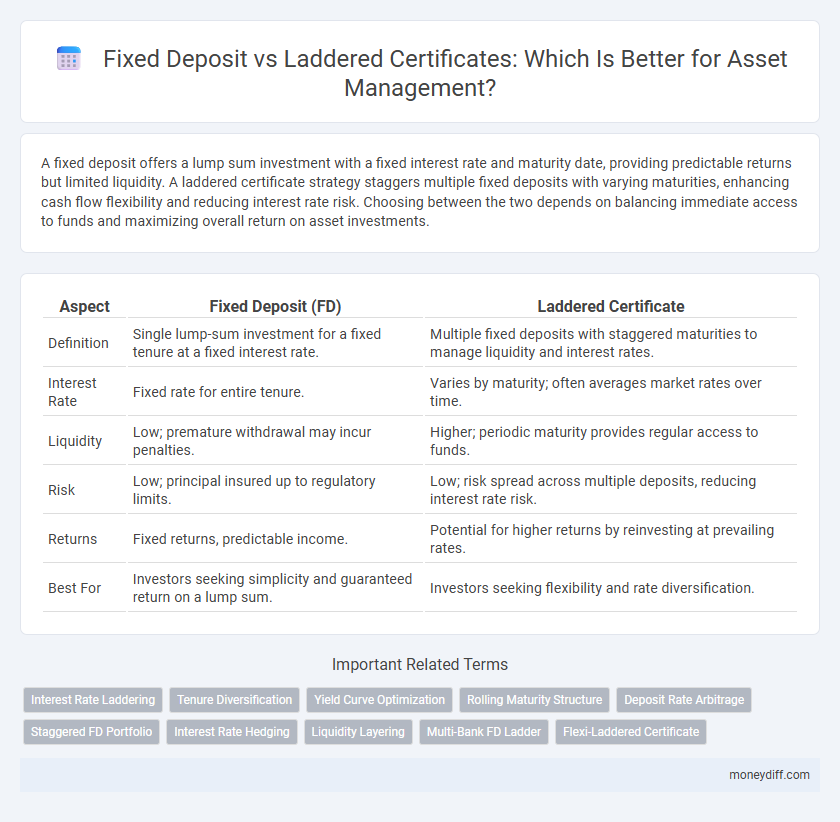

A fixed deposit offers a lump sum investment with a fixed interest rate and maturity date, providing predictable returns but limited liquidity. A laddered certificate strategy staggers multiple fixed deposits with varying maturities, enhancing cash flow flexibility and reducing interest rate risk. Choosing between the two depends on balancing immediate access to funds and maximizing overall return on asset investments.

Table of Comparison

| Aspect | Fixed Deposit (FD) | Laddered Certificate |

|---|---|---|

| Definition | Single lump-sum investment for a fixed tenure at a fixed interest rate. | Multiple fixed deposits with staggered maturities to manage liquidity and interest rates. |

| Interest Rate | Fixed rate for entire tenure. | Varies by maturity; often averages market rates over time. |

| Liquidity | Low; premature withdrawal may incur penalties. | Higher; periodic maturity provides regular access to funds. |

| Risk | Low; principal insured up to regulatory limits. | Low; risk spread across multiple deposits, reducing interest rate risk. |

| Returns | Fixed returns, predictable income. | Potential for higher returns by reinvesting at prevailing rates. |

| Best For | Investors seeking simplicity and guaranteed return on a lump sum. | Investors seeking flexibility and rate diversification. |

Understanding Fixed Deposits: A Secure Asset Choice

Fixed deposits offer a secure asset choice by providing guaranteed returns with fixed interest rates over a specified term, minimizing market risk. They deliver predictable income and capital preservation, making them ideal for conservative investors seeking stability. Laddered certificates diversify maturity dates, enhancing liquidity without sacrificing the fixed deposit's safety benefits.

Introduction to Laddered Certificates: Diversifying Maturity

Laddered certificates involve dividing a fixed deposit into multiple smaller deposits with staggered maturity dates, enabling better liquidity and risk management compared to a single fixed deposit. This strategy allows investors to access a portion of their funds regularly while potentially benefiting from varying interest rates over time. Diversifying maturity dates in laddered certificates minimizes interest rate risk and enhances portfolio flexibility.

Risk Comparison: Fixed Deposit vs Laddered Certificate

Fixed deposits offer a lower risk profile with guaranteed returns and principal protection, making them suitable for conservative investors seeking stability. Laddered certificates diversify maturity dates, reducing interest rate risk and providing greater liquidity, but expose investors to fluctuating market conditions. Comparing these options shows fixed deposits as safer for capital preservation, while laddered certificates balance risk and return through staggered investments.

Interest Rate Considerations in Asset Allocation

Fixed deposits typically offer higher fixed interest rates compared to laddered certificates of deposit (CDs), providing predictable returns for asset allocation. Laddered CDs, however, allow investors to benefit from varying interest rates over time by staggering maturity dates, reducing interest rate risk and enhancing liquidity. Asset allocation strategies incorporating both options can optimize yield while managing interest rate fluctuations and cash flow needs.

Liquidity and Flexibility: Which Option Wins?

Fixed deposits offer higher interest rates but lock funds until maturity, limiting liquidity and early withdrawal options. Laddered certificates divide investment into multiple fixed deposits with staggered maturities, enhancing flexibility and providing periodic access to funds without penalty. For investors prioritizing liquidity and flexibility, laddered certificates outperform single fixed deposits by balancing steady returns with incremental fund availability.

Maximizing Returns: Strategies for Each Investment

Fixed deposits offer guaranteed returns with fixed interest rates, ideal for investors seeking stability and predictable income on their assets. Laddered certificates diversify maturity dates, enhancing liquidity and capturing varying interest rates to maximize overall returns. Combining these strategies allows investors to balance risk and optimize asset growth by leveraging both steady yields and opportunistic rate adjustments.

Impact of Market Fluctuations on Asset Value

Fixed deposits provide a fixed interest rate, insulating asset value from market fluctuations and ensuring predictable returns. Laddered certificates distribute investment across multiple maturities, reducing risk by averaging interest rates and mitigating the impact of market volatility on overall asset value. This strategy enhances liquidity while optimizing returns in fluctuating financial markets.

Ideal Investor Profiles for Each Asset Type

Fixed deposits suit conservative investors seeking guaranteed returns with minimal risk and fixed maturity periods, ideal for capital preservation and predictable income. Laddered certificates attract investors aiming to balance liquidity and interest rate risk by staggering maturity dates, offering flexibility and potential yield enhancement. Those prioritizing stable, low-risk asset allocation favor fixed deposits, while investors targeting optimized cash flow and interest rate advantage prefer laddered certificates.

Tax Implications: Fixed Deposits vs Laddered Certificates

Fixed deposits often attract higher tax rates on interest income, which is fully taxable as per the investor's income slab, reducing net returns for high-income individuals. Laddered certificates, by dispersing investments across multiple maturities, can potentially mitigate tax impact by spreading interest receipts and enabling better tax planning, such as utilizing lower tax brackets or exemptions in staggered periods. Understanding tax implications and aligning them with investment horizons is crucial to optimizing after-tax returns for assets held in fixed deposits versus laddered certificates.

Choosing the Right Approach for Your Money Management Goals

Fixed deposits offer a guaranteed interest rate and fixed tenure, ideal for conservative investors seeking capital protection and predictable returns. Laddered certificates diversify maturity dates across multiple fixed deposits, enhancing liquidity and reducing interest rate risk by staggering reinvestment periods. Selecting the right approach depends on balancing immediate cash flow needs with long-term growth objectives and risk tolerance.

Related Important Terms

Interest Rate Laddering

Fixed Deposit interest rates remain fixed for the entire term, yielding predictable returns but limited growth potential compared to Laddered Certificates. Interest Rate Laddering in Laddered Certificates allows investors to stagger maturity dates, capturing higher rates as market conditions improve, optimizing returns while maintaining liquidity.

Tenure Diversification

Fixed Deposit offers a fixed tenure and fixed interest rates, limiting flexibility and exposure to interest rate fluctuations. Laddered Certificates diversify tenure across multiple maturities, enhancing liquidity and optimizing returns by capturing varying interest rate cycles for better asset management.

Yield Curve Optimization

Laddered Certificate of Deposit (CD) strategies optimize yield curves by staggering maturity dates, allowing investors to capture rising interest rates and maintain liquidity, unlike Fixed Deposits which lock funds at a single rate for a fixed term. This approach enhances overall returns by mitigating interest rate risk and maximizing yield opportunities across varying market conditions.

Rolling Maturity Structure

A fixed deposit offers a lump-sum investment with a single maturity date, whereas a laddered certificate employs a rolling maturity structure that staggers maturities across multiple intervals, enhancing liquidity and mitigating interest rate risk. This approach allows continuous access to funds and the opportunity to reinvest at prevailing rates, optimizing asset management and income stability.

Deposit Rate Arbitrage

Fixed Deposit offers a fixed interest rate locked for the entire tenure, providing predictable returns but limited flexibility in capital deployment. Laddered Certificates enable investors to capitalize on deposit rate arbitrage by staggering maturity dates, allowing reinvestment at potentially higher rates and optimizing overall yield in fluctuating interest rate environments.

Staggered FD Portfolio

A staggered Fixed Deposit (FD) portfolio, also known as laddered certificates, optimizes asset liquidity by splitting investments into multiple FDs with varying maturities, reducing reinvestment risk and enhancing cash flow management. This structured approach offers higher yields than single FDs by capturing fluctuating interest rates while maintaining asset stability and predictable income streams.

Interest Rate Hedging

Fixed Deposit offers a fixed interest rate, providing predictable returns but limited flexibility against rate fluctuations, while Laddered Certificates diversify investment across multiple maturities to hedge interest rate risk by capturing varying rates over time. This strategy allows asset holders to minimize exposure to rate volatility and optimize income through staggered renewal at potentially higher market rates.

Liquidity Layering

Fixed Deposits offer a fixed interest rate with limited liquidity, locking assets for a set term, while Laddered Certificates of Deposit (CDs) enhance liquidity layering by staggering maturity dates, allowing staggered access to funds and balancing interest earnings with cash flow needs. This strategic layering optimizes asset liquidity management, reducing reinvestment risk and providing regular opportunities to adjust portfolios based on changing market conditions.

Multi-Bank FD Ladder

A Multi-Bank Fixed Deposit (FD) Ladder diversifies asset allocation by spreading investments across multiple banks with staggered maturities, optimizing interest returns while minimizing risk exposure. This strategy enhances liquidity management compared to a traditional Fixed Deposit by allowing periodic access to funds as individual deposits mature.

Flexi-Laddered Certificate

Flexi-Laddered Certificates offer superior liquidity and interest rate optimization compared to traditional Fixed Deposits by allowing staggered maturity dates aligned with changing market rates and cash flow needs. This structured yet flexible approach enhances asset management efficiency, providing balanced risk and steady returns across varying economic conditions.

Fixed Deposit vs Laddered Certificate for asset. Infographic

moneydiff.com

moneydiff.com