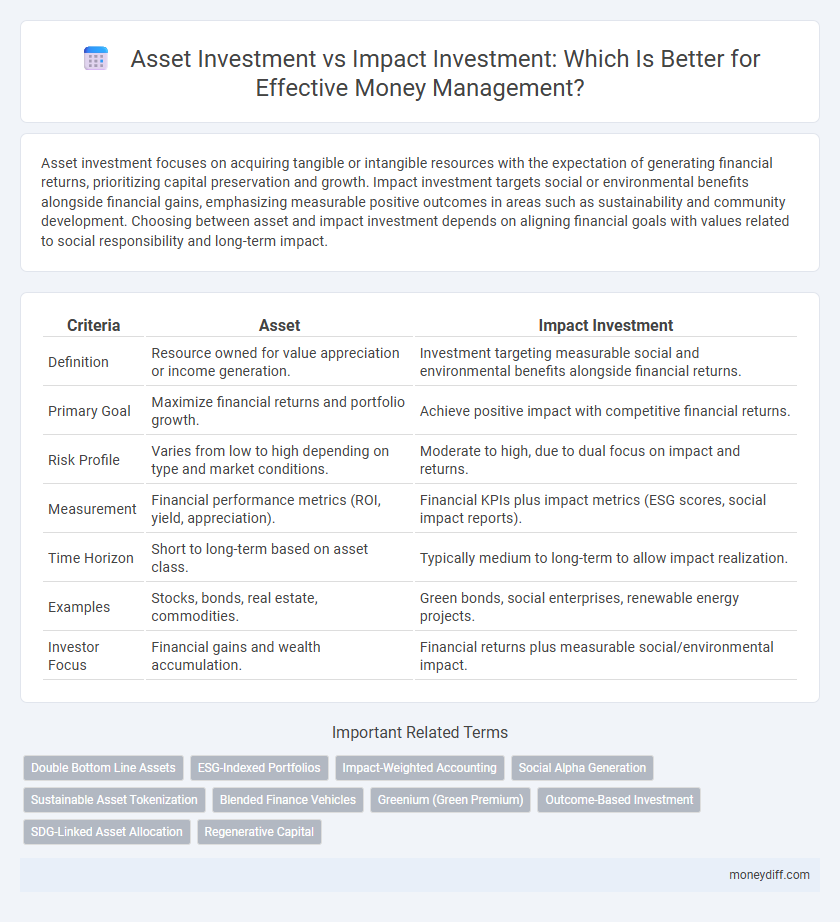

Asset investment focuses on acquiring tangible or intangible resources with the expectation of generating financial returns, prioritizing capital preservation and growth. Impact investment targets social or environmental benefits alongside financial gains, emphasizing measurable positive outcomes in areas such as sustainability and community development. Choosing between asset and impact investment depends on aligning financial goals with values related to social responsibility and long-term impact.

Table of Comparison

| Criteria | Asset | Impact Investment |

|---|---|---|

| Definition | Resource owned for value appreciation or income generation. | Investment targeting measurable social and environmental benefits alongside financial returns. |

| Primary Goal | Maximize financial returns and portfolio growth. | Achieve positive impact with competitive financial returns. |

| Risk Profile | Varies from low to high depending on type and market conditions. | Moderate to high, due to dual focus on impact and returns. |

| Measurement | Financial performance metrics (ROI, yield, appreciation). | Financial KPIs plus impact metrics (ESG scores, social impact reports). |

| Time Horizon | Short to long-term based on asset class. | Typically medium to long-term to allow impact realization. |

| Examples | Stocks, bonds, real estate, commodities. | Green bonds, social enterprises, renewable energy projects. |

| Investor Focus | Financial gains and wealth accumulation. | Financial returns plus measurable social/environmental impact. |

Understanding Asset Investment: Fundamentals and Strategies

Asset investment involves allocating capital into tangible or intangible resources such as real estate, stocks, or bonds, with the primary goal of generating financial returns over time. Effective asset investment strategies include diversification, risk assessment, and portfolio optimization to maximize long-term growth and stability. Understanding market trends, asset valuation, and liquidity considerations is essential for making informed decisions that align with individual financial objectives.

What is Impact Investment? Key Principles and Goals

Impact investment involves allocating capital to projects, companies, or funds that generate measurable social or environmental benefits alongside financial returns. Key principles emphasize intentionality, additionality, and rigor in impact measurement to ensure investments produce genuine positive change. The main goal is to address critical global challenges such as climate change, poverty, and inequality while delivering competitive financial performance.

Comparing Asset Investment and Impact Investment: Core Differences

Asset investment prioritizes financial returns by allocating capital to tangible or financial assets such as stocks, bonds, or real estate, focusing on wealth accumulation and risk management. Impact investment integrates social and environmental goals with financial performance, aiming to generate measurable positive effects alongside competitive returns. The core difference lies in the dual objective of impact investing, where social impact is evaluated as rigorously as financial outcomes, unlike traditional asset investment which concentrates solely on economic gain.

Risk and Return Profiles in Asset vs Impact Investment

Asset investments typically exhibit varying risk and return profiles depending on asset class, with traditional stocks and bonds offering moderate to high returns balanced by market volatility. Impact investments prioritize social and environmental goals alongside financial returns, often involving higher risk due to emerging sectors but potentially delivering competitive returns through targeted, sustainable projects. Understanding the fundamental differences in risk tolerance and expected return is crucial for aligning investment strategies with financial objectives and impact goals.

Social and Environmental Outcomes: Beyond Financial Gains

Asset investment primarily targets financial returns by allocating capital to tangible or intangible resources, while impact investment prioritizes generating measurable social and environmental benefits alongside financial gains. Impact investors seek projects or companies addressing issues like climate change, poverty alleviation, and renewable energy, ensuring positive outcomes beyond traditional asset appreciation. This dual focus aligns investment strategies with sustainable development goals, promoting long-term value for society and the environment.

Evaluating Performance Metrics: Asset vs Impact Portfolio

Evaluating performance metrics in asset portfolios primarily centers on financial returns, risk-adjusted outcomes, and market volatility indicators such as Sharpe ratio and alpha. Impact investment portfolios incorporate additional metrics including social and environmental impact scores, ESG (Environmental, Social, Governance) ratings, and measurable progress toward Sustainable Development Goals (SDGs). Quantitative analysis of both financial performance and impact indicators provides a comprehensive view, enabling investors to balance profit objectives with social responsibility outcomes.

Integration into Money Management Plans

Asset management emphasizes optimizing tangible and intangible assets to maximize portfolio value, while impact investment integrates financial returns with measurable social and environmental outcomes. Incorporating impact investments into money management plans requires aligning investment strategies with client values and impact goals, ensuring both risk-adjusted returns and positive societal contributions. This approach demands detailed asset allocation frameworks that balance traditional assets with impact-driven opportunities for diversified and purpose-driven portfolios.

Investor Types: Who Chooses Asset or Impact Investments?

Individual investors prioritizing financial returns tend to choose asset investments, seeking stable growth through stocks, bonds, or real estate. Impact investors, often including millennials and socially-conscious funds, focus on investments generating measurable social or environmental benefits alongside financial gains. Institutional investors diversify portfolios by blending asset investments with impact funds to balance risk, return, and purposeful outcomes.

Regulatory and Market Trends Shaping Each Approach

Regulatory frameworks for asset management emphasize transparency, fiduciary duties, and risk management, while impact investment regulations increasingly incorporate environmental, social, and governance (ESG) criteria, promoting measurable social and environmental outcomes alongside financial returns. Market trends reveal growing investor demand for impact investments driven by sustainability goals and social responsibility, contrasting with traditional asset management's focus on portfolio diversification and capital preservation. Evolving standards like the EU Sustainable Finance Disclosure Regulation (SFDR) and the Task Force on Climate-related Financial Disclosures (TCFD) are shaping both approaches by mandating greater accountability and impact reporting.

Crafting a Balanced Investment Strategy: Assets, Impact, or Both?

Crafting a balanced investment strategy involves assessing the trade-offs between traditional asset growth and social or environmental impact goals. Asset investments prioritize capital appreciation and financial returns through stocks, bonds, or real estate, while impact investments target measurable positive societal outcomes alongside financial performance. Integrating both approaches allows investors to diversify portfolios, optimize risk-adjusted returns, and contribute to sustainable development objectives.

Related Important Terms

Double Bottom Line Assets

Double Bottom Line Assets integrate both financial return and social impact, distinguishing them from traditional asset management focused solely on profit maximization. Impact investments prioritize measurable social or environmental outcomes alongside competitive financial performance, aligning investor goals with sustainable development metrics.

ESG-Indexed Portfolios

ESG-indexed portfolios leverage environmental, social, and governance criteria to optimize asset allocation while maintaining alignment with impact investment goals, balancing financial returns with measurable social and environmental outcomes. Asset investments prioritize risk-adjusted returns through diversified holdings, whereas impact investments explicitly seek to generate positive societal impacts, making ESG integration a critical backbone for sustainable money management.

Impact-Weighted Accounting

Impact-weighted accounting integrates environmental, social, and governance (ESG) factors into financial statements, enabling investors to evaluate the true societal value of assets beyond traditional financial metrics. This approach contrasts with conventional asset management by emphasizing impact investment strategies that prioritize measurable, positive social and environmental outcomes alongside financial returns.

Social Alpha Generation

Asset investment focuses on preserving and growing financial capital, while impact investment prioritizes generating measurable social and environmental benefits alongside financial returns; Social Alpha Generation integrates these approaches by leveraging innovative asset strategies to maximize positive societal impact without compromising profitability. This hybrid model attracts investors seeking sustainable value creation by embedding social metrics into asset management frameworks, enhancing both financial performance and social outcomes.

Sustainable Asset Tokenization

Sustainable asset tokenization leverages blockchain technology to create digital representations of real-world assets, enabling fractional ownership and increased liquidity while promoting environmental and social governance (ESG) criteria. This approach contrasts impact investment by focusing on enhancing asset efficiency and transparency, facilitating sustainable capital allocation without solely emphasizing measurable social or environmental outcomes.

Blended Finance Vehicles

Blended finance vehicles strategically combine public, private, and philanthropic capital to optimize asset allocation while maximizing social and environmental impact, bridging the gap between traditional asset management and impact investment goals. These vehicles enhance financial returns and risk mitigation by leveraging concessional funds, enabling scalable investments in sustainable development projects that deliver measurable impact alongside asset growth.

Greenium (Green Premium)

Greenium, the premium investors pay for environmentally sustainable assets, significantly influences asset allocation strategies by favoring investments with measurable environmental impact over traditional assets. This shift towards impact investment captures growing demand for green bonds and ESG funds, optimizing portfolios for both financial returns and sustainability metrics.

Outcome-Based Investment

Outcome-based investment prioritizes measurable social and environmental results over traditional asset appreciation, aligning capital deployment with specific impact goals. This approach contrasts with conventional asset management by emphasizing accountability and performance metrics that demonstrate tangible benefits alongside financial returns.

SDG-Linked Asset Allocation

SDG-linked asset allocation strategically channels capital toward projects and companies directly contributing to Sustainable Development Goals, enhancing both asset performance and positive global impact. This approach integrates financial returns with measurable environmental and social outcomes, differentiating it from traditional impact investments that primarily prioritize social or environmental benefits over financial gains.

Regenerative Capital

Regenerative Capital prioritizes assets that generate positive environmental and social impact alongside financial returns, contrasting with traditional impact investments that often separate profit from purpose. This approach integrates long-term asset stewardship with systemic regeneration, fostering resilient ecosystems and communities through strategic capital allocation.

Asset vs Impact Investment for money management. Infographic

moneydiff.com

moneydiff.com