Asset NFTs provide fixed ownership and standardized metadata, ensuring consistent value and straightforward smart contract interactions for digital goods. Dynamic NFTs adapt their properties over time based on external data or interactions, enabling more complex, real-time utility and personalized user experiences within smart contracts. Choosing between Asset and Dynamic NFTs depends on the desired balance between stability and flexibility in smart contract functionality.

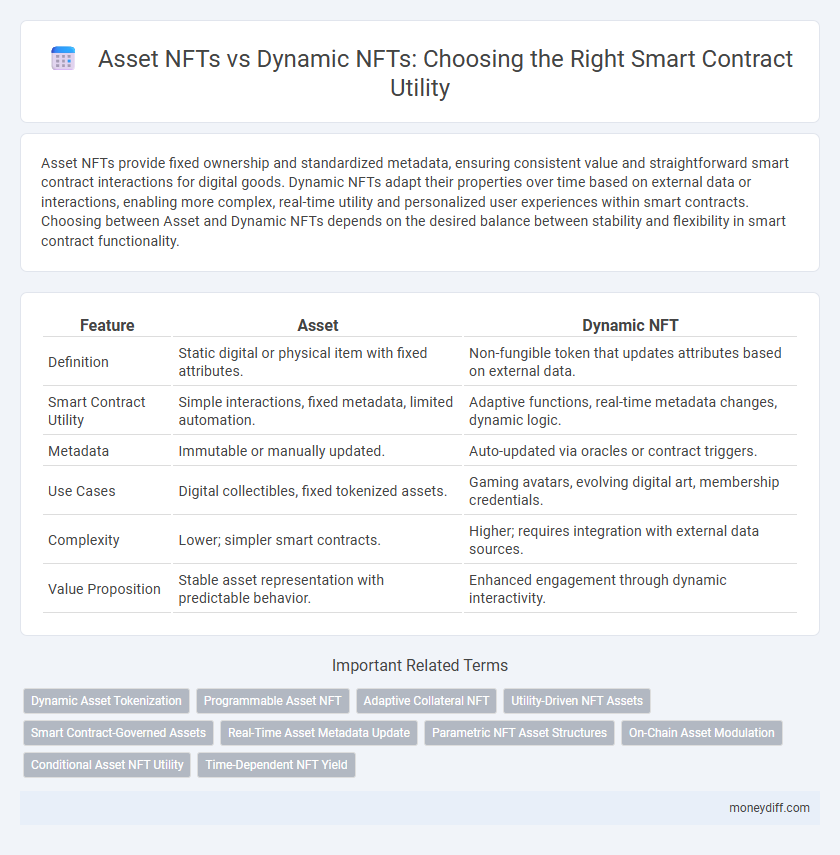

Table of Comparison

| Feature | Asset | Dynamic NFT |

|---|---|---|

| Definition | Static digital or physical item with fixed attributes. | Non-fungible token that updates attributes based on external data. |

| Smart Contract Utility | Simple interactions, fixed metadata, limited automation. | Adaptive functions, real-time metadata changes, dynamic logic. |

| Metadata | Immutable or manually updated. | Auto-updated via oracles or contract triggers. |

| Use Cases | Digital collectibles, fixed tokenized assets. | Gaming avatars, evolving digital art, membership credentials. |

| Complexity | Lower; simpler smart contracts. | Higher; requires integration with external data sources. |

| Value Proposition | Stable asset representation with predictable behavior. | Enhanced engagement through dynamic interactivity. |

Understanding Asset NFTs: Definition and Use Cases

Asset NFTs represent unique digital or physical items secured on a blockchain, providing verifiable ownership and provenance. Unlike Dynamic NFTs, which can change their attributes based on external data or conditions, Asset NFTs maintain a fixed state, making them ideal for art, collectibles, and real estate tokenization. Common use cases include representing digital art, in-game items, virtual real estate, and intellectual property rights within smart contracts for secure and transparent transactions.

Dynamic NFTs: Evolving Features and Flexibility

Dynamic NFTs offer enhanced utility in smart contracts by allowing real-time updates to metadata and attributes based on external data or user interactions, unlike static assets that remain unchanged. Their evolving features enable adaptive functionalities, such as responsive game elements or progressive art, enhancing user engagement and value over time. This flexibility makes dynamic NFTs highly suitable for complex decentralized applications requiring continuous state changes and personalized experiences.

Smart Contract Roles in Asset NFTs

Smart contracts in Asset NFTs primarily govern ownership, transferability, and royalty distribution, ensuring secure and automated management of digital assets. Unlike Dynamic NFTs, which modify metadata based on external conditions, Asset NFTs rely on immutable smart contract roles that maintain consistent functionality and integrity. This static nature simplifies verification processes and enhances security for applications such as digital art, collectibles, and real estate tokenization.

Dynamic NFTs for Adaptive Smart Contracts

Dynamic NFTs offer enhanced utility for adaptive smart contracts by enabling real-time updates based on external data or user interactions, unlike static assets that remain unchanged once minted. These NFTs can modify their attributes, metadata, or ownership conditions dynamically, allowing for more personalized and responsive applications such as gaming, finance, and identity verification. This flexibility drives greater engagement and functional complexity within blockchain ecosystems, surpassing traditional asset limitations.

Security Implications: Asset vs Dynamic NFTs

Static assets in smart contracts offer predictable security due to their immutable properties, minimizing risks of unauthorized changes. Dynamic NFTs introduce complexity by allowing real-time updates, which can create vulnerabilities if update mechanisms are not securely designed. Ensuring robust access controls and thorough validation protocols is crucial to prevent exploits in dynamic NFT smart contracts.

Liquidity and Tradability: Comparing NFT Types

Asset NFTs provide enhanced liquidity through easier fractional ownership and standardized trading protocols, enabling seamless asset transfer on various marketplaces. Dynamic NFTs offer evolving features tied to real-world events or smart contract triggers but face challenges in liquidity due to complex metadata and interaction dependencies. Consequently, Asset NFTs generally exhibit superior tradability and market integration, supporting more efficient exchange and valuation in decentralized finance ecosystems.

Customization and Upgradability in Dynamic NFTs

Dynamic NFTs offer superior customization and upgradability compared to static asset-backed NFTs by enabling real-time modifications directly through smart contracts. These tokens can evolve their attributes, visuals, or metadata based on external data or user interactions, enhancing utility and engagement. Smart contract integration allows for continuous asset enhancement without minting new tokens, streamlining asset management and maximizing value retention.

Use Cases: Asset NFTs vs Dynamic NFTs in Money Management

Asset NFTs enable static representation of physical or digital assets, providing proof of ownership and facilitating traditional asset management like real estate or collectibles. Dynamic NFTs adapt to changing states or conditions, allowing real-time updates in smart contracts for use cases such as collateral valuation or interest rate adjustments in DeFi protocols. This flexibility in Dynamic NFTs enhances money management by automating asset performance tracking and personalized financial interactions.

Compliance and Transparency through Smart Contracts

Smart contracts enhance compliance and transparency by encoding asset ownership and transfer rules directly on the blockchain, ensuring automated enforcement and auditability. Asset-backed NFTs represent tangible or intangible items with verifiable compliance standards embedded, while dynamic NFTs adapt metadata based on real-time conditions, offering flexible compliance updates. The combination of immutable transaction records and programmable behaviors in smart contracts ensures secure, transparent asset management and regulatory adherence.

Future Trends: The Convergence of Asset and Dynamic NFTs

The future of smart contract utility lies in the convergence of asset-backed and dynamic NFTs, merging the tangible value of physical or digital assets with the adaptive, programmable features of dynamic tokens. This integration enables real-time asset management, automated updates, and enhanced interoperability across decentralized platforms, driving unprecedented flexibility and user engagement. Emerging protocols and cross-chain solutions are accelerating this trend, positioning asset-dynamic NFTs as pivotal tools for next-generation decentralized finance and digital asset ecosystems.

Related Important Terms

Dynamic Asset Tokenization

Dynamic Asset Tokenization enhances smart contract utility by enabling real-time updates and conditional changes to NFTs based on external data or events, unlike static Asset NFTs which represent fixed ownership or characteristics. This adaptability allows for more complex and interactive asset management, bridging traditional asset tokenization with programmable dynamic functionalities in decentralized ecosystems.

Programmable Asset NFT

Programmable Asset NFTs enable smart contracts to dynamically modify ownership, attributes, and functionalities, enhancing utility beyond static asset NFTs, which represent fixed digital ownership without real-time interaction. This flexibility in programmable NFTs supports complex automated transactions, conditional access, and multi-layered asset management within decentralized applications.

Adaptive Collateral NFT

Adaptive Collateral NFTs leverage dynamic smart contract utility by enabling real-time asset value adjustments, enhancing flexibility and security compared to static asset NFTs. This dynamic functionality optimizes collateral management in decentralized finance, ensuring responsive risk mitigation and efficient capital allocation.

Utility-Driven NFT Assets

Utility-driven NFT assets provide programmable ownership and customizable smart contract interactions, enabling dynamic functionalities such as access control, royalties, and real-time asset updates. Unlike static assets, dynamic NFTs adapt metadata and utility based on external data or user actions, enhancing flexibility and user engagement within decentralized ecosystems.

Smart Contract-Governed Assets

Smart contract-governed assets provide structured ownership and predefined usage rules, ensuring predictable and secure transactions compared to dynamic NFTs that continuously evolve and may introduce unpredictability in asset behavior. Leveraging static assets in smart contracts enhances verifiability and reduces complexity in automated workflows, crucial for regulatory compliance and asset tokenization.

Real-Time Asset Metadata Update

Dynamic NFTs enable real-time asset metadata updates within smart contracts, allowing continuous reflection of an asset's current state or conditions, unlike static asset tokens with fixed metadata. This dynamic capability enhances applications in gaming, digital collectibles, and decentralized finance by providing adaptive, programmable asset representations.

Parametric NFT Asset Structures

Parametric NFT asset structures enable dynamic attributes within a static asset framework, enhancing smart contract utility by allowing asset properties to evolve based on predefined parameters. This contrasts with traditional dynamic NFTs, where metadata changes directly reflect external inputs, as parametric designs ensure greater predictability and programmability in asset behavior.

On-Chain Asset Modulation

On-chain asset modulation enables precise control and real-time updating of smart contract assets, making dynamic NFTs superior to static assets by embedding mutable metadata and programmable logic directly on the blockchain. This flexibility enhances utility in decentralized applications by allowing asset attributes to evolve based on external data or user interactions without compromising security or transparency.

Conditional Asset NFT Utility

Conditional Asset NFT utility enables smart contracts to dynamically manage asset ownership and functionality based on predefined conditions, enhancing flexibility beyond static Asset NFTs. Dynamic NFTs adapt attributes or metadata in real-time to reflect changes, enabling use cases like gamified rewards or personalized content, while conditional logic ensures precise control of asset states within decentralized applications.

Time-Dependent NFT Yield

Time-dependent NFT yield leverages dynamic NFTs by adjusting rewards based on holding duration, enhancing smart contract utility beyond static asset NFTs. This yield mechanism incentivizes long-term engagement, optimizing asset value through real-time state changes encoded in dynamic NFT metadata.

Asset vs Dynamic NFT for smart contract utility. Infographic

moneydiff.com

moneydiff.com