Collectible cars offer tangible value through rarity, historical significance, and physical condition, often appreciating steadily over time due to limited availability and enthusiast demand. Digital collectibles, such as NFTs, provide unique, blockchain-verified ownership with greater liquidity and accessibility, but their market volatility and speculative nature can lead to unpredictable asset appreciation. Investors seeking long-term value may prioritize physical collectibles for stability, while those open to innovative assets might explore digital options for potential high returns.

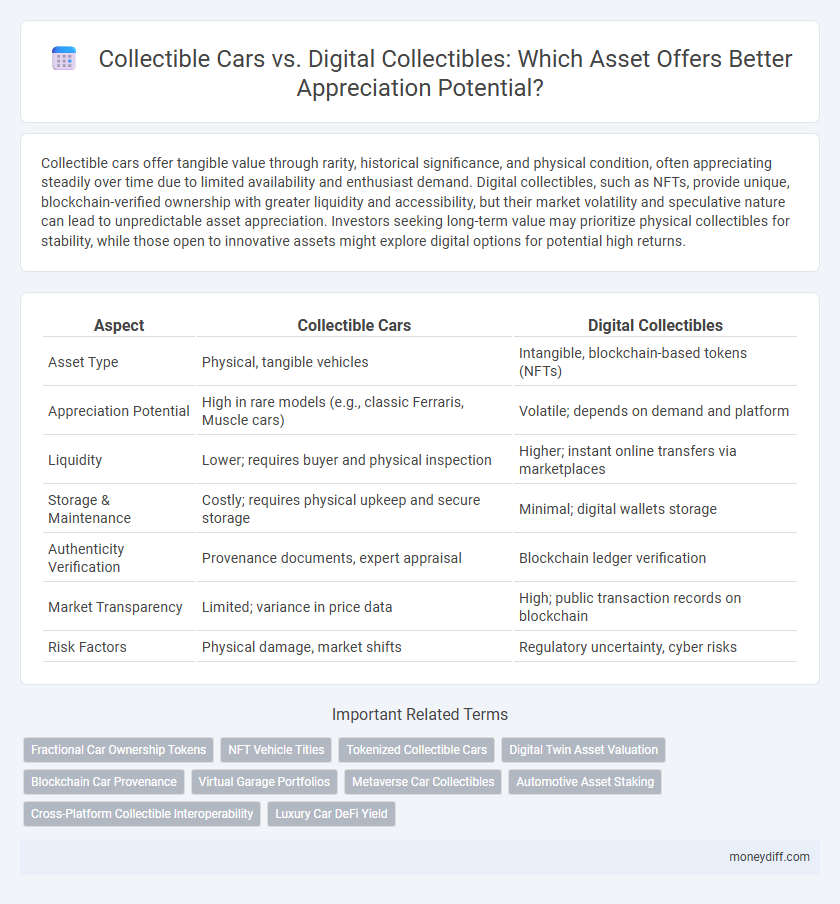

Table of Comparison

| Aspect | Collectible Cars | Digital Collectibles |

|---|---|---|

| Asset Type | Physical, tangible vehicles | Intangible, blockchain-based tokens (NFTs) |

| Appreciation Potential | High in rare models (e.g., classic Ferraris, Muscle cars) | Volatile; depends on demand and platform |

| Liquidity | Lower; requires buyer and physical inspection | Higher; instant online transfers via marketplaces |

| Storage & Maintenance | Costly; requires physical upkeep and secure storage | Minimal; digital wallets storage |

| Authenticity Verification | Provenance documents, expert appraisal | Blockchain ledger verification |

| Market Transparency | Limited; variance in price data | High; public transaction records on blockchain |

| Risk Factors | Physical damage, market shifts | Regulatory uncertainty, cyber risks |

Introduction to Collectible Cars and Digital Collectibles as Assets

Collectible cars represent tangible assets that often appreciate due to rarity, historical significance, and condition, attracting enthusiasts who value physical ownership and unique automotive heritage. Digital collectibles, such as NFTs, provide intangible assets secured by blockchain technology, offering verifiable ownership and provenance without physical storage requirements. Both asset types leverage scarcity and market demand, but collectible cars depend on physical preservation while digital collectibles thrive in decentralized and digital marketplaces.

Historical Performance of Collectible Cars

Collectible cars have demonstrated consistent asset appreciation over decades, with rare models like classic Ferraris and vintage Porsches often outperforming traditional investments. Their historical performance is driven by scarcity, provenance, and cultural significance, which collectively enhance market value and investment stability. Unlike digital collectibles, tangible vintage cars benefit from global enthusiast communities and verified auction records, providing transparent benchmarks for asset appreciation.

Growth Trends in Digital Collectibles

Digital collectibles have experienced exponential asset appreciation, driven by blockchain technology and increasing market adoption, contrasting the steady but slower growth of collectible cars. The NFT market saw a surge in value, with some digital assets appreciating over 1000% within a year, reflecting a new paradigm in asset growth trends. This rapid growth highlights the potential of digital collectibles as scalable and liquid alternative investments compared to the physical limitations of classic car markets.

Liquidity and Market Access Comparison

Collectible cars offer tangible asset appreciation with relatively limited liquidity due to niche buyer markets and longer transaction times, whereas digital collectibles benefit from higher liquidity through blockchain platforms enabling instant transfers and fractional ownership. Market access for collectible cars is often constrained by geographic and auction-specific factors, while digital collectibles leverage global marketplaces accessible 24/7, broadening investor participation. The divergent liquidity profiles and accessibility dynamics distinctly influence the asset appreciation potential and investment strategies in both tangible and digital collectible sectors.

Risks and Volatility in Both Asset Classes

Collectible cars exhibit tangible value with historical appreciation but face risks such as market illiquidity, high maintenance costs, and damage susceptibility, contributing to moderate volatility influenced by economic cycles and collector trends. Digital collectibles, including NFTs, present higher volatility due to speculative pricing, platform dependence, and regulatory uncertainties, though they offer enhanced liquidity and fractional ownership benefits. Both asset classes require careful risk assessment; collectible cars depend on physical preservation, while digital assets hinge on technological security and market sentiment.

Storage, Maintenance, and Security Considerations

Collectible cars require significant investment in secure storage facilities, climate control, and regular maintenance to preserve their value, with costs varying based on the vehicle's rarity and condition. Digital collectibles, such as NFTs, eliminate physical storage challenges but necessitate cybersecurity measures like secure wallets and platform authentication to protect against hacking or fraud. Both asset types demand tailored strategies for safeguarding against depreciation risks, balancing tangible upkeep versus digital security protocols.

Legal and Regulatory Aspects

Collectible cars are tangible assets subject to established property laws, registration requirements, and insurance regulations that provide clear legal protection and transfer protocols. Digital collectibles, often secured by blockchain technology, face evolving regulatory scrutiny regarding intellectual property rights, anti-money laundering compliance, and securities laws across jurisdictions. Investors must navigate these distinct legal frameworks to ensure asset appreciation and mitigate risks associated with ownership, transferability, and fraud.

Tax Implications: Cars vs Digital Collectibles

Collectible cars often qualify for classic car tax exemptions or reduced capital gains rates due to their tangible nature and well-established valuation frameworks. Digital collectibles, such as NFTs, fall under complex and evolving tax regulations, typically treated as property with potential for ordinary income tax on sales or exchanges, complicating asset appreciation calculations. Understanding these differing tax implications is crucial for investors aiming to optimize asset appreciation through physical versus digital collectibles.

Portfolio Diversification Benefits

Collectible cars offer tangible asset appreciation driven by rarity, historical significance, and physical condition, making them a unique hedge against market volatility. Digital collectibles, such as NFTs, provide portfolio diversification through blockchain authentication and ease of transfer, appealing to tech-savvy investors seeking exposure to the digital economy. Combining both assets enhances portfolio resilience by balancing traditional tangible value with innovative digital growth potential.

Future Outlook for Asset Appreciation

Collectible cars have a proven track record of steady appreciation driven by historical value, rarity, and cultural significance, often gaining value over decades. Digital collectibles, such as NFTs, exhibit high volatility but offer rapid growth potential fueled by blockchain technology and increasing adoption in digital economies. Future asset appreciation is likely to favor hybrid models integrating real-world scarcity with digital ownership, balancing tangible value with innovative market dynamics.

Related Important Terms

Fractional Car Ownership Tokens

Fractional Car Ownership Tokens enable investors to own shares in collectible cars, offering a liquid and accessible alternative to traditional physical car investments, which often require significant capital and face storage challenges. Digital collectibles tied to tangible assets like classic cars provide enhanced asset appreciation potential through blockchain transparency, fractionalized ownership, and easier transferability compared to solely owning physical collectible cars.

NFT Vehicle Titles

Collectible cars offer tangible asset appreciation through physical rarity and historical value, while digital collectibles like NFT vehicle titles provide transparent, secure ownership verification and facilitate seamless transferability on blockchain platforms. NFT vehicle titles enhance asset liquidity by enabling fractional ownership and reducing fraud, making them a revolutionary alternative in the automotive investment landscape.

Tokenized Collectible Cars

Tokenized collectible cars leverage blockchain technology to offer fractional ownership, enhanced liquidity, and transparent provenance, accelerating asset appreciation compared to traditional collectible cars. This digital transformation enables investors to trade high-value automotive assets securely on global marketplaces, unlocking new opportunities in asset diversification and value growth.

Digital Twin Asset Valuation

Digital twin asset valuation leverages blockchain technology and real-time data analytics to provide precise and transparent appraisals for digital collectibles, surpassing traditional collectible cars which often rely on subjective market factors. This innovative approach enhances liquidity and verifiable ownership, driving more accurate appreciation metrics for digital assets compared to the depreciation risks and maintenance costs associated with physical classic cars.

Blockchain Car Provenance

Collectible cars offer tangible asset appreciation driven by rarity, condition, and historical value, while digital collectibles leverage blockchain technology to ensure transparent and immutable provenance, enhancing trust and liquidity in asset verification. Blockchain-based car provenance provides verifiable ownership history and authenticity, reducing risks associated with fraud and enabling fractional ownership opportunities in both physical and digital automobile assets.

Virtual Garage Portfolios

Collectible cars offer tangible asset appreciation through historic value, rarity, and physical condition, attracting enthusiasts who benefit from long-term market trends and classic car auctions. Digital collectibles in Virtual Garage Portfolios leverage blockchain technology, providing liquidity, authenticated ownership, and potential for rapid value growth within virtual and metaverse ecosystems.

Metaverse Car Collectibles

Metaverse car collectibles offer innovative asset appreciation potential by leveraging blockchain technology and virtual reality, enabling unique ownership and trading experiences beyond physical limitations. While traditional collectible cars appreciate based on rarity and condition, metaverse car assets benefit from digital scarcity, interoperability across platforms, and enhanced liquidity within growing virtual economies.

Automotive Asset Staking

Collectible cars offer tangible asset appreciation through physical rarity and historical value, while digital collectibles leverage blockchain technology for verifiable ownership and liquidity. Automotive asset staking enhances investment potential by enabling stakeholders to earn rewards on digital car assets, blending traditional automotive value with decentralized finance benefits.

Cross-Platform Collectible Interoperability

Collectible cars offer tangible asset appreciation with physical scarcity and historical provenance, while digital collectibles leverage blockchain technology for enhanced liquidity and cross-platform interoperability across various virtual ecosystems. Cross-platform collectible interoperability enables seamless transfer and usage of digital assets in multiple environments, driving unique value appreciation unattainable in traditional collectible cars.

Luxury Car DeFi Yield

Luxury car DeFi yield platforms enable investors to earn passive income through tokenized collectible cars, combining tangible asset appreciation with blockchain-based liquidity and transparency. Digital collectibles, while offering ease of transfer and fractional ownership, often lack the intrinsic value and historic appreciation potential inherent to physical luxury cars in the asset market.

Collectible Cars vs Digital Collectibles for asset appreciation Infographic

moneydiff.com

moneydiff.com