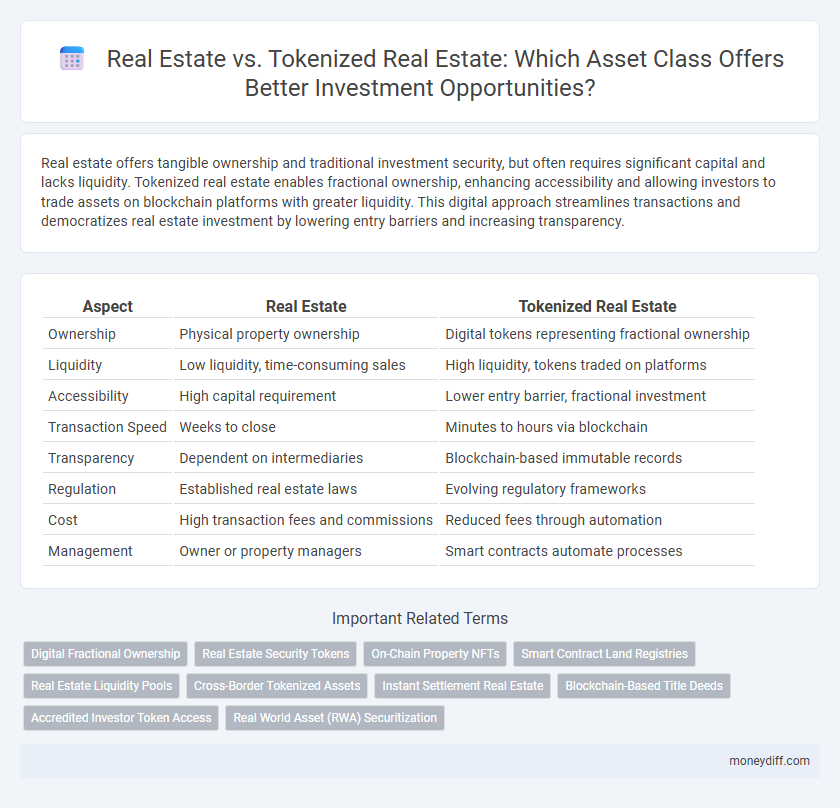

Real estate offers tangible ownership and traditional investment security, but often requires significant capital and lacks liquidity. Tokenized real estate enables fractional ownership, enhancing accessibility and allowing investors to trade assets on blockchain platforms with greater liquidity. This digital approach streamlines transactions and democratizes real estate investment by lowering entry barriers and increasing transparency.

Table of Comparison

| Aspect | Real Estate | Tokenized Real Estate |

|---|---|---|

| Ownership | Physical property ownership | Digital tokens representing fractional ownership |

| Liquidity | Low liquidity, time-consuming sales | High liquidity, tokens traded on platforms |

| Accessibility | High capital requirement | Lower entry barrier, fractional investment |

| Transaction Speed | Weeks to close | Minutes to hours via blockchain |

| Transparency | Dependent on intermediaries | Blockchain-based immutable records |

| Regulation | Established real estate laws | Evolving regulatory frameworks |

| Cost | High transaction fees and commissions | Reduced fees through automation |

| Management | Owner or property managers | Smart contracts automate processes |

Understanding Traditional Real Estate as an Asset

Traditional real estate serves as a tangible, long-term asset offering stability, income potential through rentals, and appreciation over time. It requires significant initial capital investment, involves complex legal processes, and is subject to market fluctuations and maintenance costs. Investors benefit from direct ownership rights and physical control but face limitations in liquidity and transferability compared to tokenized alternatives.

What Is Tokenized Real Estate?

Tokenized real estate represents ownership in a property through digital tokens on a blockchain, enabling fractional investment and increased liquidity compared to traditional real estate. This asset class allows investors to buy, sell, or trade shares of real estate without the typical barriers of entry such as high capital requirements and lengthy transaction processes. By leveraging blockchain technology, tokenized real estate enhances transparency, reduces costs, and provides greater accessibility to a broader range of investors.

Comparing Liquidity: Real Estate vs Tokenized Real Estate

Tokenized real estate offers significantly higher liquidity compared to traditional real estate by enabling fractional ownership and faster transactions through blockchain technology. Traditional real estate transactions are often time-consuming and involve multiple intermediaries, leading to lower market liquidity and slower asset conversion. Tokenization reduces barriers to entry and trading time, allowing investors to quickly buy or sell real estate assets on digital platforms with greater ease and transparency.

Accessibility and Investment Barriers

Real estate traditionally requires substantial capital and involves complex legal processes, limiting accessibility for many investors. Tokenized real estate lowers investment barriers by enabling fractional ownership through blockchain technology, allowing smaller, more diverse investors to participate. This digital approach enhances liquidity and provides easier entry into the real estate market compared to conventional asset acquisition.

Fractional Ownership Explained

Real estate traditionally requires significant capital investment, limiting ownership to a few individuals or entities, whereas tokenized real estate enables fractional ownership through blockchain technology, allowing investors to purchase smaller shares of a property. This fractional ownership model increases liquidity and accessibility, as investors can trade tokens representing real estate assets on digital platforms, reducing entry barriers and enhancing portfolio diversification. Tokenized real estate also offers transparency and security through immutable ledger records, streamlining transactions and ownership verification.

Security and Transparency in Asset Management

Real estate assets traditionally involve lengthy processes and centralized management, often exposing investors to risks related to opaque ownership records and limited liquidity. Tokenized real estate leverages blockchain technology to enhance security by providing immutable, transparent digital ledgers that verify ownership and transaction history in real time. This increased transparency reduces fraud risks, enables fractional ownership, and facilitates secure, efficient asset management through automated smart contracts.

Regulatory and Legal Considerations

Regulatory and legal considerations differ significantly between traditional real estate and tokenized real estate assets. Traditional real estate transactions are governed by established property laws, zoning regulations, and local government approval processes, ensuring clear title and ownership rights. In contrast, tokenized real estate involves securities laws compliance, digital asset regulations, and smart contract enforceability, requiring adherence to jurisdiction-specific cryptocurrency and blockchain regulations to protect investors and ensure legal validity.

Diversification Opportunities for Investors

Real estate offers tangible asset diversification through direct property ownership, providing long-term value and income generation. Tokenized real estate enables fractional ownership, allowing investors to diversify across multiple properties with lower capital requirements and enhanced liquidity. This digital approach broadens access to diverse real estate markets, optimizing portfolio risk management and potential returns.

Risks and Challenges in Traditional and Tokenized Real Estate

Traditional real estate faces risks including high entry costs, limited liquidity, and complex legal processes, which can delay transactions and limit investor access. Tokenized real estate introduces risks such as regulatory uncertainty, cybersecurity threats, and technological barriers that may affect asset security and market adoption. Both assets require thorough due diligence to navigate challenges related to valuation transparency, market volatility, and compliance with evolving financial regulations.

Future Outlook: Evolving Trends in Real Estate Investment

Tokenized real estate is revolutionizing asset management by enabling fractional ownership, enhancing liquidity, and reducing entry barriers compared to traditional real estate investments. Blockchain technology ensures transparent transactions and faster settlement times, attracting a broader range of investors globally. Market trends indicate accelerating adoption of tokenized properties as regulatory frameworks mature and investor confidence in digital assets grows.

Related Important Terms

Digital Fractional Ownership

Tokenized real estate enables digital fractional ownership, allowing investors to buy and sell asset shares on blockchain platforms, increasing liquidity compared to traditional real estate investments. This digital approach reduces entry barriers, offers transparent transaction records, and enhances portfolio diversification through easy access to global real estate markets.

Real Estate Security Tokens

Real Estate Security Tokens revolutionize traditional real estate investments by digitizing asset ownership on blockchain, enabling fractional ownership, enhanced liquidity, and automated compliance through smart contracts. Compared to conventional real estate, these tokens provide increased transparency, faster transactions, and access to global markets while maintaining regulatory oversight.

On-Chain Property NFTs

Real estate tokenization leverages On-Chain Property NFTs to create fractional ownership, enhancing liquidity and transparency compared to traditional real estate assets. These blockchain-based tokens enable seamless transferability and secure proof of ownership, revolutionizing asset management and investment accessibility in the real estate market.

Smart Contract Land Registries

Real estate assets traditionally rely on centralized land registries, which are often slow, opaque, and prone to fraud, while tokenized real estate leverages smart contract land registries on blockchain networks to enable transparent, automated ownership verification and transfer. This shift enhances liquidity, reduces transaction costs, and provides immutable records that streamline asset management and compliance in property markets.

Real Estate Liquidity Pools

Real estate liquidity pools enable investors to trade fractional shares of tokenized real estate assets on blockchain platforms, providing enhanced liquidity compared to traditional real estate investments that are typically illiquid and require significant capital. Tokenized real estate leverages smart contracts and decentralized finance (DeFi) protocols to facilitate faster transactions, lower entry barriers, and diversified portfolios within asset markets.

Cross-Border Tokenized Assets

Cross-border tokenized real estate enables fractional ownership and liquidity across global markets, leveraging blockchain technology to reduce transaction costs and increase transparency compared to traditional real estate assets. This digital transformation facilitates seamless access to international investors while overcoming regulatory and currency barriers inherent in conventional real estate investments.

Instant Settlement Real Estate

Real estate traditionally involves lengthy settlement periods of 30 to 60 days, creating liquidity challenges for investors and sellers. Tokenized real estate leverages blockchain technology to enable instant settlement, enhancing liquidity, reducing transaction costs, and providing fractional ownership opportunities for a broader range of investors.

Blockchain-Based Title Deeds

Real estate traditionally relies on physical title deeds recorded in centralized registries, which can be slow and prone to errors or fraud. Tokenized real estate leverages blockchain-based title deeds, offering enhanced transparency, immutability, and faster property transfers through secure digital ownership records.

Accredited Investor Token Access

Tokenized real estate offers accredited investors fractional ownership opportunities with enhanced liquidity and lower entry barriers compared to traditional real estate investments, which often require significant capital and face longer transaction timelines. Accredited investor token access leverages blockchain technology to provide transparent, secure, and efficient asset management, enabling faster portfolio diversification and real-time trading of property-backed tokens.

Real World Asset (RWA) Securitization

Real estate as a traditional real-world asset (RWA) offers tangible value and long-term stability, while tokenized real estate enables fractional ownership and enhanced liquidity through blockchain-based securitization. Tokenization of RWAs transforms real estate into digital securities, facilitating easier access to investment, increased transparency, and streamlined asset transfer.

Real Estate vs Tokenized Real Estate for asset. Infographic

moneydiff.com

moneydiff.com