granting the owner exclusive rights to the artwork, while fractional art ownership divides these rights among multiple investors through legally binding agreements. Full ownership typically requires compliance with provenance and authenticity documentation, whereas fractional ownership employs smart contracts or shareholder agreements to define dividend distribution and resale conditions. Legal structures for fractional ownership often involve creating special purpose vehicles (SPVs) or trusts, which can complicate transferability but enhance asset liquidity compared to sole ownership.

Risk Factors in Art vs Fractional Art Assets

Art ownership involves high risks such as market illiquidity, valuation volatility, and potential for forgery or damage, affecting the asset's long-term value. Fractional art ownership mitigates some risks by diversifying investment across multiple assets, but introduces complexities including platform reliability, legal disputes over shared ownership, and limited control over the physical artwork. Both forms require careful due diligence on provenance, market trends, and regulatory compliance to manage investment exposure effectively.

Valuation Methods for Each Model

Art ownership valuation varies significantly between traditional and fractional models; traditional art relies on expert appraisals, provenance, and auction sales history to determine market value. Fractional art ownership utilizes blockchain technology and smart contracts to assess and record partial asset values, often based on tokenized shares and secondary market trading activity. Each model applies distinct valuation methods that reflect how ownership is structured and traded within the asset ecosystem.

Tax Implications and Reporting Differences

Art ownership as a whole typically involves straightforward capital gains tax reporting upon sale, while fractional art ownership requires detailed tax reporting for each co-owner's share of income, expenses, and gains. Fractional ownership often necessitates issuing K-1 forms reflecting each partner's distributive share, complicating tax filings compared to sole ownership. Understanding these nuances helps investors optimize tax liability management and comply with IRS requirements specific to fractionalized art assets.

Future Trends in Art Asset Management

Fractional art ownership is revolutionizing future trends in art asset management by enabling broader investor participation and enhanced liquidity compared to traditional full art ownership. Blockchain technology ensures transparent provenance and secure transactions, fostering trust and democratizing access to high-value art assets. Predictive analytics and AI-driven valuation models are increasingly integrated to optimize portfolio diversification and maximize returns in evolving art markets.

Related Important Terms

Art Tokenization

Art tokenization transforms physical artworks into digital tokens on a blockchain, enabling fractional ownership that enhances liquidity and accessibility for investors. This method democratizes asset investment by allowing multiple owners to hold transferable shares in high-value art pieces, contrasting with traditional full art ownership models.

Digital Art Fractionalization

Digital art fractionalization revolutionizes asset ownership by dividing high-value digital artworks into smaller, tradable shares, enhancing liquidity and accessibility for diverse investors. Unlike traditional art ownership, this blockchain-enabled model provides transparent provenance, reduces entry barriers, and enables seamless participation in the booming NFT market.

NFT Art Shares

NFT art shares provide a decentralized and transparent method for fractional art ownership, allowing multiple investors to hold verifiable portions of high-value digital artworks through blockchain technology. This model enhances liquidity and accessibility compared to traditional art investment, enabling smaller capital participation and seamless transfer of ownership shares.

Art-Backed Securities

Art-backed securities enable investors to gain fractional ownership in high-value artworks, offering liquidity and diversification typically absent in direct art purchases. This financial innovation transforms exclusive art assets into tradable securities, allowing broader market participation and enhanced asset management.

Fractionalized Blue-Chip Art

Fractionalized blue-chip art allows investors to own a share of high-value masterpieces, democratizing access to prestigious assets traditionally limited to wealthy collectors. This approach enhances liquidity and diversification within art investment portfolios, leveraging blockchain technology to verify provenance and facilitate secure transactions.

Decentralized Art Funds

Decentralized Art Funds leverage blockchain technology to enable fractional art ownership, allowing investors to acquire shares in high-value artworks without purchasing the whole asset. This model enhances liquidity and democratizes access to art investments, contrasting with traditional art ownership that requires significant capital and limits transferability.

Collective Art Investments

Collective art investments through fractional art ownership enable multiple investors to share equity in high-value artworks, increasing accessibility and liquidity in the art market. This model contrasts traditional sole ownership by dispersing financial risk and allowing diversified portfolios across renowned artists and pieces.

Art DAO (Decentralized Autonomous Organization)

Art DAOs revolutionize asset ownership by enabling fractional art investment through blockchain technology, allowing multiple stakeholders to hold and trade shares of high-value artworks. This decentralized model enhances liquidity and democratizes access to the art market, contrasting with traditional singular ownership where assets remain indivisible and less accessible.

Micro-Ownership Art Platforms

Micro-ownership art platforms enable investors to purchase fractional shares of high-value artworks, increasing accessibility and liquidity compared to traditional full-art ownership. These platforms leverage blockchain technology to ensure secure provenance tracking and facilitate secondary market trading, optimizing asset management and investment diversification.

Smart Contract Art Ownership

Smart contract art ownership enables secure, transparent, and verifiable fractional ownership of high-value artworks by encoding ownership rights, transfer, and royalties on blockchain, reducing disputes and enhancing liquidity. Fractional art ownership democratizes investment access while preserving artists' royalties and provenance, contrasting with traditional full art ownership that requires single-entity control and limits market entry.

Art vs Fractional Art Ownership for asset. Infographic

moneydiff.com

moneydiff.com