Art ownership offers tangible and potentially appreciating assets, appealing to collectors who value physical possession and aesthetic enjoyment, while fractional art ownership provides a cost-effective way to diversify investments by allowing multiple investors to share equity in high-value artworks. Fractional ownership enhances liquidity and accessibility to exclusive art pieces, reducing the entry barrier compared to traditional full ownership. Both models serve alternative asset strategies, with full ownership focusing on direct asset control and fractional ownership emphasizing portfolio diversification and financial flexibility.

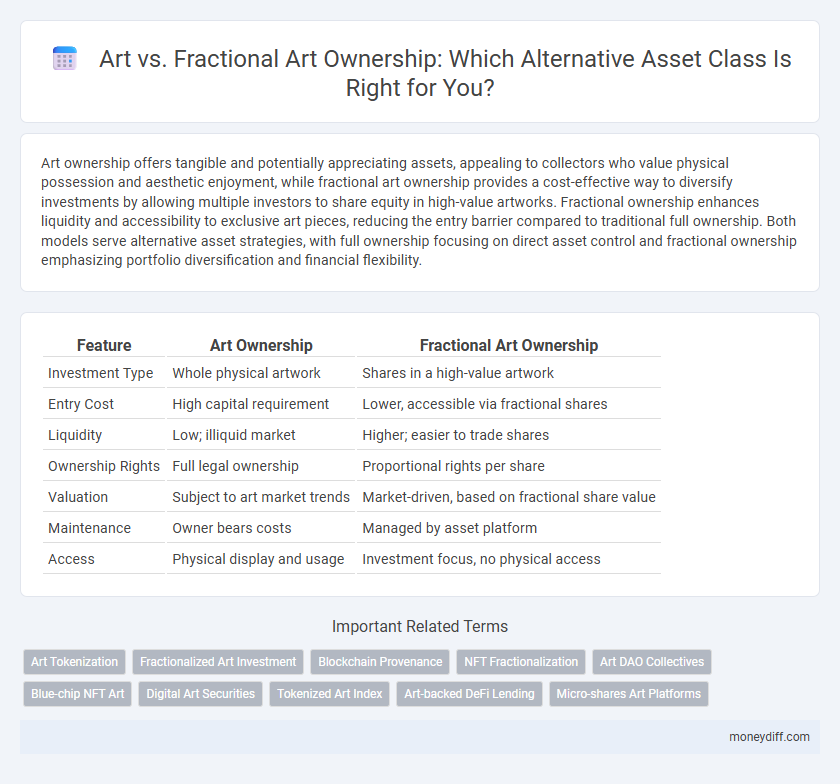

Table of Comparison

| Feature | Art Ownership | Fractional Art Ownership |

|---|---|---|

| Investment Type | Whole physical artwork | Shares in a high-value artwork |

| Entry Cost | High capital requirement | Lower, accessible via fractional shares |

| Liquidity | Low; illiquid market | Higher; easier to trade shares |

| Ownership Rights | Full legal ownership | Proportional rights per share |

| Valuation | Subject to art market trends | Market-driven, based on fractional share value |

| Maintenance | Owner bears costs | Managed by asset platform |

| Access | Physical display and usage | Investment focus, no physical access |

Understanding Art as an Alternative Asset

Art as an alternative asset offers unique diversification benefits due to its low correlation with traditional financial markets and intrinsic cultural value. Fractional art ownership democratizes access to high-value artworks by enabling multiple investors to hold partial shares, increasing liquidity and reducing entry costs. Understanding these distinctions helps investors leverage art for portfolio diversification and potential long-term appreciation.

What Is Fractional Art Ownership?

Fractional art ownership allows multiple investors to hold shares in a high-value artwork, providing access to the alternative asset market without the need for full purchase. This model leverages blockchain technology or legal frameworks to ensure secure, transparent, and divisible ownership rights. By democratizing access to fine art, fractional ownership reduces entry barriers and enhances portfolio diversification for investors.

Comparing Traditional Art Investment and Fractional Ownership

Traditional art investment involves purchasing entire artworks, offering full ownership rights but requiring substantial capital and limited liquidity. Fractional art ownership enables investors to buy shares in high-value pieces, reducing entry costs and increasing portfolio diversification while maintaining exposure to the alternative asset class. Both methods provide unique risk profiles and market access, with fractional ownership enhancing liquidity and democratizing access to blue-chip art assets.

Accessibility: Opening Doors to the Art Market

Fractional art ownership democratizes access to high-value artworks by allowing multiple investors to purchase shares, significantly lowering the financial barrier compared to traditional art acquisition. This alternative asset model enables broader participation in the art market, attracting individuals who previously lacked the capital to invest in exclusive pieces. Increased accessibility through fractional ownership fosters diversification and liquidity in art investment portfolios, transforming art into a more attainable and dynamic asset class.

Liquidity in Art vs. Fractional Art Assets

Liquidity in traditional art assets is often limited due to high entry costs, unique valuations, and illiquid markets, leading to longer transaction times and fewer buyers. Fractional art ownership enhances liquidity by enabling multiple investors to buy and sell shares in a single artwork, leveraging digital platforms and blockchain technology for faster, more efficient transactions. This fractionalization democratizes access to valuable art pieces while improving market fluidity and investor flexibility.

Risks Involved with Art vs. Fractional Art Ownership

Art ownership involves risks such as market volatility, authenticity concerns, and high transaction costs, while fractional art ownership exposes investors to liquidity issues, potential mismanagement by the platform, and regulatory uncertainties. Physical art can suffer from damage, theft, and provenance disputes, whereas fractional shares rely on digital records and third-party custodians, increasing cybersecurity risks. Understanding these distinct risk profiles is essential for investors choosing between traditional art investment and fractional ownership models in alternative assets.

Potential Returns: Traditional Art vs. Fractional Ownership

Traditional art ownership often involves high upfront costs and potential for significant appreciation based on artist reputation and market demand. Fractional art ownership lowers the entry barrier by allowing investors to purchase shares, diversifying risk while benefiting from the asset's overall value increase. Both methods offer unique potential returns, with fractional ownership providing liquidity and accessibility compared to the often illiquid nature of full art investments.

Legal Considerations in Art Investment

Art investment requires careful legal consideration, especially when choosing between full ownership and fractional art ownership. Full ownership grants exclusive rights and control, simplifying legal responsibilities, while fractional ownership involves complex contracts to define each co-owner's rights, transferability, and dispute resolution mechanisms. Navigating securities regulations and intellectual property laws is essential to protect investors and ensure compliance in fractional art investment structures.

Diversification Benefits in Alternative Asset Portfolios

Fractional art ownership enhances portfolio diversification by allowing investors to acquire shares of high-value artworks without the need for full capital commitment, reducing risk exposure compared to traditional art investments. This method increases liquidity and access to a broader range of alternative assets, enabling more balanced allocation across different art styles and periods. Integrating fractional art into alternative asset portfolios provides a strategic advantage through improved risk-adjusted returns and reduced correlation with conventional financial markets.

Choosing Between Art and Fractional Ownership: Key Factors

Choosing between art and fractional art ownership hinges on factors like investment budget, risk tolerance, and liquidity needs. Full art ownership offers exclusive control and potential for significant appreciation, while fractional ownership provides diversification and lower entry costs by sharing asset access with multiple investors. Evaluating personal financial goals and market volatility is essential for determining the optimal alternative asset strategy.

Related Important Terms

Art Tokenization

Art tokenization transforms traditional artworks into digital tokens, enabling fractional ownership and increasing liquidity in alternative asset markets. This blockchain-based approach democratizes access, allowing investors to buy and trade shares of high-value art pieces without needing full ownership.

Fractionalized Art Investment

Fractionalized art investment enables multiple investors to own shares of high-value alternative assets, increasing liquidity and accessibility compared to traditional full ownership. This model leverages blockchain technology to provide transparent, verifiable ownership records and facilitates seamless trading of art fractions in secondary markets.

Blockchain Provenance

Blockchain provenance enhances transparency and security in fractional art ownership by recording immutable transaction histories, enabling verified proof of authenticity and ownership. This decentralized ledger surpasses traditional art ownership by reducing fraud risks and facilitating easier transferability of high-value alternative assets.

NFT Fractionalization

NFT fractionalization enhances asset liquidity by dividing high-value digital art into tradable shares, making alternative asset ownership more accessible and scalable. This approach contrasts with traditional art ownership, which requires full purchase and limits investor participation due to high entry costs and illiquidity.

Art DAO Collectives

Art DAO Collectives leverage blockchain technology to enable fractional art ownership, providing investors with increased liquidity and diversified exposure to high-value alternative assets compared to traditional art ownership. This decentralized approach democratizes access to art investment, allowing fractionalization of expensive artworks while ensuring transparent provenance and governance through smart contracts.

Blue-chip NFT Art

Blue-chip NFT art as an alternative asset offers fractional ownership, enabling investors to hold a stake in high-value digital masterpieces without acquiring entire pieces, enhancing liquidity and accessibility. Full art ownership provides exclusive control and provenance but requires significant capital and limits diversification compared to fractional shares in prestigious NFTs.

Digital Art Securities

Digital art securities offer fractional art ownership, enabling investors to acquire scalable shares of high-value artworks, enhancing liquidity compared to traditional full-piece acquisition. This model leverages blockchain technology to ensure transparent provenance and seamless transferability, positioning digital art securities as a transformative alternative asset class.

Tokenized Art Index

Tokenized Art Index offers a diversified exposure to the art market by representing fractional ownership in multiple artworks, reducing the risks associated with single-piece art investments. This approach democratizes access to alternative assets, enabling investors to trade shares of high-value art pieces through blockchain technology, enhancing liquidity and transparency compared to traditional art ownership.

Art-backed DeFi Lending

Art-backed DeFi lending leverages fractional art ownership to unlock liquidity by enabling investors to use digital shares of high-value artworks as collateral on decentralized platforms. This innovation transforms alternative assets, allowing broader access to art investment while maintaining secure, transparent transactions through blockchain technology.

Micro-shares Art Platforms

Micro-shares art platforms revolutionize alternative asset investment by enabling fractional art ownership, allowing collectors to purchase micro-shares in high-value artworks without full acquisition. This democratizes access to the art market, enhances liquidity compared to traditional art ownership, and diversifies portfolios through tokenized art assets on blockchain-based platforms.

Art vs Fractional Art Ownership for alternative asset Infographic

moneydiff.com

moneydiff.com