Stocks represent traditional equity ownership in a company with regulatory oversight and established market liquidity, while tokenized assets leverage blockchain technology to offer fractional ownership, enhanced accessibility, and faster settlement times. Tokenized assets provide increased transparency and global reach but may face regulatory uncertainties compared to the well-established legal frameworks governing stocks. Investors should consider liquidity, regulatory environment, and technology adoption when choosing between stocks and tokenized assets for diversified portfolio exposure.

Table of Comparison

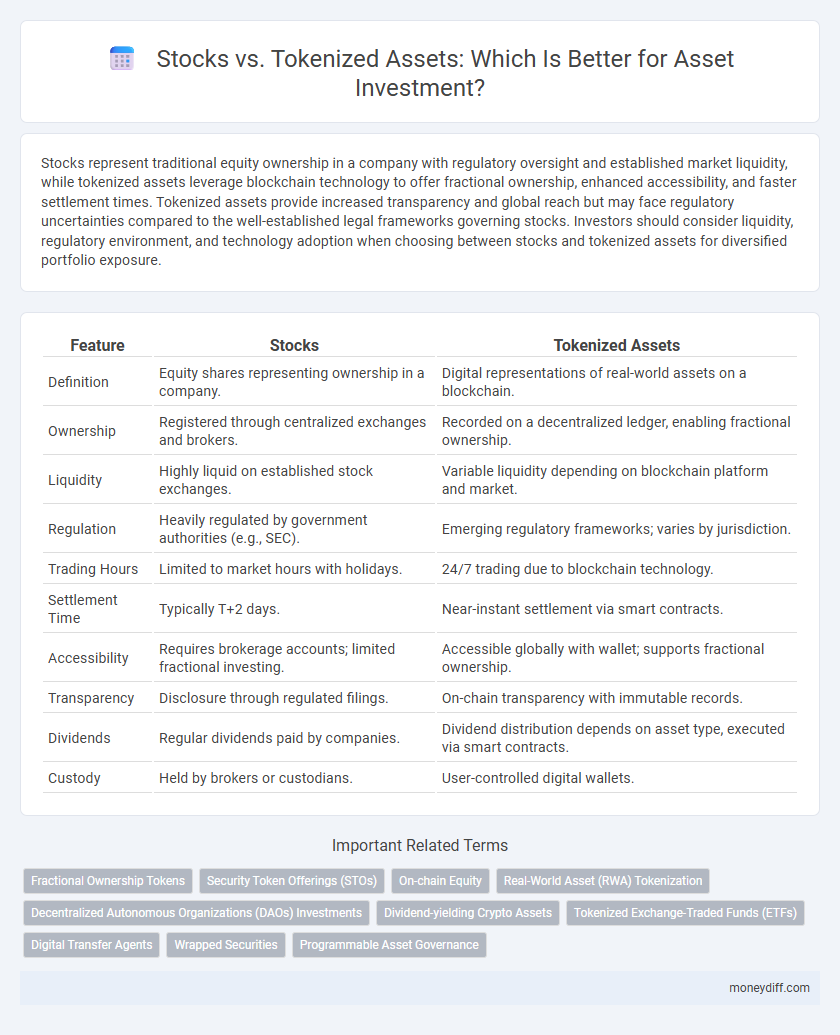

| Feature | Stocks | Tokenized Assets |

|---|---|---|

| Definition | Equity shares representing ownership in a company. | Digital representations of real-world assets on a blockchain. |

| Ownership | Registered through centralized exchanges and brokers. | Recorded on a decentralized ledger, enabling fractional ownership. |

| Liquidity | Highly liquid on established stock exchanges. | Variable liquidity depending on blockchain platform and market. |

| Regulation | Heavily regulated by government authorities (e.g., SEC). | Emerging regulatory frameworks; varies by jurisdiction. |

| Trading Hours | Limited to market hours with holidays. | 24/7 trading due to blockchain technology. |

| Settlement Time | Typically T+2 days. | Near-instant settlement via smart contracts. |

| Accessibility | Requires brokerage accounts; limited fractional investing. | Accessible globally with wallet; supports fractional ownership. |

| Transparency | Disclosure through regulated filings. | On-chain transparency with immutable records. |

| Dividends | Regular dividends paid by companies. | Dividend distribution depends on asset type, executed via smart contracts. |

| Custody | Held by brokers or custodians. | User-controlled digital wallets. |

Introduction: Understanding Stocks and Tokenized Assets

Stocks represent traditional equity ownership in a corporation, providing shareholders with voting rights and potential dividends. Tokenized assets, however, utilize blockchain technology to digitize real-world assets, offering fractional ownership, enhanced liquidity, and faster transactions. Understanding the fundamental differences between these investment forms is essential for navigating the evolving asset landscape.

Fundamental Differences Between Stocks and Tokenized Assets

Stocks represent ownership shares in a company, trading on regulated exchanges with established legal frameworks ensuring investor protection and dividend rights. Tokenized assets are digital representations of real-world assets on a blockchain, offering increased liquidity, fractional ownership, and transparent, decentralized transaction records. Unlike stocks, tokenized assets can encompass a broader range of assets beyond equities and provide greater access to global markets through blockchain technology.

Accessibility and Market Participation

Tokenized assets offer increased accessibility by enabling fractional ownership, lowering entry barriers for individual investors compared to traditional stocks that often require larger capital outlays. Digital platforms facilitate 24/7 trading of tokenized assets, expanding market participation beyond conventional exchange hours and geographic constraints. Enhanced liquidity and global reach of tokenized assets attract a more diverse investor base, democratizing access to asset investment opportunities.

Liquidity: Comparing Exit Strategies

Stocks offer established liquidity through major exchanges with standardized trading hours, enabling investors to execute exit strategies efficiently at market prices. Tokenized assets provide enhanced liquidity by enabling 24/7 trading on blockchain platforms, allowing rapid fractional asset transfers and global market access. The decentralized nature of tokenized assets reduces barriers to liquidity compared to traditional stock markets, but regulatory frameworks and platform adoption influence exit strategy effectiveness.

Regulatory Environment and Investor Protection

Stocks are regulated under established securities laws with robust investor protection mechanisms including mandatory disclosures and oversight by agencies like the SEC. Tokenized assets operate in a evolving regulatory landscape that varies by jurisdiction, often lacking the comprehensive investor safeguards found in traditional stock markets. The uncertainty around legal frameworks for tokenized assets presents higher risks related to fraud, transparency, and custody for investors.

Portfolio Diversification Opportunities

Stocks offer traditional portfolio diversification through exposure to various sectors and market capitalizations, but tokenized assets expand these opportunities by enabling fractional ownership of alternative investments like real estate, art, and commodities. Tokenized assets leverage blockchain technology to provide greater liquidity and access to global markets, which is often restricted in conventional stock investments. Combining both stocks and tokenized assets can enhance risk management and potential returns by broadening asset class exposure beyond traditional equities.

Transparency and Security in Ownership

Tokenized assets provide enhanced transparency through blockchain technology, enabling real-time tracking and immutable records of ownership. Stocks, while regulated by exchanges and oversight bodies, often lack the instantaneous visibility offered by distributed ledger systems. Security in tokenized assets is strengthened by cryptographic protocols, reducing risks of fraud and unauthorized transfer compared to traditional stock certificates.

Cost Structures and Transaction Fees

Stocks typically involve brokerage fees, regulatory charges, and capital gains taxes that can cumulatively increase investment costs, while tokenized assets use blockchain technology to reduce intermediaries, lowering transaction fees and enabling fractional ownership. Tokenized assets often offer more transparent and real-time fee structures through smart contracts, minimizing hidden costs compared to traditional stock markets. Cost efficiency in tokenized assets makes them appealing for investors seeking lower barriers and greater liquidity in asset investment.

Global Reach and Market Hours

Stocks are typically traded on centralized exchanges with fixed market hours, limiting access to specific time zones. Tokenized assets leverage blockchain technology to enable 24/7 global trading, providing investors worldwide with continuous market access. This extended availability enhances liquidity and allows for faster responses to market developments across different regions.

Risk Factors and Volatility Analysis

Stocks represent ownership in established companies subject to regulatory oversight and market fluctuations, often exhibiting moderate volatility influenced by corporate performance and economic conditions. Tokenized assets, digital representations of real-world assets on blockchain platforms, can experience heightened volatility due to emerging technology risks, lower liquidity, and regulatory uncertainties. Investors must analyze risk factors such as cybersecurity vulnerabilities, market manipulation potential, and legal frameworks when comparing traditional stocks to tokenized asset investments.

Related Important Terms

Fractional Ownership Tokens

Fractional Ownership Tokens provide a digital means to invest in tokenized assets, enabling partial ownership of high-value stocks with increased liquidity and transparency. Unlike traditional stocks, these tokens leverage blockchain technology to facilitate seamless trading and reduced transaction costs for investors.

Security Token Offerings (STOs)

Security Token Offerings (STOs) combine blockchain technology with regulatory compliance, offering investors fractional ownership, enhanced liquidity, and transparency compared to traditional stocks. These tokenized assets provide programmable rights, streamlined trading, and global access while adhering to securities laws, making them an innovative alternative for diversified asset investment.

On-chain Equity

On-chain equity offers fractional ownership and transparency through blockchain technology, enabling investors to trade tokenized assets with increased liquidity and reduced intermediaries compared to traditional stocks. Tokenized assets represent a programmable form of equity that enhances asset accessibility, lowers transaction costs, and facilitates real-time settlement on decentralized platforms.

Real-World Asset (RWA) Tokenization

Real-World Asset (RWA) tokenization transforms traditional stock investments by converting physical or financial assets into digital tokens on a blockchain, enabling fractional ownership, increased liquidity, and 24/7 trading. This innovation enhances transparency and accessibility in asset investment, bridging the gap between conventional stocks and decentralized finance ecosystems.

Decentralized Autonomous Organizations (DAOs) Investments

Tokenized assets offer fractional ownership and enhanced liquidity within Decentralized Autonomous Organizations (DAOs), enabling seamless, borderless investments compared to traditional stocks. DAOs leverage blockchain technology to provide transparent governance and automated decision-making, fostering a democratic investment environment often unavailable in conventional stock markets.

Dividend-yielding Crypto Assets

Dividend-yielding crypto assets provide investors with regular income streams similar to traditional stocks while offering the benefits of blockchain transparency, fractional ownership, and liquidity through tokenization. Tokenized assets enable seamless trading and global access, potentially enhancing dividend distribution efficiency compared to conventional stock dividends.

Tokenized Exchange-Traded Funds (ETFs)

Tokenized Exchange-Traded Funds (ETFs) offer fractional ownership, enhanced liquidity, and transparent blockchain-based transactions compared to traditional stocks, making asset investment more accessible and efficient. These digital securities reduce barriers to entry and improve diversification by allowing investors to trade ETFs 24/7 with lower fees and faster settlement times.

Digital Transfer Agents

Digital transfer agents streamline the ownership and transaction processes of both stocks and tokenized assets by providing secure, transparent record-keeping using blockchain technology. Tokenized assets offer enhanced liquidity and fractional ownership compared to traditional stocks, while digital transfer agents ensure seamless digital asset management and regulatory compliance.

Wrapped Securities

Wrapped securities represent tokenized assets that encapsulate traditional stocks on blockchain platforms, enabling fractional ownership and increased liquidity in asset investment. Unlike conventional stocks, these digital tokens facilitate seamless, borderless trading with enhanced transparency and reduced settlement times, revolutionizing the way investors access equity markets.

Programmable Asset Governance

Tokenized assets offer programmable asset governance through smart contracts, enabling automated compliance, transparent ownership transfers, and customizable voting rights, which traditional stocks lack. This programmability enhances efficiency, security, and flexibility in asset investment management compared to conventional stock trading systems.

Stocks vs Tokenized Assets for asset investment. Infographic

moneydiff.com

moneydiff.com