Real estate investment traditionally involves purchasing physical properties, requiring significant capital, lengthy transaction processes, and limited liquidity. Tokenized real estate offers a digital alternative, enabling fractional ownership through blockchain-based tokens that increase accessibility and provide faster, transparent transactions. This innovation enhances portfolio diversification and liquidity while reducing entry barriers for individual investors.

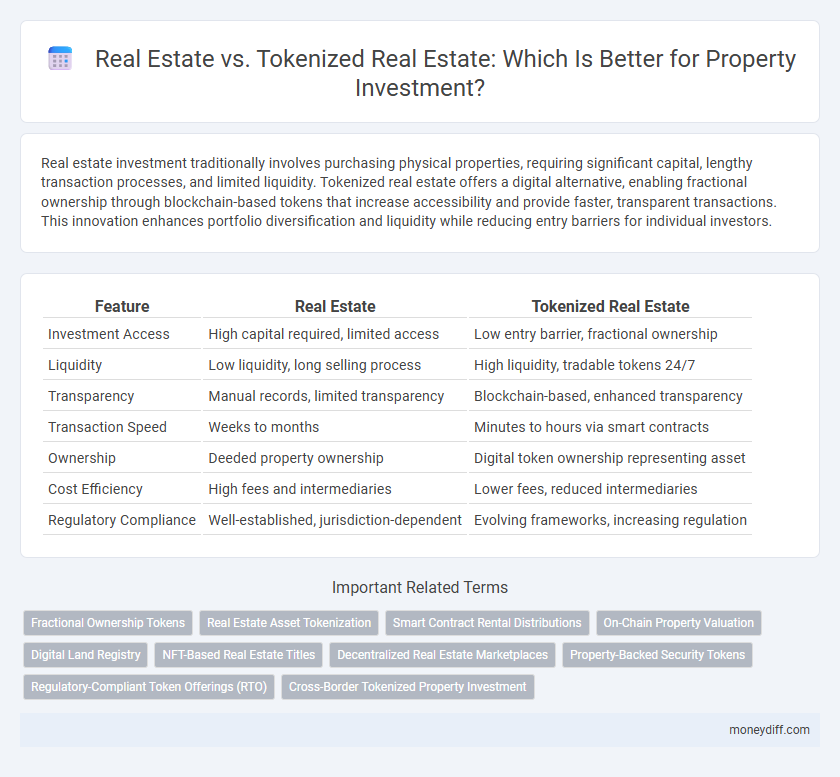

Table of Comparison

| Feature | Real Estate | Tokenized Real Estate |

|---|---|---|

| Investment Access | High capital required, limited access | Low entry barrier, fractional ownership |

| Liquidity | Low liquidity, long selling process | High liquidity, tradable tokens 24/7 |

| Transparency | Manual records, limited transparency | Blockchain-based, enhanced transparency |

| Transaction Speed | Weeks to months | Minutes to hours via smart contracts |

| Ownership | Deeded property ownership | Digital token ownership representing asset |

| Cost Efficiency | High fees and intermediaries | Lower fees, reduced intermediaries |

| Regulatory Compliance | Well-established, jurisdiction-dependent | Evolving frameworks, increasing regulation |

Understanding Traditional Real Estate Investment

Traditional real estate investment involves acquiring physical properties such as residential, commercial, or rental assets, which require significant capital, maintenance, and management efforts. Investors benefit from property appreciation, rental income, and potential tax advantages but face challenges like illiquidity, high entry barriers, and market volatility. Understanding these factors helps in comparing with tokenized real estate, where ownership is digitized and can offer greater liquidity and fractional investment options.

What Is Tokenized Real Estate?

Tokenized real estate represents ownership of property through digital tokens on a blockchain, enabling fractional investment and enhanced liquidity compared to traditional real estate. This innovative method allows investors to buy and sell shares of properties quickly and transparently, reducing barriers to entry and increasing market accessibility. By converting real estate assets into tokens, it facilitates seamless transactions, lowers costs, and provides real-time portfolio management for property investment.

Key Differences Between Real Estate and Tokenized Real Estate

Real estate investment involves direct ownership of physical property, offering tangible assets, legal rights, and traditional market liquidity through established real estate platforms. Tokenized real estate represents ownership via blockchain-based digital tokens, enabling fractional ownership, enhanced liquidity through secondary markets, and reduced entry barriers for investors globally. Key differences include liquidity levels, transaction speed, regulatory frameworks, and accessibility, with tokenized assets providing faster transfers and lower minimum investments compared to conventional real estate.

Accessibility and Minimum Investment Requirements

Real estate traditionally requires substantial capital, often limiting access to wealthy investors due to high purchase prices and significant minimum investment thresholds. Tokenized real estate leverages blockchain technology to fractionalize property ownership, allowing investors to buy smaller shares with lower minimum investments, enhancing accessibility for a broader demographic. This democratization of property investment opens opportunities for diversification and participation in real estate markets previously unreachable for many individual investors.

Liquidity: Selling Traditional vs Tokenized Properties

Traditional real estate sales typically involve lengthy processes, including agent negotiations, legal paperwork, and extended closing periods, resulting in lower liquidity for investors. Tokenized real estate enables fractional ownership through blockchain technology, allowing investors to buy and sell property shares quickly on digital marketplaces with faster transaction times and increased market accessibility. This enhanced liquidity in tokenized properties facilitates more efficient portfolio management and quicker capital reallocation compared to conventional real estate investments.

Legal and Regulatory Considerations

Real estate investment involves navigating established property laws and zoning regulations, while tokenized real estate introduces complex regulatory frameworks encompassing securities laws and digital asset compliance. Traditional property investments require clear title verification and adherence to local real estate regulations, whereas tokenized assets demand rigorous Know Your Customer (KYC) protocols and compliance with anti-money laundering (AML) standards. Investors must evaluate jurisdiction-specific legal structures, investor protection measures, and the evolving regulatory landscape governing blockchain-based asset tokenization.

Fractional Ownership Explained

Fractional ownership in real estate allows multiple investors to collectively own a property, reducing individual capital requirements and spreading risk, unlike traditional real estate investment which typically demands a full purchase or mortgage. Tokenized real estate leverages blockchain technology to digitally represent property shares as tokens, enabling easier transferability, increased liquidity, and access to global markets. This innovative approach enhances transparency and lowers entry barriers, making property investment more accessible and efficient for a broader range of investors.

Property Management in Both Models

Traditional real estate investment relies on direct property management involving physical maintenance, tenant coordination, and on-site inspections, often requiring significant time and expertise. Tokenized real estate leverages blockchain technology to enable fractional ownership, streamlining property management through smart contracts that automate rental income distribution and decision-making processes. This digital model reduces operational costs and enhances transparency, making property management more efficient compared to conventional real estate management frameworks.

Potential Risks and Security Concerns

Tokenized real estate introduces risks such as smart contract vulnerabilities, cybersecurity threats, and regulatory uncertainties, potentially impacting investor security and asset liquidity. Traditional real estate investments face risks like market volatility, property damage, and title disputes, but offer tangible asset control and legal protections. Investors must weigh blockchain-related risks against conventional property challenges when choosing between tokenized and physical real estate assets.

Future Trends in Property Investment

Tokenized real estate is poised to revolutionize property investment by enabling fractional ownership, increasing liquidity, and reducing entry barriers traditionally associated with real estate markets. Blockchain technology ensures transparency, security, and efficient transactions, attracting a broader range of investors globally. Future trends indicate growing adoption of tokenized assets due to enhanced accessibility and integration with decentralized finance (DeFi) platforms, reshaping the landscape of property investment.

Related Important Terms

Fractional Ownership Tokens

Fractional Ownership Tokens enable investors to purchase divisible stakes in real estate assets, increasing liquidity and accessibility compared to traditional whole-property investment. Tokenized real estate leverages blockchain technology to simplify transactions, enhance transparency, and reduce barriers, making property investment more scalable and efficient.

Real Estate Asset Tokenization

Real estate asset tokenization transforms physical properties into digital tokens on a blockchain, enabling fractional ownership, increased liquidity, and easier transferability compared to traditional real estate investments. This innovation significantly lowers entry barriers and enhances market accessibility for a broader range of investors seeking diversified property portfolios.

Smart Contract Rental Distributions

Real estate investment through smart contract rental distributions offers automated, transparent, and instantaneous payment processing, reducing administrative costs compared to traditional rental income methods. Tokenized real estate leverages blockchain technology to enable fractional ownership, enhancing liquidity and efficiency in rental profit sharing while ensuring secure, immutable transaction records.

On-Chain Property Valuation

Real estate investment traditionally relies on appraisals and market comparables, while tokenized real estate leverages on-chain property valuation using blockchain data to provide real-time, transparent pricing and immutable transaction history. This decentralized ledger technology enhances liquidity, reduces valuation discrepancies, and enables fractional ownership through secure smart contracts.

Digital Land Registry

Real estate investment traditionally relies on physical property transactions recorded in centralized land registries, often causing delays and limited transparency. Tokenized real estate leverages blockchain technology to create a digital land registry, enabling secure, transparent, and efficient property ownership transfers through fractionalized digital tokens.

NFT-Based Real Estate Titles

NFT-based real estate titles revolutionize property investment by enabling fractional ownership, enhanced liquidity, and transparent transaction records on blockchain networks. Unlike traditional real estate, tokenized assets reduce entry barriers and streamline transfers, offering investors real-time proof of ownership and programmable rights through smart contracts.

Decentralized Real Estate Marketplaces

Tokenized real estate enables fractional ownership and increased liquidity through blockchain technology, transforming traditional property investment by facilitating peer-to-peer transactions on decentralized real estate marketplaces. These platforms reduce entry barriers and transaction costs compared to conventional real estate, making property investment more accessible and efficient for a global audience.

Property-Backed Security Tokens

Property-backed security tokens offer enhanced liquidity and fractional ownership compared to traditional real estate investments, allowing investors to diversify portfolios with lower capital entry and increased transparency. These blockchain-based tokens represent verifiable ownership of physical properties while enabling faster transactions and reduced reliance on intermediaries, revolutionizing asset management in real estate markets.

Regulatory-Compliant Token Offerings (RTO)

Regulatory-Compliant Token Offerings (RTO) enable fractional ownership of real estate assets through blockchain technology, providing enhanced liquidity and transparency compared to traditional property investment. Unlike conventional real estate transactions, RTOs adhere to securities regulations, ensuring investor protection and streamlined compliance in tokenized real estate markets.

Cross-Border Tokenized Property Investment

Cross-border tokenized real estate investment enables fractional ownership of international properties with enhanced liquidity and reduced entry barriers, leveraging blockchain technology for transparent, secure transactions. Traditional real estate investments often involve higher capital requirements and complex legal processes across jurisdictions, limiting accessibility and speed for global investors.

Real Estate vs Tokenized Real Estate for property investment Infographic

moneydiff.com

moneydiff.com