Earning with traditional assets often provides stable returns but lacks the high growth potential seen in DeFi yield assets, which leverage decentralized finance protocols to generate passive income through staking, lending, and liquidity mining. DeFi yield assets offer greater opportunity for higher yields compared to conventional assets, but they come with increased risks such as smart contract vulnerabilities and market volatility. Investors seeking to maximize earnings should carefully balance risk tolerance and asset diversification between these two options.

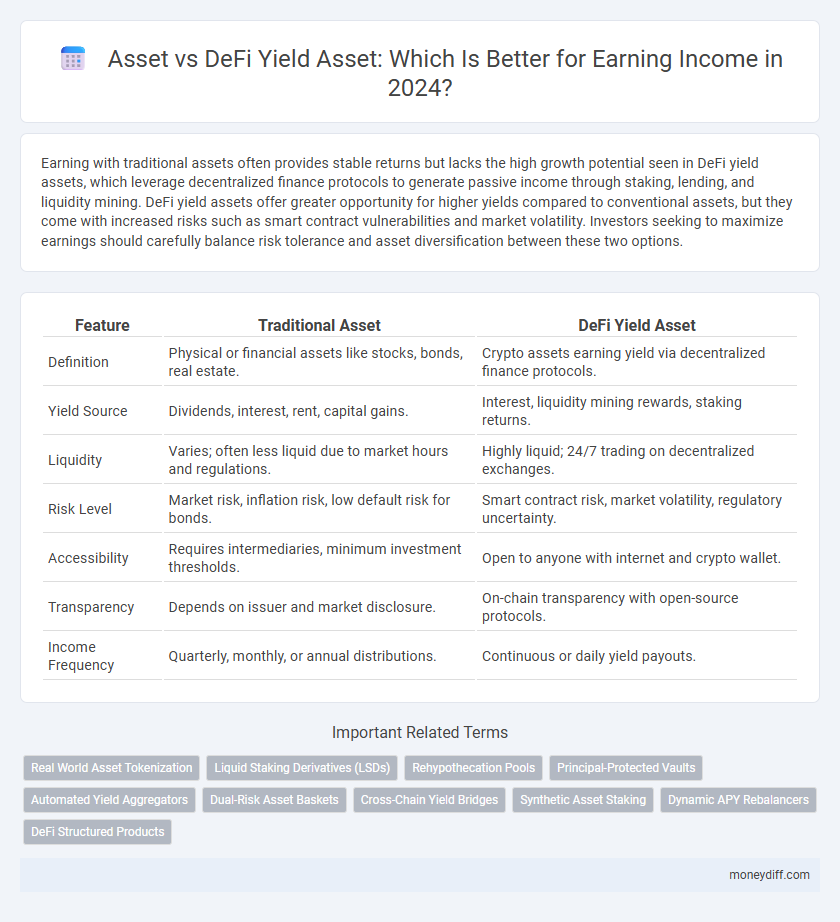

Table of Comparison

| Feature | Traditional Asset | DeFi Yield Asset |

|---|---|---|

| Definition | Physical or financial assets like stocks, bonds, real estate. | Crypto assets earning yield via decentralized finance protocols. |

| Yield Source | Dividends, interest, rent, capital gains. | Interest, liquidity mining rewards, staking returns. |

| Liquidity | Varies; often less liquid due to market hours and regulations. | Highly liquid; 24/7 trading on decentralized exchanges. |

| Risk Level | Market risk, inflation risk, low default risk for bonds. | Smart contract risk, market volatility, regulatory uncertainty. |

| Accessibility | Requires intermediaries, minimum investment thresholds. | Open to anyone with internet and crypto wallet. |

| Transparency | Depends on issuer and market disclosure. | On-chain transparency with open-source protocols. |

| Income Frequency | Quarterly, monthly, or annual distributions. | Continuous or daily yield payouts. |

Understanding Traditional Assets vs DeFi Yield Assets

Traditional assets, such as stocks, bonds, and real estate, generate returns primarily through capital appreciation and fixed income like dividends or interest payments. DeFi yield assets leverage blockchain technology and smart contracts to provide decentralized finance solutions, enabling users to earn yields through staking, liquidity provision, and lending without intermediaries. Understanding the risk profiles, liquidity, and accessibility differences between traditional and DeFi yield assets is essential for optimizing portfolio diversification and maximizing returns.

Key Differences Between Conventional Assets and DeFi Yield Assets

Conventional assets such as stocks, bonds, and real estate generate income through dividends, interest, or rental yields, offering relatively stable and regulated returns. DeFi yield assets, including liquidity pool tokens and staking derivatives, provide high-yield opportunities by leveraging blockchain protocols and smart contracts but carry higher volatility and risk due to market fluctuations and lack of centralized oversight. Key differences include transparency levels, liquidity, regulatory exposure, and the mechanisms of yield generation driven by decentralized financial networks versus traditional financial systems.

Risk Assessment: Asset Investment vs DeFi Yield Opportunities

Asset investment typically involves regulated markets with established risk profiles, offering predictable returns backed by tangible assets or income streams. DeFi yield opportunities present higher volatility and smart contract risks due to decentralized protocols, but can deliver significantly enhanced yields through liquidity mining, staking, or lending. Thorough risk assessment must evaluate counterparty risks, regulatory uncertainties, and potential impermanent loss in DeFi compared to the comparatively stable asset-based investments.

Returns Comparison: Traditional Asset Income vs DeFi Yields

Traditional asset income typically delivers steady returns through dividends, interest, or capital appreciation, averaging around 4-7% annually depending on market conditions. DeFi yield assets, utilizing liquidity pools and staking mechanisms, often provide significantly higher returns, ranging from 8% to over 20%, albeit with increased volatility and risk. Investors seeking to maximize earnings must weigh the predictable nature of traditional assets against the potentially lucrative but fluctuating yields offered by DeFi platforms.

Liquidity and Accessibility: Asset Markets vs DeFi Platforms

Asset markets often provide higher liquidity due to established trading infrastructures and regulatory oversight, enabling quick asset conversions with minimal slippage. DeFi platforms offer accessibility through permissionless entry and 24/7 trading without intermediaries, yet liquidity can be fragmented across pools, affecting yield stability. Comparing both, traditional asset markets excel in consistent liquidity, while DeFi yield assets prioritize broader access and innovative earning mechanisms despite variable liquidity conditions.

Security and Custody: Protecting Your Wealth in Assets and DeFi

Traditional assets offer established security frameworks and regulatory oversight, providing investors with trusted custody solutions to safeguard their wealth. DeFi yield assets leverage decentralized protocols with smart contract security, but require users to manage private keys and navigate potential vulnerabilities independently. Choosing between these options depends on balancing the security of regulated custody against the autonomy and risks inherent in DeFi platforms.

Entry Barriers: Investing in Assets vs DeFi Yield Strategies

Traditional asset investing often requires significant capital, regulatory knowledge, and access to brokers or financial institutions, creating high entry barriers for many individuals. DeFi yield strategies lower these barriers by enabling direct access via blockchain platforms with minimal initial investment and no centralized gatekeepers. However, DeFi entails risks such as smart contract vulnerabilities and market volatility, demanding technical understanding and risk management skills.

Regulatory Considerations: Compliance in Assets and DeFi

Regulatory considerations for traditional assets involve established frameworks ensuring transparency, investor protection, and mandatory disclosures under agencies like the SEC. DeFi yield assets operate in a rapidly evolving regulatory landscape with unclear jurisdiction, posing risks of non-compliance related to anti-money laundering (AML), know-your-customer (KYC), and securities laws. Compliance challenges in DeFi require continuous monitoring of evolving regulations to mitigate legal exposure and enhance platform credibility.

Diversification Strategies: Balancing Assets with DeFi Yields

Balancing traditional assets with DeFi yield assets enhances portfolio diversification by spreading risk across different financial instruments and blockchain protocols. Traditional assets provide stable value and regulatory clarity, while DeFi yield assets offer higher returns through decentralized lending, staking, and liquidity mining on platforms like Aave and Compound. Integrating both asset types enables investors to optimize risk-adjusted returns by leveraging the stability of conventional investments alongside the growth potential of decentralized finance yields.

Future Trends: Asset Management in the Age of DeFi

Future trends in asset management increasingly highlight the integration of traditional assets with DeFi yield-generating instruments, leveraging blockchain technology to optimize returns and liquidity. Decentralized finance protocols enable asset holders to access automated yield farming, lending, and staking opportunities, transforming asset management into a dynamic, algorithm-driven process. This convergence of traditional asset frameworks and DeFi innovations is set to redefine portfolio diversification and risk management strategies in coming years.

Related Important Terms

Real World Asset Tokenization

Real World Asset Tokenization bridges traditional assets like real estate and commodities with DeFi protocols, enhancing liquidity and access to yield opportunities beyond conventional asset yields. Tokenized real-world assets provide a stable, regulated foundation for DeFi yield products, reducing volatility and increasing transparency compared to purely digital DeFi assets.

Liquid Staking Derivatives (LSDs)

Liquid Staking Derivatives (LSDs) offer a lucrative alternative to traditional assets by enabling users to earn DeFi yields while maintaining liquidity, unlike conventional staking which locks assets. These derivatives optimize asset utility by allowing concurrent participation in staking rewards and decentralized finance protocols, significantly enhancing yield potential.

Rehypothecation Pools

Rehypothecation pools enable DeFi yield assets to generate enhanced returns by allowing multiple layers of collateral reuse, significantly outperforming traditional asset earning methods constrained by single ownership. This process increases liquidity and leverage but introduces higher systemic risk compared to conventional asset holdings, where collateral remains segregated and less exposed to cascading defaults.

Principal-Protected Vaults

Principal-protected vaults in asset management ensure the original investment remains secure while generating yield, contrasting DeFi yield assets that often expose investors to higher volatility and smart contract risks. These vaults leverage traditional asset-backed strategies to deliver stable returns without sacrificing capital preservation.

Automated Yield Aggregators

Automated yield aggregators optimize earnings by dynamically reallocating assets across DeFi platforms, maximizing returns through smart contract-driven strategies. Traditional assets offer stable income but lack the high-yield potential and automated compounding features found in DeFi yield assets facilitated by these aggregators.

Dual-Risk Asset Baskets

Dual-risk asset baskets combine traditional assets with DeFi yield-generating tokens, balancing market volatility with protocol-specific risks to optimize returns. These baskets leverage diversified exposure, mitigating the downside of individual asset failures while capturing enhanced yield opportunities in decentralized finance ecosystems.

Cross-Chain Yield Bridges

Cross-chain yield bridges enable seamless asset transfers across multiple blockchain networks, enhancing diversification and maximizing returns on DeFi yield assets compared to traditional single-chain asset holdings. By leveraging interoperable protocols, investors can access higher APYs and reduce risk through cross-chain liquidity aggregation.

Synthetic Asset Staking

Synthetic asset staking enables users to earn yields by locking synthetic tokens representing real-world assets, offering exposure without direct ownership risks. Compared to traditional asset staking, DeFi yield through synthetic assets provides enhanced liquidity, diversified collateral options, and automated interest generation on decentralized platforms.

Dynamic APY Rebalancers

Dynamic APY Rebalancers optimize asset allocation between traditional assets and DeFi yield assets, maximizing earning potential by adjusting exposure based on real-time yield fluctuations. This strategy leverages automated portfolio rebalancing to capture higher returns while managing risk across volatile decentralized finance protocols.

DeFi Structured Products

DeFi structured products offer enhanced yield opportunities compared to traditional assets by leveraging decentralized finance protocols to optimize returns through automated strategies and liquidity pooling. These assets provide customizable risk-return profiles, enabling investors to access higher yields with transparent smart contract execution and reduced counterparty risk.

Asset vs DeFi Yield Asset for earning. Infographic

moneydiff.com

moneydiff.com