Stock ownership grants investors full shares in a company, offering voting rights and dividends, while fractional ownership allows individuals to purchase a portion of a share, making investing more accessible with lower capital. Fractional ownership provides diversification and flexibility, enabling investors to build a varied portfolio without large upfront costs. Choosing between stock and fractional ownership depends on investment goals, available capital, and desired control over assets.

Table of Comparison

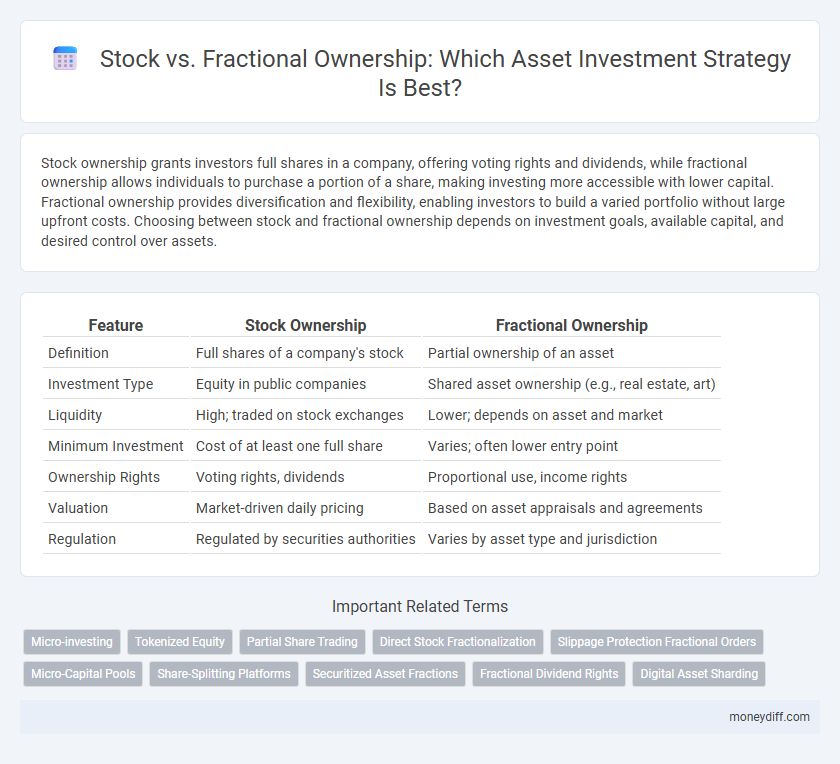

| Feature | Stock Ownership | Fractional Ownership |

|---|---|---|

| Definition | Full shares of a company's stock | Partial ownership of an asset |

| Investment Type | Equity in public companies | Shared asset ownership (e.g., real estate, art) |

| Liquidity | High; traded on stock exchanges | Lower; depends on asset and market |

| Minimum Investment | Cost of at least one full share | Varies; often lower entry point |

| Ownership Rights | Voting rights, dividends | Proportional use, income rights |

| Valuation | Market-driven daily pricing | Based on asset appraisals and agreements |

| Regulation | Regulated by securities authorities | Varies by asset type and jurisdiction |

Understanding Stocks and Fractional Ownership

Stocks represent full ownership shares in a company, allowing investors to vote on corporate matters and receive dividends proportionate to their holdings. Fractional ownership enables investors to buy a portion of a stock, making high-value assets more accessible without needing to purchase an entire share. This approach democratizes investment opportunities and allows portfolio diversification with smaller capital.

Key Differences Between Stocks and Fractional Ownership

Stocks represent whole shares of a company traded on public exchanges, granting owners voting rights and potential dividends tied to company performance. Fractional ownership allows investors to purchase a portion of a high-value asset, such as real estate or artwork, lowering entry costs and enabling diversified portfolios. Key differences include liquidity, with stocks offering easier trading and fractional ownership often involving longer holding periods and less market transparency.

Benefits of Investing in Traditional Stocks

Investing in traditional stocks offers full ownership of shares, granting shareholders voting rights and dividend payments, which enable participation in corporate decision-making and income generation. Stocks provide greater liquidity compared to fractional ownership, allowing investors to buy or sell shares quickly on major exchanges. Moreover, traditional stocks often benefit from regulatory protections and transparency, giving investors confidence in the legitimacy and value of their assets.

Advantages of Fractional Ownership Assets

Fractional ownership of assets offers increased accessibility and affordability by allowing multiple investors to share the costs and benefits, reducing individual financial burden compared to purchasing whole stocks. This model enhances diversification opportunities since investors can allocate capital across various high-value assets, such as real estate or luxury goods, which are typically out of reach for smaller portfolios. Liquidity is often improved through fractional platforms that facilitate easier buying and selling of asset shares, unlike traditional stock ownership that may require larger transactions or longer holding periods.

Risk Factors: Stocks vs Fractional Ownership

Stocks carry market volatility risk, where share prices fluctuate based on company performance and economic conditions, potentially leading to significant financial losses. Fractional ownership spreads risk by allowing investors to own partial shares or interests, often within diversified portfolios or real estate, reducing exposure to individual asset downturns. However, fractional ownership may face liquidity risks and limited control compared to direct stock ownership, impacting the ability to quickly sell or influence asset management.

Liquidity Comparison: Stocks and Fractional Investments

Stocks offer high liquidity through established exchanges, enabling quick buying and selling at market prices. Fractional ownership may have lower liquidity due to limited resale markets and potential restrictions on transferring shares. Investors seeking rapid access to funds typically prefer traditional stocks for their streamlined liquidity and broader market participation.

Accessibility and Minimum Investment Requirements

Stock ownership requires purchasing whole shares, often demanding higher minimum investments, which can limit accessibility for small investors. Fractional ownership allows investors to buy portions of a share, significantly lowering entry barriers and making asset acquisition more accessible. This flexibility enables diversified portfolios even with limited capital, enhancing investment inclusivity.

Diversification Opportunities with Stocks vs Fractional Ownership

Stocks allow investors to diversify their portfolios by purchasing shares in multiple companies across different sectors, minimizing risk through broad market exposure. Fractional ownership offers similar diversification opportunities by enabling investors to acquire portions of high-value assets, such as real estate or expensive collectibles, that might otherwise be cost-prohibitive. This fractional model enhances portfolio variety without requiring full asset purchases, fostering accessible and balanced investment strategies.

Fees and Costs Associated with Each Asset Type

Stock ownership typically involves brokerage fees, transaction costs, and potential management fees depending on the platform, with costs varying by trade size and frequency. Fractional ownership reduces initial investment barriers and often features lower or no fees, but may include platform-specific charges or limited liquidity. Comparing these expenses is crucial as stock fees can accumulate significantly over time, whereas fractional ownership fees affect smaller, serialized investments differently.

Deciding Which Asset Fits Your Money Management Goals

Stock ownership provides full shares offering voting rights and potential dividends, ideal for investors seeking control and long-term growth. Fractional ownership allows purchasing partial shares, lowering the barrier to entry and enabling diversification with limited capital. Choosing between these depends on your investment strategy, risk tolerance, and desire for liquidity and control in asset management.

Related Important Terms

Micro-investing

Stock ownership involves purchasing whole shares of a company, which often requires substantial capital, while fractional ownership allows investors to buy partial shares, making micro-investing more accessible. Micro-investing platforms leverage fractional ownership to enable diversified portfolios with minimal initial investment, democratizing access to high-value assets.

Tokenized Equity

Tokenized equity enables fractional ownership of traditionally indivisible stock assets, allowing investors to buy, sell, and trade smaller portions with enhanced liquidity and reduced entry barriers. This blockchain-based approach ensures transparent asset provenance and real-time settlement, revolutionizing access to equity markets through democratized investment opportunities.

Partial Share Trading

Partial share trading enables investors to buy fractions of high-value stocks, increasing accessibility and diversification opportunities without requiring full share investment. Fractional ownership provides proportional asset rights and dividends, making it an efficient strategy for portfolio growth in stock markets.

Direct Stock Fractionalization

Direct stock fractionalization enables investors to purchase partial shares of high-value stocks, increasing accessibility and portfolio diversification without requiring full-share investments. This approach enhances liquidity and democratizes asset ownership by allowing precise allocation of capital aligned with individual financial goals.

Slippage Protection Fractional Orders

Fractional ownership of stocks offers enhanced slippage protection by executing orders at prices closer to the market value, reducing the risk of price discrepancies common in full-share transactions. This method ensures investors can buy precise portions of high-value assets with minimized transaction costs and improved order accuracy.

Micro-Capital Pools

Stock ownership grants investors full shares in a company, offering proportional voting rights and dividends, while fractional ownership divides an asset into smaller, more affordable shares through Micro-Capital Pools, enabling broader participation and diversified risk with minimal capital outlay. Micro-Capital Pools optimize asset liquidity and accessibility by aggregating micro-investments, making high-value assets attainable for individual investors without the need for substantial upfront capital.

Share-Splitting Platforms

Share-splitting platforms enable investors to buy fractional ownership in stocks, lowering the entry barrier by allowing partial shares instead of full shares. This democratizes access to high-value assets and facilitates diversified portfolios with smaller capital investments.

Securitized Asset Fractions

Securitized asset fractions enable investors to acquire partial ownership in high-value assets, offering liquidity and diversified exposure compared to traditional whole stock ownership. This method leverages blockchain technology to tokenize real-world assets, enhancing transparency, reducing entry barriers, and facilitating fractional trading in global markets.

Fractional Dividend Rights

Fractional ownership in assets allows investors to receive proportional dividend rights based on their specific share, enabling access to high-value stocks with smaller capital outlays. This contrasts with traditional stock ownership, where dividends are distributed only to full shareholders, limiting participation for those unable to afford entire shares.

Digital Asset Sharding

Digital asset sharding enables fractional ownership by dividing a single asset into smaller, tradeable units, increasing liquidity and accessibility compared to traditional whole stock ownership. This method optimizes asset management and investment diversification by allowing more investors to participate without requiring full asset acquisition.

Stock vs Fractional Ownership for asset. Infographic

moneydiff.com

moneydiff.com