Traditional art investment involves purchasing entire artworks, offering tangible ownership but requiring significant capital and storage considerations. Fractional art investment allows multiple investors to own shares of high-value pieces, increasing accessibility and liquidity while diversifying risk. Both strategies provide unique opportunities, but fractional investment democratizes access to prestigious art assets without the need for full ownership.

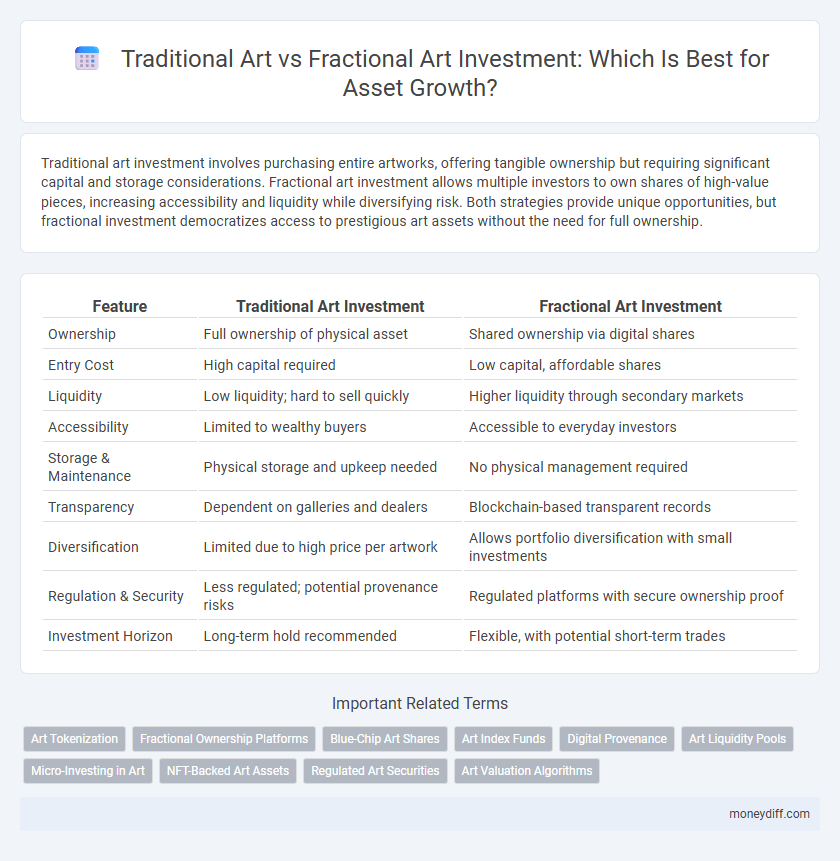

Table of Comparison

| Feature | Traditional Art Investment | Fractional Art Investment |

|---|---|---|

| Ownership | Full ownership of physical asset | Shared ownership via digital shares |

| Entry Cost | High capital required | Low capital, affordable shares |

| Liquidity | Low liquidity; hard to sell quickly | Higher liquidity through secondary markets |

| Accessibility | Limited to wealthy buyers | Accessible to everyday investors |

| Storage & Maintenance | Physical storage and upkeep needed | No physical management required |

| Transparency | Dependent on galleries and dealers | Blockchain-based transparent records |

| Diversification | Limited due to high price per artwork | Allows portfolio diversification with small investments |

| Regulation & Security | Less regulated; potential provenance risks | Regulated platforms with secure ownership proof |

| Investment Horizon | Long-term hold recommended | Flexible, with potential short-term trades |

Understanding Traditional Art Investment: A Classic Asset

Traditional art investment involves acquiring physical artworks such as paintings, sculptures, and prints, which have historically appreciated in value due to their rarity, artist reputation, and cultural significance. This classic asset class requires significant capital, expertise in authenticity and provenance, and typically offers long-term appreciation with less liquidity compared to other investments. Collectors benefit from tangible ownership and potential tax advantages but must consider storage, insurance, and market volatility when managing these high-value assets.

What Is Fractional Art Investment?

Fractional art investment allows multiple investors to own shares of a high-value artwork, making costly pieces more accessible compared to traditional art purchases that require full ownership. This approach leverages blockchain technology or digital platforms to securely divide and track ownership, increasing liquidity within the art market. Fractional investment broadens participation and diversifies risk by enabling investors to hold partial interest in a diverse portfolio of artworks without the need for significant capital.

Comparing Returns: Traditional vs. Fractional Art Investment

Traditional art investment often requires substantial capital and presents limited liquidity, with returns depending heavily on market timing and provenance. Fractional art investment allows multiple investors to own shares of high-value artworks, enhancing liquidity and enabling diversified portfolios with potentially steady returns. While traditional art may offer higher appreciation over time, fractional investment reduces entry barriers and mitigates risk through fractional ownership and secondary market trading.

Accessibility and Entry Barriers in Art Investing

Traditional art investment often requires substantial capital, making it accessible primarily to wealthy collectors due to high entry barriers such as auction house fees and provenance verification. Fractional art investment lowers these barriers by allowing multiple investors to buy shares of a high-value artwork, significantly reducing the required entry capital and increasing liquidity. Digital platforms enable broader accessibility, democratizing art ownership and expanding the investor base beyond traditional art market participants.

Liquidity: How Easy Is It to Buy or Sell Art Assets?

Traditional art investment often involves high entry costs and limited market access, making liquidity a significant challenge due to infrequent sales and lengthy transaction processes. Fractional art investment enhances liquidity by enabling investors to buy and sell shares of art assets on specialized platforms, facilitating faster transactions and lower capital requirements. This approach democratizes art ownership while providing more accessible exit options compared to the traditional art market.

Risks and Volatility: Evaluating Investment Safety

Traditional art investment involves high risks and volatility due to market illiquidity and subjective valuation, which can lead to difficulty in asset liquidation and unpredictable price swings. Fractional art investment mitigates these risks by enabling diversification across multiple assets and providing enhanced liquidity through digital platforms. Despite lower entry barriers, fractional art remains exposed to market fluctuations and regulatory uncertainties that can influence investment safety.

Ownership Structure: Full vs. Shared Art Asset Control

Traditional art investment involves full ownership, granting investors complete control over the asset, including decision-making on sales, loans, or exhibitions. Fractional art investment divides ownership into shares, allowing multiple investors to hold partial stakes, thereby sharing risks and potential returns without requiring full capital commitment. This shared ownership structure increases liquidity and accessibility but may complicate decision-making processes due to collective governance.

Costs and Fees in Traditional and Fractional Art Investments

Traditional art investments often involve high upfront costs, including hefty purchase prices, insurance, storage, and maintenance fees, which can significantly impact overall returns. Fractional art investment reduces entry barriers by allowing multiple investors to own shares of a high-value artwork, spreading acquisition and holding expenses while typically incurring platform fees and transaction costs. The cost efficiency of fractional art makes it an attractive alternative, especially for investors seeking diversification without the extensive financial commitments characteristic of traditional art asset acquisition.

Portfolio Diversification with Art: Which Method Wins?

Portfolio diversification through art investment involves balancing risk and liquidity between traditional art and fractional art ownership. Traditional art requires significant capital and presents challenges in liquidity and valuation, while fractional art investment offers lower entry costs, enhanced liquidity through secondary markets, and easier access to diversified art assets. Fractional art investment generally provides superior portfolio diversification benefits due to its ability to spread exposure across multiple high-value artworks with less financial commitment.

Future Trends in Art Investment: Traditional or Fractional?

Future trends in art investment indicate a growing shift towards fractional art ownership, leveraging blockchain technology to increase liquidity and accessibility for smaller investors. Traditional art investment remains valued for its tangible, high-value assets and long-term appreciation, but fractional platforms are democratizing access, enabling diversified portfolios with lower entry costs. Enhanced transparency and lower transaction barriers suggest fractional art investment will increasingly complement or even surpass traditional models in market dynamism and investor participation.

Related Important Terms

Art Tokenization

Art tokenization transforms traditional art investment by dividing ownership into digital shares, enabling fractional art investment and greater market accessibility. This blockchain-based approach increases liquidity and democratizes asset participation compared to conventional full-piece acquisitions.

Fractional Ownership Platforms

Fractional ownership platforms revolutionize traditional art investment by allowing multiple investors to buy shares in high-value artworks, increasing liquidity and accessibility in the art market. These platforms leverage blockchain technology for secure, transparent transactions, enabling diversified portfolios and democratizing asset ownership beyond conventional gallery constraints.

Blue-Chip Art Shares

Blue-chip art shares offer a liquidity advantage over traditional art investment by enabling fractional ownership in masterpieces valued in the millions. This approach democratizes access to high-value assets, allowing investors to diversify portfolios with blue-chip artworks while potentially reducing entry costs and enhancing market flexibility.

Art Index Funds

Art Index Funds offer diversified exposure to the art market by pooling investments in a broad range of artworks, reducing risk compared to the concentrated nature of traditional art investment. Fractional art investment within these funds allows investors to acquire shares of high-value pieces, enhancing liquidity and accessibility absent in conventional art asset ownership.

Digital Provenance

Traditional art investment relies on physical ownership and historical value, often facing challenges in verifying authenticity and provenance, whereas fractional art investment utilizes blockchain technology to provide transparent digital provenance, enhancing trust and liquidity for asset holders. Digital provenance ensures immutable ownership records and seamless transferability, revolutionizing how investors engage with art assets.

Art Liquidity Pools

Traditional art investment offers tangible ownership but often struggles with low liquidity and high entry costs, limiting market access. Fractional art investment through art liquidity pools enables diversified asset exposure by tokenizing valuable artworks, allowing investors to buy and sell shares easily within a secondary market.

Micro-Investing in Art

Traditional art investment requires significant capital and carries risks related to authenticity and liquidity, whereas fractional art investment allows micro-investors to purchase shares of high-value artworks, enhancing accessibility and diversification. Platforms offering fractional ownership utilize blockchain technology to ensure transparency, ownership verification, and ease of transaction, making art investment more inclusive and efficient.

NFT-Backed Art Assets

NFT-backed art assets revolutionize traditional art investments by enabling fractional ownership, increasing liquidity and accessibility for a broader range of investors. Unlike conventional art, which requires significant capital and faces challenges in valuation and transferability, NFT-backed fractional art offers transparent blockchain-based provenance and seamless tradeability within digital marketplaces.

Regulated Art Securities

Traditional art investment often involves high upfront costs and limited liquidity, whereas fractional art investment enables multiple investors to own regulated art securities, enhancing accessibility and market transparency. Regulated art securities adhere to financial compliance standards, providing a secure framework for fractional ownership and potential asset appreciation within the art market.

Art Valuation Algorithms

Art valuation algorithms provide precise market data analysis, enhancing the accuracy of asset appraisal in both traditional and fractional art investments. These algorithms leverage machine learning and big data to assess trends, provenance, and liquidity, optimizing investment decisions in diversified art portfolios.

Traditional Art vs Fractional Art Investment for asset. Infographic

moneydiff.com

moneydiff.com