Asset ownership provides direct control and intrinsic value, allowing investors to benefit from dividends, voting rights, and tangible market performance. Synthetic assets, created through derivatives and smart contracts, offer flexibility, leverage, and access to otherwise unavailable markets without owning the underlying asset. Effective money management balances the stability of real assets with the agility of synthetics to optimize risk and return.

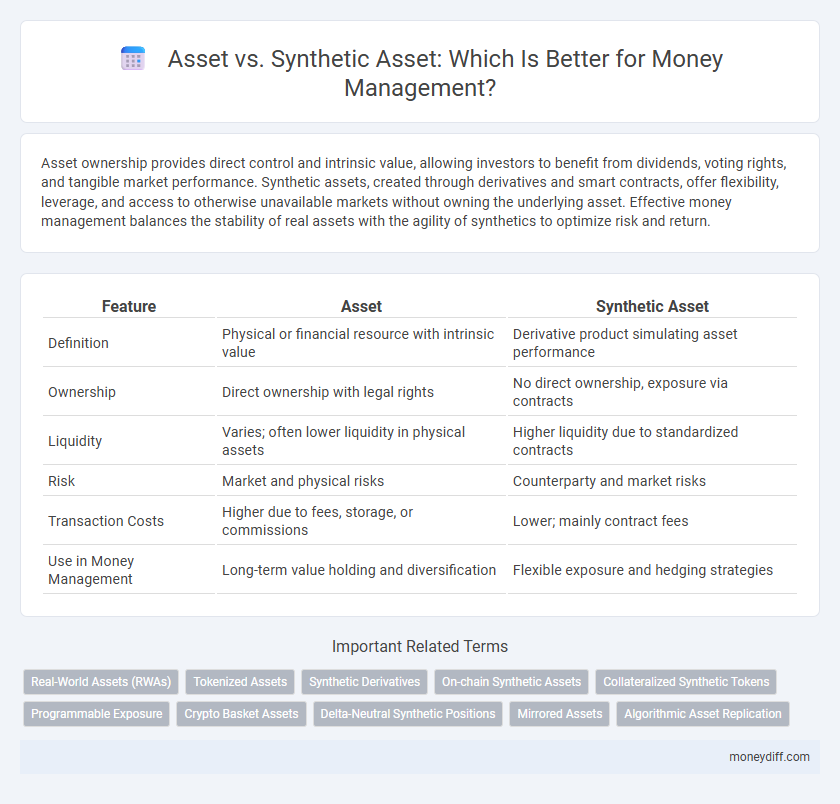

Table of Comparison

| Feature | Asset | Synthetic Asset |

|---|---|---|

| Definition | Physical or financial resource with intrinsic value | Derivative product simulating asset performance |

| Ownership | Direct ownership with legal rights | No direct ownership, exposure via contracts |

| Liquidity | Varies; often lower liquidity in physical assets | Higher liquidity due to standardized contracts |

| Risk | Market and physical risks | Counterparty and market risks |

| Transaction Costs | Higher due to fees, storage, or commissions | Lower; mainly contract fees |

| Use in Money Management | Long-term value holding and diversification | Flexible exposure and hedging strategies |

Understanding Assets and Synthetic Assets

Assets represent tangible or financial resources like stocks, bonds, or real estate that hold intrinsic value and can generate income or appreciate over time. Synthetic assets are derivative instruments designed to mimic the price movements and returns of real assets without requiring ownership of the underlying asset, often used for hedging or speculative purposes. Understanding the differences between physical assets and synthetic assets is crucial for effective money management and risk diversification strategies.

Key Differences: Assets vs Synthetic Assets

Assets represent tangible or financial items of value, such as real estate, stocks, or bonds, directly owned and held by an individual or institution. Synthetic assets are financial instruments created through derivatives or complex structures, designed to mimic the performance and risk profile of traditional assets without direct ownership. The key differences lie in ownership rights, regulatory treatment, and the underlying exposure, with synthetic assets offering flexibility and tailored risk but often carrying higher counterparty risk compared to direct asset holding.

How Traditional Assets Work in Money Management

Traditional assets such as stocks, bonds, and real estate serve as tangible or securitized financial instruments that enable investors to diversify portfolios and generate income through dividends, interest, or capital appreciation. These assets are regulated by established financial markets, ensuring transparency, liquidity, and investor protection, which are critical for effective risk management and long-term wealth preservation. Portfolio managers leverage traditional asset allocation strategies based on market conditions, risk tolerance, and investment horizons to optimize returns and maintain financial stability.

The Rise of Synthetic Assets in Financial Strategies

Synthetic assets have gained momentum in financial strategies by enabling investors to replicate the performance of traditional assets without direct ownership, offering enhanced liquidity and accessibility. These instruments, often created through derivatives such as options and swaps, provide customized exposure to various market conditions and asset classes. Their rise supports diversified portfolio management and risk optimization in increasingly complex financial markets.

Advantages of Managing Wealth with Real Assets

Real assets provide tangible value and inherent stability, making them less susceptible to market volatility compared to synthetic assets. Investors benefit from income generation through rentals, dividends, or commodity yields, enhancing long-term wealth preservation. These assets also offer portfolio diversification, reducing overall risk and protecting against inflation effectively.

Benefits and Risks of Synthetic Assets in Portfolios

Synthetic assets offer enhanced diversification and tailored exposure to specific market conditions without requiring ownership of the underlying asset, enabling efficient capital use and risk management in portfolios. However, synthetic assets carry counterparty risk, liquidity challenges, and potential valuation complexities that can amplify portfolio volatility if not properly managed. Investors must balance the flexibility and cost-efficiency of synthetic assets against these risks to optimize portfolio performance and resilience.

Liquidity and Accessibility: Assets vs Synthetic Assets

Assets provide direct ownership and typically offer higher liquidity due to established markets and clear valuation processes, enabling quick access to funds or resale. Synthetic assets replicate the value of underlying assets through financial derivatives and smart contracts but may face limitations in liquidity, depending on platform adoption and regulatory environment. Accessibility differs as physical assets often require significant capital and intermediaries, while synthetic assets allow fractional ownership and 24/7 trading on decentralized platforms.

Regulatory Considerations for Assets and Synthetic Assets

Regulatory frameworks for traditional assets often involve rigorous disclosure, compliance, and custody requirements designed to protect investors and maintain market integrity. Synthetic assets, created through derivatives or tokenization, face evolving regulatory scrutiny that addresses counterparty risk, transparency, and classification under securities laws. Understanding these regulatory considerations is critical for money managers to ensure compliance and mitigate potential legal and operational risks when integrating synthetic assets into portfolios.

Diversification: Blending Assets and Synthetic Assets

Combining traditional assets with synthetic assets enhances portfolio diversification by reducing correlation and spreading risk across different market exposures. Synthetic assets replicate the value of underlying securities through derivatives, allowing investors to access otherwise inaccessible markets or asset classes. This blending strategy optimizes risk-adjusted returns and provides flexibility in dynamic market conditions.

Choosing the Right Asset Type for Your Money Management Goals

Traditional assets such as stocks and bonds offer direct ownership and proven long-term value appreciation, making them suitable for conservative money management strategies focused on stability and growth. Synthetic assets replicate the value of underlying assets using derivatives, providing flexible exposure and diversification opportunities but introducing higher complexity and risk. Selecting the right asset type depends on risk tolerance, investment horizon, and liquidity needs to align with specific financial goals.

Related Important Terms

Real-World Assets (RWAs)

Real-World Assets (RWAs) provide tangible collateral and intrinsic value, enhancing portfolio stability and reducing volatility compared to Synthetic Assets, which derive value from derivatives and are often exposed to counterparty and systemic risks. Incorporating RWAs into money management strategies improves liquidity and risk-adjusted returns by grounding investments in physical or financial instruments with transparent, verifiable market valuations.

Tokenized Assets

Tokenized assets represent ownership rights in real-world assets like real estate or equities, offering increased liquidity, transparency, and fractional ownership compared to traditional assets. Synthetic assets replicate the value of underlying assets through smart contracts, providing customizable exposure without holding the actual asset, but they carry higher counterparty risk and reliance on oracles for accurate price feeds.

Synthetic Derivatives

Synthetic derivatives replicate the performance of real assets without requiring ownership, enabling precise exposure management and enhanced liquidity in portfolios. These instruments reduce capital outlay and counterparty risk while facilitating diversified strategies through contracts based on underlying asset values.

On-chain Synthetic Assets

On-chain synthetic assets enable decentralized exposure to real-world assets without the need for direct ownership, leveraging smart contracts to replicate the value and performance of traditional assets on blockchain networks. Unlike conventional assets, synthetic assets enhance liquidity and accessibility in decentralized finance (DeFi) by allowing users to manage diverse portfolios while mitigating counterparty risks inherent in off-chain asset custody.

Collateralized Synthetic Tokens

Collateralized synthetic tokens enable money management by representing real-world assets on blockchain networks while maintaining liquidity and reducing counterparty risk; unlike traditional assets, these synthetic tokens rely on over-collateralization with digital assets to ensure value stability and enable seamless trading. This approach enhances portfolio diversification and access to asset classes without direct ownership, leveraging decentralized finance protocols for transparency and automated risk management.

Programmable Exposure

Assets provide direct ownership and intrinsic value, while synthetic assets enable programmable exposure by replicating asset performance through smart contracts, offering customizable risk and return profiles in decentralized finance. Synthetic assets facilitate diversified money management strategies by allowing precise control over asset exposure without requiring actual asset holding.

Crypto Basket Assets

Crypto basket assets aggregate multiple cryptocurrencies to diversify risk and enhance portfolio stability, whereas synthetic assets replicate the value of underlying assets through smart contracts without ownership rights. Utilizing crypto basket assets for money management offers direct exposure and inherent value, while synthetic assets provide flexibility and access to otherwise illiquid or complex financial instruments.

Delta-Neutral Synthetic Positions

Delta-neutral synthetic positions replicate asset price movements without direct ownership, reducing market exposure and enabling precise risk management. These strategies optimize capital efficiency by balancing underlying asset and derivative components to maintain a net-zero delta, enhancing portfolio stability amid market volatility.

Mirrored Assets

Mirrored assets replicate the value and performance of underlying assets without direct ownership, offering liquidity and diversification in money management strategies. Synthetic assets leverage smart contracts to mirror real asset prices, enabling exposure to markets with reduced capital and increased accessibility compared to traditional asset acquisition.

Algorithmic Asset Replication

Algorithmic asset replication leverages mathematical models and market data to create synthetic assets that mirror the performance of underlying physical assets, enabling efficient portfolio diversification and risk management. These synthetic assets offer advantages like enhanced liquidity, lower transaction costs, and customizable exposure compared to traditional assets, making them integral in modern quantitative money management strategies.

Asset vs Synthetic Asset for money management. Infographic

moneydiff.com

moneydiff.com