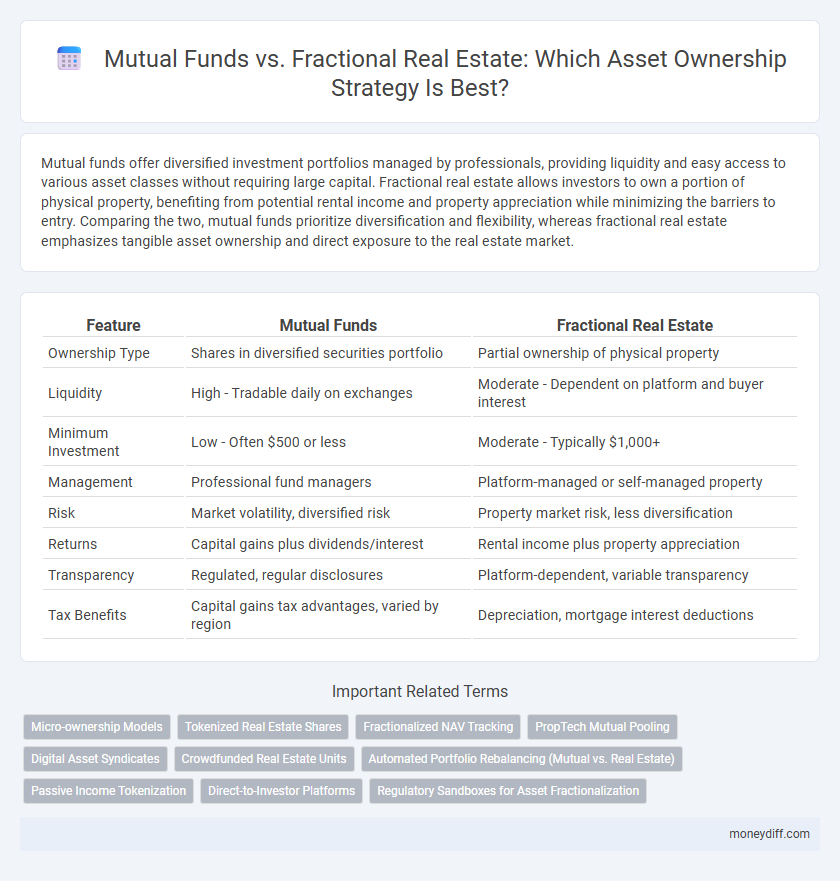

Mutual funds offer diversified investment portfolios managed by professionals, providing liquidity and easy access to various asset classes without requiring large capital. Fractional real estate allows investors to own a portion of physical property, benefiting from potential rental income and property appreciation while minimizing the barriers to entry. Comparing the two, mutual funds prioritize diversification and flexibility, whereas fractional real estate emphasizes tangible asset ownership and direct exposure to the real estate market.

Table of Comparison

| Feature | Mutual Funds | Fractional Real Estate |

|---|---|---|

| Ownership Type | Shares in diversified securities portfolio | Partial ownership of physical property |

| Liquidity | High - Tradable daily on exchanges | Moderate - Dependent on platform and buyer interest |

| Minimum Investment | Low - Often $500 or less | Moderate - Typically $1,000+ |

| Management | Professional fund managers | Platform-managed or self-managed property |

| Risk | Market volatility, diversified risk | Property market risk, less diversification |

| Returns | Capital gains plus dividends/interest | Rental income plus property appreciation |

| Transparency | Regulated, regular disclosures | Platform-dependent, variable transparency |

| Tax Benefits | Capital gains tax advantages, varied by region | Depreciation, mortgage interest deductions |

Understanding Mutual Funds and Fractional Real Estate

Mutual funds pool capital from multiple investors to purchase a diversified portfolio of securities managed by professional fund managers, offering liquidity and regulatory oversight. Fractional real estate allows investors to own a percentage of physical property, providing direct exposure to real estate markets without full ownership responsibilities. Understanding these asset types involves evaluating liquidity, management style, and investment horizon to align with financial goals.

Key Differences in Asset Structure

Mutual funds pool money from multiple investors to invest in diversified portfolios of stocks, bonds, or other securities, with ownership represented by shares in the fund. Fractional real estate involves direct ownership of a specific property divided among investors, granting each a deeded interest in the physical asset. Key differences in asset structure include the liquidity and regulatory framework, as mutual funds offer high liquidity and are regulated by securities laws, while fractional real estate ownership is less liquid and governed by property and contract law.

Risk and Return Comparison

Mutual funds offer diversified exposure to financial markets with moderate risk and historically stable returns, making them suitable for conservative investors. Fractional real estate provides direct asset ownership with potential for higher returns through rental income and property appreciation but carries increased risks such as market volatility and liquidity challenges. Comparing risk and return, mutual funds typically deliver lower volatility and consistent income, whereas fractional real estate can yield superior returns at the expense of higher illiquidity and market sensitivity.

Liquidity and Exit Strategies

Mutual funds offer high liquidity with the ability to sell shares on any trading day, enabling swift exit strategies and easy portfolio rebalancing. Fractional real estate investments typically have lower liquidity, requiring longer time horizons and potential market conditions to sell interests effectively. Understanding these liquidity differences is essential for aligning asset ownership with investment goals and cash flow needs.

Entry Requirements and Investment Minimums

Mutual funds typically require a minimum investment ranging from $500 to $3,000, making them accessible for many individual investors, while fractional real estate platforms often have entry points as low as $100 to $1,000, enabling more flexible capital allocation. Mutual funds generally have fewer entry barriers, with most brokerage accounts allowing investors to start with modest initial deposits, whereas fractional real estate investment demands understanding property-specific fees and potential additional costs. Both options offer diversified asset exposure, but fractional real estate allows direct partial ownership of physical properties, potentially requiring higher due diligence despite lower minimums.

Diversification Potential

Mutual funds offer broad diversification by pooling investments across various sectors, industries, and asset classes, reducing risk through professional portfolio management. Fractional real estate provides access to specific property markets, enabling ownership diversification within real estate portfolios but with less overall sector variety. Combining mutual funds with fractional real estate can optimize asset allocation, balancing market exposure and income stability.

Tax Implications of Each Investment

Mutual funds often benefit from favorable tax treatment, including capital gains distributions taxed at lower long-term rates and the ability to defer taxes through tax-efficient fund structures. Fractional real estate ownership can offer tax advantages such as depreciation deductions, mortgage interest deductions, and potential 1031 exchange benefits to defer capital gains taxes on property sales. Understanding specific IRS rules and state tax regulations is crucial when comparing the tax implications of mutual funds versus fractional real estate investments.

Management and Operational Involvement

Mutual funds offer professional management with minimal operational involvement from investors, as fund managers handle asset selection, diversification, and administrative tasks. Fractional real estate ownership requires more active participation, including property management, maintenance coordination, and decision-making regarding tenant relations or property improvements. The choice depends on whether investors prefer a hands-off approach with mutual funds or direct engagement with real estate assets.

Long-Term Growth Prospects

Mutual funds offer diversified exposure to stock and bond markets, providing steady long-term growth through professional management and reinvested dividends. Fractional real estate ownership delivers direct participation in property appreciation and rental income, with potential tax benefits enhancing overall returns. Both assets support wealth accumulation over time, but mutual funds typically offer higher liquidity and ease of portfolio rebalancing compared to fractional real estate investments.

Choosing the Right Asset for Your Portfolio

Mutual funds offer diversified exposure to stocks and bonds, providing liquidity and professional management ideal for risk-averse investors seeking balanced growth. Fractional real estate allows direct ownership in physical properties with potential for steady rental income and appreciation, suitable for those prioritizing tangible assets and long-term wealth accumulation. Selecting the right asset depends on your investment horizon, risk tolerance, and desired level of involvement in managing your portfolio.

Related Important Terms

Micro-ownership Models

Micro-ownership models in asset management offer distinct advantages, with mutual funds providing diversified exposure to a broad portfolio of securities, while fractional real estate allows investors to own specific portions of physical properties. These models enhance accessibility and liquidity, enabling investors to participate in high-value assets with lower capital requirements and tailored risk profiles.

Tokenized Real Estate Shares

Tokenized Real Estate Shares offer a fractional ownership model that brings liquidity, transparency, and blockchain-based security to real estate assets, contrasting with traditional mutual funds which primarily invest in diversified portfolios without direct property control. By enabling investors to buy and trade digital tokens representing real estate shares, tokenization provides easier access, reduced entry barriers, and faster transactions compared to conventional mutual fund structures.

Fractionalized NAV Tracking

Fractional real estate offers precise NAV tracking by enabling investors to own specific portions of tangible property, reflecting real-time market value fluctuations more transparently than mutual funds. This direct asset linkage enhances valuation accuracy and liquidity, providing a clearer performance metric compared to the pooled structure of traditional mutual funds.

PropTech Mutual Pooling

Mutual funds offer diversified asset ownership with professional management, while fractional real estate through PropTech mutual pooling enables direct investment in real estate assets with lower entry costs and increased liquidity. PropTech platforms leverage technology to streamline asset management, enhance transparency, and democratize access to real estate investments compared to traditional mutual funds.

Digital Asset Syndicates

Digital Asset Syndicates enable fractional real estate ownership by pooling funds digitally, offering greater liquidity and accessibility compared to traditional mutual funds focused on diverse financial assets. This structure leverages blockchain technology to provide transparent asset management and real-time ownership tracking, enhancing investor control and reducing entry barriers.

Crowdfunded Real Estate Units

Crowdfunded real estate units provide fractional ownership in tangible properties, offering diversification and potential income through rental yields and property appreciation, unlike mutual funds which pool capital primarily into stocks or bonds. These units enable investors to participate in real estate markets with lower entry costs and direct asset exposure, enhancing portfolio balance and risk management compared to traditional mutual fund shares.

Automated Portfolio Rebalancing (Mutual vs. Real Estate)

Mutual funds offer automated portfolio rebalancing through algorithm-driven systems that adjust asset allocations periodically to maintain target investment goals, enhancing diversification and risk management. Fractional real estate investments typically lack automated rebalancing features, requiring manual adjustments by investors or platform managers to maintain portfolio balance, which can introduce delays and increased management complexity.

Passive Income Tokenization

Mutual funds offer diversified asset ownership through pooled investment portfolios, while fractional real estate leverages passive income tokenization to grant investors direct stakes in properties with blockchain-enabled liquidity and transparency. Tokenized real estate enhances passive income potential by enabling seamless transferability and fractional dividend distribution, contrasting traditional mutual funds' reliance on fund managers for income generation.

Direct-to-Investor Platforms

Direct-to-investor platforms for mutual funds offer diversified portfolio access with professional management and liquidity, while fractional real estate platforms provide tangible asset ownership, potential rental income, and property appreciation opportunities. Investors benefit from seamless online transactions, lower entry barriers, and transparency in both asset classes through these emerging digital platforms.

Regulatory Sandboxes for Asset Fractionalization

Regulatory sandboxes facilitate innovation in asset fractionalization by providing controlled environments for testing mutual funds and fractional real estate ownership models, ensuring compliance with securities laws while fostering investor protection. These frameworks enable startups and fintechs to refine asset-sharing platforms, accelerating market adoption and enhancing liquidity in traditionally illiquid assets.

Mutual Funds vs Fractional Real Estate for asset ownership. Infographic

moneydiff.com

moneydiff.com