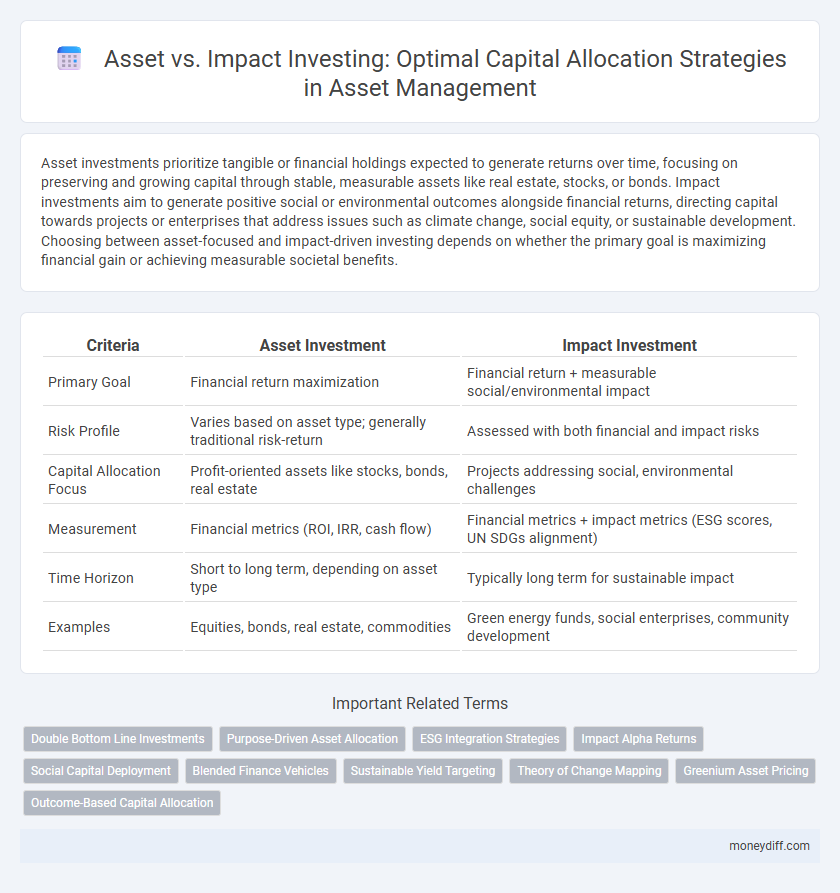

Asset investments prioritize tangible or financial holdings expected to generate returns over time, focusing on preserving and growing capital through stable, measurable assets like real estate, stocks, or bonds. Impact investments aim to generate positive social or environmental outcomes alongside financial returns, directing capital towards projects or enterprises that address issues such as climate change, social equity, or sustainable development. Choosing between asset-focused and impact-driven investing depends on whether the primary goal is maximizing financial gain or achieving measurable societal benefits.

Table of Comparison

| Criteria | Asset Investment | Impact Investment |

|---|---|---|

| Primary Goal | Financial return maximization | Financial return + measurable social/environmental impact |

| Risk Profile | Varies based on asset type; generally traditional risk-return | Assessed with both financial and impact risks |

| Capital Allocation Focus | Profit-oriented assets like stocks, bonds, real estate | Projects addressing social, environmental challenges |

| Measurement | Financial metrics (ROI, IRR, cash flow) | Financial metrics + impact metrics (ESG scores, UN SDGs alignment) |

| Time Horizon | Short to long term, depending on asset type | Typically long term for sustainable impact |

| Examples | Equities, bonds, real estate, commodities | Green energy funds, social enterprises, community development |

Understanding Asset Investment and Impact Investment

Asset investment primarily focuses on acquiring tangible or intangible resources that generate financial returns and appreciate in value over time. Impact investment targets capital allocation to ventures that deliver measurable social and environmental benefits alongside financial gains. Understanding the distinction lies in recognizing that asset investment prioritizes wealth accumulation, whereas impact investment balances profitability with positive societal impact.

Key Differences Between Asset and Impact Investment

Asset investment primarily focuses on maximizing financial returns by allocating capital to traditional vehicles such as stocks, bonds, and real estate. Impact investment integrates financial return goals with measurable social and environmental benefits, targeting sectors like renewable energy, affordable housing, and social enterprises. The key difference lies in impact measurement and intentionality, as impact investments specifically aim to generate positive societal outcomes alongside competitive financial performance.

Evaluating Investment Goals: Profit vs Purpose

Evaluating investment goals involves distinguishing between asset-based investments prioritizing financial returns and impact investments targeting measurable social or environmental outcomes. Asset investments focus on maximizing profit through capital appreciation and income generation, while impact investments integrate purpose by supporting projects aligned with sustainability and social responsibility. Effective capital allocation balances financial performance with intentional positive impact, aligning investor objectives with broader societal goals.

Risk Assessment in Asset vs Impact Investment

Risk assessment in asset investment primarily focuses on financial metrics such as volatility, liquidity, and return on investment, with tools like Value at Risk (VaR) and stress testing used to quantify potential losses. Impact investment requires an additional layer of evaluation that includes social and environmental risks, measuring outcomes against predefined impact goals alongside financial performance. Integrating risk assessment in impact investment demands balancing fiduciary responsibilities with the uncertainty inherent in achieving measurable societal benefits.

Measuring Returns: Financial vs Social Impact

Asset investment primarily targets financial returns through quantifiable metrics such as ROI, IRR, and cash flow analysis, ensuring capital growth and profitability. Impact investment prioritizes measurable social and environmental outcomes alongside financial performance, using tools like Social Return on Investment (SROI) and impact reporting frameworks. Balancing these approaches requires integrating financial analytics with impact measurement standards to optimize capital allocation that delivers both economic value and societal benefits.

Capital Allocation Strategies Explained

Asset investment focuses on acquiring tangible or intangible resources that generate long-term financial returns, prioritizing portfolio diversification and risk management. Impact investment allocates capital to ventures delivering measurable social or environmental benefits alongside financial gains, targeting sustainable development goals. Strategic capital allocation balances these approaches to optimize both fiscal performance and societal impact.

Asset Investment: Types and Performance

Asset investment involves allocating capital into tangible and intangible resources such as real estate, equities, bonds, and intellectual property to generate financial returns. Diverse asset classes exhibit varying risk-return profiles, with equities typically offering higher growth potential while bonds provide stability and income. Performance measurement relies on metrics like total return, yield, and volatility, enabling investors to optimize portfolio diversification and enhance long-term wealth accumulation.

Impact Investment: Metrics and Outcomes

Impact investment prioritizes measurable social and environmental outcomes alongside financial returns, utilizing metrics such as the Impact Reporting and Investment Standards (IRIS) and Sustainable Development Goals (SDGs) alignment to quantify effects. Capital allocation in impact investing emphasizes transparency and accountability, enabling investors to track progress through key performance indicators like reduced carbon emissions, improved community health, and enhanced educational access. This results-driven approach fosters sustainable growth by channeling funds into ventures that generate both economic value and positive social impact.

Integrating Both Approaches for Balanced Portfolios

Integrating asset-based strategies with impact investments enhances capital allocation by balancing financial returns and social outcomes. Combining traditional asset classes such as equities and bonds with impact-driven assets like green bonds and social impact funds creates diversified portfolios that optimize risk-adjusted performance. This blended approach aligns investor objectives with sustainable development goals, fostering long-term value creation and measurable positive change.

Future Trends in Capital Allocation Decisions

Future trends in capital allocation highlight a growing emphasis on impact investments that deliver measurable social and environmental outcomes alongside financial returns. Asset managers increasingly integrate environmental, social, and governance (ESG) criteria to align portfolios with sustainable development goals (SDGs). Advances in data analytics and impact measurement tools enable more precise assessments, driving capital flows toward projects generating long-term value beyond traditional asset performance.

Related Important Terms

Double Bottom Line Investments

Double Bottom Line investments prioritize both financial returns and measurable social or environmental impact, merging asset value growth with meaningful societal benefits. Impact investments strategically allocate capital to assets that generate sustainable positive outcomes while preserving or enhancing long-term financial performance.

Purpose-Driven Asset Allocation

Purpose-driven asset allocation prioritizes investments aligned with specific social or environmental outcomes, integrating impact measurement into traditional asset management strategies. This approach contrasts with pure impact investment by balancing financial returns with purposeful capital deployment, optimizing both asset growth and measurable positive impact.

ESG Integration Strategies

Asset allocation prioritizes incorporating ESG integration strategies by embedding environmental, social, and governance criteria directly into portfolio construction, while impact investment focuses on deploying capital specifically to generate measurable social and environmental outcomes alongside financial returns. ESG integration leverages comprehensive data analytics and risk assessment models to optimize asset performance and sustainability, contrasting with impact investing's targeted approach towards projects that deliver explicit positive change.

Impact Alpha Returns

Impact investment prioritizes generating measurable social and environmental benefits alongside financial returns, often yielding Impact Alpha returns that outperform traditional asset-based strategies by leveraging positive externalities. Capital allocation towards impact assets enhances portfolio resilience and drives sustainable growth, aligning investor objectives with broader societal progress.

Social Capital Deployment

Social capital deployment prioritizes asset allocation by channeling funds into sustainable projects that generate measurable social returns alongside financial gains, enhancing community resilience and equity. Impact investment emphasizes targeted capital deployment in ventures explicitly designed to solve social issues, leveraging both asset growth and positive societal change as key performance indicators.

Blended Finance Vehicles

Blended finance vehicles strategically combine concessional capital from public or philanthropic sources with private sector investment to optimize risk-adjusted returns and mobilize larger pools of capital towards impactful assets. These structures enhance capital allocation efficiency by balancing financial asset performance with measurable social and environmental impact, bridging the gap between traditional asset investment and impact investing.

Sustainable Yield Targeting

Asset investment prioritizes the preservation and growth of principal value while generating stable, sustainable yields that align with long-term financial goals. Impact investment targets measurable social and environmental outcomes alongside financial returns, optimizing capital allocation for both sustainable yield and positive societal impact.

Theory of Change Mapping

Asset investment prioritizes tangible resources and ownership structures, driving capital allocation through financial returns and risk assessments. Impact investment emphasizes Theory of Change mapping by aligning capital deployment with measurable social and environmental outcomes to maximize positive transformation.

Greenium Asset Pricing

Greenium asset pricing reflects the premium investors are willing to pay for green assets, influencing capital allocation by favoring sustainable projects over traditional impact investments that prioritize social or environmental outcomes without necessarily delivering financial outperformance. This premium drives asset managers to integrate environmental factors into portfolio construction, aligning returns with sustainability goals while attracting capital toward low-carbon and climate-resilient assets.

Outcome-Based Capital Allocation

Outcome-based capital allocation prioritizes investments that generate measurable social or environmental benefits alongside financial returns, distinguishing impact investments which explicitly target positive outcomes. Asset allocation traditionally emphasizes financial performance and risk management, whereas outcome-based strategies integrate impact metrics to align capital deployment with specific, quantifiable societal goals.

Asset vs Impact Investment for capital allocation. Infographic

moneydiff.com

moneydiff.com