Asset pet management emphasizes sustainable practices by prioritizing green assets that reduce environmental impact and enhance resource efficiency. Green assets integrate eco-friendly materials and energy-saving technologies, making them crucial for long-term sustainability goals. Adopting green assets over traditional assets supports reduced carbon footprints and promotes resilience against environmental risks.

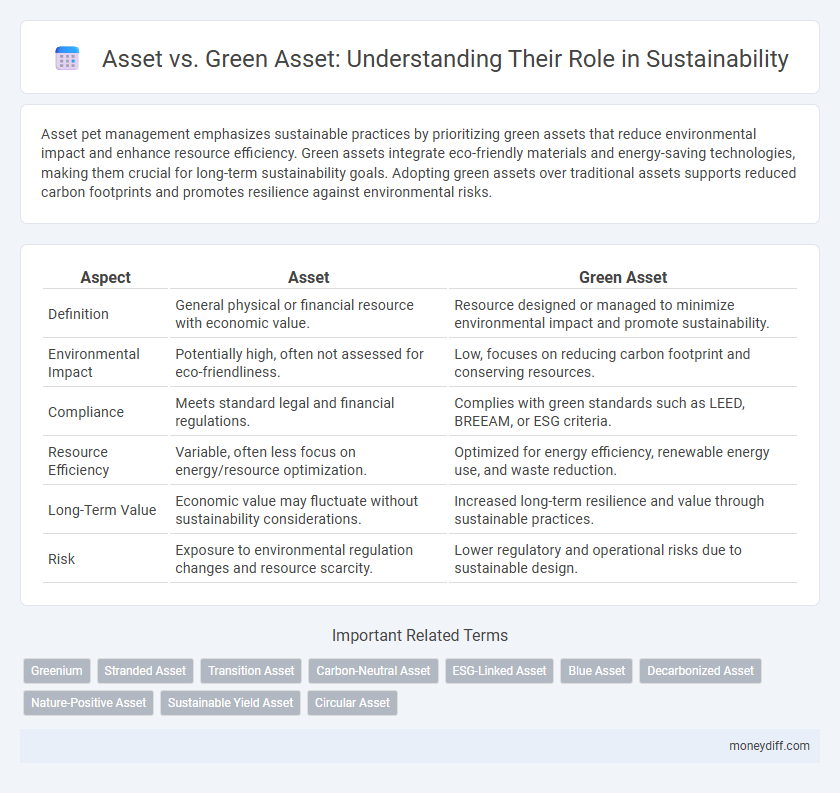

Table of Comparison

| Aspect | Asset | Green Asset |

|---|---|---|

| Definition | General physical or financial resource with economic value. | Resource designed or managed to minimize environmental impact and promote sustainability. |

| Environmental Impact | Potentially high, often not assessed for eco-friendliness. | Low, focuses on reducing carbon footprint and conserving resources. |

| Compliance | Meets standard legal and financial regulations. | Complies with green standards such as LEED, BREEAM, or ESG criteria. |

| Resource Efficiency | Variable, often less focus on energy/resource optimization. | Optimized for energy efficiency, renewable energy use, and waste reduction. |

| Long-Term Value | Economic value may fluctuate without sustainability considerations. | Increased long-term resilience and value through sustainable practices. |

| Risk | Exposure to environmental regulation changes and resource scarcity. | Lower regulatory and operational risks due to sustainable design. |

Understanding Traditional Assets: A Foundation

Traditional assets, including real estate, machinery, and financial instruments, serve as foundational investments but often lack explicit sustainability criteria. These assets typically prioritize economic returns without directly addressing environmental impact or carbon footprint reduction. Understanding the characteristics and limitations of traditional assets is essential for transitioning towards green assets that integrate sustainability principles and support long-term environmental goals.

Defining Green Assets: Characteristics and Scope

Green assets are financial instruments or physical investments specifically designed to support environmentally sustainable projects that reduce carbon emissions, conserve natural resources, or promote renewable energy. These assets typically include green bonds, sustainable real estate, and clean technology ventures, characterized by their adherence to strict environmental, social, and governance (ESG) criteria. Unlike traditional assets, green assets emphasize measurable positive environmental impact and contribute directly to achieving climate goals and sustainable development targets.

Key Differences Between Traditional and Green Assets

Traditional assets primarily encompass physical or financial resources such as real estate, machinery, or stocks, which may not consider environmental impacts or sustainability criteria. Green assets specifically include investments in renewable energy, energy-efficient buildings, or sustainable infrastructure designed to minimize carbon footprint and promote environmental stewardship. Key differences revolve around their contribution to environmental goals, risk profiles linked to regulatory changes, and long-term value resilience amid growing sustainability demands.

Sustainability Metrics in Asset Management

Sustainability metrics in asset management evaluate both traditional assets and green assets based on environmental impact, social responsibility, and governance (ESG) criteria to ensure long-term value creation. Green assets prioritize renewable energy, energy efficiency, and reduced carbon emissions, driving positive environmental outcomes within investment portfolios. Incorporating comprehensive sustainability metrics enables asset managers to align investments with climate goals and regulatory frameworks while enhancing financial performance.

Financial Performance: Green Assets vs Conventional Investments

Green assets, such as renewable energy projects and sustainable infrastructure, often demonstrate competitive financial performance compared to conventional investments by offering lower risk profiles due to regulatory support and growing market demand. Studies show green assets can yield stable returns and benefit from incentives like tax credits and subsidies, enhancing overall profitability. Investors increasingly favor green assets for long-term value creation and resilience amid environmental and social governance (ESG) considerations.

Regulatory Frameworks Supporting Green Asset Growth

Rigorous regulatory frameworks such as the EU Taxonomy Regulation and the Sustainable Finance Disclosure Regulation (SFDR) drive the expansion of green assets by defining clear criteria for environmentally sustainable investments. These policies promote transparency and risk mitigation, encouraging asset managers and investors to prioritize green asset portfolios aligned with global climate goals. Compliance requirements and standardization efforts under these frameworks accelerate capital flow towards renewable energy projects, sustainable infrastructure, and other green asset classes.

Risk Profiles: Assessing Traditional and Green Assets

Traditional assets often carry higher long-term risks due to regulatory changes, environmental liabilities, and market volatility linked to sustainability concerns. Green assets, such as renewable energy projects and sustainable infrastructure, typically exhibit lower risk profiles by aligning with evolving environmental regulations and consumer preferences. Evaluating risk profiles requires analyzing factors like carbon footprint, regulatory compliance, and resilience to climate-related disruptions for both asset types.

Environmental Impact: Measuring Asset Sustainability

Green assets demonstrate significantly lower environmental impact compared to traditional assets due to their incorporation of renewable energy sources, energy efficiency, and sustainable materials. Measuring asset sustainability involves assessing carbon footprint, resource consumption, waste generation, and emissions throughout the asset lifecycle. Quantifying these environmental metrics enables organizations to prioritize green assets that contribute to reduced ecological degradation and support long-term sustainability goals.

Integrating Green Assets into Investment Portfolios

Integrating green assets into investment portfolios enhances sustainability by prioritizing environmentally responsible investments such as renewable energy projects, sustainable real estate, and clean technologies. Green assets reduce carbon footprints and promote long-term ecological balance while offering potential financial returns aligned with global climate goals and ESG criteria. Investors increasingly demand transparent metrics and impact reporting to ensure green assets contribute effectively to environmental, social, and governance priorities.

The Future Outlook: Evolving Trends in Sustainable Asset Management

Sustainable asset management is increasingly prioritizing green assets, which integrate environmental, social, and governance (ESG) criteria to drive long-term value and mitigate climate risks. The future outlook highlights a shift towards more innovative financing mechanisms and advanced data analytics to optimize the performance of green assets and support decarbonization targets. Investors and asset managers are expected to enhance transparency and accountability, aligning portfolios with global sustainability frameworks such as the EU Taxonomy and the Task Force on Climate-related Financial Disclosures (TCFD).

Related Important Terms

Greenium

Green assets, characterized by environmentally sustainable practices, often command a "greenium," a premium reflecting investor preference for lower carbon risk and enhanced ESG performance. This greenium influences asset pricing by increasing demand for green bonds, renewable energy projects, and sustainable infrastructure, driving capital flows toward sustainable investments and reducing financing costs compared to conventional assets.

Stranded Asset

Stranded assets refer to investments that have lost value prematurely due to environmental regulations, market shifts, or technological advancements favoring green assets. Transitioning from traditional assets to green assets mitigates the risk of stranded assets by aligning investments with sustainable energy sources and carbon reduction goals.

Transition Asset

Transition assets play a crucial role in sustainability by bridging traditional high-carbon assets and fully green assets, facilitating the gradual decarbonization of industries. These assets typically include technologies and infrastructure that support energy efficiency and lower emissions while enabling a shift toward renewable energy sources.

Carbon-Neutral Asset

Carbon-neutral assets, distinguished by their minimal or fully offset carbon emissions, play a crucial role in advancing sustainability compared to traditional assets that may contribute to environmental degradation. Investing in green assets emphasizes renewable energy, energy efficiency, and sustainable materials, thereby reducing the carbon footprint and promoting long-term ecological balance.

ESG-Linked Asset

ESG-linked assets integrate environmental, social, and governance criteria into traditional asset valuations, driving sustainable investment decisions that prioritize long-term impact and risk mitigation. Green assets specifically target environmental benefits, such as renewable energy infrastructure, whereas broader ESG-linked assets encompass social responsibility and governance practices alongside environmental considerations.

Blue Asset

Blue assets, encompassing coastal and marine resources such as offshore wind farms and sustainable fisheries, play a crucial role in advancing sustainability by supporting carbon sequestration and biodiversity conservation. Unlike green assets primarily linked to terrestrial ecosystems, blue assets provide unique opportunities for climate resilience and blue economy growth through responsible management of aquatic environments.

Decarbonized Asset

Decarbonized assets represent a critical subset of green assets, specifically engineered to minimize carbon emissions through sustainable technologies and energy-efficient practices. Transitioning traditional assets to decarbonized models accelerates the achievement of net-zero targets and enhances long-term environmental and financial resilience.

Nature-Positive Asset

Nature-positive assets prioritize biodiversity restoration, carbon sequestration, and ecosystem health, significantly outperform traditional assets in long-term environmental impact. These assets integrate sustainable practices that enhance natural capital, supporting global sustainability goals and reducing ecological risks associated with conventional asset portfolios.

Sustainable Yield Asset

Sustainable Yield Assets prioritize long-term resource regeneration and minimal environmental impact, ensuring consistent returns without depleting natural capital. Unlike traditional assets, Green Assets integrate sustainability metrics, but Sustainable Yield Assets specifically emphasize balance between economic growth and ecosystem preservation to support enduring value creation.

Circular Asset

Circular assets prioritize sustainability by emphasizing the reuse, refurbishment, and recycling of materials, reducing waste and environmental impact compared to traditional assets. Green assets typically focus on energy efficiency and renewable resources, whereas circular assets integrate closed-loop models to maximize resource longevity and economic value.

Asset vs Green Asset for sustainability. Infographic

moneydiff.com

moneydiff.com