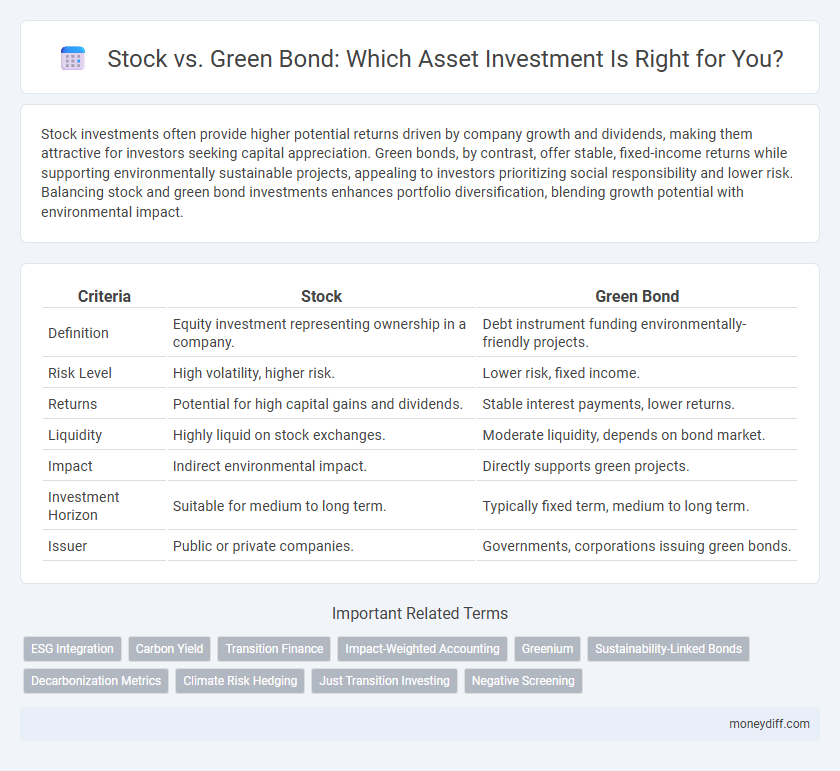

Stock investments often provide higher potential returns driven by company growth and dividends, making them attractive for investors seeking capital appreciation. Green bonds, by contrast, offer stable, fixed-income returns while supporting environmentally sustainable projects, appealing to investors prioritizing social responsibility and lower risk. Balancing stock and green bond investments enhances portfolio diversification, blending growth potential with environmental impact.

Table of Comparison

| Criteria | Stock | Green Bond |

|---|---|---|

| Definition | Equity investment representing ownership in a company. | Debt instrument funding environmentally-friendly projects. |

| Risk Level | High volatility, higher risk. | Lower risk, fixed income. |

| Returns | Potential for high capital gains and dividends. | Stable interest payments, lower returns. |

| Liquidity | Highly liquid on stock exchanges. | Moderate liquidity, depends on bond market. |

| Impact | Indirect environmental impact. | Directly supports green projects. |

| Investment Horizon | Suitable for medium to long term. | Typically fixed term, medium to long term. |

| Issuer | Public or private companies. | Governments, corporations issuing green bonds. |

Understanding Stock Investments

Stock investments represent ownership shares in publicly traded companies, offering potential for capital appreciation and dividend income. Stocks are generally more volatile than green bonds but can provide higher long-term returns through market appreciation and business growth. Investors seeking asset diversification often balance stocks with green bonds due to the latter's stable income and environmental impact focus.

Introduction to Green Bonds

Green bonds are fixed-income financial instruments specifically designed to fund projects with environmental benefits, differing from traditional stocks by offering stable returns linked to sustainable initiatives. Unlike stocks, which represent ownership and come with market volatility, green bonds provide investors with a predictable income stream while supporting renewable energy, clean transportation, and climate resilience projects. This emerging asset class aligns investment strategies with environmental goals, appealing to investors seeking both financial returns and positive ecological impact.

Risk and Return: Stocks vs Green Bonds

Stocks typically offer higher returns but come with increased volatility and market risk, making them suitable for investors with a higher risk tolerance. Green bonds provide more stable, fixed-income returns with lower risk, backed by environmentally sustainable projects and often supported by government or institutional guarantees. Balancing stocks and green bonds can optimize portfolio risk and return, aligning financial goals with sustainability priorities.

Environmental Impact: Comparing Both Assets

Green bonds directly fund projects that reduce carbon emissions and promote renewable energy, offering measurable environmental benefits, while stocks vary widely in their environmental impact depending on the company's sustainability practices. Investors seeking positive environmental outcomes may prefer green bonds due to their transparent use of proceeds tied to eco-friendly initiatives. However, stock investments in leading clean energy or sustainable companies can also drive significant environmental progress through influencing corporate strategies and innovation.

Liquidity Considerations in Stocks and Green Bonds

Stocks typically offer higher liquidity due to active trading on major exchanges, enabling quick buying and selling at transparent prices. Green bonds, while increasingly popular for sustainable investing, tend to have lower liquidity because they are often held by institutional investors and traded less frequently. Investors prioritizing immediate access to funds may favor stocks, whereas those focused on long-term impact and environmental goals might accept the reduced liquidity of green bonds.

Portfolio Diversification with Stocks and Green Bonds

Incorporating green bonds into an asset portfolio alongside stocks enhances diversification by reducing overall risk through exposure to different market sectors and financial instruments. Stocks offer growth potential tied to company performance and market conditions, while green bonds provide stable, fixed-income returns funded by environmentally sustainable projects. This combination balances volatility and income generation, aligning investment goals with both financial returns and environmental impact.

Market Performance Trends: Historical Analysis

Stock investments have demonstrated higher volatility but greater long-term returns compared to green bonds, which have shown stable performance with moderate yields driven by increasing demand for sustainable assets. Historical market data reveals that green bonds experienced steady growth as regulatory support and ESG integration intensified, attracting conservative investors seeking lower-risk assets. Stocks outperform in bullish markets due to capital appreciation opportunities, while green bonds offer resilience during market downturns, balancing portfolio risk with eco-conscious impacts.

Regulatory and Tax Implications

Stock investments often face capital gains tax on dividends and appreciation, with regulatory oversight by entities like the SEC to ensure transparent reporting and market fairness. Green bonds benefit from favorable tax treatment in many jurisdictions, such as tax exemptions or credits, incentivizing investment in environmentally sustainable projects under frameworks aligned with ESG regulations. Regulatory compliance for green bonds requires adherence to specific environmental impact reporting standards, impacting asset valuation and investor decision-making differently than traditional stock investments.

Investor Profiles Suited for Stocks vs Green Bonds

Stock investments are best suited for investors seeking higher growth potential and willing to accept greater market volatility, typically including younger individuals with longer investment horizons. Green bonds attract risk-averse investors prioritizing stable income streams and social or environmental impact, often appealing to institutional investors or those focused on sustainability. Understanding these investor profiles helps optimize asset allocation by balancing growth ambitions and ethical investment goals.

Future Outlook: Sustainability in Asset Allocation

Stock investments offer dynamic growth potential but face increasing pressure to meet environmental, social, and governance (ESG) criteria, influencing their long-term viability. Green bonds provide a targeted approach to sustainability by directly funding environmentally friendly projects, appealing to investors prioritizing climate risk mitigation and regulatory compliance. Incorporating green bonds into asset allocation enhances portfolio resilience against evolving sustainability standards and supports the transition to a low-carbon economy.

Related Important Terms

ESG Integration

Green bonds provide targeted investment opportunities that directly fund environmentally sustainable projects, enhancing a portfolio's ESG integration by supporting carbon reduction and renewable energy initiatives. In contrast, stocks offer broader exposure to companies with varying ESG practices, requiring rigorous analysis to identify firms with strong environmental, social, and governance performance for effective asset investment alignment.

Carbon Yield

Stock investments offer variable returns with exposure to market volatility, while green bonds provide fixed-income opportunities specifically funding environmentally beneficial projects. Green bonds deliver measurable carbon yield by directly supporting carbon reduction initiatives, making them a strategic asset choice for investors targeting sustainable, low-carbon portfolios.

Transition Finance

Stock investments offer potential for high returns but carry significant market volatility, while green bonds provide stable, fixed-income streams specifically earmarked for environmentally sustainable projects. Transition finance, bridging traditional assets and green initiatives, leverages green bonds to support carbon-intensive sectors' shift toward low-carbon technologies, balancing financial performance with sustainability goals.

Impact-Weighted Accounting

Stock investments offer ownership stakes with variable returns based on market performance, whereas green bonds provide fixed income tied to environmentally beneficial projects. Impact-Weighted Accounting enables investors to quantify and compare the social and environmental outcomes of stocks and green bonds, enhancing asset allocation decisions towards sustainable value creation.

Greenium

Green bonds typically offer a "greenium," a premium price reflecting investor demand for sustainable assets, resulting in slightly lower yields compared to traditional stocks. This greenium enhances portfolio diversification and aligns asset investment with environmental, social, and governance (ESG) criteria, appealing to investors prioritizing long-term sustainable returns.

Sustainability-Linked Bonds

Sustainability-linked bonds (SLBs) offer a flexible alternative to traditional green bonds by tying coupon rates to the issuer's achievement of pre-defined sustainability performance targets, thus providing investors with both financial returns and measurable environmental impact. Compared to stocks, SLBs deliver lower risk with fixed income characteristics while promoting corporate accountability in reducing carbon emissions and enhancing ESG outcomes.

Decarbonization Metrics

Stock investments often lack standardized decarbonization metrics, making it challenging to quantify their impact on reducing carbon emissions compared to green bonds. Green bonds provide transparent, verifiable data on carbon reduction projects, enabling investors to directly assess and support decarbonization efforts within their asset portfolios.

Climate Risk Hedging

Green bonds provide a targeted climate risk hedging advantage by directly funding environmentally sustainable projects, reducing exposure to carbon-intensive asset stranding. Stocks, while offering growth potential, often carry higher climate-related financial risks due to regulatory shifts and market volatility in carbon-heavy industries.

Just Transition Investing

Stock investments offer exposure to a broad range of companies, enabling diversification across industries and growth potential in emerging sectors supporting a Just Transition. Green bonds specifically finance environmentally sustainable projects, providing fixed-income returns while directly contributing to the decarbonization and social equity goals central to Just Transition investing.

Negative Screening

Negative screening in asset investment excludes stocks associated with environmental harm, while green bonds specifically fund projects with positive environmental impacts. Investors prioritizing sustainability often favor green bonds to ensure capital supports eco-friendly initiatives, contrasting with traditional stock portfolios that may only partially apply exclusion criteria.

Stock vs Green Bond for asset investment Infographic

moneydiff.com

moneydiff.com