Asset ownership provides direct control and intrinsic value, whereas tokenized assets represent ownership digitally on a blockchain, enabling enhanced liquidity and fractional investment. Tokenized assets allow seamless trade and easier portfolio diversification, while traditional assets may face higher barriers to entry and slower transaction processes. Effective money management benefits from understanding the balance between tangible asset security and the flexibility offered by tokenized alternatives.

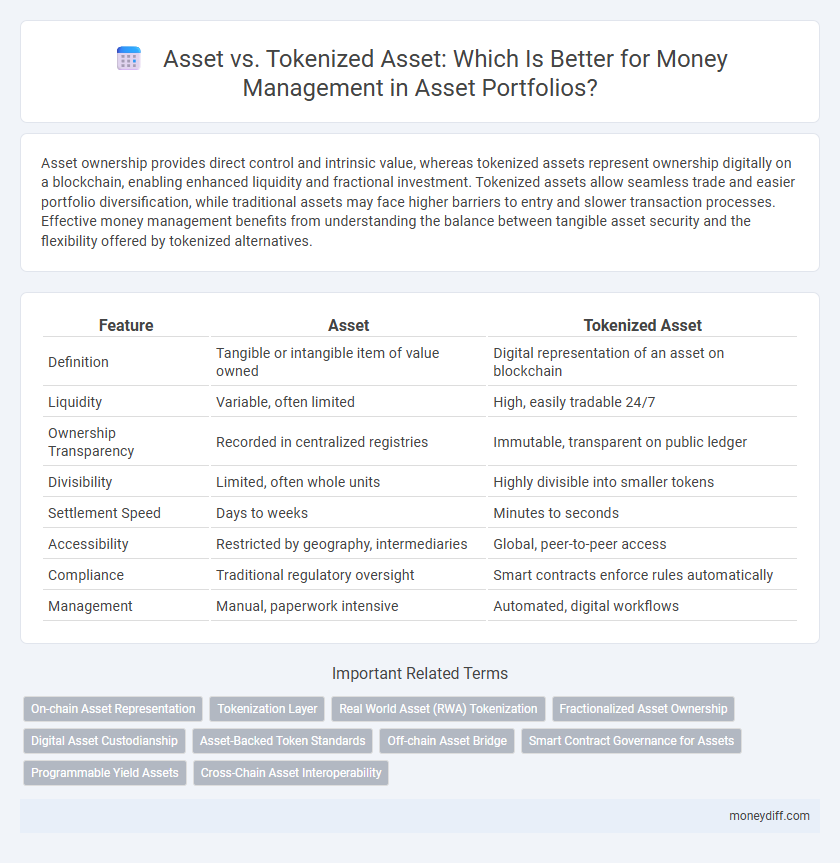

Table of Comparison

| Feature | Asset | Tokenized Asset |

|---|---|---|

| Definition | Tangible or intangible item of value owned | Digital representation of an asset on blockchain |

| Liquidity | Variable, often limited | High, easily tradable 24/7 |

| Ownership Transparency | Recorded in centralized registries | Immutable, transparent on public ledger |

| Divisibility | Limited, often whole units | Highly divisible into smaller tokens |

| Settlement Speed | Days to weeks | Minutes to seconds |

| Accessibility | Restricted by geography, intermediaries | Global, peer-to-peer access |

| Compliance | Traditional regulatory oversight | Smart contracts enforce rules automatically |

| Management | Manual, paperwork intensive | Automated, digital workflows |

Understanding Traditional Assets in Money Management

Traditional assets in money management include tangible and intangible items such as real estate, stocks, bonds, and commodities that hold intrinsic value and can generate income or appreciate over time. These assets provide stability, diversification, and risk management opportunities within investment portfolios by leveraging established market infrastructures and regulatory frameworks. Unlike tokenized assets, traditional assets rely on physical custody or centralized record-keeping, limiting fractional ownership and real-time liquidity.

What Are Tokenized Assets?

Tokenized assets represent real-world assets such as real estate, stocks, or commodities transformed into digital tokens on a blockchain, enabling fractional ownership and increased liquidity. Unlike traditional assets, tokenized assets offer enhanced transparency, faster transaction settlements, and accessibility to a wider range of investors through secure smart contracts. This innovation in money management facilitates easier diversification and efficient portfolio management by bridging physical assets with decentralized finance platforms.

Key Differences Between Assets and Tokenized Assets

Traditional assets represent physical or financial ownership recorded in centralized ledgers, while tokenized assets utilize blockchain technology to digitize ownership, enabling fractional ownership and enhanced liquidity. Tokenized assets provide increased transparency through immutable records, faster settlement times, and lower transaction costs compared to conventional assets. The key difference lies in accessibility and efficiency, where tokenized assets allow for easier trading and global reach, transforming money management strategies.

Advantages of Tokenized Assets for Investors

Tokenized assets enable fractional ownership, allowing investors to diversify portfolios with lower capital requirements and increased liquidity compared to traditional assets. Blockchain technology ensures transparent, secure transactions and reduces intermediaries, lowering costs and settlement times. Enhanced accessibility through digital platforms broadens investment opportunities to a global audience, promoting inclusivity and market efficiency.

Risks and Challenges of Tokenized Assets

Tokenized assets present unique risks including regulatory uncertainty, cybersecurity vulnerabilities, and liquidity challenges compared to traditional assets. Smart contract errors or platform failures can lead to financial losses, while fluctuating market acceptance complicates valuation and trading. Investors must navigate complex compliance requirements and potential scalability issues inherent to digital asset frameworks.

Asset Liquidity: Traditional vs Tokenized

Traditional assets such as real estate, stocks, and bonds often face liquidity challenges due to lengthy transaction processes and limited market access. Tokenized assets leverage blockchain technology to enable fractional ownership and 24/7 trading on decentralized exchanges, significantly enhancing liquidity. This shift reduces capital lock-in periods and increases financial agility for investors managing diverse portfolios.

Regulatory Considerations in Tokenized Asset Management

Regulatory considerations in tokenized asset management involve compliance with securities laws, anti-money laundering (AML) regulations, and investor protection mandates. Unlike traditional assets, tokenized assets require adherence to blockchain-specific regulations and smart contract auditing to ensure transparency and security. Regulatory frameworks are evolving to address the unique risks presented by tokenized assets, emphasizing the need for robust governance structures and clear custody solutions.

Cost Efficiency: Assets vs Tokenized Assets

Traditional assets often entail higher management and transaction costs due to intermediaries and paperwork, impacting overall cost efficiency in money management. Tokenized assets leverage blockchain technology to reduce fees, streamline processes, and enable fractional ownership, significantly lowering barriers and expenses. This enhanced cost efficiency facilitates more accessible and liquid investment opportunities compared to conventional asset management.

Security Aspects in Asset and Tokenized Asset Management

Traditional assets rely on centralized security protocols that are vulnerable to fraud and unauthorized access, while tokenized assets leverage blockchain technology to enhance transparency and resistance to tampering. The immutability and cryptographic security inherent in tokenized asset management reduce risks related to data breaches and asset misappropriation. Smart contracts automate compliance and secure transactions, offering robust protection compared to conventional asset management systems.

Future Trends in Asset and Tokenized Asset Adoption

Future trends in asset management highlight increased adoption of tokenized assets due to enhanced liquidity, fractional ownership, and transparent blockchain records. Traditional assets face growing integration challenges, while tokenized assets enable seamless cross-border transactions and automated compliance through smart contracts. Market projections indicate a surge in tokenized asset platforms driven by investor demand for real-time, efficient, and cost-effective money management solutions.

Related Important Terms

On-chain Asset Representation

On-chain asset representation enhances transparency and liquidity by recording asset ownership and transaction history directly on the blockchain, enabling seamless verification and transfer without intermediaries. Tokenized assets convert traditional assets into digital tokens, offering fractional ownership and increased accessibility while maintaining the underlying asset's value within decentralized finance ecosystems.

Tokenization Layer

Tokenized assets leverage a blockchain-based tokenization layer that enhances liquidity, transparency, and fractional ownership compared to traditional assets. This digital representation allows seamless integration with smart contracts and automated money management systems, optimizing asset accessibility and efficiency.

Real World Asset (RWA) Tokenization

Tokenized assets represent real-world assets (RWAs) such as real estate, commodities, or equities through blockchain technology, enabling fractional ownership, increased liquidity, and transparent transaction records. Compared to traditional assets, RWA tokenization enhances money management by reducing barriers to entry, streamlining asset transfer processes, and providing real-time market access to a broader range of investors.

Fractionalized Asset Ownership

Fractionalized asset ownership enables investors to hold partial stakes in high-value assets, increasing liquidity and accessibility compared to traditional assets. Tokenized assets leverage blockchain technology to represent these fractions as digital tokens, streamlining transactions and enhancing transparency in money management.

Digital Asset Custodianship

Digital asset custodianship ensures secure management and safeguarding of both traditional assets and tokenized assets, leveraging blockchain technology for enhanced transparency and immutability. Tokenized assets offer fractional ownership and increased liquidity, requiring specialized custodianship solutions to manage smart contracts and digital keys effectively.

Asset-Backed Token Standards

Asset-backed token standards enhance money management by providing transparent, secure digital representations of real-world assets such as real estate, commodities, or equities. These tokenized assets enable fractional ownership, increased liquidity, and streamlined compliance through blockchain technology, distinguishing them from traditional asset management methods.

Off-chain Asset Bridge

Off-chain Asset Bridge enables seamless integration between traditional assets and blockchain-based tokenized assets, enhancing liquidity and accessibility in money management. This technology facilitates secure transfers and real-time reconciliation while maintaining regulatory compliance across disparate financial systems.

Smart Contract Governance for Assets

Smart contract governance enhances transparency and automation in managing tokenized assets by enforcing predefined rules and real-time compliance without intermediaries. Traditional assets lack this programmable control, limiting efficiency and increasing risks in money management operations.

Programmable Yield Assets

Programmable yield assets offer dynamic income streams by embedding smart contract functionalities that automate interest payments and yield adjustments, distinguishing them from traditional assets with fixed or manual yield distributions. Tokenized assets enable fractional ownership and enhanced liquidity on blockchain platforms, optimizing money management through transparent and programmable financial protocols.

Cross-Chain Asset Interoperability

Cross-chain asset interoperability enables seamless transfer and management of both traditional assets and tokenized assets across multiple blockchain networks, enhancing liquidity and accessibility. Tokenized assets provide programmable features and fractional ownership, allowing for more efficient and transparent money management compared to conventional assets locked within isolated financial systems.

Asset vs Tokenized Asset for money management. Infographic

moneydiff.com

moneydiff.com