Assets represent tangible or intangible resources with intrinsic value, while digital assets specifically refer to electronically stored items like cryptocurrencies, digital files, or online accounts. In money management, physical assets such as property or cash provide stability and long-term value, whereas digital assets offer liquidity and ease of transfer but may carry higher volatility and security risks. Balancing traditional assets with digital assets diversifies a portfolio, optimizing growth potential and risk management.

Table of Comparison

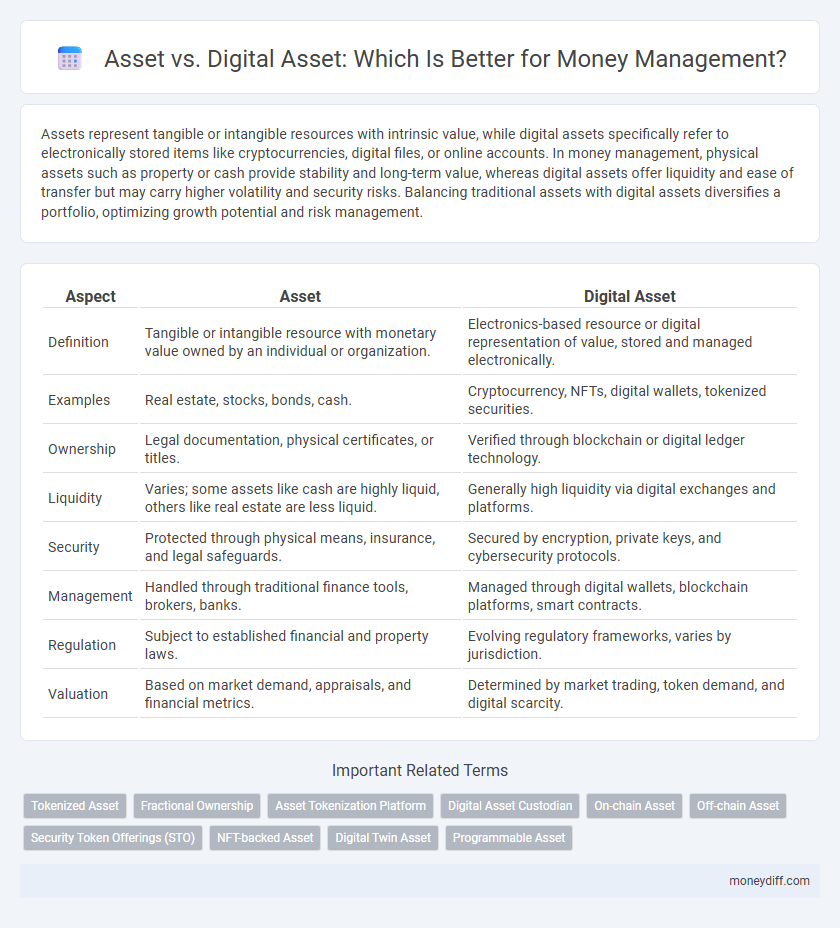

| Aspect | Asset | Digital Asset |

|---|---|---|

| Definition | Tangible or intangible resource with monetary value owned by an individual or organization. | Electronics-based resource or digital representation of value, stored and managed electronically. |

| Examples | Real estate, stocks, bonds, cash. | Cryptocurrency, NFTs, digital wallets, tokenized securities. |

| Ownership | Legal documentation, physical certificates, or titles. | Verified through blockchain or digital ledger technology. |

| Liquidity | Varies; some assets like cash are highly liquid, others like real estate are less liquid. | Generally high liquidity via digital exchanges and platforms. |

| Security | Protected through physical means, insurance, and legal safeguards. | Secured by encryption, private keys, and cybersecurity protocols. |

| Management | Handled through traditional finance tools, brokers, banks. | Managed through digital wallets, blockchain platforms, smart contracts. |

| Regulation | Subject to established financial and property laws. | Evolving regulatory frameworks, varies by jurisdiction. |

| Valuation | Based on market demand, appraisals, and financial metrics. | Determined by market trading, token demand, and digital scarcity. |

Understanding Traditional Assets in Money Management

Traditional assets in money management include physical items like real estate, stocks, bonds, and cash, which hold intrinsic value and are tangible or legally recognized. These assets provide stability and liquidity, forming the foundation of diversified portfolios to manage risk and generate income over time. Understanding how traditional assets function helps investors balance growth potential with security, differing significantly from digital assets that rely on blockchain technology and digital ownership.

Defining Digital Assets: A Modern Approach

Digital assets represent a modern evolution of traditional assets, encompassing cryptocurrencies, digital tokens, and blockchain-based ownership rights that enhance liquidity and security in money management. Unlike conventional assets such as cash, real estate, or stocks, digital assets leverage decentralized technologies to facilitate instantaneous transactions and verifiable ownership. This innovative approach redefines asset management by integrating digitization, programmability, and interoperability, driving efficiency and transparency in financial ecosystems.

Key Differences Between Physical and Digital Assets

Physical assets in money management include tangible items like real estate, vehicles, and cash, characterized by their physical presence and often requiring maintenance and secure storage. Digital assets, such as cryptocurrencies, online bank accounts, and digital securities, exist solely in electronic form and provide enhanced liquidity, easier transferability, and potentially faster transactions. Key differences between physical and digital assets revolve around their form, accessibility, security measures, and how they are tracked and valued in financial portfolios.

Advantages of Managing Traditional Assets

Managing traditional assets offers greater stability and tangible value compared to digital assets, providing a reliable foundation for long-term financial planning. Traditional assets such as real estate, stocks, and bonds benefit from well-established regulatory frameworks and market transparency, reducing risk and enhancing trust. Their physical or legally recognized nature facilitates easier valuation, collateralization, and integration into estate planning strategies.

Benefits of Adopting Digital Assets for Wealth Growth

Digital assets offer enhanced liquidity and faster transaction speeds compared to traditional assets, enabling more efficient money management and wealth growth. They provide increased transparency through blockchain technology, reducing risks of fraud and improving security. Additionally, digital assets allow for greater diversification and global accessibility, expanding investment opportunities beyond conventional asset classes.

Security Considerations: Assets vs. Digital Assets

Traditional assets like cash, real estate, and stocks rely on physical security measures and regulated financial institutions to mitigate risks such as theft or fraud. Digital assets, including cryptocurrencies and NFTs, require robust cybersecurity protocols, encrypted wallets, and multi-factor authentication to protect against hacking and cyber threats. Effective money management must prioritize these security differences, integrating both physical safeguards and advanced digital protections to minimize loss and ensure asset integrity.

Liquidity and Accessibility in Asset Types

Traditional assets like real estate and vehicles often have lower liquidity and limited accessibility due to the need for physical transactions and longer conversion times. Digital assets, such as cryptocurrencies and tokens, offer higher liquidity through instant transfers on blockchain networks and enhanced accessibility via online platforms and mobile wallets. This increased liquidity and accessibility make digital assets a more flexible option for dynamic money management strategies.

Risk Management Strategies for Both Assets

Risk management strategies for physical assets emphasize insurance coverage, regular maintenance, and diversification to mitigate loss and depreciation risks. Digital asset risk management prioritizes cybersecurity measures, such as encryption, multi-factor authentication, and secure wallets, to protect against hacking and theft. Both asset types require continuous monitoring and contingency planning to address market volatility and technological vulnerabilities effectively.

Regulatory Frameworks: Physical vs. Digital Assets

Regulatory frameworks for physical assets typically involve well-established legal standards governing ownership, transfer, and taxation, such as real estate laws and securities regulation. Digital assets, including cryptocurrencies and tokens, face evolving regulations with a focus on cybersecurity, anti-money laundering (AML), and know-your-customer (KYC) requirements, reflecting their intangible and decentralized nature. Compliance challenges arise as jurisdictions strive to balance innovation with investor protection, leading to diverse and sometimes conflicting asset classification and reporting rules.

Which Asset Type Fits Your Financial Goals?

Traditional assets, such as real estate, stocks, and bonds, offer stability and long-term growth potential, making them suitable for conservative investors prioritizing steady income and capital preservation. Digital assets, including cryptocurrencies and NFTs, provide high volatility but also the potential for rapid appreciation, appealing to risk-tolerant investors seeking diversification and innovation exposure. Aligning asset type with your financial goals requires evaluating risk tolerance, investment horizon, and liquidity needs to optimize portfolio performance.

Related Important Terms

Tokenized Asset

Tokenized assets represent ownership rights through blockchain-based digital tokens, enabling fractional investment, enhanced liquidity, and transparent, secure transactions compared to traditional physical assets. This innovation in money management democratizes access to high-value assets like real estate and art while reducing intermediaries and transaction costs.

Fractional Ownership

Fractional ownership allows investors to purchase partial interests in both traditional assets and digital assets, enhancing liquidity and accessibility in money management. Digital assets leverage blockchain technology to enable secure, transparent fractional ownership, distinguishing them from conventional assets by offering programmable ownership and real-time transaction settlements.

Asset Tokenization Platform

Asset tokenization platforms transform traditional assets into digital tokens, enabling fractional ownership, increased liquidity, and seamless transferability within blockchain ecosystems. This innovation revolutionizes money management by bridging physical asset value with digital finance, enhancing transparency, security, and accessibility.

Digital Asset Custodian

A Digital Asset Custodian specializes in safeguarding cryptocurrencies, tokens, and other blockchain-based assets through advanced encryption and multi-signature wallets, ensuring secure access and transaction integrity in contrast to traditional asset management. Unlike conventional asset custodians, digital asset custodians also provide secure key management, regulatory compliance, and seamless integration with decentralized finance platforms for efficient money management.

On-chain Asset

On-chain assets represent digital ownership recorded on a blockchain, providing transparent, immutable proof of value transfer and reducing reliance on traditional intermediaries for money management. Unlike conventional physical assets, on-chain digital assets enable real-time tracking, fractional ownership, and automated smart contract execution, enhancing liquidity and security in financial ecosystems.

Off-chain Asset

Off-chain assets, physical or financial resources like real estate or cash holdings, differ fundamentally from digital assets such as cryptocurrencies and tokens because they exist outside blockchain networks. Managing off-chain assets requires traditional financial strategies involving direct custodianship and regulatory compliance, contrasting with the decentralized nature of digital asset management.

Security Token Offerings (STO)

Security Token Offerings (STO) represent a transformative evolution from traditional assets by digitizing ownership and enabling fractional investment with blockchain-secured transparency and regulatory compliance. Unlike conventional assets, digital assets in STOs provide enhanced liquidity, programmable rights, and automated governance through smart contracts, revolutionizing money management strategies.

NFT-backed Asset

NFT-backed assets represent a revolutionary shift in money management by combining the inherent value of traditional assets with the unique digital provenance and immutability of blockchain technology. Unlike conventional assets, NFT-backed assets enable secure, transparent ownership and liquidity through tokenization, enhancing investment diversification and facilitating seamless transferability in decentralized markets.

Digital Twin Asset

Digital Twin Assets enable real-time mirroring of physical assets in a virtual environment, enhancing accuracy in money management through precise monitoring, predictive maintenance, and dynamic valuation. Unlike traditional assets, Digital Twin Assets integrate IoT data and advanced analytics to optimize financial decisions and improve asset lifecycle management.

Programmable Asset

Programmable assets revolutionize money management by embedding automated rules and smart contracts directly into digital assets, enabling precise control, real-time tracking, and seamless execution of financial transactions. Unlike traditional assets, these programmable digital assets increase efficiency, transparency, and security in asset management through blockchain technology and decentralized finance protocols.

Asset vs Digital Asset for money management. Infographic

moneydiff.com

moneydiff.com