Bonds provide a reliable source of fixed income by lending capital to governments or corporations, typically offering steady interest payments. Green bonds serve the same financial purpose but specifically fund environmentally sustainable projects, appealing to investors prioritizing ethical and eco-friendly investments. Choosing between traditional bonds and green bonds depends on balancing financial return expectations with a commitment to environmental impact.

Table of Comparison

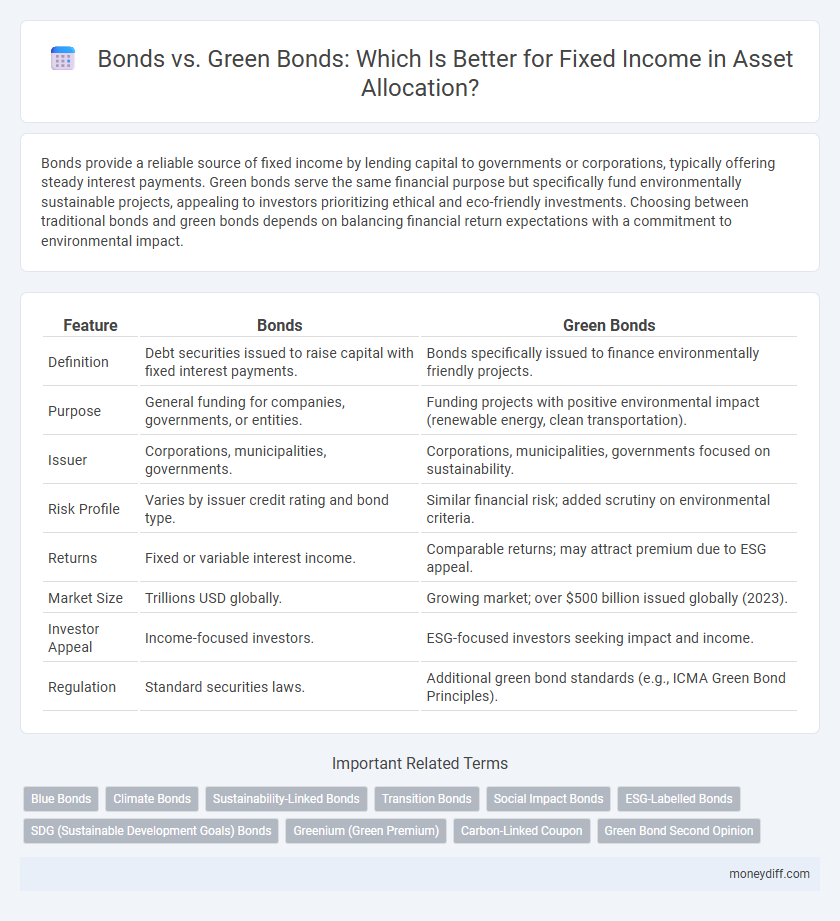

| Feature | Bonds | Green Bonds |

|---|---|---|

| Definition | Debt securities issued to raise capital with fixed interest payments. | Bonds specifically issued to finance environmentally friendly projects. |

| Purpose | General funding for companies, governments, or entities. | Funding projects with positive environmental impact (renewable energy, clean transportation). |

| Issuer | Corporations, municipalities, governments. | Corporations, municipalities, governments focused on sustainability. |

| Risk Profile | Varies by issuer credit rating and bond type. | Similar financial risk; added scrutiny on environmental criteria. |

| Returns | Fixed or variable interest income. | Comparable returns; may attract premium due to ESG appeal. |

| Market Size | Trillions USD globally. | Growing market; over $500 billion issued globally (2023). |

| Investor Appeal | Income-focused investors. | ESG-focused investors seeking impact and income. |

| Regulation | Standard securities laws. | Additional green bond standards (e.g., ICMA Green Bond Principles). |

Understanding Bonds: Traditional Fixed Income Instruments

Traditional bonds represent fixed income instruments issued by corporations or governments, offering periodic interest payments and principal repayment at maturity. Green bonds function similarly but allocate capital exclusively to environmentally sustainable projects, attracting investors seeking ESG-compliant assets. Investors evaluating fixed income options weigh credit risk, yield, and impact considerations between conventional bonds and green bonds for portfolio diversification.

What Are Green Bonds? An Introduction

Green bonds are fixed-income securities specifically designed to fund projects with positive environmental benefits, such as renewable energy, sustainable agriculture, and pollution reduction initiatives. Unlike traditional bonds, green bonds offer investors an opportunity to align their portfolios with environmental, social, and governance (ESG) criteria while earning steady interest payments. Issued by governments, municipalities, and corporations, these bonds support the global transition to a low-carbon economy by financing eco-friendly infrastructure and innovation.

Key Differences: Bonds vs Green Bonds

Bonds represent traditional fixed income securities issued to raise capital for a wide range of purposes, while green bonds specifically finance projects with environmental benefits such as renewable energy or climate adaptation. The key difference lies in the use of proceeds, with green bonds requiring transparency and third-party verification to ensure funds support sustainable initiatives. Investors in green bonds often seek to align financial returns with environmental impact, potentially accepting slightly different risk or return profiles compared to conventional bonds.

Risk Profiles: Assessing Safety in Both Investments

Bonds and green bonds both offer fixed income with varying risk profiles influenced by issuer credit quality, market volatility, and sector-specific factors. Green bonds often carry similar credit risk to traditional bonds issued by the same entity but may face additional scrutiny related to project sustainability and environmental outcomes. Investors evaluating safety should consider credit ratings, project transparency, and regulatory support for green initiatives alongside standard fixed income risk metrics.

Yield and Return: Financial Performance Comparison

Bonds typically offer stable yields based on credit risk and market interest rates, whereas green bonds may provide slightly lower yields due to their focus on environmental projects and investor demand for sustainable finance. Despite potentially lower yields, green bonds often exhibit competitive total returns when factoring in growing market interest and preferential treatment by certain institutional investors. Empirical studies show green bonds can achieve comparable or superior risk-adjusted returns compared to conventional fixed income securities over long-term horizons.

Environmental Impact: Green Bonds and Sustainable Investing

Green Bonds allocate capital specifically to environmentally sustainable projects, enhancing renewable energy, clean transportation, and conservation efforts, making them a central tool in sustainable investing. Traditional Bonds provide fixed income without necessarily targeting environmental outcomes, limiting their impact on ecological preservation. Investors seeking to support climate action and reduce carbon footprints often prefer Green Bonds for their measurable environmental benefits and alignment with ESG criteria.

Market Growth Trends: Bonds vs Green Bonds

The fixed income market shows consistent growth in traditional bonds, driven by stable government and corporate debt issuance worldwide. Green bonds exhibit a rapid expansion trend, fueled by increasing investor demand for sustainable investment options and regulatory incentives promoting environmental projects. Market analysis reveals green bonds' issuance growth rate surpasses that of conventional bonds, reflecting a shift towards ESG-focused capital allocation.

Investor Suitability: Which Option Fits Your Portfolio?

Bonds offer stable fixed income with predictable returns, ideal for conservative investors seeking capital preservation and steady interest payments. Green bonds appeal to environmentally conscious investors aiming to support sustainable projects while earning competitive yields, aligning financial goals with ESG criteria. Portfolio diversification benefits from including both traditional and green bonds to balance risk, impact, and return objectives.

Regulatory Landscape for Bonds and Green Bonds

The regulatory landscape for traditional bonds is governed by established securities laws and financial regulations, ensuring transparency, disclosure, and investor protection. Green bonds face evolving regulatory frameworks that emphasize environmental impact assessment, use of proceeds, and adherence to international standards such as the Green Bond Principles (GBP) and the EU Taxonomy Regulation. Growing regulatory scrutiny and mandatory reporting requirements for green bonds aim to enhance market integrity and promote sustainable finance within the fixed income asset class.

Future Outlook: The Evolving Role of Bonds in Sustainable Finance

Green bonds are rapidly gaining traction within sustainable finance, offering fixed income investors opportunities aligned with environmental goals. Traditional bonds continue to provide stability and diversification, but green bonds are poised to capture a larger market share as regulatory frameworks and investor demand for ESG-compliant assets intensify. Innovations in impact reporting and standardized taxonomy are expected to drive transparency and growth, reinforcing the evolving role of bonds in advancing sustainable investment portfolios.

Related Important Terms

Blue Bonds

Blue Bonds, a subset of green bonds, specifically fund ocean and marine conservation projects, offering fixed income investors targeted exposure to sustainable aquatic ecosystem initiatives. These bonds support climate resilience and biodiversity while delivering stable returns in the fixed income market.

Climate Bonds

Climate Bonds deliver fixed income investments designed to fund environmentally sustainable projects, offering investors exposure to green assets that support carbon reduction and renewable energy initiatives. Unlike traditional bonds, these instruments are certified under the Climate Bonds Standard, ensuring proceeds finance climate-resilient infrastructure and contribute to global decarbonization targets.

Sustainability-Linked Bonds

Sustainability-linked bonds (SLBs) differ from traditional bonds by tying interest rates or principal repayment to the issuer's achievement of predetermined environmental, social, or governance (ESG) targets, offering investors a direct incentive for corporate sustainability performance. Unlike green bonds, which finance specific environmental projects, SLBs provide flexible funding while promoting broader sustainability efforts, making them a growing component of the fixed income asset class focused on long-term impact and risk mitigation.

Transition Bonds

Transition bonds offer a strategic fixed income option designed to support companies shifting toward sustainable business models, bridging the gap between traditional bonds and green bonds. These bonds finance projects that reduce carbon emissions or improve environmental impact, providing investors with a balance of financial return and progressive ecological impact compared to conventional fixed income assets.

Social Impact Bonds

Social Impact Bonds (SIBs) blend financial returns with measurable social outcomes by funding initiatives that address social challenges, differentiating them from traditional bonds and green bonds focused primarily on environmental projects. Investors in SIBs benefit from fixed income streams linked to social impact performance, fostering sustainable development alongside financial gains.

ESG-Labelled Bonds

ESG-labelled bonds, such as green bonds, prioritize environmental and social impact, offering fixed income investors a way to support sustainable projects while earning returns. Compared to traditional bonds, green bonds often attract investors focused on climate action and may benefit from regulatory incentives and growing market demand for responsible investments.

SDG (Sustainable Development Goals) Bonds

Bonds provide traditional fixed income with defined risk and return profiles, whereas Green Bonds specifically finance projects aligned with environmental sustainability and are increasingly linked to Sustainable Development Goals (SDG Bonds). SDG Bonds target global challenges such as clean energy, water access, and climate action, offering investors opportunities to support measurable social and environmental outcomes alongside financial returns.

Greenium (Green Premium)

Green bonds typically offer a lower yield compared to conventional bonds due to the Greenium, reflecting increased investor demand for sustainable assets and the premium placed on environmental impact. This Greenium results in a trade-off where investors accept reduced fixed income returns in exchange for supporting projects with positive environmental benefits.

Carbon-Linked Coupon

Green bonds offer fixed income investors the opportunity to earn returns tied to environmental performance, featuring a carbon-linked coupon that adjusts based on the issuer's carbon reduction achievements or penalties. Traditional bonds provide stable, predetermined interest payments without any environmental performance linkage, lacking the incentive mechanisms designed to promote sustainability goals.

Green Bond Second Opinion

Green Bonds offer fixed income investors eco-focused returns backed by projects with verified environmental benefits, often supported by a Green Bond Second Opinion to confirm alignment with climate and sustainability standards. Traditional Bonds provide steady income without specific environmental criteria, making the Second Opinion a critical tool for assessing green credibility and investor confidence in sustainable finance.

Bonds vs Green Bonds for fixed income Infographic

moneydiff.com

moneydiff.com