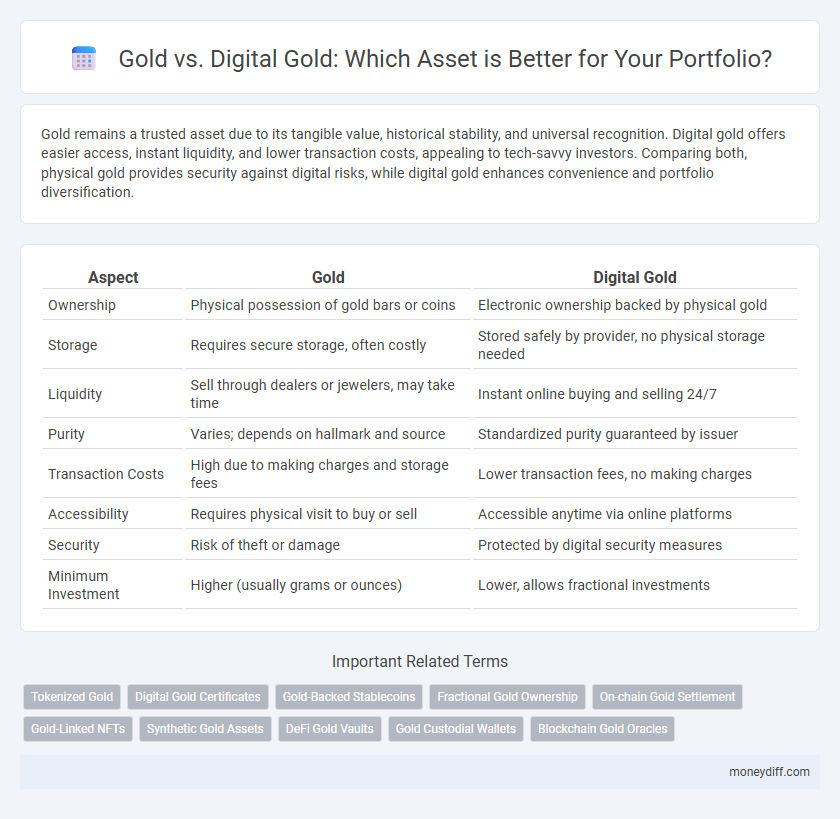

Gold remains a trusted asset due to its tangible value, historical stability, and universal recognition. Digital gold offers easier access, instant liquidity, and lower transaction costs, appealing to tech-savvy investors. Comparing both, physical gold provides security against digital risks, while digital gold enhances convenience and portfolio diversification.

Table of Comparison

| Aspect | Gold | Digital Gold |

|---|---|---|

| Ownership | Physical possession of gold bars or coins | Electronic ownership backed by physical gold |

| Storage | Requires secure storage, often costly | Stored safely by provider, no physical storage needed |

| Liquidity | Sell through dealers or jewelers, may take time | Instant online buying and selling 24/7 |

| Purity | Varies; depends on hallmark and source | Standardized purity guaranteed by issuer |

| Transaction Costs | High due to making charges and storage fees | Lower transaction fees, no making charges |

| Accessibility | Requires physical visit to buy or sell | Accessible anytime via online platforms |

| Security | Risk of theft or damage | Protected by digital security measures |

| Minimum Investment | Higher (usually grams or ounces) | Lower, allows fractional investments |

Understanding Gold as a Traditional Asset

Gold, as a traditional asset, has maintained its value for thousands of years due to its intrinsic physical properties and scarcity. It serves as a reliable hedge against inflation and currency volatility, providing tangible security that digital gold cannot fully replicate. Investors value physical gold for its universal acceptance and its proven role in preserving wealth through economic uncertainties.

What Is Digital Gold?

Digital gold is a virtual representation of physical gold that can be bought, sold, and stored electronically, offering easy access and liquidity compared to traditional gold bars or coins. It is backed by real gold held in secure vaults and verified by blockchain technology to ensure transparency and authenticity. Investors can benefit from fractional ownership, lower transaction costs, and instant trading without the need for physical delivery or storage concerns.

Key Differences Between Physical Gold and Digital Gold

Physical gold offers tangible ownership with the ability to hold and store gold bars or coins, ensuring intrinsic value and no dependency on digital platforms. Digital gold provides ease of access, fractional ownership, and seamless transactions through online platforms, but it relies on third-party custodians and lacks physical possession. Key differences include liquidity, storage requirements, and investment security, with physical gold favored for long-term wealth preservation and digital gold for flexible, instant trading.

Security Aspects: Gold vs Digital Gold

Gold offers tangible security through physical ownership, resistant to cyber threats and digital fraud, making it a reliable asset during technological disruptions. Digital gold provides enhanced security with blockchain technology, ensuring transparent, immutable records and ease of transfer, but remains vulnerable to hacking and digital platform risks. Investors must weigh the physical security of traditional gold against the technological safeguards and potential cyber risks inherent in digital gold assets.

Liquidity Comparison: Which Is Easier to Trade?

Gold offers high liquidity through established global markets and physical exchanges, allowing instant buying and selling with minimal price impact. Digital Gold, traded on online platforms and apps, provides greater accessibility and faster transactions but may face liquidity constraints during peak demand or platform issues. Investors must weigh traditional market stability against the convenience and speed of digital asset trading.

Storage and Maintenance: Physical vs Digital Gold

Physical gold requires secure vault storage, often involving high costs and risks such as theft or damage, demanding regular insurance and maintenance. Digital gold offers seamless online storage with encryption protocols, eliminating physical risks and reducing expenses related to handling and safeguarding assets. Investors benefit from instant liquidity and easy accessibility without the logistical challenges posed by physical gold custody.

Cost Implications: Fees and Expenses

Gold investments typically incur costs such as storage fees, insurance, and dealer premiums, which can cumulatively reduce net returns. Digital gold platforms often charge transaction fees, management fees, and sometimes withdrawal fees, but these are generally lower than physical gold expenses. Evaluating total cost implications between gold and digital gold is crucial for investors aiming to optimize asset allocation efficiency.

Accessibility: Who Can Invest and How?

Gold offers tangible ownership accessible primarily through physical purchase at banks, jewelers, and specialized dealers, often requiring significant upfront capital and secure storage. Digital gold provides broader accessibility by allowing investors to buy fractional units online via platforms and apps, enabling participation with minimal amounts and offering ease of transaction and liquidity. Institutional investors and retail clients benefit from digital gold's convenience, while traditional gold appeals more to those valuing physical asset control and long-term holding.

Taxation of Gold vs Digital Gold Investments

Taxation of physical gold often involves capital gains tax upon sale, with varying rates depending on holding period and local regulations. Digital gold investments may be subject to similar capital gains taxes but can offer more transparent transaction records and easier tax reporting through platforms. Understanding jurisdiction-specific tax treatment is crucial for optimizing returns on gold versus digital gold assets.

Long-Term Returns and Asset Diversification

Gold has historically provided stable long-term returns and serves as a hedge against inflation, making it a reliable asset for diversification. Digital gold offers easier liquidity and accessibility, enabling investors to diversify portfolios with fractional ownership and lower transaction costs. Combining physical gold with digital gold can enhance portfolio resilience by balancing traditional security with modern flexibility.

Related Important Terms

Tokenized Gold

Tokenized gold offers a secure and transparent way to invest in physical gold by leveraging blockchain technology, enabling fractional ownership and easy transferability without the need for physical storage. This digital asset combines the intrinsic value of gold with the flexibility and liquidity of digital financial instruments, making it an efficient alternative to traditional gold investments.

Digital Gold Certificates

Digital Gold Certificates offer a secure and transparent alternative to physical gold ownership by enabling instant custody verification and fractional investment through blockchain technology. Unlike traditional gold, these certificates eliminate storage and insurance costs while providing seamless liquidity and accessibility via regulated digital platforms.

Gold-Backed Stablecoins

Gold-backed stablecoins combine the intrinsic value of physical gold with the liquidity and accessibility of digital assets, offering investors a secure and transparent way to diversify their portfolios. Unlike traditional gold investments, these tokenized assets enable seamless global transactions while reducing custody risks and enhancing price stability through blockchain technology.

Fractional Gold Ownership

Fractional gold ownership enables investors to buy precise portions of physical gold, offering a tangible asset with intrinsic value and protection against inflation compared to purely digital representations. Digital gold platforms provide enhanced liquidity, instant transactions, and lower entry barriers but depend on secure digital infrastructure, making fractional ownership a flexible option for diversifying asset portfolios.

On-chain Gold Settlement

On-chain gold settlement leverages blockchain technology to enable secure, transparent, and instantaneous transfer of gold ownership without physical movement, reducing settlement risks and costs inherent in traditional gold transactions. Digital gold platforms backed by verifiable reserves offer asset holders liquidity and fractional ownership, bridging the trust gap between tangible gold assets and blockchain's efficiency.

Gold-Linked NFTs

Gold-linked NFTs represent a revolutionary fusion of traditional asset stability and blockchain innovation, offering investors the tangible value of physical gold combined with the liquidity and transparency of digital assets. Unlike conventional gold holdings, Gold-linked NFTs enable fractional ownership, instant transferability, and enhanced security, positioning them as a cutting-edge alternative in the evolving asset management landscape.

Synthetic Gold Assets

Synthetic gold assets offer a blockchain-backed alternative to physical gold, providing instant liquidity and fractional ownership without the need for storage or insurance. These digital tokens replicate gold's value, enabling seamless trading and portfolio diversification while minimizing the risks associated with traditional gold investments.

DeFi Gold Vaults

DeFi Gold Vaults offer a secure, transparent way to hold gold-backed digital assets, combining the intrinsic value of physical gold with blockchain technology for enhanced liquidity and accessibility. Compared to traditional gold investments, these vaults enable fractional ownership, instant transfers, and reduced storage risks, revolutionizing asset management in decentralized finance.

Gold Custodial Wallets

Gold custodial wallets offer a secure and convenient method for asset holders to store physical gold digitally, combining traditional gold's intrinsic value with blockchain technology's transparency. Compared to digital gold, custodial wallets provide regulated ownership backed by physical reserves, ensuring asset security and liquidity in volatile markets.

Blockchain Gold Oracles

Blockchain gold oracles enhance digital gold assets by providing real-time, tamper-proof price data and authenticity verification, bridging physical gold markets with decentralized finance platforms. These oracles enable seamless asset tokenization, ensuring transparent, secure investments that rival traditional gold's stability and intrinsic value.

Gold vs Digital Gold for asset. Infographic

moneydiff.com

moneydiff.com