Asset pets typically refer to tangible items owned for personal enjoyment or utility, whereas infrastructure assets represent large-scale physical systems essential for economic activities, such as transportation networks or utilities. In money management, infrastructure assets often provide more stable, long-term returns due to their critical role in public services and consistent demand. Choosing between asset pets and infrastructure assets depends on investment goals, with infrastructure assets suited for strategic financial growth and asset pets more aligned with personal value and discretionary spending.

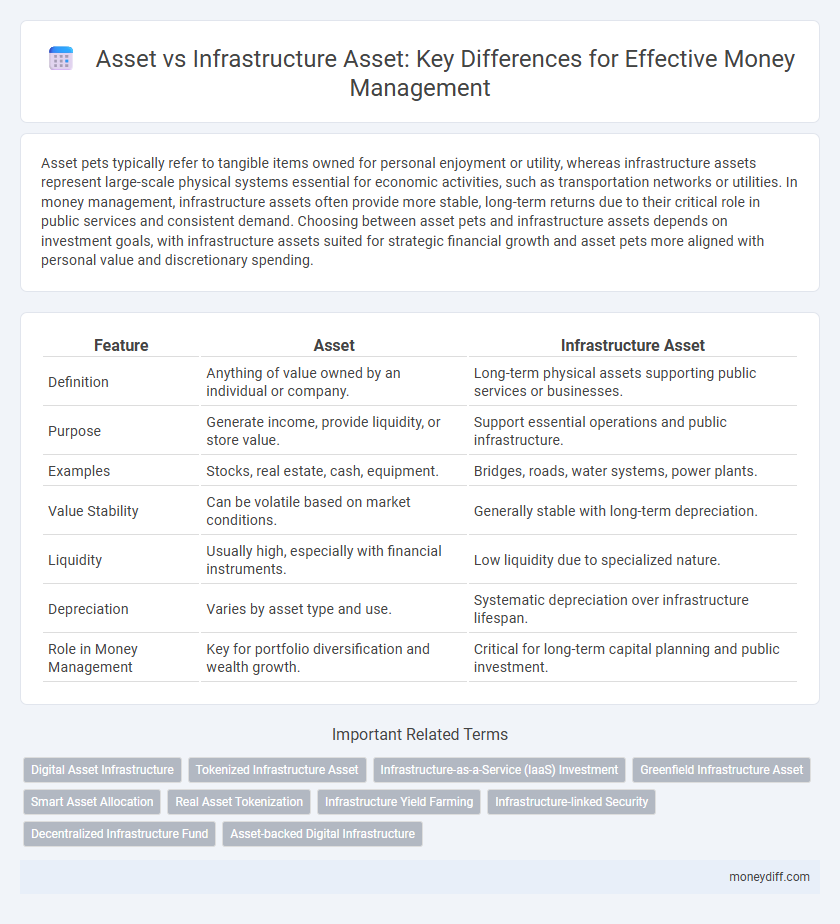

Table of Comparison

| Feature | Asset | Infrastructure Asset |

|---|---|---|

| Definition | Anything of value owned by an individual or company. | Long-term physical assets supporting public services or businesses. |

| Purpose | Generate income, provide liquidity, or store value. | Support essential operations and public infrastructure. |

| Examples | Stocks, real estate, cash, equipment. | Bridges, roads, water systems, power plants. |

| Value Stability | Can be volatile based on market conditions. | Generally stable with long-term depreciation. |

| Liquidity | Usually high, especially with financial instruments. | Low liquidity due to specialized nature. |

| Depreciation | Varies by asset type and use. | Systematic depreciation over infrastructure lifespan. |

| Role in Money Management | Key for portfolio diversification and wealth growth. | Critical for long-term capital planning and public investment. |

Understanding Assets and Infrastructure Assets

Assets represent valuable resources owned by an individual or organization that can generate future economic benefits, including cash, investments, and tangible property. Infrastructure assets specifically refer to physical systems and facilities such as roads, bridges, and utilities integral to public services and long-term value creation. Differentiating these categories aids in strategic money management by identifying asset liquidity, depreciation rates, and investment horizons.

Key Differences Between Assets and Infrastructure Assets

Assets represent any valuable resource owned by an individual or organization, including cash, investments, property, and equipment, while infrastructure assets specifically refer to long-term physical systems vital for public services, such as roads, bridges, and utilities. The key difference lies in their purpose and lifespan; infrastructure assets typically require significant capital investment with extended useful lives and are essential for economic stability and community development. In money management, infrastructure assets demand specialized accounting and maintenance strategies due to their scale, regulatory implications, and impact on public welfare, unlike general assets that may prioritize liquidity and market value.

Classification of Assets in Money Management

Assets in money management are classified into two main categories: general assets and infrastructure assets. General assets include cash, investments, and receivables, which provide liquidity and short-term financial benefits. Infrastructure assets, such as roads, bridges, and utilities, represent long-term investments that generate sustained economic value and require specialized management strategies for maintenance and depreciation.

The Role of Infrastructure Assets in Wealth Building

Infrastructure assets provide stable, long-term cash flows and inflation protection, making them essential components in diversified investment portfolios. Their inherent physical utility and monopolistic characteristics often result in predictable revenue streams, enhancing wealth preservation and growth. Incorporating infrastructure assets into money management strategies helps mitigate market volatility while generating consistent income for sustained wealth building.

Valuation Methods for Assets vs Infrastructure Assets

Valuation methods for assets typically involve market-based approaches such as comparable sales, income capitalization, or cost approaches, reflecting the asset's liquidity and market demand. Infrastructure assets require specialized valuation techniques including discounted cash flow (DCF) models that account for long-term operational life, stable cash flows, and regulatory factors impacting revenue streams. The distinction in valuation is crucial for accurate financial reporting and investment decision-making in money management.

Risk Assessment: Assets vs Infrastructure Assets

Risk assessment for assets centers on liquidity, market volatility, and depreciation, whereas infrastructure assets involve long-term considerations like regulatory changes, physical wear, and operational disruptions. Infrastructure assets typically carry lower market risk but higher exposure to maintenance costs and project-specific uncertainties, impacting cash flow stability. Effective money management demands tailored risk models reflecting the distinct risk profiles of assets and infrastructure assets to optimize portfolio resilience.

Liquidity Considerations for Different Asset Types

Liquidity considerations vary significantly between general assets and infrastructure assets due to their differing market characteristics. Assets like stocks and bonds typically offer high liquidity, enabling quicker conversion to cash without substantial loss of value, while infrastructure assets such as toll roads or energy facilities often entail lower liquidity because of their specialized nature and longer investment horizons. Effective money management requires balancing these liquidity profiles to ensure sufficient access to funds while optimizing long-term returns.

Asset Allocation Strategies: Traditional and Infrastructure Assets

Asset allocation strategies balance investment portfolios by diversifying between traditional assets like stocks and bonds, and infrastructure assets such as bridges, toll roads, and energy facilities. Traditional assets provide liquidity and market-driven returns, whereas infrastructure assets offer stable cash flows and inflation protection due to long-term contracts and regulated pricing. Effective money management involves allocating capital to infrastructure assets to reduce portfolio volatility and enhance risk-adjusted returns through steady income streams and lower correlation with traditional markets.

Tax Implications: Assets versus Infrastructure Assets

Tax implications for assets and infrastructure assets differ significantly. Regular assets often qualify for accelerated depreciation and immediate expense deductions, reducing taxable income more quickly. Infrastructure assets typically benefit from longer depreciation schedules and may qualify for specialized tax credits or incentives aimed at public or long-term capital projects, impacting cash flow and investment returns.

Choosing the Right Assets for Optimal Money Management

Selecting the right assets, including infrastructure assets, is crucial for optimal money management as infrastructure assets provide stable cash flows and long-term value appreciation, making them ideal for risk-averse investors. Financial assets like stocks and bonds offer liquidity and higher returns but with increased volatility, balancing a portfolio between these asset types enhances diversification and financial resilience. Evaluating asset liquidity, risk tolerance, and investment horizon ensures a tailored strategy that maximizes wealth growth while managing potential financial uncertainties.

Related Important Terms

Digital Asset Infrastructure

Digital asset infrastructure provides the foundational technology and systems enabling secure management, storage, and transfer of digital assets such as cryptocurrencies, tokenized securities, and digital wallets. Unlike traditional asset management, infrastructure assets focus on the critical digital frameworks that facilitate liquidity, transparency, and real-time tracking in modern financial ecosystems.

Tokenized Infrastructure Asset

Tokenized infrastructure assets represent a transformative approach in money management by enabling fractional ownership, enhanced liquidity, and transparent valuation of traditionally illiquid infrastructure projects. This innovation bridges the gap between conventional assets and infrastructure investments, allowing investors to diversify portfolios with digital tokens backed by tangible infrastructure assets.

Infrastructure-as-a-Service (IaaS) Investment

Investing in Infrastructure-as-a-Service (IaaS) provides scalable, cloud-based infrastructure assets that reduce upfront capital expenditure and enhance operational flexibility compared to traditional physical assets. IaaS allows money management to allocate funds efficiently by leveraging on-demand virtualized resources, minimizing maintenance costs, and enabling rapid deployment of IT infrastructure.

Greenfield Infrastructure Asset

Greenfield infrastructure assets represent newly developed facilities or projects, offering opportunities for long-term value creation and sustainable investment returns compared to traditional assets. These assets demand substantial upfront capital and carry higher risks but contribute to economic growth and resilient portfolios by fostering innovative, eco-friendly infrastructure development.

Smart Asset Allocation

Smart asset allocation involves differentiating between general assets and infrastructure assets, focusing on balancing liquidity, risk, and return profiles. Infrastructure assets, often characterized by stable cash flows and long-term growth potential, complement traditional assets by enhancing portfolio diversification and resilience in money management strategies.

Real Asset Tokenization

Real asset tokenization transforms physical assets such as real estate and infrastructure into digital tokens, enhancing liquidity and accessibility for investors. While infrastructure assets typically encompass large-scale public utilities, real asset tokens enable fractional ownership and efficient money management across diverse asset classes.

Infrastructure Yield Farming

Infrastructure assets in money management offer long-term stability and consistent cash flow through essential services, while traditional assets may provide higher short-term returns but with greater volatility. Infrastructure yield farming leverages blockchain-based protocols to optimize returns by staking assets in decentralized finance platforms, merging tangible infrastructure benefits with innovative digital asset strategies.

Infrastructure-linked Security

Infrastructure-linked securities offer investors stable cash flows and lower risk profiles by directly tying returns to essential public assets like toll roads, bridges, and utilities. These infrastructure assets differ from general assets by providing long-term, inflation-protected income streams backed by government contracts or regulated tariffs, enhancing portfolio diversification and capital preservation.

Decentralized Infrastructure Fund

Decentralized Infrastructure Funds prioritize investing in infrastructure assets such as blockchain networks, decentralized data storage, and peer-to-peer communication systems, distinguishing them from traditional financial assets like stocks or bonds. These infrastructure assets provide foundational support for decentralized applications, offering long-term value and stability in money management through enhanced security, transparency, and scalability.

Asset-backed Digital Infrastructure

Asset-backed digital infrastructure represents a strategic integration of physical and financial resources, enhancing money management through securitized digital assets tethered to tangible infrastructure. This approach contrasts traditional assets by leveraging blockchain and tokenization to optimize liquidity, transparency, and value retention in infrastructure investments.

Asset vs Infrastructure Asset for money management. Infographic

moneydiff.com

moneydiff.com