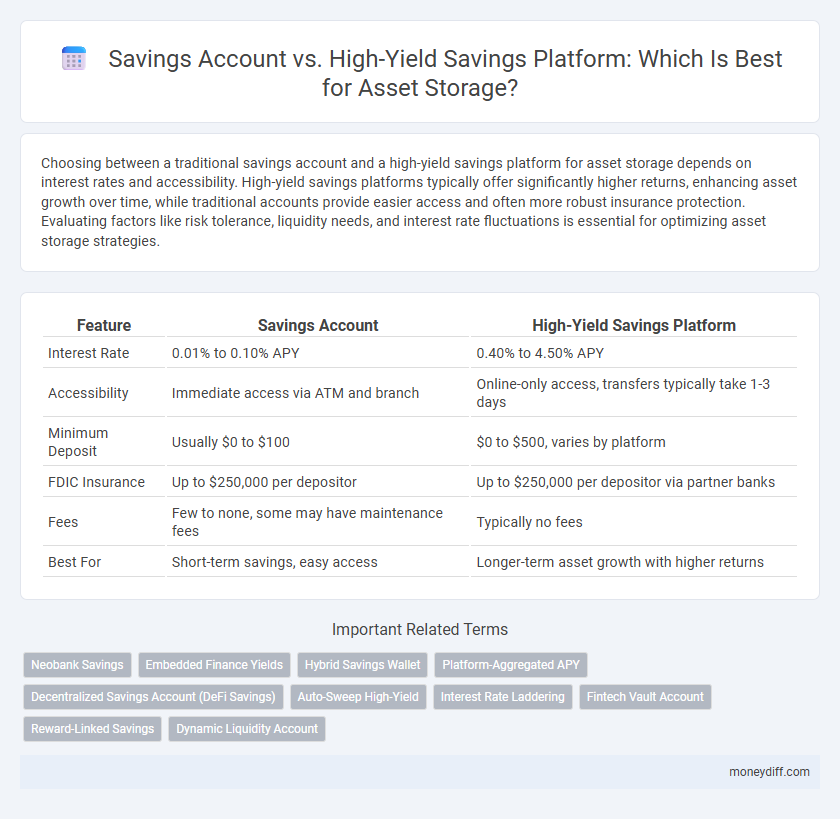

Choosing between a traditional savings account and a high-yield savings platform for asset storage depends on interest rates and accessibility. High-yield savings platforms typically offer significantly higher returns, enhancing asset growth over time, while traditional accounts provide easier access and often more robust insurance protection. Evaluating factors like risk tolerance, liquidity needs, and interest rate fluctuations is essential for optimizing asset storage strategies.

Table of Comparison

| Feature | Savings Account | High-Yield Savings Platform |

|---|---|---|

| Interest Rate | 0.01% to 0.10% APY | 0.40% to 4.50% APY |

| Accessibility | Immediate access via ATM and branch | Online-only access, transfers typically take 1-3 days |

| Minimum Deposit | Usually $0 to $100 | $0 to $500, varies by platform |

| FDIC Insurance | Up to $250,000 per depositor | Up to $250,000 per depositor via partner banks |

| Fees | Few to none, some may have maintenance fees | Typically no fees |

| Best For | Short-term savings, easy access | Longer-term asset growth with higher returns |

Understanding Savings Accounts: A Traditional Asset Storage Option

Savings accounts offer a secure and liquid method for asset storage with federally insured protection up to $250,000 by the FDIC, making them a reliable option for short-term savings and emergency funds. Their fixed interest rates are generally lower compared to high-yield savings platforms, emphasizing stability over growth potential. Traditional savings accounts provide easy access to funds through ATMs and online banking, supporting everyday financial management without compromising on asset security.

What Is a High-Yield Savings Platform?

A high-yield savings platform is an online financial service offering significantly higher interest rates on deposits compared to traditional savings accounts, enabling faster asset growth. These platforms leverage digital efficiency and lower overhead costs to provide annual percentage yields (APYs) often several times greater than conventional banks. Users benefit from FDIC insurance protection while maximizing returns on stored assets through competitive, variable interest rates tailored for optimized savings performance.

Interest Rate Comparison: Savings Account vs High-Yield Savings

High-yield savings accounts offer significantly higher interest rates compared to traditional savings accounts, often ranging from 3% to 5% APY versus 0.01% to 0.10% APY in standard accounts. This difference results in greater compound growth potential, making high-yield platforms more effective for maximizing asset storage over time. Investors seeking to optimize passive income from liquid assets favor high-yield savings due to their superior return on interest.

Safety and Security: Protecting Your Assets

Savings accounts at FDIC-insured banks offer robust protection, securing deposits up to $250,000 per account holder against bank failure. High-yield savings platforms, often provided by online banks, also benefit from FDIC insurance, ensuring asset safety while delivering competitive interest rates. Both options prioritize encryption protocols and fraud detection systems to safeguard personal and financial data, reinforcing overall asset security.

Liquidity and Accessibility: Easy Access to Your Funds

Savings accounts provide immediate liquidity with easy access through ATMs, online banking, and branch visits, making funds readily available for everyday needs. High-yield savings platforms often offer competitive interest rates but may impose withdrawal limits or require longer transfer times, slightly reducing immediate accessibility. Prioritizing liquidity and ease of access is essential when choosing between traditional savings accounts and high-yield platforms for efficient asset storage.

Fees and Account Minimums: What to Expect

Savings accounts typically have low to no fees and minimal to no account minimums, making them accessible for most asset holders. High-yield savings platforms often require higher minimum balances and may charge fees if the account balance falls below these thresholds. Understanding fee structures and minimum requirements is essential to maximize returns and avoid unexpected costs when storing assets.

Digital Experience: Traditional Banks vs Fintech Platforms

Traditional banks offer savings accounts with basic digital interfaces, often limited by outdated online platforms and slower transaction processes. Fintech platforms provide high-yield savings accounts featuring seamless mobile apps, real-time analytics, and instant fund transfers, enhancing user engagement and financial management. The advanced digital experience of fintech drives better asset growth opportunities through intuitive interfaces and innovative tools.

FDIC Insurance: Are Your Assets Protected?

Savings accounts and high-yield savings platforms both offer FDIC insurance up to $250,000 per depositor, per insured bank, ensuring asset protection against bank failures. High-yield savings accounts typically provide better interest rates, maximizing asset growth while maintaining the same level of federal insurance. Consider the bank's FDIC membership status and insurance limits to secure your assets effectively.

Ideal Use Cases: Which Option Fits Your Financial Goals?

A traditional savings account suits individuals seeking easy access to funds, minimal fees, and steady, low-risk returns for short-term financial goals or emergency funds. High-yield savings platforms provide significantly higher interest rates, ideal for asset growth over medium to long-term horizons, especially when the goal is maximizing returns without sacrificing liquidity. Evaluating factors like withdrawal limits, interest compounding frequency, and platform security helps determine the best fit for your asset storage aligned with financial objectives.

Making the Right Choice: Evaluating Savings Options for Asset Management

Choosing between a traditional savings account and a high-yield savings platform is crucial for effective asset management, as interest rates significantly impact asset growth over time. High-yield savings platforms typically offer annual percentage yields (APYs) that are multiple times higher than standard savings accounts, enhancing compound interest benefits. Evaluating factors such as liquidity, security via FDIC insurance, and fee structures helps ensure the selected option aligns with long-term financial goals.

Related Important Terms

Neobank Savings

Neobank savings accounts offer higher interest rates compared to traditional savings accounts, making them an efficient choice for asset storage with enhanced liquidity and easy digital access. High-yield savings platforms generally provide competitive APYs but may lack the user-friendly interface and integrated budgeting tools that neobanks deliver for optimized asset management.

Embedded Finance Yields

High-yield savings platforms integrated with embedded finance enable asset holders to earn superior returns compared to traditional savings accounts by leveraging real-time interest optimization and automated reinvestment strategies. These platforms utilize APIs and financial technology to seamlessly embed yield generation within everyday transactions, maximizing passive income while maintaining liquidity and security.

Hybrid Savings Wallet

Hybrid Savings Wallet combines the security of traditional Savings Accounts with the enhanced interest rates of High-Yield Savings Platforms, offering an optimized asset storage solution that maximizes returns while maintaining liquidity. By integrating automated fund transfers and diversified interest sources, it enables users to efficiently grow and manage their savings with minimal risk.

Platform-Aggregated APY

Savings accounts typically offer lower annual percentage yields (APY) compared to high-yield savings platforms that aggregate rates from multiple financial institutions, enabling users to maximize asset growth by selecting optimal returns. Platform-aggregated APY provides enhanced liquidity and competitive interest rates, making it a superior choice for efficient asset storage and passive income generation.

Decentralized Savings Account (DeFi Savings)

Decentralized Savings Accounts (DeFi Savings) leverage blockchain technology to offer higher interest rates and enhanced asset control compared to traditional savings accounts or high-yield platforms. By eliminating intermediaries, DeFi Savings provide transparent, permissionless asset storage with increased security and programmable smart contract functions.

Auto-Sweep High-Yield

Auto-Sweep High-Yield Savings platforms automatically transfer excess funds from a regular savings account into higher interest rates, maximizing asset growth without manual intervention. This system optimizes returns by combining liquidity access with superior APYs compared to traditional savings accounts, enhancing overall asset storage efficiency.

Interest Rate Laddering

Savings accounts typically offer fixed, lower interest rates, whereas high-yield savings platforms employ interest rate laddering strategies that allocate funds across multiple tiers with varied rates to maximize overall returns. This approach leverages compounding benefits and rate differentials, optimizing asset growth while maintaining liquidity and risk diversification.

Fintech Vault Account

A Fintech Vault Account offers higher interest rates compared to traditional savings accounts, maximizing asset growth through competitive APYs often exceeding 4%, while maintaining FDIC insurance and easy access to funds. Unlike regular savings accounts with lower returns, these platforms leverage technology to optimize asset storage, providing seamless digital management and enhanced liquidity for investors seeking efficient wealth accumulation.

Reward-Linked Savings

Reward-Linked Savings accounts integrate asset storage with incentive structures, offering higher returns compared to traditional Savings Accounts by leveraging performance-based bonuses tied to market or platform metrics. High-Yield Savings Platforms further optimize asset growth through competitive interest rates combined with reward-linked features, enhancing overall yield while maintaining liquidity and security.

Dynamic Liquidity Account

Dynamic Liquidity Accounts offer higher interest rates compared to traditional savings accounts by leveraging advanced algorithms to optimize asset allocation across multiple high-yield savings platforms. This approach enhances asset growth potential while maintaining easy access and liquidity, making it a superior choice for efficient asset storage.

Savings Account vs High-Yield Savings Platform for asset storage Infographic

moneydiff.com

moneydiff.com