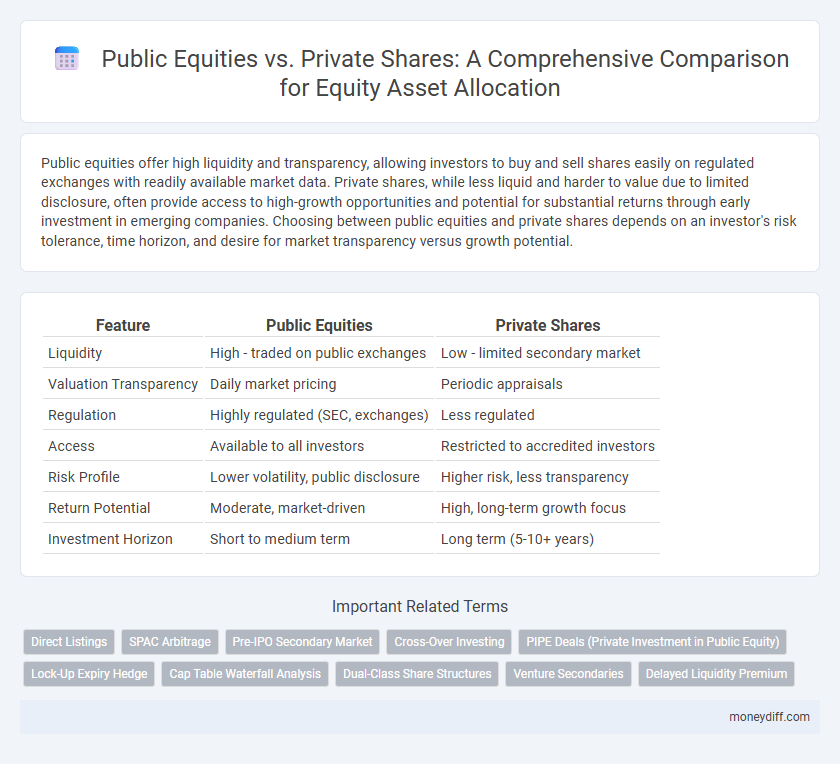

Public equities offer high liquidity and transparency, allowing investors to buy and sell shares easily on regulated exchanges with readily available market data. Private shares, while less liquid and harder to value due to limited disclosure, often provide access to high-growth opportunities and potential for substantial returns through early investment in emerging companies. Choosing between public equities and private shares depends on an investor's risk tolerance, time horizon, and desire for market transparency versus growth potential.

Table of Comparison

| Feature | Public Equities | Private Shares |

|---|---|---|

| Liquidity | High - traded on public exchanges | Low - limited secondary market |

| Valuation Transparency | Daily market pricing | Periodic appraisals |

| Regulation | Highly regulated (SEC, exchanges) | Less regulated |

| Access | Available to all investors | Restricted to accredited investors |

| Risk Profile | Lower volatility, public disclosure | Higher risk, less transparency |

| Return Potential | Moderate, market-driven | High, long-term growth focus |

| Investment Horizon | Short to medium term | Long term (5-10+ years) |

Overview of Public Equities and Private Shares

Public equities represent ownership stakes in companies traded on stock exchanges, offering high liquidity and transparency through regular financial disclosures. Private shares, held in non-publicly traded companies, provide access to potentially higher returns with limited liquidity and less regulatory oversight. Investors often balance public equities for market efficiency against private shares for exclusive growth opportunities.

Key Differences Between Public and Private Equity Assets

Public equities offer high liquidity with shares traded on regulated exchanges, enabling quick buying and selling at transparent market prices. Private shares are less liquid, typically involving direct ownership in privately held companies, and require longer investment horizons with valuation based on company performance and negotiated terms. Public equities provide greater regulatory oversight and price discovery, while private shares allow for more control and potential for higher returns through active management.

Accessibility and Liquidity Considerations

Public equities offer high liquidity and ease of access through stock exchanges, enabling investors to quickly buy or sell shares at transparent market prices. Private shares, conversely, are less liquid due to limited buyer pools and absence of public markets, often requiring longer holding periods and complex transfer processes. Accessibility to private equity typically depends on investor qualifications and network connections, making public equities more suitable for retail investors seeking flexibility.

Risk Profiles: Public vs. Private Equity

Public equities offer higher liquidity and transparency but are subject to market volatility and regulatory scrutiny, resulting in more immediate price fluctuations. Private shares typically involve less liquidity and longer investment horizons, with valuations based on periodic appraisals rather than real-time market pricing, leading to potentially higher but less predictable returns. Risk profiles differ as public equities present market risk and short-term exposure, while private equity carries operational, illiquidity, and exit risks tied to the underlying business performance and deal structures.

Valuation Methods and Transparency Issues

Public equities benefit from market-driven valuation methods based on real-time trading prices, offering high transparency through regulatory disclosures and continuous market updates. Private shares rely on less frequent valuation techniques such as discounted cash flow (DCF) analysis or comparable company multiples, often resulting in valuation subjectivity and reduced transparency due to limited financial disclosures. This difference impacts investor confidence and pricing accuracy, with public equities providing more reliable and accessible valuation data compared to private shares.

Return Potential: Historical Performance Insights

Public equities generally offer higher liquidity and transparency, enabling timely price discovery and easier portfolio rebalancing. Historically, public equities have delivered average annual returns of around 7-10%, driven by broad market participation and efficient pricing mechanisms. Private shares often show higher return potential, with some studies indicating internal rates of return (IRR) exceeding 15%, but this comes with longer holding periods and reduced marketability risks.

Diversification Benefits in Equity Asset Allocation

Public equities offer higher liquidity and market transparency, allowing for rapid adjustments in equity asset allocation to optimize portfolio diversification. Private shares provide access to unique growth opportunities and reduced correlation with public markets, enhancing diversification benefits by mitigating systematic risks. Combining both asset types in equity portfolios improves risk-adjusted returns through exposure to different market cycles and valuation inefficiencies.

Regulatory Environment and Investor Protections

Public equities are subject to comprehensive regulatory frameworks such as the SEC in the United States, ensuring transparency, regular disclosures, and strong investor protections through standardized reporting and market oversight. Private shares operate in a less regulated environment with fewer disclosure requirements, increasing information asymmetry and potential risks for investors due to limited transparency and liquidity constraints. Regulatory oversight for private shares typically relies on exemptions under securities laws, which prioritize accredited investors and impose fewer investor protection mechanisms compared to public equities.

Fees, Costs, and Investment Minimums

Public equities typically have lower management fees and transaction costs due to high liquidity and regulation-driven transparency, making them more accessible for individual investors with modest investment minimums often under $1,000. Private shares demand higher fees, including management and performance fees that can reach 2% and 20% respectively, alongside substantial upfront investment minimums commonly starting at $100,000 or more. These cost structures reflect the increased due diligence, illiquidity risk, and limited marketability inherent to private equity compared to the more standardized, cost-efficient public equity markets.

Suitability for Different Types of Investors

Public equities offer high liquidity and transparency, making them suitable for individual investors and those seeking short-term investment horizons. Private shares typically require longer holding periods and higher risk tolerance, appealing to institutional investors or high-net-worth individuals aiming for potentially higher returns through active management. Investment choices should align with each investor's risk profile, time horizon, and access to capital.

Related Important Terms

Direct Listings

Direct listings enable companies to offer public equities without the dilution typical of private share issuances, providing immediate price discovery and liquidity by allowing existing shareholders to sell shares directly on public markets. Compared to private shares, direct listings bypass traditional underwriting, reducing costs and accelerating access to capital while exposing equity assets to broader market dynamics and regulatory requirements.

SPAC Arbitrage

Public equities offer greater liquidity and transparency compared to private shares, making SPAC arbitrage strategies more accessible and efficient in public markets. Investors exploit price inefficiencies between a SPAC's trading price and its net asset value before the merger completion, capitalizing on the regulatory disclosures and market pricing dynamics absent in private shares.

Pre-IPO Secondary Market

The pre-IPO secondary market offers private shares with potential for significant returns by accessing equity assets before public listings, often at discounted valuations compared to public equities. This market provides liquidity to early investors and employees, enabling trading of shares in high-growth private companies that are not yet available on public exchanges.

Cross-Over Investing

Cross-over investing bridges public equities and private shares by enabling investors to access high-growth companies in both pre-IPO and public stages, leveraging market inefficiencies for enhanced returns. This strategy maximizes exposure to innovation-driven assets while balancing liquidity and valuation transparency inherent in public markets with the growth potential of private equity.

PIPE Deals (Private Investment in Public Equity)

PIPE deals offer institutional investors access to discounted public equities through private placements, providing liquidity advantages compared to traditional private shares. These transactions enhance capital efficiency by combining characteristics of both public equities and private shares, allowing issuers to raise funds quickly while minimizing market disruption.

Lock-Up Expiry Hedge

Public equities offer greater liquidity and immediate market pricing, while private shares typically involve lock-up periods restricting sales, making lock-up expiry hedge strategies essential to manage post-lock-up price volatility and liquidity risk in private equity investments. Effective lock-up expiry hedging mitigates downside risk by using derivatives or staggered sell-offs to protect asset value in equity portfolios during transition phases.

Cap Table Waterfall Analysis

Cap table waterfall analysis in public equities provides transparent insight into ownership dilution and stock option impacts across multiple funding rounds, enabling clear valuation and shareholder prioritization. Private shares require detailed waterfall modeling to accurately reflect liquidation preferences and conversion rights, crucial for understanding equity distribution in exit scenarios and investor returns.

Dual-Class Share Structures

Dual-class share structures create distinct voting rights between public equities and private shares, often granting founders or insiders greater control despite owning fewer economic shares. This arrangement impacts the liquidity and governance of equity assets, prioritizing control in private shares while maintaining broader market participation in public equities.

Venture Secondaries

Public equities offer high liquidity and transparent pricing, enabling immediate market access and real-time valuation, whereas private shares, particularly in venture secondaries, provide access to pre-IPO growth opportunities with potential for substantial returns but limited liquidity and opaque pricing. Venture secondaries facilitate portfolio diversification by acquiring pre-existing private equity stakes, reducing upfront capital commitment and risk compared to primary venture investments while still capturing value from promising startups.

Delayed Liquidity Premium

Public equities offer immediate liquidity but typically lack a delayed liquidity premium, whereas private shares often command higher valuations due to restricted marketability and longer holding periods. This delayed liquidity premium compensates investors for the additional risk and time commitment associated with private equity investments.

Public Equities vs Private Shares for equity assets. Infographic

moneydiff.com

moneydiff.com