Hedge funds and crypto hedge funds offer distinct approaches to wealth management, with traditional hedge funds primarily investing in established assets like equities, bonds, and commodities, providing stability and regulatory oversight. Crypto hedge funds focus on digital assets such as cryptocurrencies and blockchain projects, presenting higher volatility but potential for substantial returns through innovative market opportunities. Investors seeking a balance between risk and reward may choose based on their tolerance for market fluctuations and interest in emerging technologies.

Table of Comparison

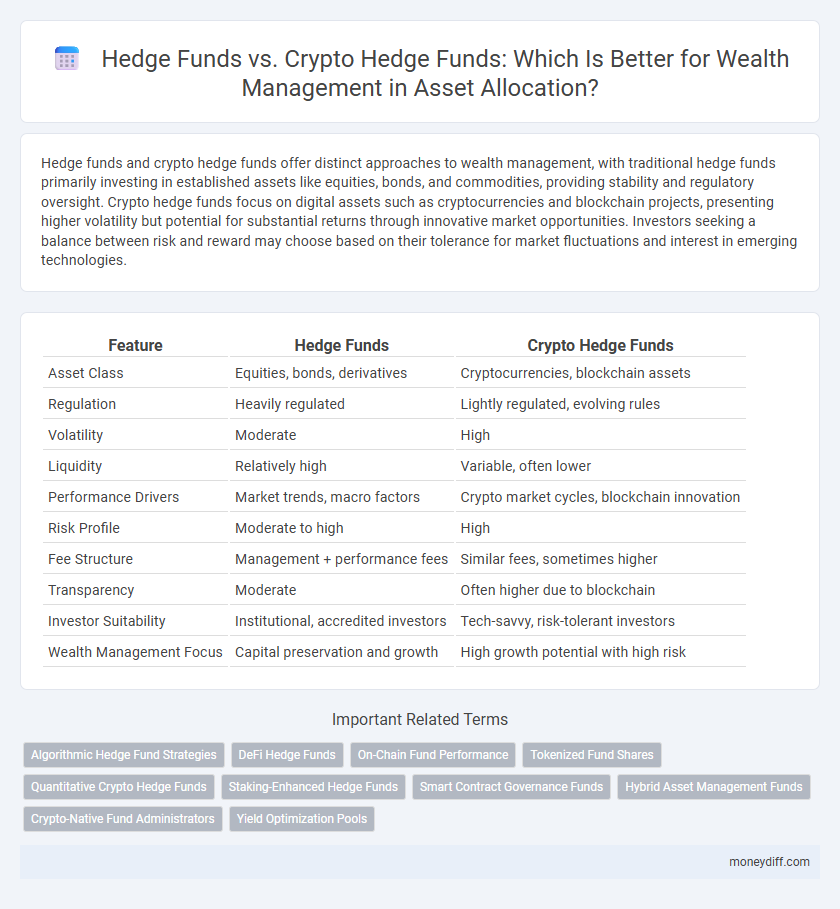

| Feature | Hedge Funds | Crypto Hedge Funds |

|---|---|---|

| Asset Class | Equities, bonds, derivatives | Cryptocurrencies, blockchain assets |

| Regulation | Heavily regulated | Lightly regulated, evolving rules |

| Volatility | Moderate | High |

| Liquidity | Relatively high | Variable, often lower |

| Performance Drivers | Market trends, macro factors | Crypto market cycles, blockchain innovation |

| Risk Profile | Moderate to high | High |

| Fee Structure | Management + performance fees | Similar fees, sometimes higher |

| Transparency | Moderate | Often higher due to blockchain |

| Investor Suitability | Institutional, accredited investors | Tech-savvy, risk-tolerant investors |

| Wealth Management Focus | Capital preservation and growth | High growth potential with high risk |

Understanding Traditional Hedge Funds: Core Principles

Traditional hedge funds employ diverse investment strategies including long-short equity, global macro, and arbitrage to optimize risk-adjusted returns for high-net-worth individuals. These funds leverage sophisticated financial instruments, stringent risk management protocols, and extensive market research to achieve portfolio diversification and capital preservation. Understanding these core principles is essential for comparing them with crypto hedge funds, which operate in a more volatile and less regulated market.

What Sets Crypto Hedge Funds Apart?

Crypto hedge funds distinguish themselves through their ability to invest in highly volatile digital assets such as Bitcoin, Ethereum, and emerging altcoins, providing unique diversification opportunities beyond traditional equities and bonds. These funds leverage blockchain technology and advanced algorithmic trading to exploit market inefficiencies and offer higher potential returns, albeit with increased risk. Their regulatory environment remains evolving, creating both challenges and opportunities for innovative wealth management strategies tailored to tech-savvy investors seeking exposure to the burgeoning crypto economy.

Regulatory Framework: Traditional vs Crypto Hedge Funds

Traditional hedge funds operate under well-established regulatory frameworks such as the Investment Company Act of 1940 and the Dodd-Frank Act, ensuring transparency, investor protection, and compliance with strict reporting standards. Crypto hedge funds face evolving regulatory landscapes with varying guidelines across jurisdictions, often encountering challenges related to cryptocurrency classification, anti-money laundering (AML) compliance, and licensing requirements. The disparity in regulatory clarity between traditional and crypto hedge funds impacts risk management practices and investor confidence, shaping the strategies employed in wealth management portfolios.

Asset Diversification Strategies in Different Hedge Funds

Hedge funds traditionally diversify assets across equities, bonds, and commodities to mitigate risks and enhance portfolio stability. Crypto hedge funds focus on digital assets such as cryptocurrencies, blockchain tokens, and decentralized finance projects, offering exposure to high-growth but volatile markets. Integrating both fund types in wealth management strategies allows investors to balance conventional stability with innovative asset growth opportunities, optimizing overall portfolio diversification.

Risk Management: Conventional Methods vs Crypto Innovations

Hedge funds employ traditional risk management techniques such as diversification, value at risk (VaR), and stress testing to mitigate market volatility and protect investor capital. Crypto hedge funds integrate these conventional methods with blockchain-specific innovations like smart contract auditing, on-chain analytics, and decentralized finance protocols to enhance transparency and manage unique risks inherent to digital assets. This hybrid approach provides a dynamic framework, balancing established financial safeguards with cutting-edge technology-driven risk controls.

Performance Metrics: Evaluating Returns in Each Fund Type

Hedge funds traditionally deliver steady risk-adjusted returns using diversified asset classes and strategies, emphasizing alpha generation and volatility management. Crypto hedge funds exhibit higher volatility but offer potentially superior returns due to exposure to cryptocurrency market cycles and innovative digital assets. Performance metrics such as Sharpe ratio, Sortino ratio, and maximum drawdown provide critical insights for comparing risk-adjusted returns between conventional hedge funds and crypto hedge funds in wealth management portfolios.

Liquidity: Comparing Access and Redemption Policies

Hedge funds generally offer limited liquidity with lock-up periods ranging from several months to years, often imposing strict redemption windows that may affect timely access to invested capital. Crypto hedge funds typically provide higher liquidity due to 24/7 market operations and shorter redemption notice periods, enabling faster asset conversion and withdrawal. Investors must evaluate these liquidity differences carefully to align their wealth management strategies with cash flow needs and market volatility tolerance.

Transparency and Reporting Standards

Hedge funds traditionally operate under stringent regulatory frameworks, ensuring high transparency and standardized reporting that facilitate investor confidence and compliance. Crypto hedge funds, while rapidly growing, often face challenges in meeting these established transparency and reporting standards due to the evolving nature of blockchain technology and regulatory uncertainty. Investors seeking robust wealth management solutions may weigh the proven transparency of traditional hedge funds against the innovative but less regulated environment of crypto hedge funds.

Investor Eligibility and Minimum Investment Requirements

Hedge funds typically require accredited investors with minimum investments often starting at $1 million, ensuring compliance with stringent regulatory standards. Crypto hedge funds tend to have lower entry thresholds, sometimes accepting investments as low as $50,000, and attract a broader range of investors, including those seeking exposure to digital assets. Both types of funds emphasize investor qualification to manage risk, but crypto hedge funds offer more flexibility in eligibility and minimum capital commitments.

Future Trends: Evolution of Hedge and Crypto Hedge Funds

Hedge funds are increasingly integrating blockchain technology and digital assets to enhance portfolio diversification and risk management. Crypto hedge funds are evolving from speculative ventures into sophisticated platforms employing advanced algorithms and artificial intelligence for predictive analysis. Future trends highlight a convergence where traditional hedge funds adopt crypto strategies, driven by regulatory clarity and institutional investor demand.

Related Important Terms

Algorithmic Hedge Fund Strategies

Algorithmic hedge fund strategies leverage complex quantitative models and high-frequency trading to optimize asset allocation and risk management, offering systematic and data-driven approaches in both traditional hedge funds and crypto hedge funds. Crypto hedge funds apply these algorithms to volatile digital asset markets, capitalizing on blockchain data and market inefficiencies for enhanced portfolio diversification and potential higher returns.

DeFi Hedge Funds

DeFi hedge funds leverage decentralized finance protocols to offer innovative asset management strategies, providing enhanced transparency, liquidity, and access to a global market compared to traditional hedge funds. These funds employ smart contracts and decentralized exchanges to optimize portfolio performance while mitigating risks through algorithmic governance in rapidly evolving crypto ecosystems.

On-Chain Fund Performance

Hedge funds traditionally deliver stable returns through diversified asset portfolios, while crypto hedge funds leverage blockchain analytics to optimize on-chain fund performance by transparently tracking transactions and asset flows. This on-chain visibility enhances risk management and enables real-time performance assessment, differentiating crypto hedge funds in wealth management strategies.

Tokenized Fund Shares

Tokenized fund shares in crypto hedge funds offer enhanced liquidity and fractional ownership, differentiating them from traditional hedge funds by enabling real-time trading and lower entry barriers. These digital assets leverage blockchain technology to provide transparent asset management and seamless global access, revolutionizing wealth management strategies.

Quantitative Crypto Hedge Funds

Quantitative Crypto Hedge Funds leverage algorithmic trading and advanced data analytics to capitalize on market inefficiencies within the cryptocurrency sector, offering potential for higher returns and diversified risk compared to traditional hedge funds. Employing machine learning models and blockchain data, these funds provide innovative strategies for wealth management that address the volatility and unique market dynamics of digital assets.

Staking-Enhanced Hedge Funds

Hedge funds utilizing traditional assets prioritize diversified portfolios and active management, while crypto hedge funds leverage blockchain technology and digital assets, offering enhanced liquidity and transparency. Staking-enhanced hedge funds integrate proof-of-stake cryptocurrencies to generate passive income and mitigate volatility, optimizing wealth management strategies through consistent yield generation and reduced market exposure.

Smart Contract Governance Funds

Hedge funds and crypto hedge funds differ significantly in wealth management, with crypto hedge funds leveraging Smart Contract Governance Funds to enhance transparency, automate asset allocation, and reduce operational costs through blockchain technology. These smart contracts facilitate decentralized decision-making and real-time adjustments, offering investors increased control and improved security compared to traditional hedge fund structures.

Hybrid Asset Management Funds

Hybrid asset management funds combine traditional hedge fund strategies with cryptocurrency investments, offering diversified exposure that balances risk and potential high returns. These funds leverage advanced quantitative models and blockchain technology to optimize portfolio performance, providing a sophisticated approach to wealth management in volatile markets.

Crypto-Native Fund Administrators

Crypto hedge funds leverage blockchain technology and digital asset expertise to offer innovative wealth management solutions, outperforming traditional hedge funds in transparency and real-time asset tracking. Crypto-native fund administrators specialize in secure custody, regulatory compliance, and smart contract integrations, enhancing operational efficiency and investor confidence in volatile markets.

Yield Optimization Pools

Hedge funds traditionally leverage diversified asset classes to optimize yield through structured strategies, while crypto hedge funds specialize in yield optimization pools by utilizing decentralized finance (DeFi) protocols and liquidity mining to generate higher returns. Yield optimization pools in crypto hedge funds harness automated smart contracts and staking mechanisms, offering dynamic risk-adjusted income streams that outperform conventional fixed-income strategies in volatile markets.

Hedge Funds vs Crypto Hedge Funds for wealth management Infographic

moneydiff.com

moneydiff.com